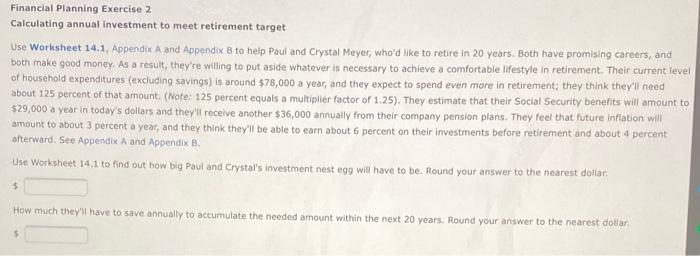

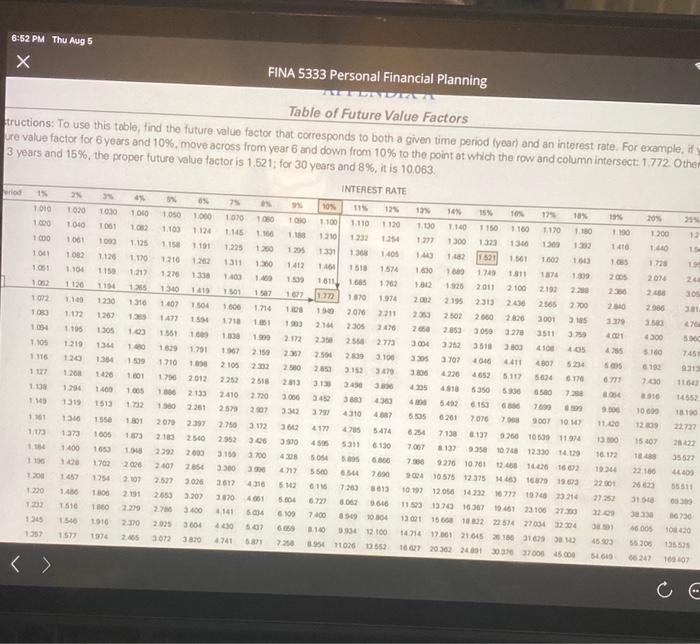

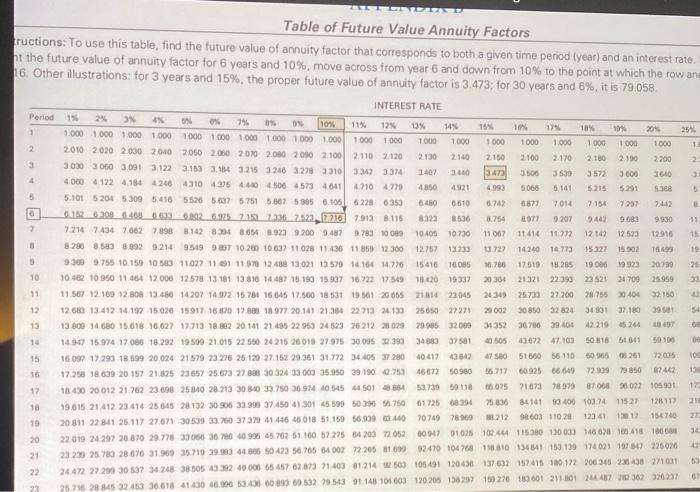

Financial Planning Exercise 2 Calculating annual Investment to meet retirement target Use Worksheet 14.1. Appendix A and Appendix B to help Paul and Crystal Meyer, who'd like to retire in 20 years. Both have promising careers, and both make good money. As a result, they're willing to put aside whatever is necessary to achieve a comfortable lifestyle in retirement. Their current level of household expenditures (excluding savings) is around $78,000 a year, and they expect to spend even more in retirement; they think they'll need about 125 percent of that amount. (Note: 125 percent equals a multiplier factor of 1.25). They estimate that their Social Security benefits will amount to $29,000 a year in today's dollars and they'll receive another $36,000 annually from their company pension plans. They feel that future Inflation will amount to about 3 percent a year, and they think they'll be able to earn about 6 percent on their investments before retirement and about 4 percent afterward. See Appendix A and Appendix B. Use Worksheet 14.1 to find out how big Paul and Crystals investment nest egg will have to be. Round your answer to the nearest dollar $ How much they'll have to save annually to accumulate the needed amount within the next 20 years. Round your answer to the nearest dolan 5 6:52 PM Thu Aug 5 FINA 5333 Personal Financial Planning Table of Future Value Factors tructions: To use this table, find the future value factor that corresponds to both a given time period (year and an interest rate. For example, i tre value factor for 6 years and 10%, move across from year 6 and down from 10% to the point at which the row and column intersect: 1772. Other 3 years and 15%, the proper future value factor is 1.521: for 30 years and 8%, it is 10,063. erlod INTEREST RATE 7 1% T010 1.000 1600 2 T020 1040 1 010 1000 1061 1050 1103 IN 1 OSO 19% 102 1000 1.124 1070 1145 1160 12 1061 1000 1191 1250 1.041 1092 20% 1200 1.40 1728 2014 1125 1.125 1110 1.212 1 1.225 1311 1400 1:50 1412 1.100 115 1104 13 103 1190 1410 105 2005 230 2340 3279 10 1 120 1501 1072 100 1230 1504 1310 1 1600 305 31 1.100 1210 1270 1340 1407 1477 1551 1629 1710 1790 1594 157 1714 1. 