Answered step by step

Verified Expert Solution

Question

1 Approved Answer

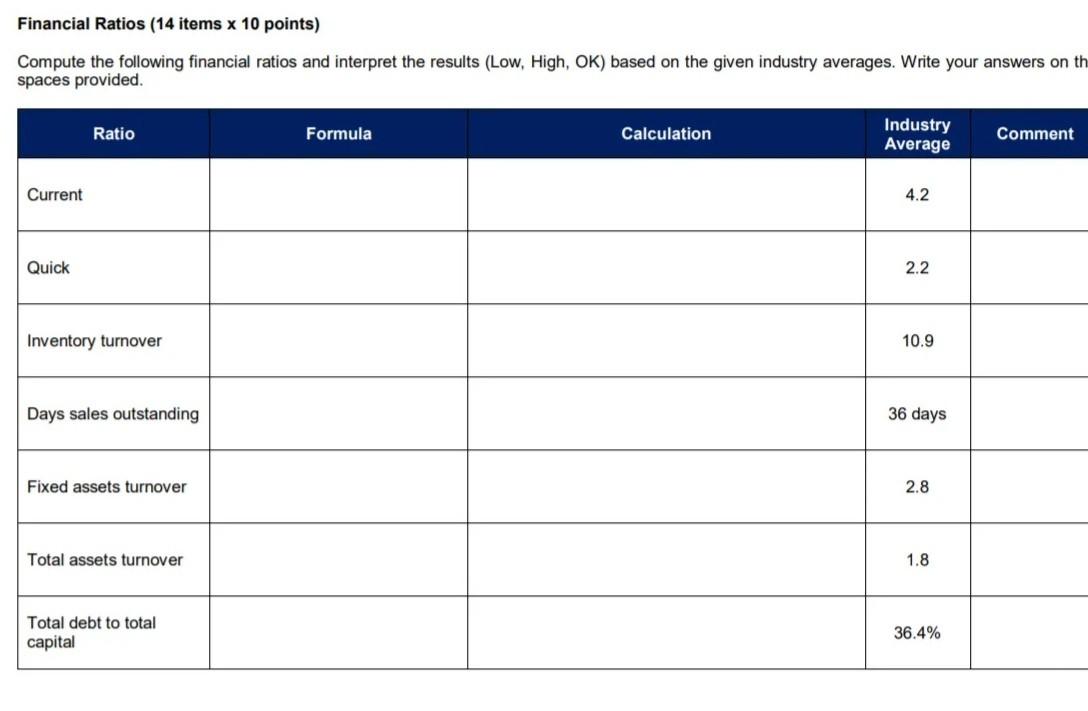

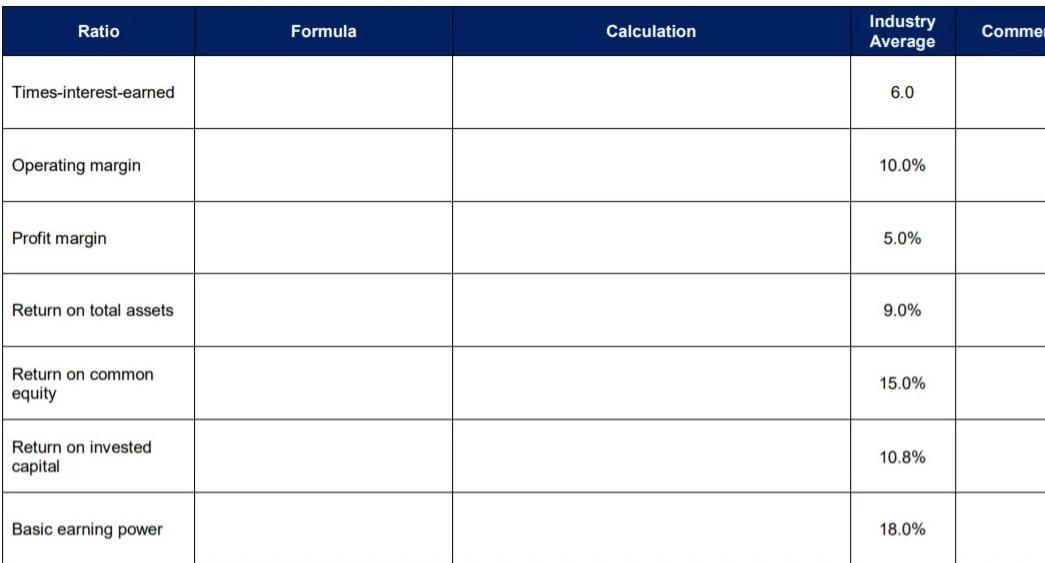

Financial Ratios (14 items x 10 points) Compute the following financial ratios and interpret the results (Low, High, OK) based on the given industry averages.

