Question

FINANCIAL RATIOS AND DATA In preparing to analyze the financial performance of the Walden Conservatory of Music, you recall from your coursework four areas to

FINANCIAL RATIOS AND DATA

In preparing to analyze the financial performance of the Walden Conservatory of Music, you recall from your coursework four areas to consider for financial review: Liquidity, Solvency, Profitability, and Efficiency. It is essential that nonprofits maintain an adequate level of liquidity to meet current obligations. The Current Ratio and the Quick Ratio are the same as those used in for-profit analysis, whereas the Defensive Interval, Liquid Funds Amount, and Liquid Funds Indicator are unique to nonprofit analysis most notably because nonprofit organizations have net assets (which may or may not be restricted) rather than equity. In addition to maintaining an adequate level of liquidity in the short term, nonprofits must be sure they can cover their total obligations in the long term.

Solvency ratios measure an organizations ability to operate over the long term. Debt to Asset Ratio is the same as the one used in for-profit analysis, whereas Debt to Net Asset Ratio and Times Interest Earned Ratio are different from those in for-profit analysis because nonprofit organizations have net assets and increases/decreases in net assets instead of equity and net income (or loss). Too much leverage can make a nonprofit organization vulnerable to future financial destructions.

Profitability ratios indicate the extent to which the nonprofit is earning a surplus or deficit. Return on Investment Ratio is the same as the one in a for-profit analysis. Savings Indicator is calculated in the same way as the profit margin in a for-profit analysis; however, the terminology is different to account for the fact that the mission of the nonprofit is not primarily concerned with maximizing profits. Nonprofits incurring significant deficits run the risk of becoming fiscally distressed. Conversely, nonprofits that earn large surpluses run the risk of stakeholder backlash and public ire that they are hoarding resources and not investing enough in their mission.

Finally, nonprofit organizations aim to be efficient with the resources entrusted to them. Efficiency ratios measure what proportion of total expenses is spent on programs compared to administrative and fundraising activities. Administrative Expense Ratio and Program Service Ratio are unique because nonprofits have to classify expenses by function as program (mission) related, administrative, or fundraising. Whereas charity evaluators, such as the Better Business Bureau Wise Giving Alliance, expect charities to spend at least a minimum threshold amount on program services, nonprofits not investing enough in their administrative capacity may fall victim to what has been commonly referred to as the starvation cycle whereby underinvestment in a nonprofits capacity ultimately leads to diminished outcomes.[1]

You and the consultants are given the Statement of Financial Position and Statement of Activities based on Form 990s (the IRS tax form for tax-exempt organizations) of the Conservatory from 2014 to 2018 for your analyses (see Tables 1 and 2).

(Insert Table 1 and Table 2 here)