100 2150 1310 1308 1305 1034 1105 1.116 134 103 1.80 1509 1122 1196 1219 1203 1.200 1.294 1319 1346 45 134 1420 16 1.791 100 2012 2133 2261 2.105 2080 3.500 4300 5160 6192 7.00 1993 2.172 27 20 2013 3.000 1801 10% 125 1.100 1110 1 130 1210 1232 1214 1391 1300 10 1 510 1.611 1685 1202 1.772 1670 1994 201 211 2305 2470 235 2554 2.500 2800 3.100 2850 3.152 370 313 240 3452 383 30 229 4310 4.00 4177 5.414 450 5311 6130 5014 5.895 666 5.500 6544 7.600 6115 726) 8613 8067 366 7400 8.99 10.000 2100 99 12.100 8.95411026652 13 16% TON 129 10% 1.030 1100 1150 1 160 1.170 1180 1977 1300 1323 1300 1:22 143 18 1521 1.561 1.000 1.000 1609 1740 1 811 1.300 7812 1925 2011 2.100 2192 22 2002 2193 2565 2700 2502 2600 2820 3001 315 2660 2853 3050 3270 3511 3004 322 3511 3000 410 3 3707 4046411 4807 5234 3.000 4220 4652 5117 5024 178 125 4810 5350 5.900 6.500 72 400 5.492 6.153 7699 5.505 6201 7070 708 9007 10 6.254 7130 137 92661009 1197 7007 8137 9358 10748 12:330 14.129 7.50 927610701 126 12 16 02 104 10595 12375 1685 19.03 10 197 120564232772314 1153 1370 16.307 1946123106 2733 1301 1581222574 270343204 1471 17361 21 645 2163160 16 0720.302201303101700945000 073 1400 1665 054 7451 23 1 1455 1810 22722 1145 1513 1980 3342 9.00 2510 10000 12209 11 1.173 1550 1005 2079 2397 2012 11.00 2252 2518 2410 2720 257) 2007 2750 3.172 2952 306 3150 3700 35 36124310 3820 4001 1801 103 10 2020 1400 2290 1653 1702 3900 42 17 13500 16.12 15.03 1 3300 2007 7.527 1457 28.02 35572 LO 55511 2007 2540 2000 2854 3.016 3207 3400 3604 3830 1196 1200 1220 1232 134 1252 5.13 1754 1800 1860 1910 22001 27251 315 1510 1540 2191 2.279 210 11 5.000 6100 400 50 00230 1420 2025 3072 16.00 1572 2465 4741 45903 101 102 2015 SESEO Table of Future Value Annuity Factors ructions: To use this table, find the future value of annuity factor that corresponds to both a given time period (year) and an interest rate. ht the future value of annuity factor for 6 years and 10%, move across from year 6 and down from 10% to the point at which the row anu 16. Other illustrations: for 3 years and 15%, the proper future value of annuity factor is 3.473; for 30 years and 6%, it is 79.058 Period 1 2 3 5 o 7 10 11 INTEREST RATE 15 3 0% 7% 0% 10% 11% 12% 13% 14% 15% 106 17% 1.000 1.000 1000 1000 1000 1000 1000 1000 1000 1000 18% 204 25% 1000 1000 1000 1.000 1 000 1000 1.000 1 000 1000 1000 1 2010 2020 2030 2040 2050 2.000 2070 2000 2000 2.100 2.110 2120 2.130 2100 2.150 2.100 2.170 2.180 2.190 2200 3030 3060 3.091 3.122 3153 3.14 3.215 3246 1278 3310 33423374 1407 3.440 3:473 3500 3530 3572 3.000 1640 3 4000 4.122 4.1844246 