Answered step by step

Verified Expert Solution

Question

1 Approved Answer

financial mathematics Question 1 An investor is considering whether to invest in either or both of the following loans: Loan A: For a purchase price

financial mathematics

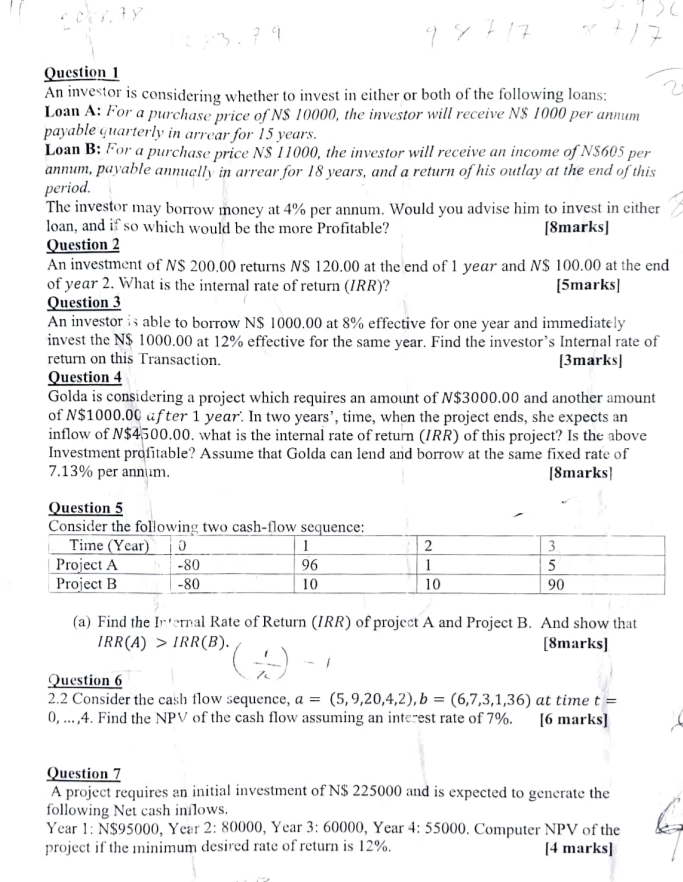

Question 1 An investor is considering whether to invest in either or both of the following loans: Loan A: For a purchase price of NS 10000, the investor will receive N\$ 1000 per annum payable quarterly in arrear for 15 years. Loan B: For a purchase price NS 11000, the investor will receive an income of N\$605 per annum, payable annually in arrear for 18 years, and a return of his outlay at the end of this period. The investor may borrow money at 4% per annum. Would you advise him to invest in either loan, and if so which would be the more Profitable? [8marks] Question 2 An investment of N$200.00 returns N$120.00 at the end of 1 year and N$100.00 at the end of year 2. What is the internal rate of return (IRR) ? [5marks] Question 3 An investor is able to borrow N\$ 1000.00 at 8% effective for one year and immediately invest the N $1000.00 at 12% effective for the same year. Find the investor's Internal rate of return on this Transaction. [3marks] Question 4 Golda is considering a project which requires an amount of N$3000.00 and another amount of N$1000.00 ifter 1 year'. In two years', time, when the project ends, she expects an inflow of N$4500.00. what is the internal rate of return (IRR) of this project? Is the above Investment profitable? Assume that Golda can lend and borrow at the same fixed rate of 7.13% per annum. [8marks] Question 5 Consider the following two cash-flow seauence: (a) Find the In'ernal Rate of Return (IRR) of project A and Project B. And show that IRR(A)>IRR(B) [8marks] Question 6 2.2 Consider the cash flow sequence, a=(5,9,20,4,2),b=(6,7,3,1,36) at time t= 0,,4. Find the NPV of the cash flow assuming an interest rate of 7%. [6 marks] Question 7 A project requires an initial investment of N\$ 225000 and is expected to generate the following Net cash inflows. Year 1: N\$95000, Year 2: 80000, Year 3: 60000, Year 4: 55000. Computer NPV of the project if the minimum desired rate of return is 12%. [4 marks] Question 1 An investor is considering whether to invest in either or both of the following loans: Loan A: For a purchase price of NS 10000, the investor will receive N\$ 1000 per annum payable quarterly in arrear for 15 years. Loan B: For a purchase price NS 11000, the investor will receive an income of N\$605 per annum, payable annually in arrear for 18 years, and a return of his outlay at the end of this period. The investor may borrow money at 4% per annum. Would you advise him to invest in either loan, and if so which would be the more Profitable? [8marks] Question 2 An investment of N$200.00 returns N$120.00 at the end of 1 year and N$100.00 at the end of year 2. What is the internal rate of return (IRR) ? [5marks] Question 3 An investor is able to borrow N\$ 1000.00 at 8% effective for one year and immediately invest the N $1000.00 at 12% effective for the same year. Find the investor's Internal rate of return on this Transaction. [3marks] Question 4 Golda is considering a project which requires an amount of N$3000.00 and another amount of N$1000.00 ifter 1 year'. In two years', time, when the project ends, she expects an inflow of N$4500.00. what is the internal rate of return (IRR) of this project? Is the above Investment profitable? Assume that Golda can lend and borrow at the same fixed rate of 7.13% per annum. [8marks] Question 5 Consider the following two cash-flow seauence: (a) Find the In'ernal Rate of Return (IRR) of project A and Project B. And show that IRR(A)>IRR(B) [8marks] Question 6 2.2 Consider the cash flow sequence, a=(5,9,20,4,2),b=(6,7,3,1,36) at time t= 0,,4. Find the NPV of the cash flow assuming an interest rate of 7%. [6 marks] Question 7 A project requires an initial investment of N\$ 225000 and is expected to generate the following Net cash inflows. Year 1: N\$95000, Year 2: 80000, Year 3: 60000, Year 4: 55000. Computer NPV of the project if the minimum desired rate of return is 12%. [4 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started