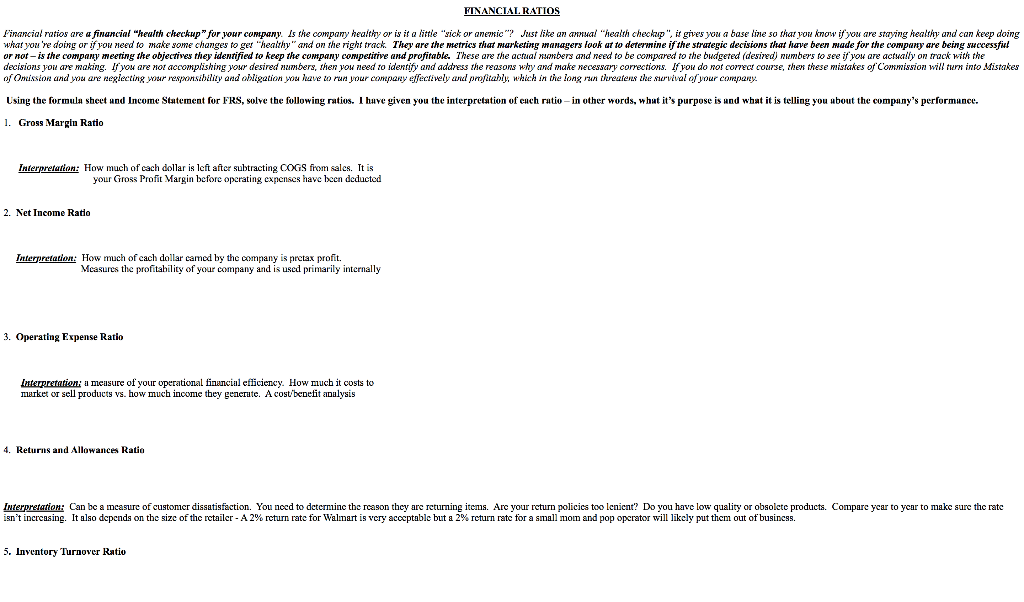

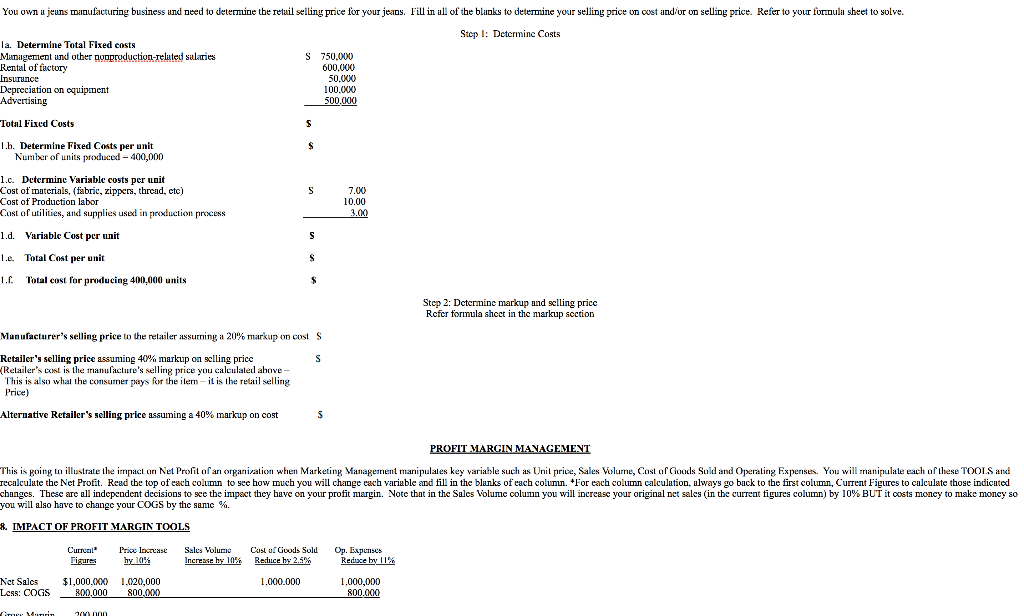

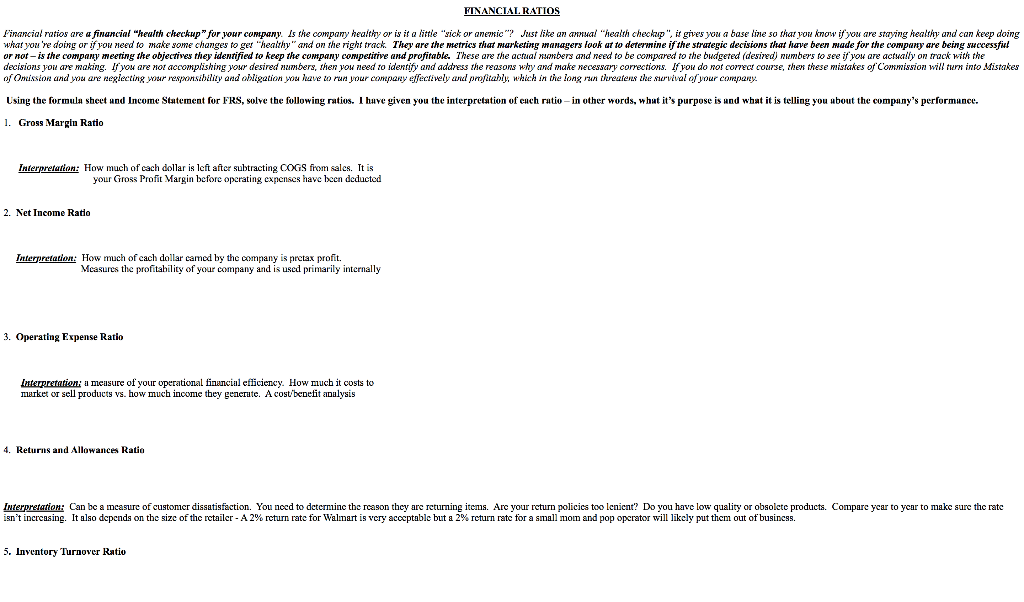

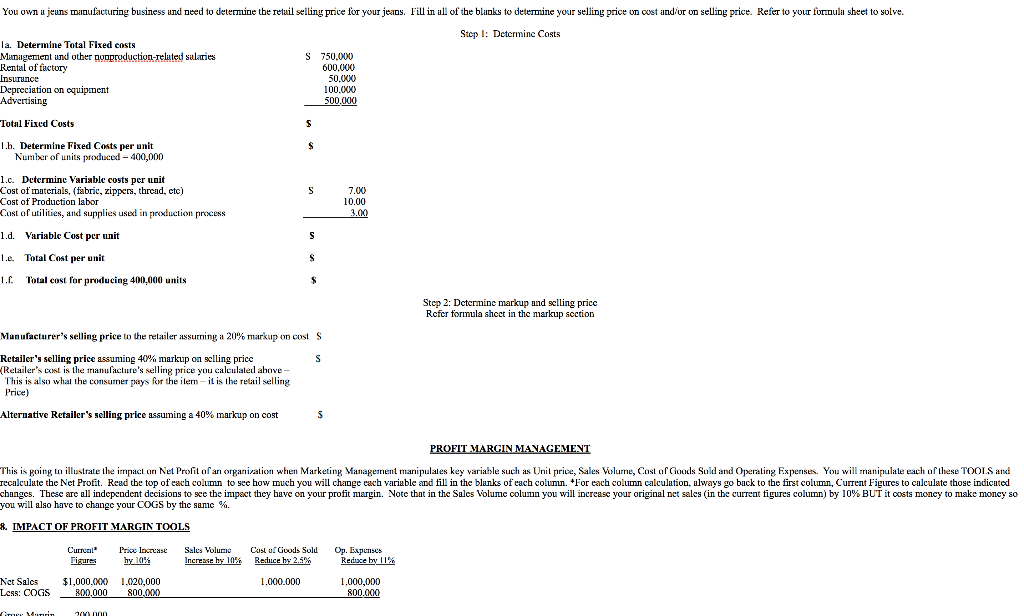

FINANCIAL RATIOS financial ratios are a financial "health checkup" for your company. Is the company healthy or is it a little "sick or anemic"? Just like an annual "health checkup", it gives you a base dine so that you know if you are staying healthy and can keep doing what you're doing or if you need to make some changes to ger "healthy and on the right track. They are the metrics that marketing managers look at to determine if the strategic decisions that have been made for the company are being successful or nor is the company meeting the objectives they identified to keep the company competitive and profitable. These are the actual numbers and need to be compared to the budgeted (desired) numbers to see if you are actually on track with the decisions you are making. If you are not accomplishing your desired numbers, then you need to identify and address the reasons why and make necessary corrections. If you do not correct course, then these mistakes of Commission will turn into Mistakes of Omission and wou are neglecting wour responsibility and obligation wou have to run your company effectively and profitably, which in the long run threatens the survival of your company Using the formula sheet und Income Statement for FRS, solve the following ratios. I have given you the interpretation of euch rutio- in other words, what it's purpose is und what it is telling you about the company's performance. 