Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial plan and results for 3 months of operations (Start date 10/1/20 and end date 12/31/20) I need to make a general ledger from these

Financial plan and results for 3 months of operations (Start date 10/1/20 and end date 12/31/20)

I need to make a general ledger from these 3 journals (it doesn't have to be T accounts)

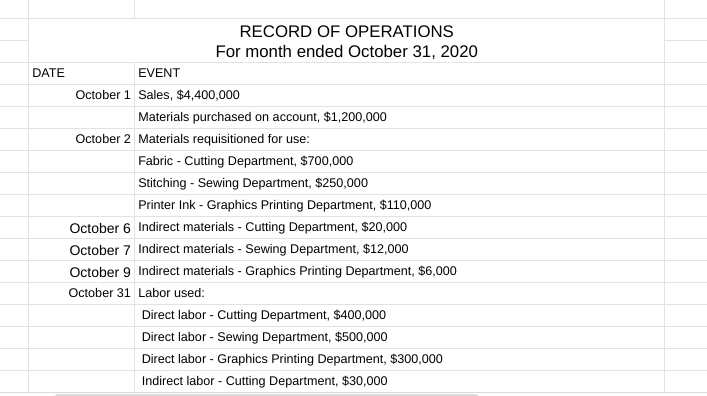

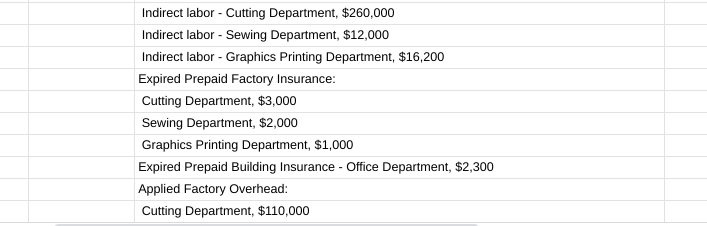

1st Journal

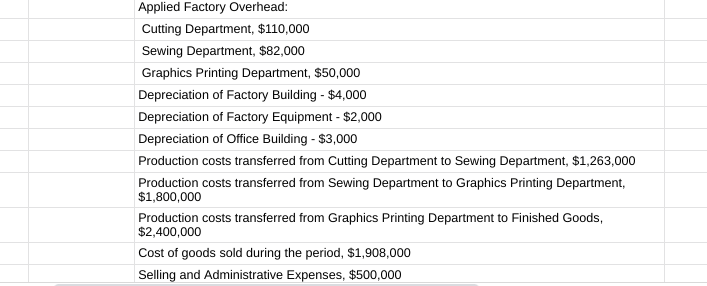

2nd Journal

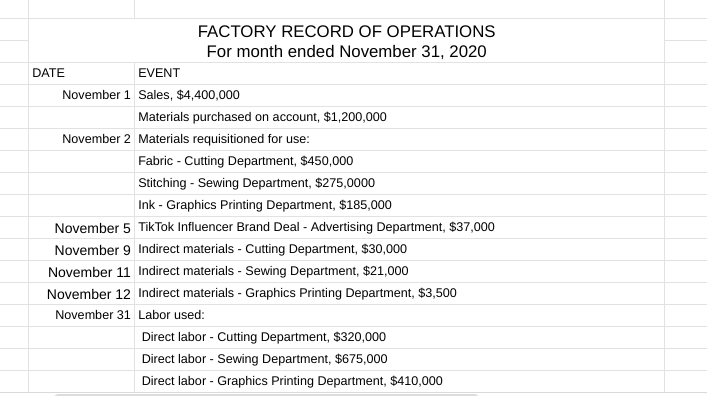

3rd Journal ^

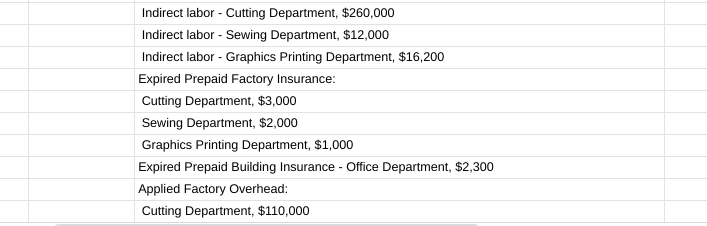

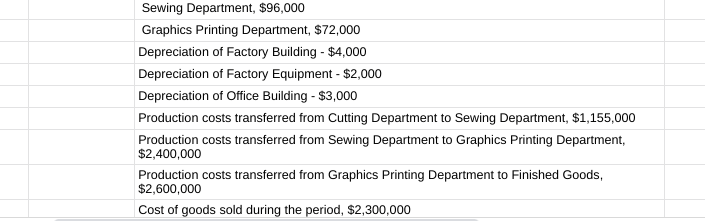

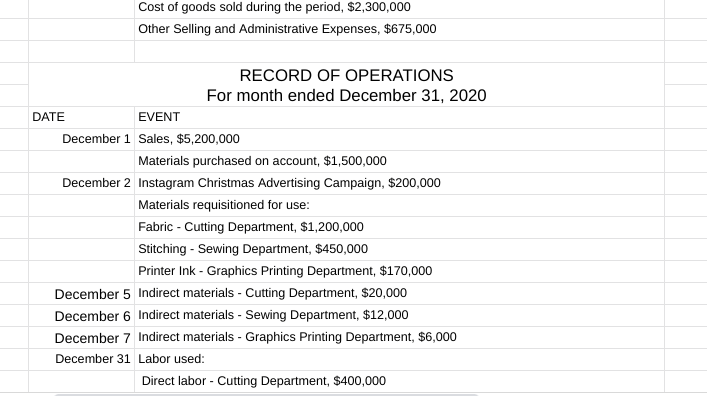

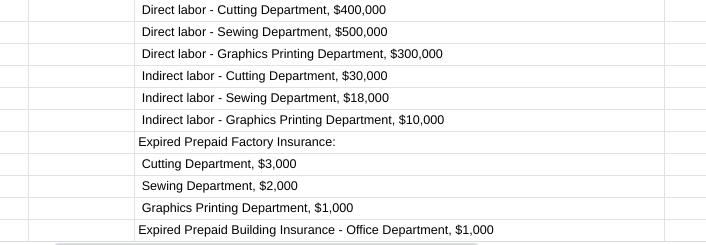

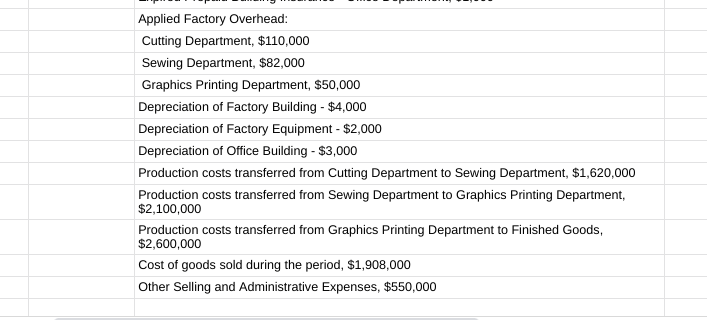

RECORD OF OPERATIONS For month ended October 31, 2020 DATE EVENT October 1 Sales, $4,400,000 Materials purchased on account, $1,200,000 October 2 Materials requisitioned for use: Fabric - Cutting Department, $700,000 Stitching - Sewing Department, $250,000 Printer Ink - Graphics Printing Department, $110,000 October 6 Indirect materials - Cutting Department, $20,000 October 7 Indirect materials - Sewing Department, $12,000 October 9 Indirect materials - Graphics Printing Department, $6,000 October 31 Labor used: Direct labor - Cutting Department, $400,000 Direct labor - Sewing Department, $500,000 Direct labor - Graphics Printing Department, $300,000 Indirect labor - Cutting Department, $30,000 Indirect labor - Cutting Department, $260,000 Indirect labor - Sewing Department, $12,000 Indirect labor - Graphics Printing Department, $16,200 Expired Prepaid Factory Insurance: Cutting Department, $3,000 Sewing Department, $2,000 Graphics Printing Department, $1,000 Expired Prepaid Building Insurance - Office Department, $2,300 Applied Factory Overhead: Cutting Department, $110,000 Applied Factory Overhead: Cutting Department, $110,000 Sewing Department, $82,000 Graphics Printing Department, $50,000 