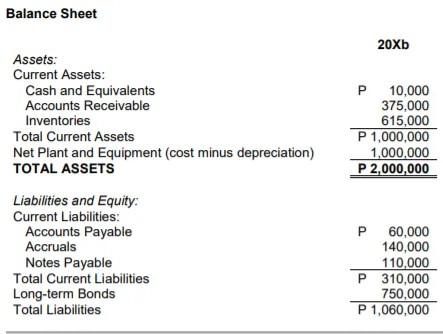

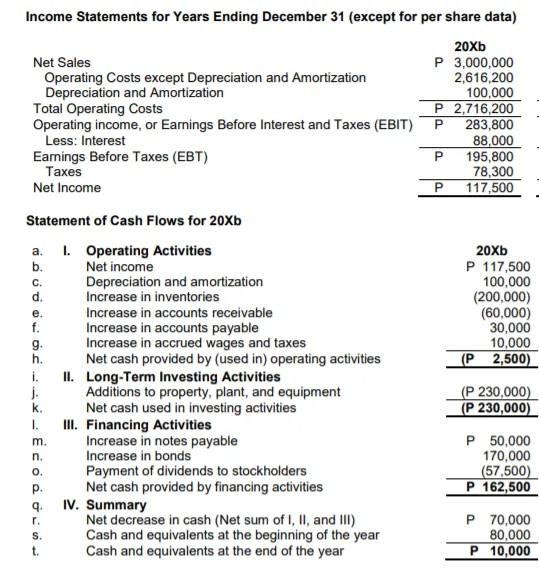

Financial Ratios (14 items x 10 points) Compute the following financial ratios and interpret the results (Low, High, OK) based on the given industry averages. Write your answers on th spaces provided. Ratio Formula Calculation Industry Average Comment Current 4.2 Quick 2.2 Inventory turnover 10.9 Days sales outstanding 36 days Fixed assets turnover 2.8 Total assets turnover 1.8 Total debt to total capital 36.4% Ratio Formula Calculation Industry Average Commel Times-interest-earned 6.0 Operating margin 10.0% Profit margin 5.0% Return on total assets 9.0% Return on common equity 15.0% Return on invested capital 10.8% Basic earning power 18.0% Balance Sheet 20Xb P 10,000 375,000 615,000 P 1,000,000 1,000,000 P 2,000,000 Assets: Current Assets: Cash and Equivalents Accounts Receivable Inventories Total Current Assets Net Plant and Equipment (cost minus depreciation) TOTAL ASSETS Liabilities and Equity: Current Liabilities: Accounts Payable Accruals Notes Payable Total Current Liabilities Long-term Bonds Total Liabilities P 60,000 140,000 110,000 P310,000 750,000 P 1,060,000 Common Equity: Common Stock (50,000 shares) Retained Earnings Total Common Equity Total Liabilities and Equity P 130,000 810,000 P 940,000 P 2,000,000 P Income Statements for Years Ending December 31 (except for per share data) 20Xb Net Sales P 3,000,000 Operating costs except Depreciation and Amortization 2,616,200 Depreciation and Amortization 100,000 Total Operating costs P 2,716,200 Operating income, or Earnings Before Interest and Taxes (EBIT) P 283,800 Less: Interest 88,000 Earings Before Taxes (EBT) P 195,800 Taxes 78,300 Net Income 117,500 Statement of Cash Flows for 20Xb a. 1. Operating Activities 20Xb b. Net income P 117,500 c. Depreciation and amortization 100,000 d. Increase in inventories (200,000) Increase in accounts receivable (60,000) f. Increase in accounts payable 30,000 g. Increase in accrued wages and taxes 10,000 h. Net cash provided by (used in) operating activities (P2,500) i. II. Long-Term Investing Activities j Additions to property, plant, and equipment (P 230,000) k. Net cash used in investing activities (P 230,000) III. Financing Activities Increase in notes payable P 50,000 n. Increase in bonds 170,000 . Payment of dividends to stockholders (57,500) P. Net cash provided by financing activities P 162,500 IV. Summary Net decrease in cash (Net sum of I, II and III) P70,000 S. Cash and equivalents at the beginning of the year 80,000 Cash and equivalents at the end of the year P10,000 e. I. m. cocco

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started