Financial planning case 12-6

A Married Couple with Children Address Their Life Insurance Needs

Joseph and Marcia Michael of Athens, Georgia, are a married couple in their mid-30s. They have two children, ages 5 and 3, and Marcia is pregnant with their third child. Marcia is a part-time book indexer who earned $28,000 after taxes last year. Because she performs much of her work at home, it is unlikely that she will need to curtail her work after the baby is born. Joseph is a marriage counselor; he earned $72,000 last year after taxes. Because both are self-employed, Marcia and Joseph do not have access to group life insurance. They are each covered by $60,000 universal life policies they purchased three years ago. In addition, Joseph is covered by a $60,000, five-year guaranteed renewable term policy, which will expire next year. The Michaels are currently reassessing their life insurance program. As a preliminary step in their analysis, they have determined that Marcia's three survivors would qualify for Social Security survivor's benefits of about $1,900 per month, or an annual benefit of $22,800, if she were to die. For Joseph's survivors, the figure would be $2,600 per month, or an annual benefit of $31,200. Both agree that they would like to support each of their children to age 22, but to date, they have been unable to start a college savings fund. The couple estimates that it would cost $300,000 to put all three children through a regional university in their state as measured in today's dollars. They expect that burial expenses for each spouse would total about $12,000, and they would like to have a lump sum of $50,000 to help the surviving spouse make payments on their home mortgage. They also feel that each spouse would want to take a three-month leave from work if the other were to die. Assume that 25% of income is used for personal needs.

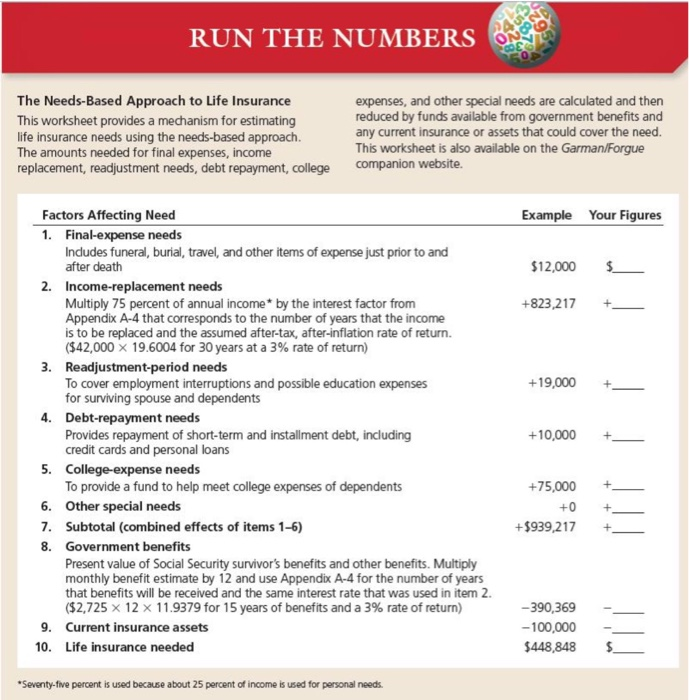

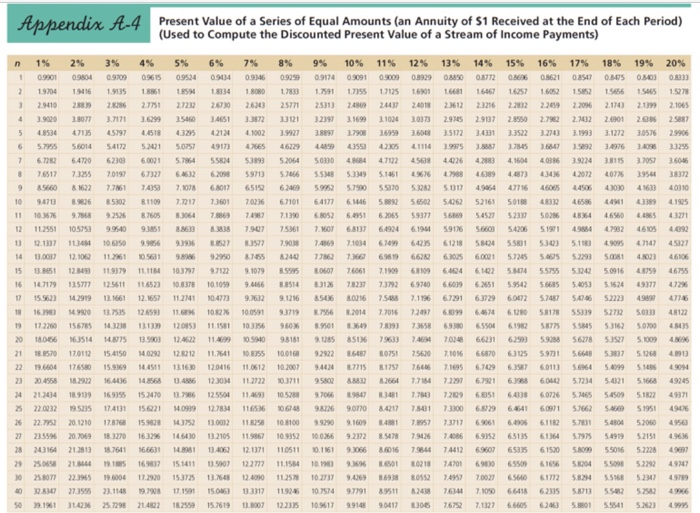

a) Calculate the amount of life insurance that Marcia needs based on the information given. Use the Run the Numbers worksheet or the Garman/Forgue companion website. Assume a 3 percent rate of return after taxes and inflation and an income need for 22 years because the unborn child will need financial support for that many years. Round Present value of a Series of Equal Amounts in intermediate calculations to four decimal places. (Use Appendix A.4.) Round your answer to the nearest dollar.

