Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial ratio analysis. Please help in explaining how to calculate. A Financial Ratio Analysis of Target Corporation A Profitability Assessment Assume that you are an

Financial ratio analysis. Please help in explaining how to calculate.

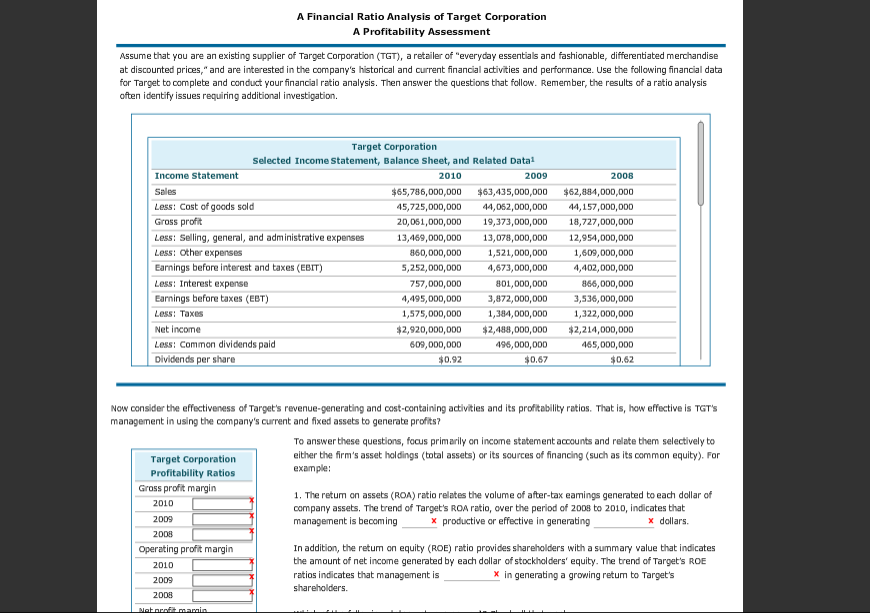

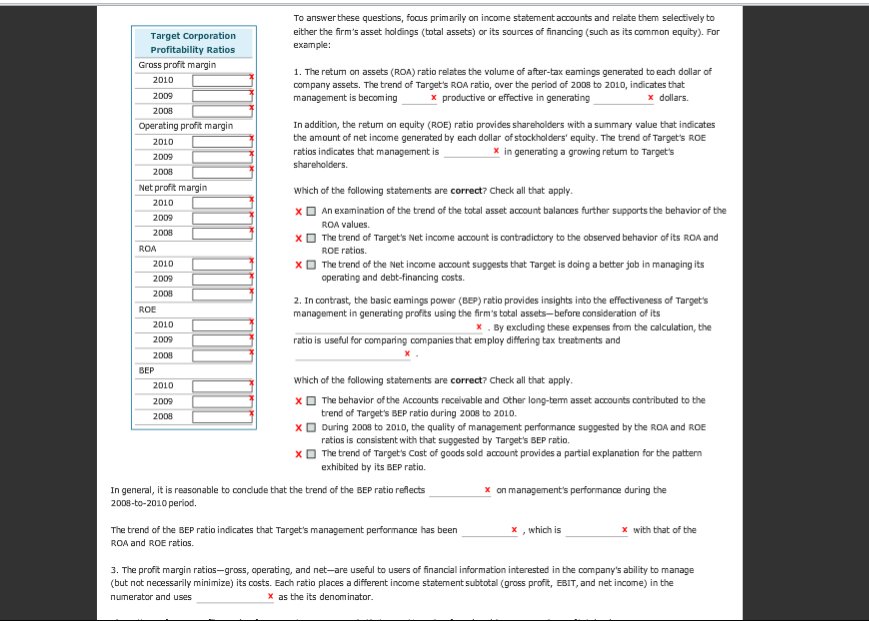

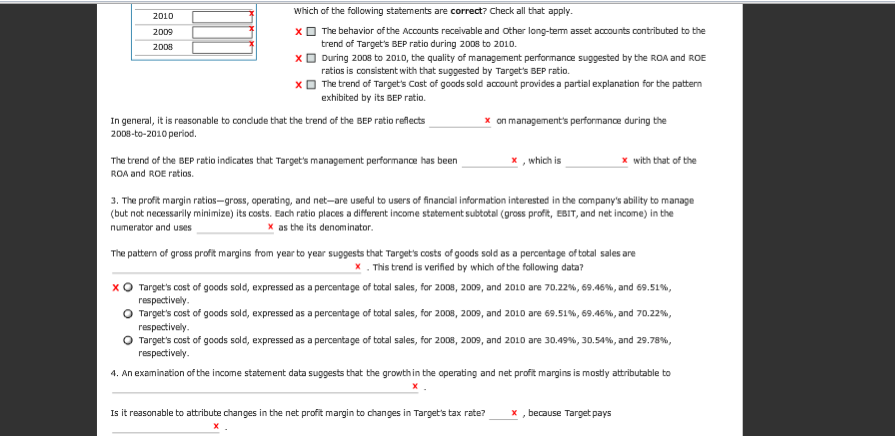

A Financial Ratio Analysis of Target Corporation A Profitability Assessment Assume that you are an existing supplier of Target Corporation (TGT), a retailer of "everyday essentials and fashionable, differentiated merchandise at discounted prices," and are interested in the company's historical and current financial activities and performance. Use the following financial data for Target to complete and conduct your financial ratio analysis. Then answer the questions that follow. Remember, the results of a ratio analysis often identify issues requiring additional investigation. Target Corporation Selected Income statement, Balance Sheet, and Related Data Income Statement Sales Less: Cost of goads sold Gross profit Less: Selling, general, and administrative expenses Less: Other expenses Earnings before interest and taxes (EBIT) Less: Interest expense Earnings before taxes (EBT) Less: Taxes Net income Less: Common dividends paid Dividends per share 2010 2009 2008 $65,786,0DD,D00 $3,435,00D,000 $62,884,00D,000 000 44,157,000,000 18,727,00D,ODD 12,954,00D,ODD 1,609,00D, DDD 5,252,000,000 4,73,00D,DD4,402,0DD,0DD 866,000,000 4,495,00D,000 3,872,00D,DD 3,536,0DD,00D 1,322,000,000 $2,920,000,000 *2,488,000,000 *2,214,000,000 65,ODD,ODD 0.2 5,725,000,000 44 20,051,0DD,DDD 19,373,DDD,0D0 1 13,469,0DD,0D0 1 1 000 44,052,000,0DD 13,078,00D,ODD 60,000,000 1,521,000,000 757,000,DDD 801,000,000 1,575,00o,0 1,384, 0DD,DDD 09,DDD, DDD 0.92 496,000,00D 0.67 Now consider the effectiveness of Target's revenue-generating and cost-containing activities and its profitability ratios. That is, how effective is TGTs management in using the company's current and fixed assets to generate profits? Target Corporation Profitability Ratios To answer these questions, focus primarily on income statement accounts and relate them selectively to either the firm's asset holdings (total assets) or its sources of financing (such as its common equity). For example: Gross profit margin 1. The retum on assets (ROA) ratio relates the volume of after-tax eamings generated to each dollar of company assets. The trend of Target's ROA ratio, over the period of 2008 to 2010, indicates that management is becoming 2009 x productive or effective in generating x dollars In addition, the retum on equity (ROE) ratio provides shareholders with a summary value that indicates the amount of net income generated by each dollar of stockholders' equity. The trend of Target's ROE ratios indicates that management is Operating profit margin xin generating a growing retum to Target's 2009 2008Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started