Sustainability mindset and related figures AND data

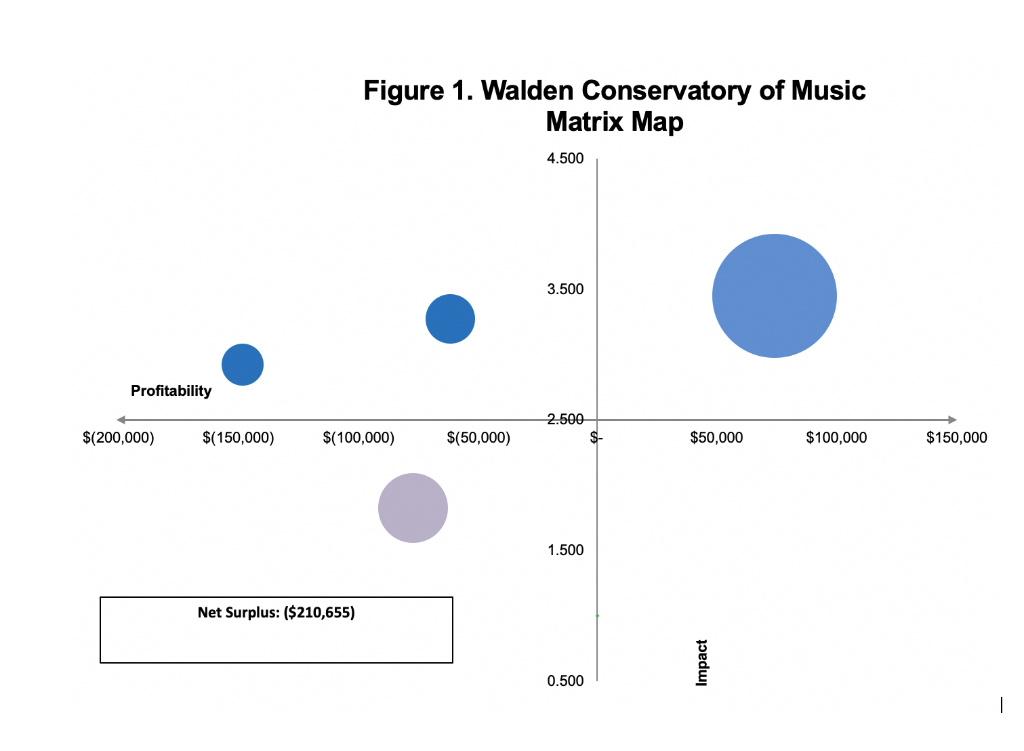

As a part of its strategic review, Illuminations Inc. conducted an in-depth review of Waldens three mission-focused programs as well as the development program. Its review utilized a mapping tool that considered both the mission impact of each program as well as its financial performance. The mapping tool is derived from the book The Sustainability Mindset by Steven Zimmerman and Jeanne Bell. The tool first measures the financial performance of each program. The financial performance was based on the latest twelve months of data.

The tool then compares the financial performance of each program or area with its relative mission impact. Mission impact is based on a survey of key stakeholders including large donors, board members, program staff, and executive officers. Each stakeholder was asked to respond to a mission impact survey as follows:

On a scale of 1 to 4 with 4 being the highest, please rate each program below on the following criteria. As you complete the survey, remember that there is no right answer in the survey and take into account all the information you have from your experience with the organization.

The four criteria are: a) Contribution to Intended Impact: Relative to other programs, how well does this program contribute to what the overall organization aims to accomplish? b) Excellence in Execution: Is this program something that the organization delivers in an exceptional manner? c) Significant Unmet Need: Is there significant competition or are there similar offerings of this program? Is there an adequate supply of services to meet the demand for them in our community? d) Scale: How many people are touched or influenced by this program?

Survey results are summarized in Table 3.

(Insert Table 3 here)

Internal financial information related to employee compensation is detailed in Table 4. All salaries are allocated to the four programs based on the percentage of time spent working in each program. Walden Conservatory of Music has an executive director, a development manager, a chief financial officer, and a chief operating officer. In addition, there are four auxiliary staff with a total salary of $200,000 (average of $50,000 per staff member). The auxiliary staff are tasked with custodial duties, as well as supporting the education and administrative efforts of the Conservatory. The teaching faculty consists of twenty-six part-time (50% appointments) and eight full time faculty. The full-time teaching faculty are salaried employees, while the part-time teaching staff are paid per lesson taught. The total payroll expense for the Conservatory is $1,487,000.

(Insert Table 4 here)

. Table 5 details a breakout of all expenses by the four program areas. Note the first expense shown is salaries, which is the total payroll expense row from Table 4. Additional expenses include fringe benefits as well as operating expenses. The total expenses row shows the total direct expenses by the four programs as well as the total shared cost and total administrative costs. To determine the full cost of the four programs, it is necessary to fully allocate both the shared costs as well as the administrative costs. Shared costs include costs such as supplies and utilities that are used by all areas. As can be seen from the table, the shared costs are allocated to each of the four programs as well as administrative costs based on the relative share of expenses. The direct & shared exp subtotal represents the total of direct expenses and shared expenses for each program area as well as administrative costs. The administrative expenses of $462,667 are allocated based on the relative share of direct and shared expense each of the four programs has to the total of the direct and shared expense (not including the administrative expenses in the total). The administrative expense allocation plus the direct and shared expenses equals the fully allocated expenses. The total revenue in the last row represents the revenue attributable to each program. For concerts, camps, and lessons, the total revenue is based on reciprocal revenue sources (i.e., tickets, fees, and tuition) along with any donor contributions directly associated with the program (i.e., contributions restricted for an individual program). Total revenue for the development program is based on revenue raised through individual development activity along with unrestricted contributions. Subtracting the fully allocated expenses from the total revenue will give you the profitability of each program.