4310 4375 440 4500 4573 4641 4710 4779 4850 4921 4.990 5066 5101 5215 5.251 5368 5 5.101 5204 53095.416 5526 5.7 5.751 5.367 5.905 6.105 6228 6353 GARO 6610 0.74% 6877 7014 7.154 7.297 742 012020814_000102_6935 71527336723221070128115 8322 8536 3.754 1977 5.207 943 9.683 9.990 11 7.216 7434 76627898 8.1428348654 89239.2009.487 9.783 1000 10.405 10730 11067 11414 117721214912522 12910 15 8.290 8.583 8.89292149549 9307 10.200 10.637 11.028 11430 11850 12300 12757 11233 13727 1424014773 15227 15 902 TA 19 9300 9.755 10.159 10 583 11022 116 117 12.488 13 021 13.579 14.164 14.776 15,416 16085 10.780 17519 18205 1906 19.32320799 25 10:46 10 950 11664 12 006 12578 13 181 13.810 14 487 15193 15937 10.722 17549 1420 19332 20304 21.321 22393 23 525 34700 25.959 30 11.567 12.189 12.808 13.450 1420 14.972 15.781 16645 17.500 18.531 19.501 200052136 22045 24349 26733 27 200 2755 39,404 32.150 12.669 13.412 14192 15026 15917 16200 1200118 977 20.141 2134 22 713 24133 25650 27271 2002 30850 32.824 3430137.1809 13 809 14.680 15.018 16.627 17.713 18 882 20 141 21 495 22953 24523 25212 2023 29.985 32008 3679639.400 ST 14.9-07 15 974 17.086 18.292 19.500 21015 22 550 24 215 26 018 27 975 30.095 22393 34883 32.501 20:505 672 47.100 50 310 5341 50100 | 16 037 17 293 18 599 20024 21579 23 276 25.129 27 152 29 361 31772 34 405 37 280 40417 4342 7.580 51660 56 110 0.96506261 72.005 10 17.25 18.639 20.157 21.825 23657 25.673 27.8 30 324 33000 35.950 39.190.753 46672 50980 36.717 60925 66.649 72909 79-850 2442 131 18.430 20 012 21.762 23.698 25840 28 213 30 340 33.750 36 974 40,545 44 501 854 53.739 118 05075 21673 78979 17 87.008022 105001 128117 75.836 84161 59.400 103.74 11527 19.615 21412 23 414 25.645 28132 30 906 39 999 37 45061301 45599 500 5.750 61725 08:34 212 603 1102012341 1312 15440 20811 22841 25.117 27.671 30539 33.70 37 379 41.446 46 018 51 159 56.909 410 70749 78.500 34 22.019 24 297 26870 29.778 33000 36.00 40.905 45.762 51.100 57275 54 203 72052 009791035 102444115000 150000 146 678 6418 18 23 230 25 783 28670 31.909 35719 39 900 44 305 50 423 56.765 64002 72.265 11.6093470 104768118010134441153 139 174091 192 50 225026 24472 27.299 30537 34 24 3850532 49 006 65457 62 073 71 403 81.214 2 600 105491 12000 137032152415 100.122 206305 28 271031 25.718 28 845 32453 36.618 41430 46.000 53.435 00 990 60 532 79 543 91.148 101 603 120 205 136 297 199 270 10001 21101 2447 2362 36237 12 13 9358 15 16 17 18 19 20 21 22 23