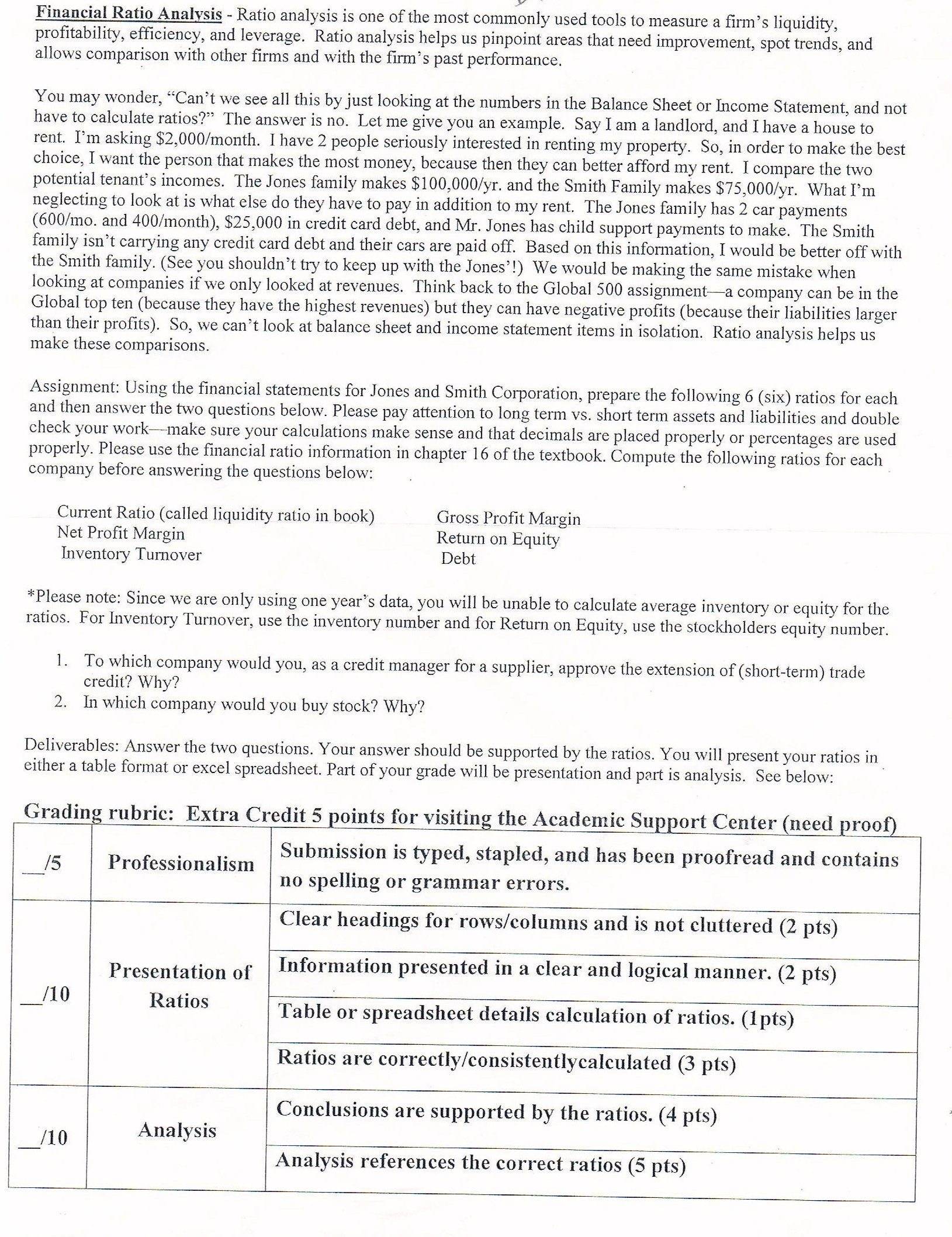

Financial Ratio Analysis - Ratio analysis is one of the most commonly used tools to measure a firm's liquidity, profitability, efficiency, and leverage. Ratio analysis helps us pinpoint areas that need improvement, spot trends, and allows comparison with other firms and with the firm's past performance. You may wonder, "Can't we see all this by just looking at the numbers in the Balance Sheet or Income Statement, and not have to calculate ratios?" The answer is no. Let me give you an example. Say I am a landlord, and I have a house to rent. I'm asking $2,000/month. I have 2 people seriously interested in renting my property. So, in order to make the best choice, I want the person that makes the most money, because then they can better afford my rent. I compare the two potential tenant's incomes. The Jones family makes $100,000/yr. and the Smith Family makes $75,000/yr. What I'm neglecting to look at is what else do they have to pay in addition to my rent. The Jones family has 2 car payments (600/mo. and 400/month), $25,000 in credit card debt, and Mr. Jones has child support payments to make. The Smith family isn't carrying any credit card debt and their cars are paid off. Based on this information, I would be better off with the Smith family. (See you shouldn't try to keep up with the Jones'!) We would be making the same mistake when looking at companies if we only looked at revenues. Think back to the Global 500 assignment-a company can be in the Global top ten (because they have the highest revenues) but they can have negative profits (because their liabilities larger than their profits). So, we can't look at balance sheet and income statement items in isolation. Ratio analysis helps us make these comparisons. Assignment: Using the financial statements for Jones and Smith Corporation, prepare the following 6 (six) ratios for each and then answer the two questions below. Please pay attention to long term vs. short term assets and liabilities and double check your work-make sure your calculations make sense and that decimals are placed properly or percentages are used properly. Please use the financial ratio information in chapter 16 of the textbook. Compute the following ratios for each company before answering the questions below: *Please note: Since we are only using one year's data, you will be unable to calculate average inventory or equity for the ratios. For Inventory Turnover, use the inventory number and for Return on Equity, use the stockholders equity number. To which company would you, as a credit manager for a supplier, approve the extension of (short-term) trade credit? Why? In which company would you buy stock? Why? Deliverables: Answer the two questions. Your answer should be supported by the ratios. You will present your ratios in either a table format or excel spreadsheet. Part of your grade will be presentation and part is analysis. See below: Grading rubric: Extra Credit 5 points for visiting the Academic Support