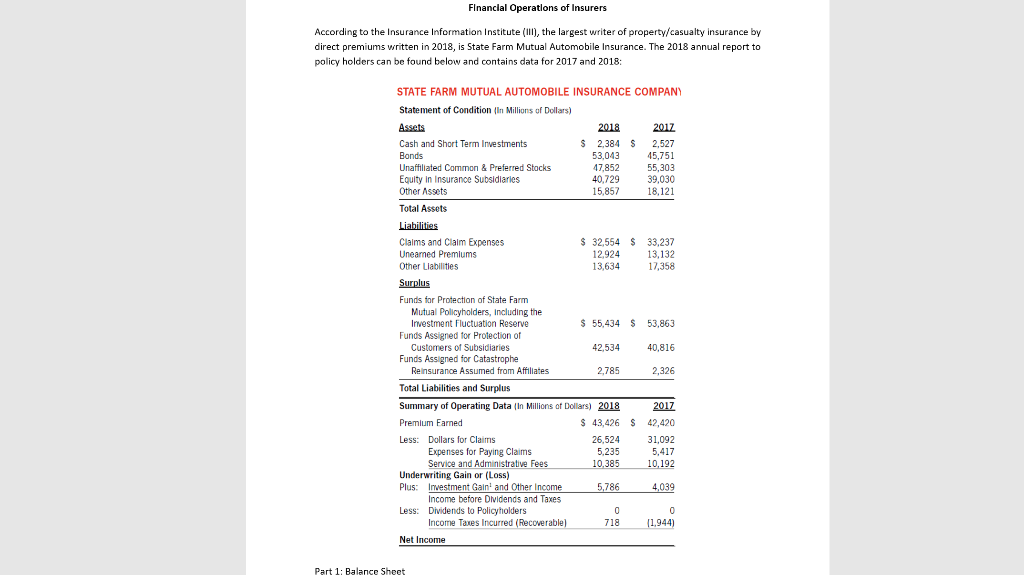

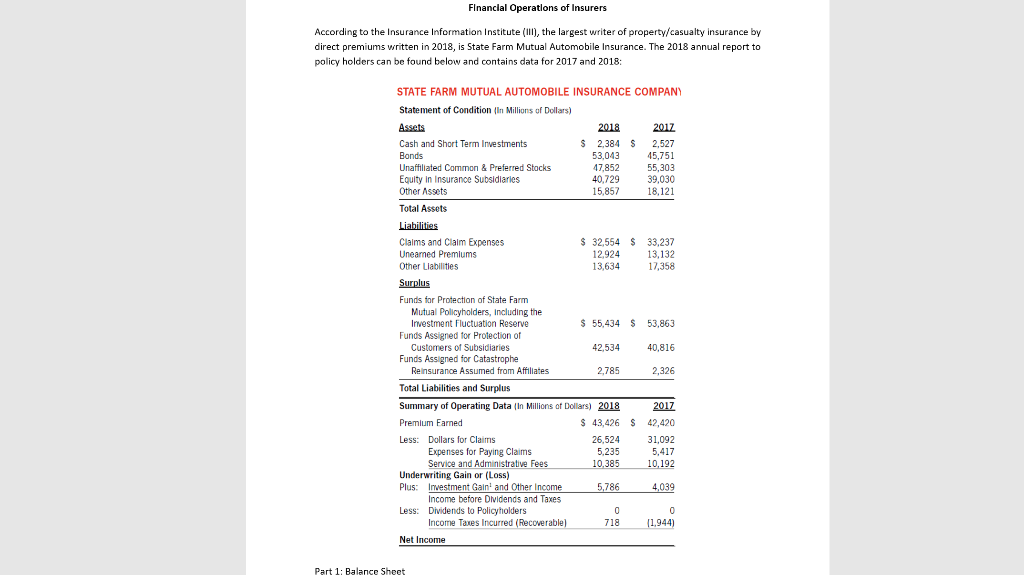

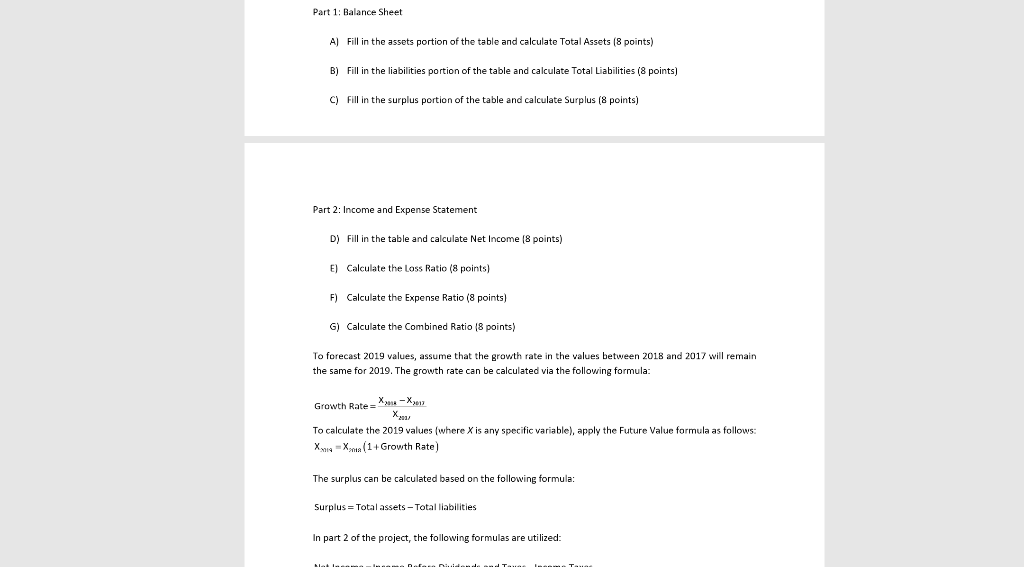

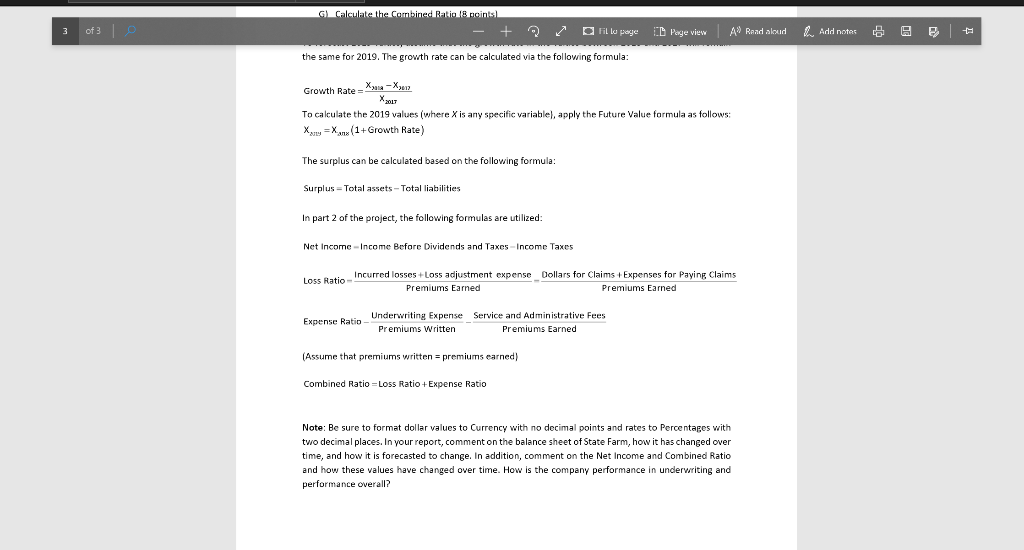

Financial Operations of Insurers According to the Insurance Information Institute (Ill), the largest writer of property/casualty Insurance by direct premiums written in 2018, is State Farm Mutual Automobile Insurance. The 2018 annual report to policy holders can be found below and contains data for 2017 and 2018: STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY Statement of Condition (in Millions of Dollars) Assets 2018 2017 Cash and Short Term Investments $ 2,384 S 2,527 Bonds 53,043 45,751 Unaffiliated Common & Preferred Stocks 47,852 55,303 Equity in Insurance Subsidiaries 40.729 39.030 Other Assets 15,857 18,121 Total Assets $ 33,237 13,132 17,358 $ 53,863 40,816 2,326 Liabilities Claims and Claim Expenses $ 32,554 Unearned Premiums 12,924 Other Liabilities 13,634 Surplus Funds for Protection of State Farm Mutual Policyholders, including the Investment Fluctuation Reserve $ 55,434 Funds Assigned for Protection of Customers of Subsidiaries 42,534 Funds Assigned for Catastrophe Reinsurance Assumed from Affiliates 2,785 Total Liabilities and Surplus Summary of Operating Data (in Millions of Dollars) 2018 Premium Farned $ 43,426 Less: Dollars for Claims 26,524 Expenses for Paying Claims 5,235 Service and Administrative Fees 10.385 Underwriting Gain or (Loss) Plus: Investment Gaint and Other Income 5,786 Income before Dividends and Taxes Less: Dividends to Policyholders Income Taxes incurred (Recoverable) 718 Net Income $ 2017 42,420 31,092 5,417 10,192 4,039 1.944) Part 1: Balance Sheet Part 1: Balance Sheet Fill in the assets portion of the table and calculate Total Assets (8 points) Fill in the liabilities portion of the table and calculate Total Liabilities (8 points) C) Fill in the surplus portion of the table and calculate Surplus (8 points) Part 2: Income and Expense Statement D) Fill in the table and calculate Net Income (8 points) E) Calculate the loss Ratio (8 points) F) Calculate the Expense Ratio (8 points) G) Calculate the combined Ratio (8 points) To forecast 2019 values, assume that the growth rate in the values between 2018 and 2017 will remain the same for 2019. The growth rate can be calculated via the following formula: Growth Rate= -X13 X 2017 To calculate the 2019 values (where X is any specific variable), apply the Future Value formula as follows: X 14 X2 (1+Growth Rate) The surplus can be calculated based on the following formula: Surplus = Total assets - Total liabilities In part 2 of the project, the following formulas are utilized: 3 of 30 G) Calculate the combined Ratiopoints - + fillo pare D Page view A Read aloud Add notes 6 the same for 2019. The growth rate can be calculated via the following formula: Growth Rate = -1 To calculate the 2019 values (where X is any specific variable), apply the Future Value formula as follows: X1 = Xanx (1+Growth Rate) The surplus can be calculated based on the following formula: Surplus = Total assets - Total liabilities In part 2 of the project, the following formulas are utilized: Net Income -Income Before Dividends and Taxes- Income Taxes Loss Ratio -" Incurred losses +Loss adjustment expense Dollars for Claims + Expenses for Paying Claims Premiums Earned Premiums Earned Expense Ratio - Underwriting Expense Service and Administrative Fees Premiums Written Premiums Earned (Assume that premiums written = premiums earned) Combined Ratio -Loss Ratio +Expense Ratio Note: Be sure to format dollar values to Currency with no decimal points and rates to Percentages with two decimal places. In your report, comment on the balance sheet of State Farm, how it has changed over time, and how it is forecasted to change. In addition, comment on the Net Income and Combined Ratio and how these values have changed over time. How is the company performance in underwriting and performance overall? Financial Operations of Insurers According to the Insurance Information Institute (Ill), the largest writer of property/casualty Insurance by direct premiums written in 2018, is State Farm Mutual Automobile Insurance. The 2018 annual report to policy holders can be found below and contains data for 2017 and 2018: STATE FARM MUTUAL AUTOMOBILE INSURANCE COMPANY Statement of Condition (in Millions of Dollars) Assets 2018 2017 Cash and Short Term Investments $ 2,384 S 2,527 Bonds 53,043 45,751 Unaffiliated Common & Preferred Stocks 47,852 55,303 Equity in Insurance Subsidiaries 40.729 39.030 Other Assets 15,857 18,121 Total Assets $ 33,237 13,132 17,358 $ 53,863 40,816 2,326 Liabilities Claims and Claim Expenses $ 32,554 Unearned Premiums 12,924 Other Liabilities 13,634 Surplus Funds for Protection of State Farm Mutual Policyholders, including the Investment Fluctuation Reserve $ 55,434 Funds Assigned for Protection of Customers of Subsidiaries 42,534 Funds Assigned for Catastrophe Reinsurance Assumed from Affiliates 2,785 Total Liabilities and Surplus Summary of Operating Data (in Millions of Dollars) 2018 Premium Farned $ 43,426 Less: Dollars for Claims 26,524 Expenses for Paying Claims 5,235 