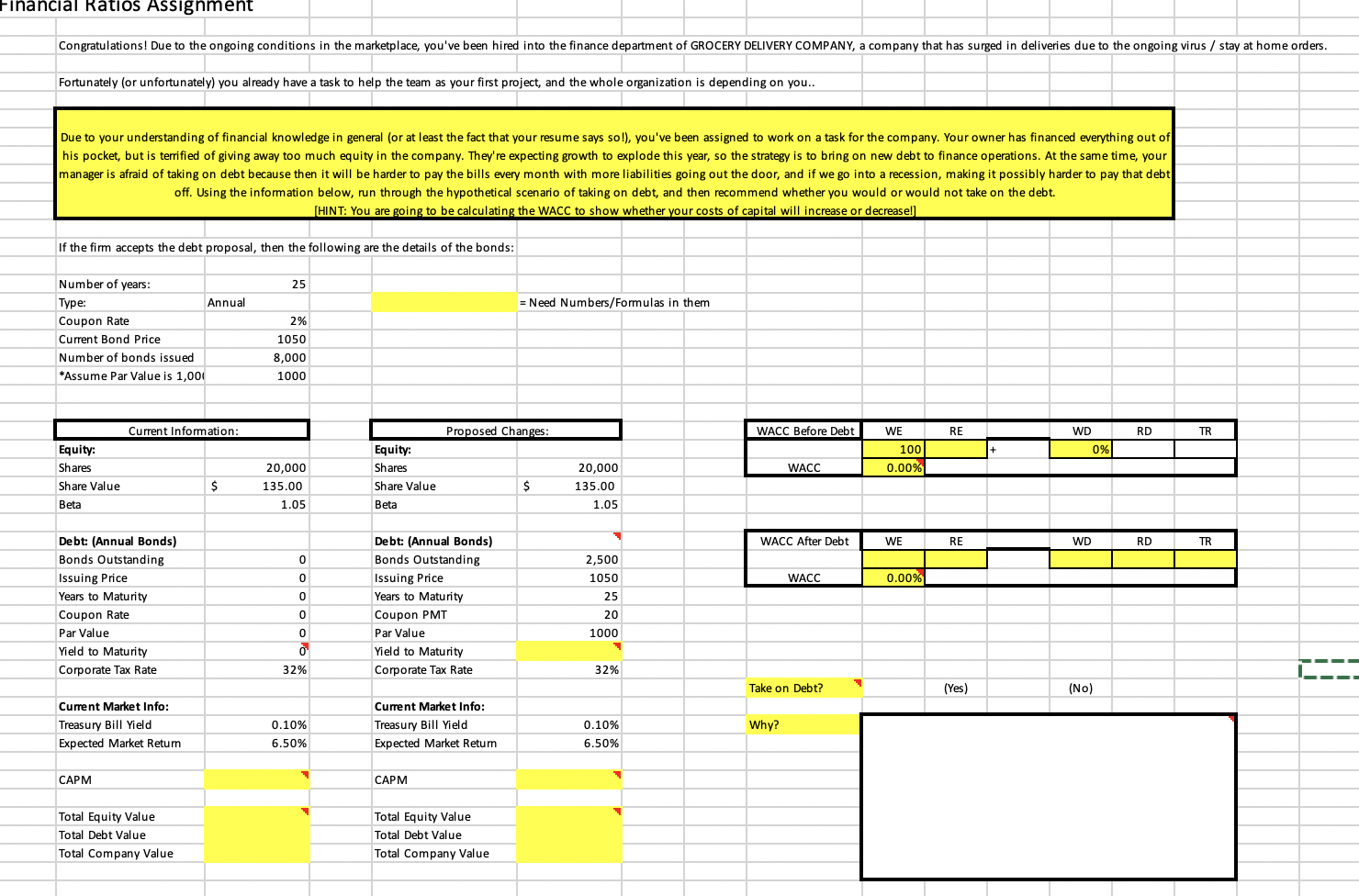

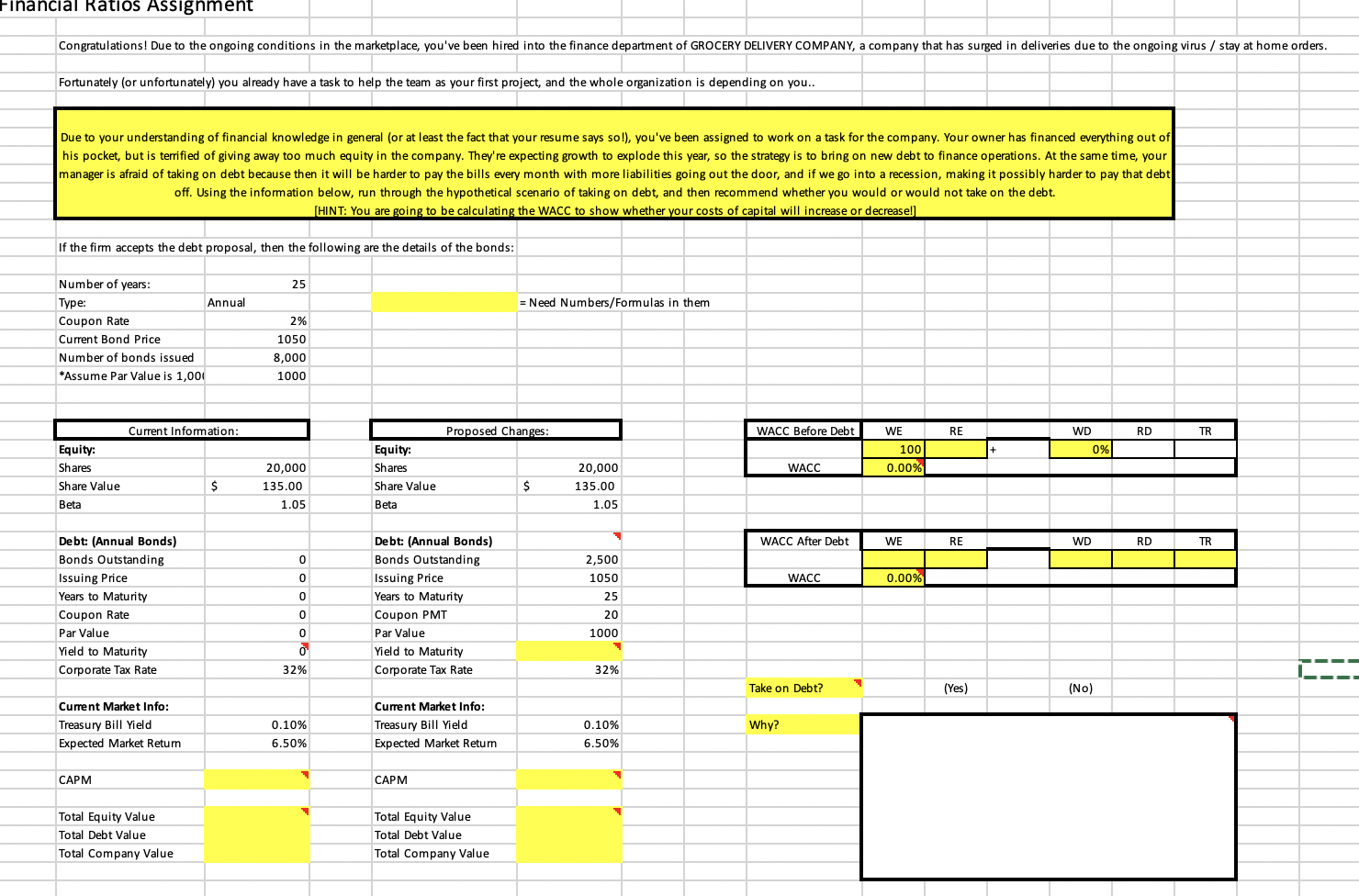

Financial Ratios Assignment Congratulations! Due to the ongoing conditions in the marketplace, you've been hired into the finance department of GROCERY DELIVERY COMPANY, a company that has surged in deliveries due to the ongoing virus / stay at home orders. Fortunately (or unfortunately) you already have a task to help the team as your first project, and the whole organization is depending on you.. Due to your understanding of financial knowledge in general (or at least the fact that your resume says so!), you've been assigned to work on a task for the company. Your owner has financed everything out of his pocket, but is terrified of giving away too much equity in the company. They're expecting growth to explode this year, so the strategy is to bring on new debt to finance operations. At the same time, your manager is afraid of taking on debt because then it will be harder to pay the bills every month with more liabilities going out the door, and if we go into a recession, making it possibly harder to pay that debt off. Using the information below, run through the hypothetical scenario of taking on debt, and then recommend whether you would or would not take on the debt. (HINT: You are going to be calculating the WACC to show whether your costs of capital will increase or decrease!) If the firm accepts the debt proposal, then the following are the details of the bonds: 25 = Need Numbers/Formulas in them 2% Number of years: Type: Annual Coupon Rate Current Bond Price Number of bonds issued *Assume Par Value is 1,001 