Answered step by step

Verified Expert Solution

Question

1 Approved Answer

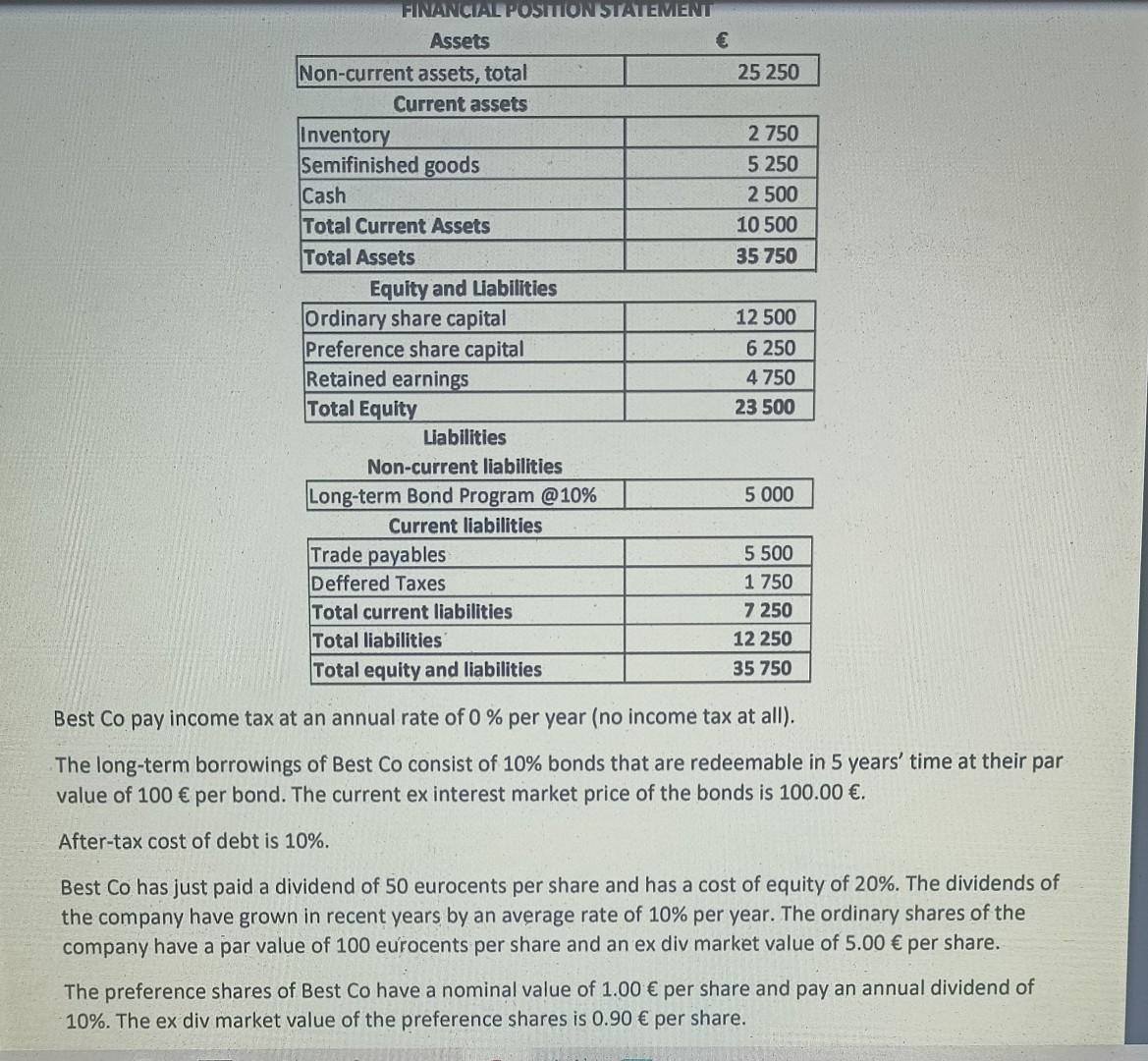

FINANCIAL POSITION STATEMENT Assets Non-current assets, total 25 250 Current assets Inventory 2 750 Semifinished goods 5 250 Cash 2 500 Total Current Assets 10

