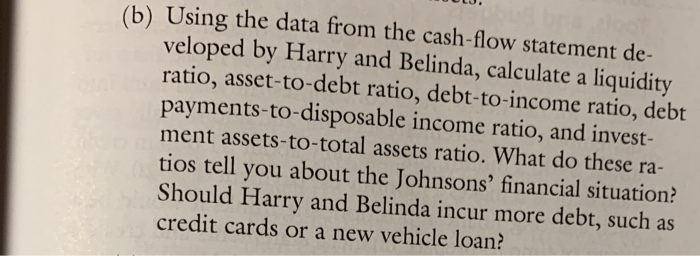

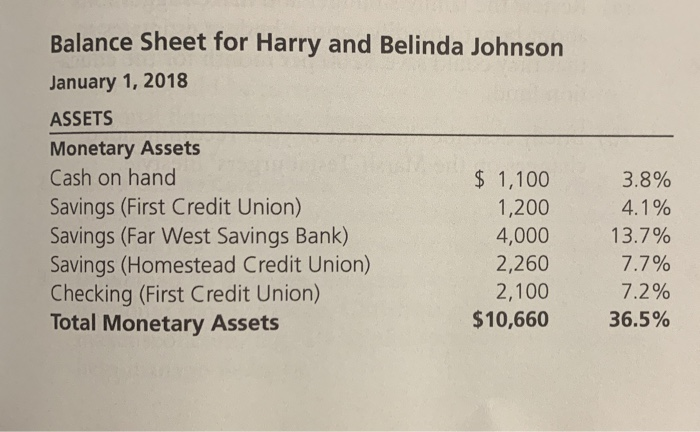

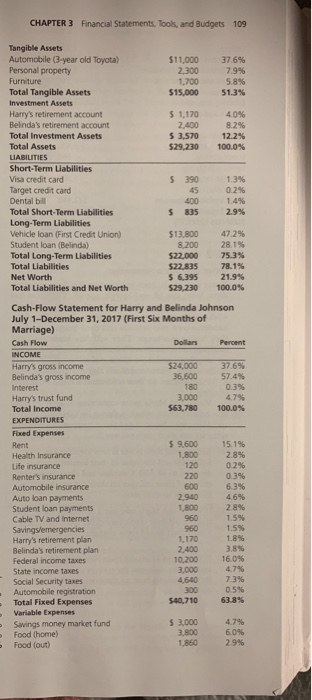

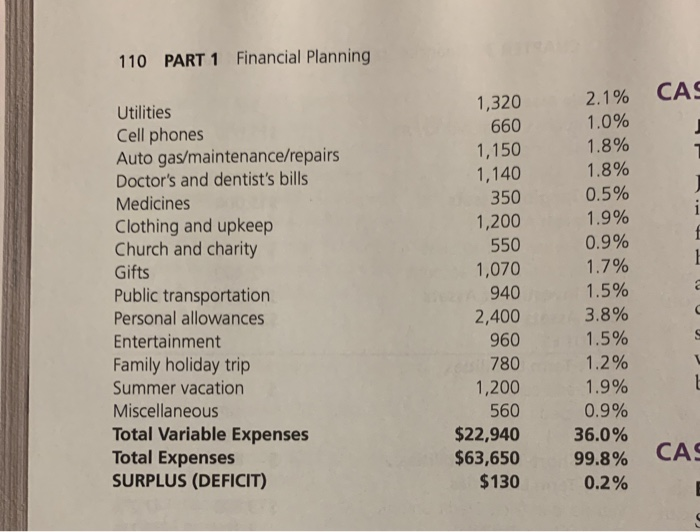

FINANCIAL PLANNING CASES between their places of employment. However, their rent will increase by $100 a month in July. Harry drives about ten minutes to his job, and Belinda travels about 15 min- utes via public transportation to reach her downtown job. Harry and Belinda's apartment is very nice, but small, and it is furnished primarily with furniture given to them by some of his friends. Soon after getting married, Harry and Belinda decided to begin their financial planning. Fortu- nately each had taken a college course in personal finance. After initial discussion, they worked together for three evenings to develop the financial statements presented be- low. Note that the cash flow statement covered the first six months of their marriage. CASE 1 The Financial Statements of Harry and Belinda Johnson Suggest Budgeting Problems Harry has worked at a medium-size interior design firm for five years and earns a salary of $4,080 per month. He also receives $3,000 in interest income once a year from a trust fund set up by his deceased father's estate. Belinda earns a salary of $6,400 per month, and she has many job-related benefits including flexible benefits program, life insurance, health insurance, a 401 (k) retirement program, workplace financial education, and a credit union. The Johnsons live in an old apartment located approximately halfway (b) Using the data from the cash-flow statement de- veloped by Harry and Belinda, calculate a liquidity ratio, asset-to-debt ratio, debt- to -income ratio, debt payments-to-disposable income ratio, and invest- ment assets-to-total assets ratio. What do these ra- tios tell you about the Johnsons' financial situation? Should Harry and Belinda incur more debt, such as credit cards or a new vehicle loan? Balance Sheet for Harry and Belinda Johnson January 1, 2018 ASSETS Monetary Assets Cash on hand $ 1,100 3.8% Savings (First Credit Union) Savings (Far West Savings Bank) Savings (Homestead Credit Union) Checking (First Credit Union) Total Monetary Assets 1,200 4,000 2,260 2,100 $10,660 