Question

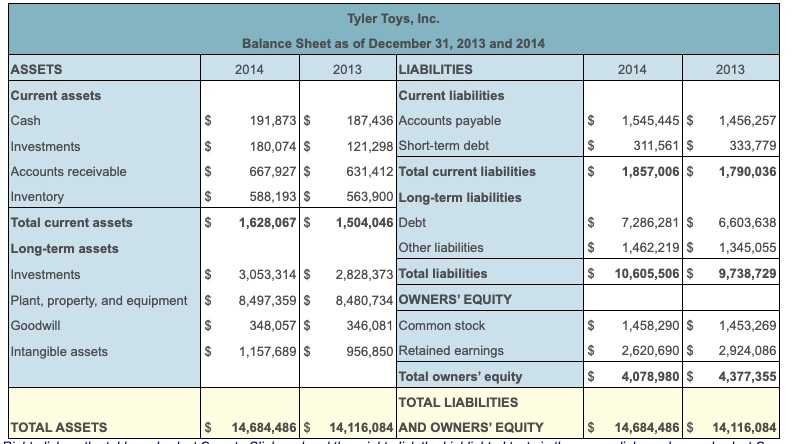

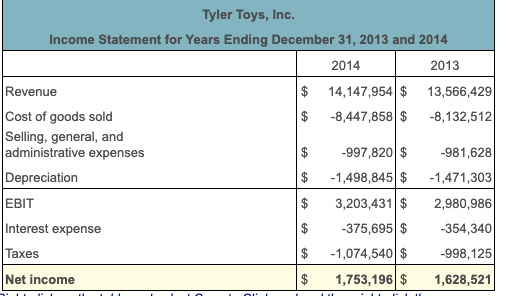

Financial ratios: Liquidity.The financial statements for Tyler Toys, Inc. are shown in the popup window:Calculate the current ratio, quick ratio, and cash ratio for Tyler

Financial ratios: Liquidity.The financial statements for Tyler Toys, Inc. are shown in the popup window:Calculate the current ratio, quick ratio, and cash ratio for Tyler Toys for 2013 and 2014. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? (ROUND ALL ANSWERS TO 4 DECIMAL PLACES)

What is the current ratio for 2014?

what is the current ratio for 2013?

what is the quick ratio for 2014?

what is the quick ratio for 2013?

what is the cash ratio for 2014?

what is the cash ratio for 2013?

Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? (select the best response)

a. The ratios look reasonable and the change shows improving liquidity for all ratios except the cash ratio.

b. The ratios do not look reasonable and the managers of Tyler Toys should make the appropriate adjustments.

c. The ratios look reasonable and the change shows deteriorating liquidity for all ratios.

d. The ratios look reasonable and the change shows improving liquidity for all ratios.

2014 2013 $ $ $ $ 1,545,445 $ 311,561 $ 1,857,006 $ 1,456,257 333,779 1,790,036 $ $ ASSETS Current assets Cash Investments Accounts receivable $ Inventory Total current assets Long-term assets Investments Plant, property, and equipment $ Goodwill Intangible assets $ $ Tyler Toys, Inc. Balance Sheet as of December 31, 2013 and 2014 2014 2013 LIABILITIES Current liabilities 191,873 $ 187,436 Accounts payable 180,074 $ 121,298 Short-term debt 667,927 $ 631,412 Total current liabilities 588,193 $ 563,900 Long-term liabilities 1,628,067 $ 1,504,046 Debt Other liabilities 3,053,314 $ 2,828,373 Total liabilities 8,497,359 $ 8,480,734 OWNERS' EQUITY 348,057 $ 346,081 Common stock 1,157,689 $ 956,850 Retained earnings Total owners' equity TOTAL LIABILITIES 14,684,486 $ 14,116,084 AND OWNERS' EQUITY $ 6,603,638 $ 7,286,281 $ 1,462,219 $ 10,605,506 $ 1,345,055 $ 9,738,729 $ $ $ $ 1,458,290 $ 2,620,690 $ 4,078,980 $ 1,453,269 2,924,086 4,377,355 $ TOTAL ASSETS $ $ 14,684,486 $ 14,116,084 2013 Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 Revenue $ 14,147,954 $ 13,566,429 Cost of goods sold -8,447,858 $ -8,132,512 Selling, general, and administrative expenses -997,820 $ -981,628 Depreciation $ -1,498,845 $ -1,471,303 EBIT 3,203,431 $ 2,980,986 Interest expense -375,695 $ -354,340 Taxes -1,074,540 $ -998,125 Net income 1,753,196 $ 1,628,521 $ $ HA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started