1050 8,000 1000 Current Information: Proposed Changes: WACC Before Debt R E 1 RD TR WE 1001 0.00% WD 0% WACC Equity: Shares Share Value Beta Equity: Shares Share Value Beta 20,000 135.00 1.05 $ $ 20,000 135.00 1.05 WACC After Debt WE R E WD | RD | TRI WACC 0.00% Debt: (Annual Bonds) Bonds Outstanding Issuing Price Years to Maturity Coupon Rate Par Value Yield to Maturity Corporate Tax Rate Debt: (Annual Bonds) Bonds Outstanding Issuing Price Years to Maturity Coupon PMT Par Value Yield to Maturity Corporate Tax Rate 2,500 1050 25 20 1000 32% 32% Take on Debt? (Yes) (No) Current Market Info: Treasury Bill Yield Expected Market Retur Current Market Info: Treasury Bill Yield Expected Market Retum 0.10% 6.50% Why? 0.10% 6.50% CAPM CAPM Total Equity Value Total Debt Value Total Company Value Total Equity Value Total Debt Value Total Company Value Financial Ratios Assignment Congratulations! Due to the ongoing conditions in the marketplace, you've been hired into the finance department of GROCERY DELIVERY COMPANY, a company that has surged in deliveries due to the ongoing virus / stay at home orders. Fortunately (or unfortunately) you already have a task to help the team as your first project, and the whole organization is depending on you.. Due to your understanding of financial knowledge in general (or at least the fact that your resume says so!), you've been assigned to work on a task for the company. Your owner has financed everything out of his pocket, but is terrified of giving away too much equity in the company. They're expecting growth to explode this year, so the strategy is to bring on new