1. Gross Margiu Ratio Interpretation: How much of cach dollar is left after subtracting COGS from sales. It is your Gross Profit Margin before operating expenses have been deducted 2. Net Income Ratio Interpretation: How much of cach dollar camed by the company is pretax profit. Measures the profitability of your company and is used primarily internally 3. Operating Expense Ratio market or sell products vs. how much incwme they genetute. A cost benefit analysis Interpretation: u mesure of your operational financial efficiency. How much it costs to 4. Returns and Allowances Ratio Interpretation: Can be a measure of customer dissatisfaction. You need to determine the rcason they are returning itens. Are your return policies too lenient? Do you have low quality or obsolete products. Compare year to year to niake sure the rate isn't increasing. It also depends on the size of the retailer - A 2% rcturn rate for Walmart is very acceptable but a 2% return rate for a small mom and pop opcrator will likely put them out of business. 5. Inventory Turnover Ratio You own u jeans Dioufacturing business und Deed to determine the retail selling price for your jeans. Fill in all of the blanks to determine your selling price on cost and/or on selling price. Refer to your fondula sheet to solve. Step 1: Determine Costs 1a. Determine Total Fixed costs Manilgement and other pooproduction-related salaries S 750.000 Rental of factory 600,000 50.000 Depreciation on equipment 100.000 Advertising 500.000 Total Fixed Costs 1.b. Determine Fixed Costs per unit Number of units produced - 400,000 S S S 1.c. Determine Variable costs per unit Cost of materials, (fabric, zippers, thrend, etc) Cost of Production labor Cost of utilities, and supplies