Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Planning Cases The Johnsons' Credit Questions They are considering trading their car in for a newer used vehicle so that Harry can have dependable

Financial Planning Cases

The Johnsons' Credit Questions

They are considering trading their car in for a

newer used vehicle so that Harry can have

dependable transportation for commuting to

work. The couple still owes $4,950 to the

credit union for their current car, or $275 per

month for the remaining 18 months of the 48-

month loan. The trade-in value of this car plus

$1,000 that Harry earned from a freelance

interior design job should allow the couple to

pay off the auto loan and leave $1,200 for a

down payment on the newer car. The

Johnsons have agreed on a sales price for the

newer car of $26,000.

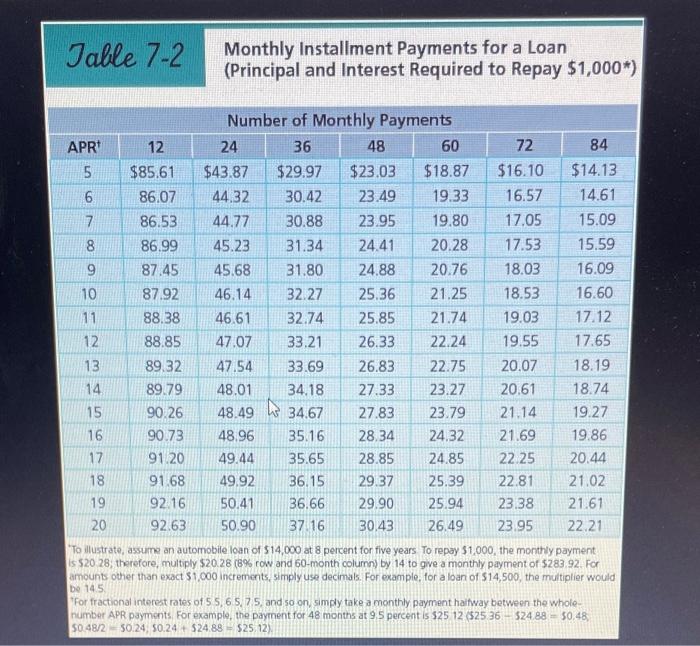

(b) Calculate the monthly payment for a loan

period of three, four, five, and six years at 7

percent APR. Describe the relationship

between the loan period and the payment

amount.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started