Depreciation of Factory Building - $4,000 Depreciation of Factory Equipment - $2,000 Depreciation of Office Building - $3,000 Production costs transferred from Cutting Department to Sewing Department, $1,263,000 Production costs transferred from Sewing Department to Graphics Printing Department, $1,800,000 Production costs transferred from Graphics Printing Department to Finished Goods, $2,400,000 Cost of goods sold during the period, $1,908,000 Selling and Administrative Expenses, $500,000 FACTORY RECORD OF OPERATIONS For month ended November 31, 2020 DATE EVENT November 1 Sales, $4,400,000 Materials purchased on account, $1,200,000 November 2 Materials requisitioned for use: Fabric - Cutting Department, $450,000 Stitching - Sewing Department, $275,0000 Ink - Graphics Printing Department, $185,000 November 5 Tik Tok Influencer Brand Deal - Advertising Department, $37,000 November 9 Indirect materials - Cutting Department, $30,000 November 11 Indirect materials - Sewing Department, $21,000 November 12 Indirect materials - Graphics Printing Department, $3,500 November 31 Labor used: Direct labor - Cutting Department, $320,000 Direct labor - Sewing Department, $675,000 Direct labor - Graphics Printing Department, $410,000 Indirect labor - Cutting Department, $260,000 Indirect labor - Sewing Department, $12,000 Indirect labor - Graphics Printing Department, $16,200 Expired Prepaid Factory Insurance: Cutting Department, $3,000 Sewing Department, $2,000 Graphics Printing Department, $1,000 Expired Prepaid Building Insurance - Office Department, $2,300 Applied Factory Overhead: Cutting Department, $110,000 Sewing Department, $96,000 Graphics Printing Department, $72,000 Depreciation of Factory Building - $4,000 Depreciation of Factory Equipment - $2,000 Depreciation of Office Building - $3,000 Production costs transferred from Cutting Department to Sewing Department, $1,155,000 Production costs transferred from Sewing Department to Graphics Printing Department, $2,400,000 Production