$ ______

b) Calculate the amount of life insurance that Joseph needs based on the information given. Use the Run the Numbers worksheet or the Garman/Forgue companion website. Assume a 3 percent rate of return after taxes and inflation and an income need for 22 years because the unborn child will need financial support for that many years. Round Present value of a Series of Equal Amounts in intermediate calculations to four decimal places. (Use Appendix A.4.) Round your answer to the nearest dollar.

$ _______

03 RUN THE NUMBERS The Needs-Based Approach to Life Insurance This worksheet provides a mechanism for estimating life insurance needs using the needs-based approach. The amounts needed for final expenses, income replacement, readjustment needs, debt repayment, college expenses, and other special needs are calculated and then reduced by funds available from government benefits and any current insurance or assets that could cover the need. This worksheet is also available on the Garman/Forgue companion website. Example Your Figures $12,000 $ +823,217 + +19,000 + Factors Affecting Need 1. Final-expense needs Indudes funeral, burial, travel, and other items of expense just prior to and after death 2. Income-replacement needs Multiply 75 percent of annual income* by the interest factor from Appendix A-4 that corresponds to the number of years that the income is to be replaced and the assumed after-tax, after-inflation rate of return. (542,000 X 19.6004 for 30 years at a 3% rate of return) 3. Readjustment-period needs To cover employment interruptions and possible education expenses for surviving spouse and dependents 4. Debt-repayment needs Provides repayment of short-term and installment debt, including credit cards and personal loans 5. College-expense needs To provide a fund to help meet college expenses of dependents 6. Other special needs 7. Subtotal (combined effects of items 1-6) 8. Government benefits Present value of Social Security survivor's benefits and other benefits. Multiply monthly benefit estimate by 12 and use Appendix A-4 for the number of years that benefits will be received and the same interest rate that was used in item 2. ($2,725 x 12 x 11.9379 for 15 years of benefits and a 3% rate of return) 9. Current insurance assets 10. Life insurance needed +10,000 + + +75,000 +0 +$939,217 + + + -390,369 -100,000 $448,848 $. *Seventy-five percent is used because about 25 percent of income is used for personal needs. Ahhendis 1.4 Present Value of a Series of Equal Amounts (an Annuity of $1 Received at the End of Each Period) (Used to Compute the Discounted Present Value of a Stream of Income Payments) n 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1 0.990109804 0.970909615 09524 0.9134 0.9346 09259 0.9174 09091 0.900908929 0.8850 0.8772086608621 0.8547 0.8075 0.3403 0.8333 2 1.970419416 1.9135 18861 18594 1834 18080 1.7833 1759117355 1.7125 1691 16681 16467 16257 1605215852 1.5656 1.5465 15278 3 2.9410 2883928786 2.7751 27232 267302623 25771 2.531324869 2443724018 2.36122.3216 2.2832 2.2459 2.2096 2.173 2.1399 2.1065 39000 39077 3.712136799 506 1 2 1 29 169 1024 30373 2.935 2907 285502.792 2.102 2001 2.086 2.5887 5 48534 4713545197 5 19 43295 2124 100239977 29897 37908 36959 350 35172 341 33522 3278331993 31272 30576 29906 5.7955 56014 5.4172524215.0757 491734.76654622944899 435 4.2305 4.1114 39975 3. 