4.1% 13.7% 7.7% 7.2% 36.5% CHAPTER 3 Financial Statements, Tools, and Budgets 109 Tangible Assets Automobile (3-year old Toyota) Personal property $11,000 37.6% 2,300 1,700 $15,000 7.9% 5.8 % Furniture Total Tangible Assets 51.3 % Investment Assets $ 1,170 Harry's retirement account Belinda's retirement account Total Investment Assets Total Assets 4.0% 8.2% 12.2% 100.0 % 2,400 $ 3,570 $29,230 LIABILITIES Short-Term Liabilities Visa credit card Target credit card Dental bill S 390 1.3% 45 0.2% 1.4 % 2.9 % 400 Total Short-Term Liabilities Long-Term Liabilities 835 47.2% Vehicle loan (First Credit Union) $13,800 Student loan (Belinda) Total Long-Term Liabilities Total Liabilities 28.1% 8.200 $22.000 75.3 % $22,835 78.1% $ 6,395 Net Worth Total Liabilities and Net Worth 21.9% 100.0 % $29,230 Cash-Flow Statement for Harry and Belinda Johnson July 1-December 31, 2017 (First Six Months of Marriage) Cash Flow Dollars Percent INCOME 37.6% $24,000 36,600 Harry's gross income Belinda's gross income Interest Harry's trust fund Total Income 57.4% 180 0.3% 3,000 563,780 4.7% 100.0 % EXPENDITURES Fixed Expenses $ 9,600 1,800 120 15.1% Rent Health Insurance 2.8 % 0.2% Life insurance 220 0.3% 6.3 % 4.6% Renter's insurance Automobile insurance 600 Auto loan payments Student loan payments 2,940 2.8% 1.5% 1,800 Cable TV and Internet Savings/emergencies Harry's retirement plan Belinda's retirement plan 960 960 1.5% 1.8% 1,170 2,400 10,200 3.8 % 16.0 % Federal income taxes 4.7% 3,000 4,640 State income taxes 7.3% 0.5 % Social Security taxes Automobile registration Total Fixed Expenses Variable Expenses Savings money market fund Food (home) Food (out) 300 $40,710 63.8% $ 3,000 3800 4.7% 6.0 % 1,860 2.9% 110 PART 1 Financial Planning 2.1% CAS 1.0% 1,320 Utilities 660 Cell phones Auto gas/maintenance/repairs Doctor's and dentist's bills 1.8% 1,150 1,140 350 1.8% 0.5% Medicines 1.9% 0.9% 1,200 550 Clothing and upkeep Church and charity 1.7% 1,070 940 Gifts 1.5% Public transportation Personal allowances 3.8% 2,400 1.5% 960 Entertainment 1.2% 780 Family holiday trip Summer vacation 1.9% 1,200 Miscellaneous 560 0.9% Total Variable Expenses Total Expenses SURPLUS (DEFICIT) $22,940 $63,650 $130 36.0% CA 99.8% 0.2%