Answered step by step

Verified Expert Solution

Question

1 Approved Answer

financial math The Scenario: Alon Nusk has just inherited $1,000,000 and wishes to invest this sum in the five funds listed below: Fund Code Return

financial math

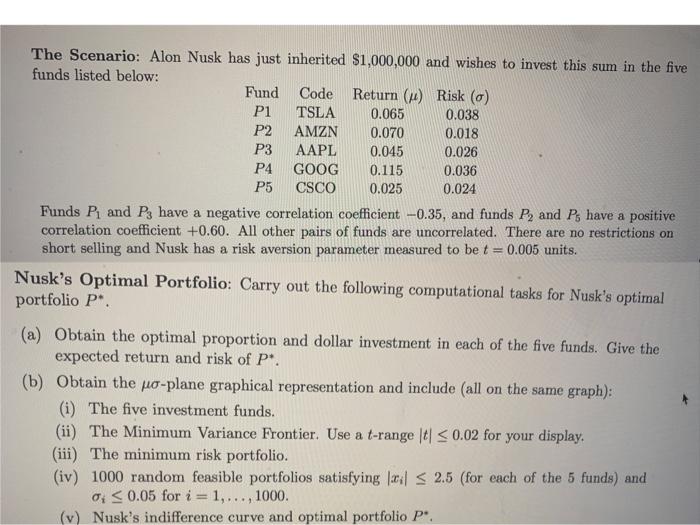

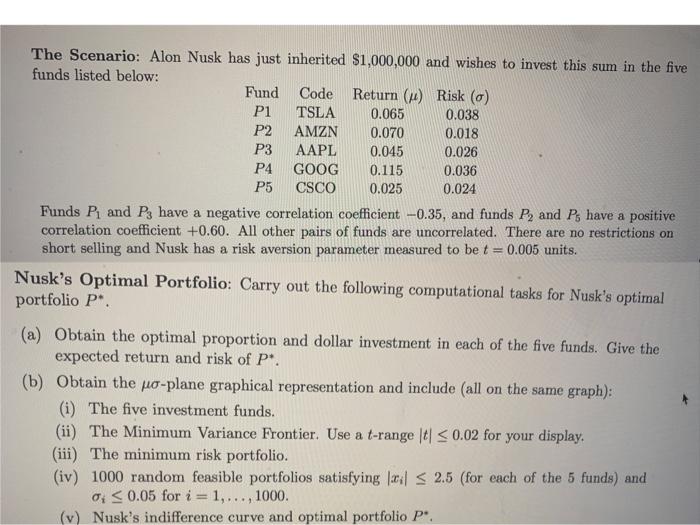

The Scenario: Alon Nusk has just inherited $1,000,000 and wishes to invest this sum in the five funds listed below: Fund Code Return (1) Risk (o) P1 TSLA 0.065 0.038 P2 AMZN 0.070 0.018 P3 AAPL 0.045 0.026 P4 GOOG 0.115 0.036 P5 CSCO 0.025 0.024 Funds P and Ps have a negative correlation coefficient -0.35, and funds P, and have a positive correlation coefficient +0.60. All other pairs of funds are uncorrelated. There are no restrictions on short selling and Nusk has a risk aversion parameter measured to be t = 0.005 units. Nusk's Optimal Portfolio: Carry out the following computational tasks for Nusk's optimal portfolio P. a (a) Obtain the optimal proportion and dollar investment in each of the five funds. Give the expected return and risk of P. (b) Obtain the wo-plane graphical representation and include (all on the same graph): (i) The five investment funds. (ii) The Minimum Variance Frontier. Use a t-range It!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started