Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Projections For Business Growth Trajectory Alan projects that sales for Year ending 3 1 st December 2 0 2 1 to be $ 2

Financial Projections For Business Growth Trajectory Alan projects that sales for Year ending st December to be $ million whilst Year ending st December would be $m These projections included confirmed contracts worth $ million in Year and $ million in year to supply machinery and equipment. He is confident that LMS reputation will enable him to clinch the remaining differences of $ million in Year and $ million for Year respectively. ACCT Financial Accounting Mock Exam SMU Classification: The additional warehouse space required by first quarter of Y would cost $ If this loan request of $ was approved, principal payments amount to $ per annum, starting from February ; with annual interest payments at $ per annum for the first years. As the business grew and expanded, LMS began to meet with liquidity and funding problems. The company estimated that it required $ to support its growth plans. With a track record of timely interest payments during the previous years and a steady increase in profit, LMS submitted a loan proposal to the bank anxiously pending for a favourable outcome.

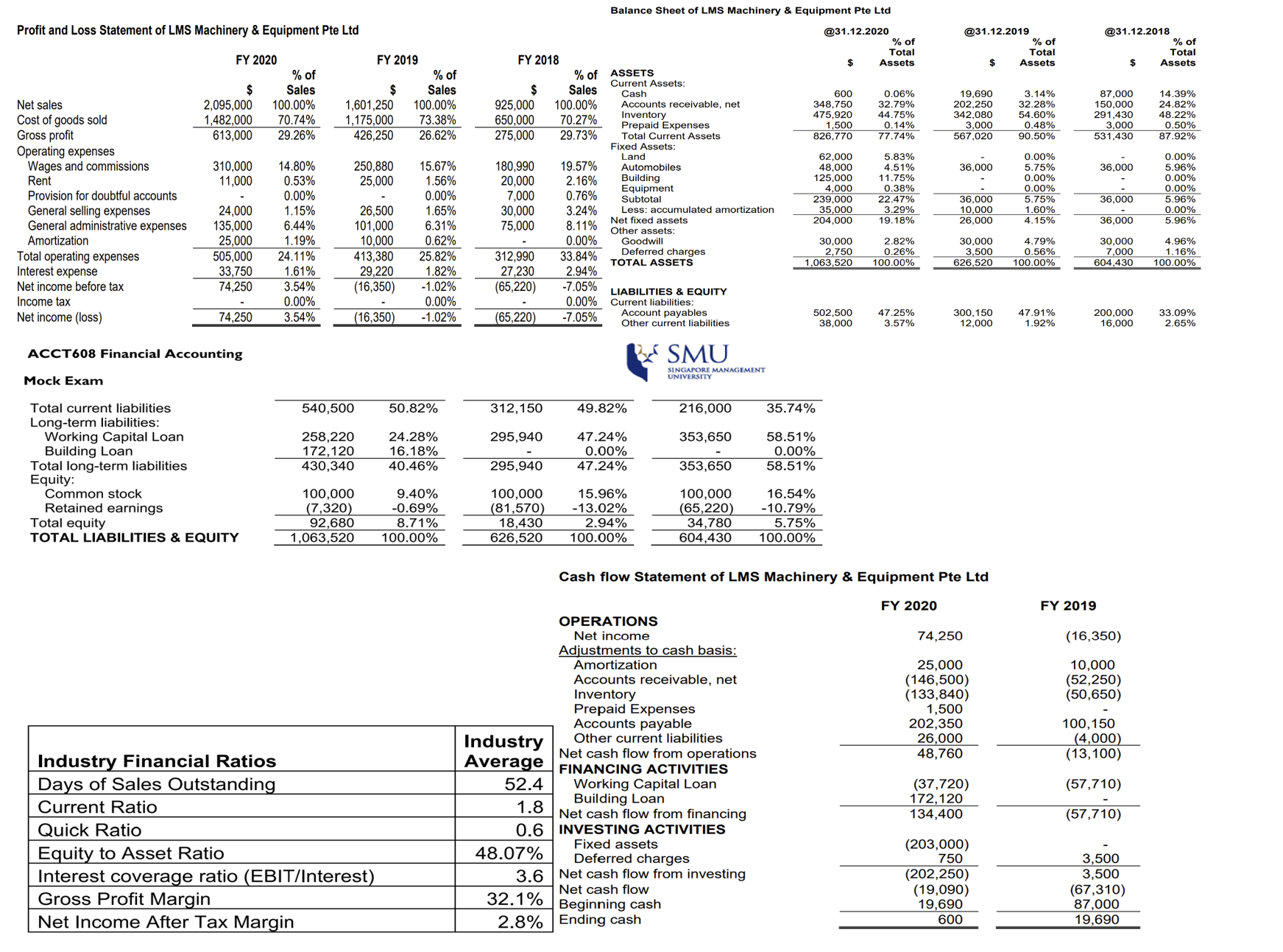

Q Using the Profit and Loss Statement and Balance Sheet provided, analyse the trend of the companys financial performance over the Years and with the Year as the base year.

Q Analyse the health of the cash position of LMS regarding the operating, investing, and financing activities in the Cash Flow Statement over the Years and ACCT Financial Accounting Mock Exam SMU Classification: Restricted

Q Compute and compare the financial ratios of LMS against the industry average, and determine the level of Activity, Liquidity, Solvency, and Profitability of the company. Future Financial Requirements

Q Based on LMS projected Financial Statements for Year and Year would $ be sufficient to fund their growth trajectory? Funding Analysis

Q Based on your analysis conducted for Questions determine whether you, as a bank loan officer, would grant the $ loan request to LMS Please explain your reasons for the options you are going to provide to Alan.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started