Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FINANCIAL MODELLING true or false 1. A forecast balance sheet could be estimated based on a firm's past financial ratios and statements 2. A cash

FINANCIAL MODELLING

true or false 1. A forecast balance sheet could be estimated based on a firm's past financial ratios and statements

2. A cash budget is a byproduct (secondary result) of producing forecast financial statements.

3. The ending cash balance of the cash budget should be equal to the net income shown on the income statement.

4. Other things held constant, the more debt a firm uses, the lower its return on total assets will be

5. Firms A and B have the same current ratio, 0.75, the same amount of sales, and the same amount of current liabilities. However, Firm A has a higher inventory turnover ratio than B. Therefore, we can conclude that A's quick ratio must be smaller than B's.

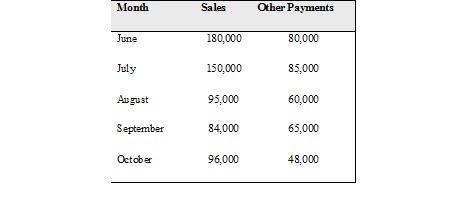

TJ max asked you to create a cash budget in order to determine its borrowing needs from June to September period. You have gathered the following information.

April and May sales were $145,000 and $160,000, respectively. The firm collects 45% of its sales during the month. Of the remaining 55% of sales, 70% is collected in the following month and 30 % is collected two months after the sale. Each month it purchases inventory equal to 50% of the current months expected sales. The company pays for 45% of its inventory purchases in the same month and 55% in the following month. A minimum cash balance of $20,000 must be maintained each month. Its cash balance at the end of May was also $20,000.

Create a cash budget for June to September 2021 and three Scenarios( best case, base case, and worst case) assuming that sales revenues are 10% better than expected, exactly as expected or 10% worse than expected showing(scenario summary) their effect on the maximum cumulative borrowing to answer the below questions.

1. The total collection for the month of July will be *

a. $163,200

b. $241,500

c. $236,500

d. $150,000

e. None of the above

2. The total payments for the month of September will be: *

a. $42,000

b. $84,000

c. $45,025

d. $110,025

e. None of the above

3. The total disbursement for the month of August will be: *

a. $122,625

b. $62,625

c. $7,575

d. $95,000

e. None of the above

4. The current borrowing for the month of July will be: *

a. $0

b. $3,025

c. $6,350

d. None of the above.

e.$1,000

5. The ending cash balance for the month of July will be: *

a. -$5050

b. $16,975

c. $20,000

d. $3,025

e. None of the above

6. The maximum cumulative borrowing will be *

a. $6,350

b. $0

c. $20,000

d. $3,025

e. None of the above

7. If the sales revenues are 10% better than expected, then the maximum cumulative borrowing will be *

a. $3025

b. $6,350

c. $34,715

d. $0

e. None of the above

FINANCIAL MODELLING IS THE SUBJECT EXPLANATION NOT IMPORTANT THANK YOU

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started