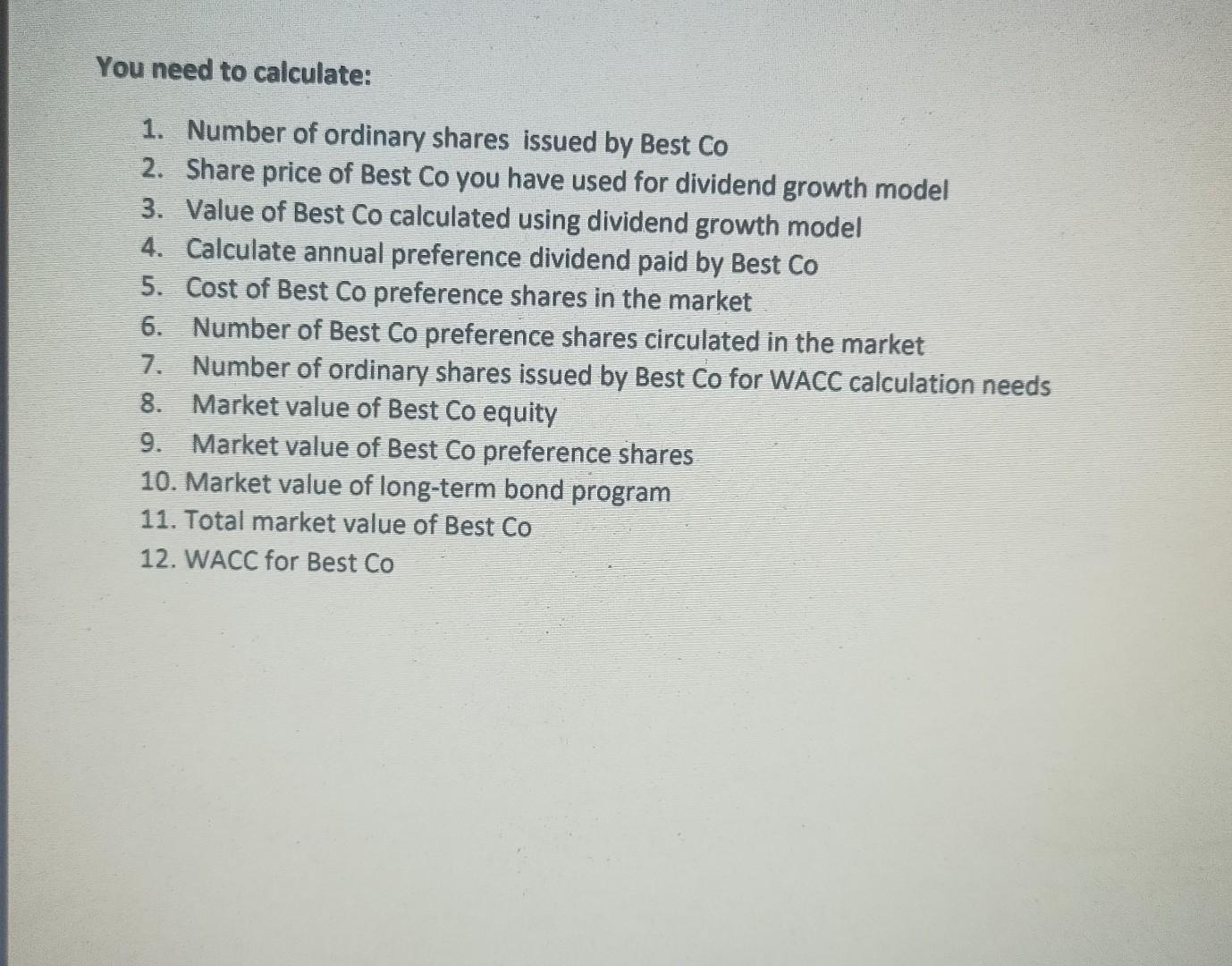

FINANCIAL POSITION STATEMENT Assets Non-current assets, total 25 250 Current assets Inventory 2 750 Semifinished goods 5 250 Cash 2 500 Total Current Assets 10 500 Total Assets 35 750 Equity and Liabilities Ordinary share capital 12 500 Preference share capital 6 250 Retained earnings 4750 Total Equity 23 500 Liabilities Non-current liabilities Long-term Bond Program @10% 5 000 Current liabilities Trade payables 5 500 Deffered Taxes 1 750 Total current liabilities 7 250 Total liabilities 12 250 Total equity and liabilities 35 750 Best Co pay income tax at an annual rate of 0% per year (no income tax at all). The long-term borrowings of Best Co consist of 10% bonds that are redeemable in 5 years' time at their par value of 100 per bond. The current ex interest market price of the bonds is 100.00 . After-tax cost of debt is 10%. Best Co has just paid a dividend of 50 eurocents per share and has a cost of equity of 20%. The dividends of the company have grown in recent years by an average rate of 10% per year. The ordinary shares of the company have a par value of 100 eurocents per share and an ex div market value of 5.00 per share. The preference shares of Best Co have a nominal value of 1.00 per share and pay an annual dividend of 10%. The ex div market value of the preference shares is 0.90 per share. You need to calculate: 1. Number of ordinary shares issued by Best Co 2. Share price of Best Co you have used for dividend growth model 3. Value of Best Co calculated using dividend growth model 4. Calculate annual preference dividend paid by Best Co 5. Cost of Best Co preference shares in the market 6. Number of Best Co preference shares circulated in the market 7. Number of ordinary shares issued by Best Co for WACC calculation needs 8. Market value of Best Co equity 9. Market value of Best Co preference shares 10. Market value of long-term bond program 11. Total market value of Best Co 12. WACC for Best Co

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started