7 3.78453687 3.5892 3.4976 3.4098 33295 67282 6.4720 62308 6.0021 5.7864 55824 538935.2064 5033048684 4.7122450384426 42883 4160440386 3.922438115 3.7057 3.6046 76517 735 70197 6.6632 62093 59713 5.706655348 5.33495.1461 676 4798846389 4873 434 42072 20763954 38372 9 85660 81622 77861 74197,078 6.8017 6519 624695952 57900 570 52782 51317 49664 47716 45065 4506 4300 41633 40110 10 94713 0 826 5302 1109 7.7217 73601 70236 67101 4177 6.1446 5.8892 5.6502 5426252161 50188 483 4 658644911 43389 4.1995 11 10.3676 9.7858 9.2526 87605 8.306479869 7.4987 7.1390680526.6951 6205559377 56869 5.4527 52337 50256 8364 46560 186543271 12 1125511057539954093851 833 1838 7907 75361 7. MOT 6812 609 619 59176 566 547065191 479245805 4092 13 2.1337 11341 10.050 9.9856 9393638527 357 7903 7486971014 6 9 425 1218 S S 515301 511) 49095 7147 4927 14 13.0037 12.100211236105601 98986 92950 8.755 82407786273666989 6626 6.3025 60021 57245 5.46355.2293 50081 4802346106 15 3551 120 119379 11.1184103797 97122 1079 R5505 0607 76061 71909 68109 6.494 6102 5 5 5755 52250916 48759 46755 16 14.7179 135777125611 11.6523 10.8378 10.1059 9.4166 8.8514 8.316 78237 7.3792 6.9740 6.609 6.2651 5.954255685 5.4053 5.1624 49377 47296 15.562314291913.1661 12.1657 112741 104773 9.7032 9.1216 850680216 75488 7.1196 6.7291 6.37296.0072 5.7487 54146 522234989747746 18 16.3983 14.9920 13.7535 12.6593 11.6896 1082 10.0591 9.3719 8.7556 8.2014 7.7016 7249768099 646746.1028058178 553395273250333 48122 19 172260 156785 1718 1213 120853 11.1581 10:335696036 8.9501 836497839373658 6978065504 6.1982 58775 5845 5.31625.000 48435 20180156 163514 14.8775 13.5803 12.4622 11.4699 0.5940 981819.1285 85136796337.469470248 66231 62593 59288 56278 5.3527 5.1009486 21 18.8570 170112 15.4150 0 292128212 11.7641 108355 10.0168 92922 864878075175620 7.101666870 63125 59731 5.6648 5.3837 5.1268 4.9913 22 19.6604 176580 15.936914511 13.1630120416110612 10.2007 9.442487715 8.1757 766671695 6.702963587 60113 5.6964 5.60995.14569094 23 20.4558 18 2922164036 14568 13 46 1230 112722 3711 952 M 816647714 72297 6.7921 693 604 57234 5.021 5.1668 49245 24 21 434 18 9139169155 15 34701 76 12 5504 11 693 10.528 7066 89 348 7753 729 6.3951 6.438 60226 5765 5.450951022 49371 5 22.032 95235174131 1521 1.091912.7834 116536 10.64% 98726 90770 8.4217 7.841 7.3300 6,872964641 60971 57662 54669 51951 49076 26 22.792 20.1210 17.8768 15.9828 3752 13.0082 118358 10.8100 9.92909.16098.4881 789577.3717 6.9061 6.4906 6.1182 5.7831 5.430452060 49563 27 235596 207069 18370163296 146430132105 11.9867 10,9352 006 922 8 7 7086 6015265115 114 597 5491952151 4966 28 243164 21.2813 18.7641 16.6631 14.8951 13.406212.1371 110511 0.1161 93066 85016 79644 744126960765335 61520 5.8099550165.2228 49692 29250558 21 15169837151411 07 122777 111504103 9 R6501 80218 74701 69 65509 61656 57204 5500852292 49347 30 25.8077 22.3965 19.6004 17.2920 153725 13.7648 12.4090 112578 1027379.4269 86938 8055274957 7.00276.5660 61712 58294 5.51685.2347 4.9799 302.8347 27.3555 23.1148 9.798 17.1591 15.04631.3317 11.9246 10.757497791 89511 8243 7634 7.1050 6.6418 62335 5.8713 552 5.2582 49966 503.1961 34236 25.7298214822 182559 1.7619 3.8007 12.2335109617 9914890417 8305 76752 7.1327 6.660562463 5.801 5.5541 5.2623 49995 1