(Insert Table 5 here)

Figure 1 is a mapping of this data. Note the map includes a bubble for each program area. The size of the bubble indicates the relative size of the program area based on total expenses. The x-axis represents the profitability of the program area, while the y-axis represents the relative mission impact of the program area. As noted in The Sustainability Mindset, activities in the upper right quadrant are in the star quadrant. Organizations should consider investing in and growing these programs. When making the decision to invest in the star programs, it is important to consider the stability of the funding sources that contributed to program surpluses. Are these funding sources likely to persist into future? Are they one-time grants that may go away and cause the program to fall into a different quadrant in future years? Can we ensure the high-level impact the program currently makes will continue if the program is expanded?

The bottom right quadrant is referred to as the money tree quadrant. Organizations should consider whether these programs can be watered and harvested to increase impact. For example, for programs that fall into this quadrant, is there a way to further engage our stakeholders through the program and still maintain its surplus financial position? For programs that maintain modest surpluses but low mission impact, the organization should also consider the opportunity cost of maintaining the program. Could resources be allocated to other areas thereby increasing mission impact at only a modest financial impact to the organization?

Programs in the upper left-hand quadrant are in the heart quadrant. Organizations will typically want to keep these programs but must consider ways to contain costs. The organizations overall financial condition plays a particularly important role in assessing strategic options with heart programs. If the organization is in an overall financially strong position, they can consider further subsidizing heart programs while considering options for increasing mission impact and potentially revising the cost structure to minimize financial deficits. However, if the organization is in an overall financially precarious position, there will be less room to financially subsidize the program and attention will need to be paid to whether the organization can maintain the heart program in the absence of changes to the cost structure of the program.

Finally, the bottom left quadrant is referred to as the stop sign quadrant. Organizations must consider whether these programs should be closed or transferred to another organization. For mission focused programs in the stop sign quadrant, questions should be asked about why the organization continues to run a program that has low mission impact and requires subsidy. Did the program historically make money? Is this a legacy program that was mission impactful, but overtime has become less mission centric? For fund development programs that fall into the stop sign quadrant, there has been a clear failure to cultivate development funders. If the organization has dedicated fund development staff and runs their fundraising events in house, questions should be asked about whether this structure is financially sustainable. Does the organization have the right personnel to successfully raise funds that exceed the cost of the development activities? Would the organization be better off outsourcing some or all of the fund development activity to a professional fundraising company?

[1]. For a more expansive discussion of the starvation cycle, see Lecy and Searing (2015).

Questions:

7. Review Figure 1. For each quadrant (star, money tree, heart, and stop), identify the programs in the quadrant and discuss the financial and nonfinancial characteristics that support its placement in the quadrant.

8. Based on your review of the profitability and mission impact of the individual program areas, what initial recommendations do you have for the CEO to ensure WCM is on a sustainable path for the future? What are potential implications to WCM if they adopt your recommendations? Consider the overall financial health of WCM assessed in questions 1 to 4 when making your recommendations.

Figure 1. Walden Conservatory of Music Matrix Map 4.500 3.500 Profitability $(200,000) 2.500 $- $(150,000) $(100,000) $(50,000) $50,000 $100,000 $150,000 1.500 Net Surplus: ($210,655) Impact 0.500 I Figure 1. Walden Conservatory of Music Matrix Map 4.500 3.500 Profitability $(200,000) 2.500 $- $(150,000) $(100,000) $(50,000) $50,000 $100,000 $150,000 1.500 Net Surplus: ($210,655) Impact 0.500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started