costs transferred from Graphics Printing Department to Finished Goods, $2,600,000 Cost of goods sold during the period, $2,300,000 Cost of goods sold during the period, $2,300,000 Other Selling and Administrative Expenses, $675,000 RECORD OF OPERATIONS For month ended December 31, 2020 DATE EVENT December 1 Sales, $5,200,000 Materials purchased on account, $1,500,000 December 2 Instagram Christmas Advertising Campaign, $200,000 Materials requisitioned for use: Fabric - Cutting Department, $1,200,000 Stitching - Sewing Department, $450,000 Printer Ink - Graphics Printing Department, $170,000 December 5 Indirect materials - Cutting Department, $20,000 December 6 Indirect materials - Sewing Department, $12,000 December 7 Indirect materials - Graphics Printing Department, $6,000 December 31 Labor used: Direct labor - Cutting Department, $400,000 Direct labor - Cutting Department, $400,000 Direct labor - Sewing Department, $500,000 Direct labor - Graphics Printing Department, $300,000 Indirect labor - Cutting Department, $30,000 Indirect labor - Sewing Department, $18,000 Indirect labor - Graphics Printing Department, $10,000 Expired Prepaid Factory Insurance: Cutting Department, $3,000 Sewing Department, $2,000 Graphics Printing Department, $1,000 Expired Prepaid Building Insurance - Office Department, $1,000 Applied Factory Overhead: Cutting Department, $110,000 Sewing Department, $82,000 Graphics Printing Department, $50,000 Depreciation of Factory Building - $4,000 Depreciation of Factory Equipment - $2,000 Depreciation of Office Building - $3,000 Production costs transferred from Cutting Department to Sewing Department, $1,620,000 Production costs transferred from Sewing Department to Graphics Printing Department, $2,100,000 Production costs transferred from Graphics Printing Department to Finished Goods, $2,600,000 Cost of goods sold during the period, $1,908,000 Other Selling and Administrative Expenses, $550,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started