Center (need proof) Financial Ratio Analysis - Ratio analysis is one of the most commonly used tools to measure a firm's liquidity, profitability, efficiency, and leverage. Ratio analysis helps us pinpoint areas that need improvement, spot trends, and allows comparison with other firms and with the firm's past performance. You may wonder, "Can't we see all this by just looking at the numbers in the Balance Sheet or Income Statement, and not have to calculate ratios?" The answer is no. Let me give you an example. Say I am a landlord, and I have a house to rent. I'm asking $2,000/month. I have 2 people seriously interested in renting my property. So, in order to make the best choice, I want the person that makes the most money, because then they can better afford my rent. I compare the two potential tenant's incomes. The Jones family makes $100,000/yr. and the Smith Family makes $75,000/yr. What I'm neglecting to look at is what else do they have to pay in addition to my rent. The Jones family has 2 car payments (600/mo. and 400/month), $25,000 in credit card debt, and Mr. Jones has child support payments to make. The Smith family isn't carrying any credit card debt and their cars are paid off. Based on this information, I would be better off with the Smith family. (See you shouldn't try to keep up with the Jones'!) We would be making the same mistake when looking at companies if we only looked at revenues. Think back to the Global 500 assignment-a company can be in the Global top ten (because they have the highest revenues) but they can have negative profits (because their liabilities larger than their profits). So, we can't look at balance sheet and income statement items in isolation. Ratio analysis helps us make these comparisons. Assignment: Using the financial statements for Jones and Smith Corporation, prepare the following 6 (six) ratios for each and then answer the two questions below. Please pay attention to long term vs. short term assets and liabilities and double check your work-make sure your calculations make sense and that decimals are placed properly or percentages are used properly. Please use the financial ratio information in chapter 16 of the textbook. Compute the following ratios for each company before answering the questions below: *Please note: Since we are only using one year's data, you will be unable to calculate average inventory or equity for the ratios. For Inventory Turnover, use the inventory number and for Return on Equity, use the stockholders equity number. To which company would you, as a credit manager for a supplier, approve the extension of (short-term) trade credit? Why? In which company would you buy stock? Why? Deliverables: Answer the two questions. Your answer should be supported by the ratios. You will present your ratios in either a table format or excel spreadsheet. Part of your grade will be presentation and part is analysis. See below: Grading rubric: Extra Credit 5 points for visiting the Academic Support Center (need proof)