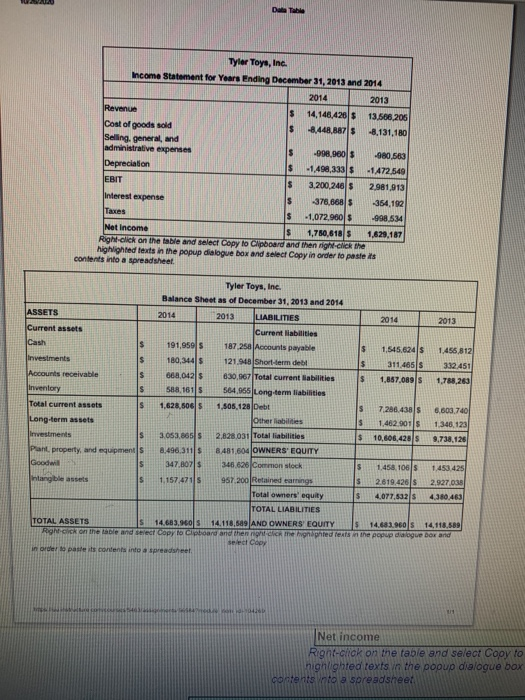

Financial ratios: Asset management. The financial statements for Tyler Toys, Inc. are shown in the popup window: Calculate the inventory tumover, days' sales in inventory, receivables turnover, days' sales in receivables, and total asset turnover for 2013 and 2014 for Tyler Toys. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? What is the inventory turnover ratio for 2014? (Round to four decimal places.) What is the inventory turnover ratio for 2013? (Round to four decimal places.) What is the days' sales in inventory ratio for 2014? days (Round to four decimal places) What is the days' sales in inventory ratio for 2013? days (Round to four decimal places.) PP Moty. Telus turnover, days' sales in receivables, and total asset tumover for 2013 and 2014 for Tyler Toys. Should any of these ratios or Cucate the inventory turnover the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? What is the days' sales in Inventory ratio for 2013? days (Round to four decimal places.) What is the receivables turnover ratio for 2014? (Round to four decimal places.) What is the receivables turnover ratio for 2013? (Round to four decimal places.) What is the days' sales in receivables ratio for 2014? days (Round to four decimal places.) Cute the inventory umover days sales in inventory, receivables turnover, days' sales in receivables, and total asset turnover for 2013 and 2014 for Tyler Toys. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? wwwwwww days (Round to four decimal places) What is the days' sales in receivables ratio for 2013? days (Round to four decimal places.) What is the total asset turnover ratio for 2014? (Round to four decimal places.) What is the total asset turnover ratio for 2013? (Round to four decimal places.) Dube Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue $ 14,146,426 $ 13.506,206 Cost of goods sold S -8.448.8875 -8,131,180 Selling general, ad administrative expenses $ -998,000 $ -980,583 Depreciation $ -1,498,333$ -1472.549 EBIT $ 3.200.246 $ 2.981,013 Interest expense $ 376,668 -354,192 Taxes $ -1,072,960 -998.534 Net Income $ 1,780,6185 1,629,187 Right click on the table and select Copy to clipboard and then night click the highlighted texts in the popup dialogue box and select Copy in order to pastes contents into a spreadsheet. Tyler Toys, Inc. Balance Sheet as of December 31, 2013 and 2014 ASSETS 2014 2013 LIABILITIES 2014 2013 Current assets Current liabilities Cash IS 191,9595 187 258 Accounts payable $ 1.545.6245 1.456,812 Investments S 180,3445 121.948 Short-term debt $ 311.4655 332.451 Accounts receivable S 668,04215 830,67 Total current liabilities $ 1,887,089S 1.788,263 Inventory IS 58.8.16115 564,965 Long-term liabilities Total current assets S 1,628,5065 1,505,120 Debt S 7.280.438| 6,603,7401 Long-term assets Other liabilities S 1,462.001s 1,346,123 Investments IS 3.053,865 S 2,828,031 Total liabilities $ 10,606,428 9,738,126 Pant property, and equipments 8,496,311 8.481.604 OWNERS' EQUITY Goodwill IS 347.8075 346.626 Common stock $ 1.458, 1065 1.453 425 Intangible assets $ 1.157.4715 957 200 Retained earnings S 2.619,426 $ 2.927.000 Total owners' equity $ 4,077.5325 4,380.463 TOTAL LIABILITIES TOTAL ASSETS 14.683,90 14.118,509 AND OWNERS' EQUITY IS 14.683.960S 14,118.589 Right on the table and select copy to clipboard and then me highted tents the popup dialogue box and Select Copy in order to paste its contents into a spreadsheet 10 Net income Right click on the table and select Cooy to highlighted texts in the pooup dialogue box contents into a spreadsheer