debt to finance operations. At the same time, your manager is afraid of taking on debt because then it will be harder to pay the bills every month with more liabilities going out the door, and if we go into a recession, making it possibly harder to pay that debt off. Using the information below, run through the hypothetical scenario of taking on debt, and then recommend whether you would or would not take on the debt. (HINT: You are going to be calculating the WACC to show whether your costs of capital will increase or decrease!) If the firm accepts the debt proposal, then the following are the details of the bonds: 25 = Need Numbers/Formulas in them 2% Number of years: Type: Annual Coupon Rate Current Bond Price Number of bonds issued *Assume Par Value is 1,001 1050 8,000 1000 Current Information: Proposed Changes: WACC Before Debt R E 1 RD TR WE 1001 0.00% WD 0% WACC Equity: Shares Share Value Beta Equity: Shares Share Value Beta 20,000 135.00 1.05 $ $ 20,000 135.00 1.05 WACC After Debt WE R E WD | RD | TRI WACC 0.00% Debt: (Annual Bonds) Bonds Outstanding Issuing Price Years to Maturity Coupon Rate Par Value Yield to Maturity Corporate Tax Rate Debt: (Annual Bonds) Bonds Outstanding Issuing Price Years to Maturity Coupon PMT Par Value Yield to Maturity Corporate Tax Rate 2,500 1050 25 20 1000 32% 32% Take on Debt? (Yes) (No) Current Market Info: Treasury Bill Yield Expected Market Retur Current Market Info: Treasury Bill Yield Expected Market Retum 0.10% 6.50% Why? 0.10% 6.50% CAPM CAPM Total Equity Value Total Debt Value Total Company Value Total Equity Value Total Debt Value Total Company Value