used in production process 7.00 10.00 3.00 1.d. Variable Cost per unit S 1.e. Total Cost per unit S 1.C Total cost for producing 400,000 units $ Step 2: Determine markup and selling price Rcfer formula sheet in the markup section Manufacturer's selling price to the retailer assurning a 20% markup on costs Retailer's selling price assuming 40% markup on selling price S (Retailer's cost is the manufacture's selling price you calculated above- This is also what the consumer pays for the item-it is the retail selling Price) Alternative Retailer's selling price assuming a 40% markup on cost $ PROFIT MARGIN MANAGEMENT This is going to illustrate the impact on Net Proit of an organization when Marketing Management manipulates key variable such as Unil price, Sales Volurne, Cost of Goods Sold and Operating Expenses. You will manipulate each of these TOOLS and recalculate the Net Profit. Read the top of each column to see how much you will change each variable and fill in the blanks of each column. *For each column calculation, always go back to the first column, Current Figures to calculate those indicated changes. These are all independent decisions to see the inpact they have on your profit margin. Note that in the Sales Volunic column you will increase your original net sales (in the current figures column) by 10% BUT it costs money to make moncy so you will also have to change your COGS by the same %. 8. IMPACT OF PROFIT MARGIN TOOLS Curreal Price Increase hy 10% Sales Volume Increase by 10% Cast of Goods Sold Reduce by 2.5% Op. Expenses Reduce by 11% 1,000,000 800.000 1.000.000 Net Sales Less: COGS $1,000,000 1.020,000 800,000 800,000 timer Yunnin