Service and Administrative Fees 10.385 Underwriting Gain or (Loss) Plus: Investment Gaint and Other Income 5,786 Income before Dividends and Taxes Less: Dividends to Policyholders Income Taxes incurred (Recoverable) 718 Net Income $ 2017 42,420 31,092 5,417 10,192 4,039 1.944) Part 1: Balance Sheet Part 1: Balance Sheet Fill in the assets portion of the table and calculate Total Assets (8 points) Fill in the liabilities portion of the table and calculate Total Liabilities (8 points) C) Fill in the surplus portion of the table and calculate Surplus (8 points) Part 2: Income and Expense Statement D) Fill in the table and calculate Net Income (8 points) E) Calculate the loss Ratio (8 points) F) Calculate the Expense Ratio (8 points) G) Calculate the combined Ratio (8 points) To forecast 2019 values, assume that the growth rate in the values between 2018 and 2017 will remain the same for 2019. The growth rate can be calculated via the following formula: Growth Rate= -X13 X 2017 To calculate the 2019 values (where X is any specific variable), apply the Future Value formula as follows: X 14 X2 (1+Growth Rate) The surplus can be calculated based on the following formula: Surplus = Total assets - Total liabilities In part 2 of the project, the following formulas are utilized: 3 of 30 G) Calculate the combined Ratiopoints - + fillo pare D Page view A Read aloud Add notes 6 the same for 2019. The growth rate can be calculated via the following formula: Growth Rate = -1 To calculate the 2019 values (where X is any specific variable), apply the Future Value formula as follows: X1 = Xanx (1+Growth Rate) The surplus can be calculated based on the following formula: Surplus = Total assets - Total liabilities In part 2 of the project, the following formulas are utilized: Net Income -Income Before Dividends and Taxes- Income Taxes Loss Ratio -" Incurred losses +Loss adjustment expense Dollars for Claims + Expenses for Paying Claims Premiums Earned Premiums Earned Expense Ratio - Underwriting Expense Service and Administrative Fees Premiums Written Premiums Earned (Assume that premiums written = premiums earned) Combined Ratio -Loss Ratio +Expense Ratio Note: Be sure to format dollar values to Currency with no decimal points and rates to Percentages with two decimal places. In your report, comment on the balance sheet of State Farm, how it has changed over time, and how it is forecasted to change. In addition, comment on the Net Income and Combined Ratio and how these values have changed over time. How is the company performance in underwriting and performance overall