Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Reporting, Financial Statement Analysis and Valuation: A Strategic Perspective, James M. Wahlen, Stephen P. Baginski and Mark Bradshaw, 8th Edition ISBN-13: 9781285190907 Chapter 12,

Financial Reporting, Financial Statement Analysis and Valuation: A Strategic Perspective, James M. Wahlen, Stephen P. Baginski and Mark Bradshaw, 8th Edition

ISBN-13: 9781285190907

Chapter 12, Problem 17PC

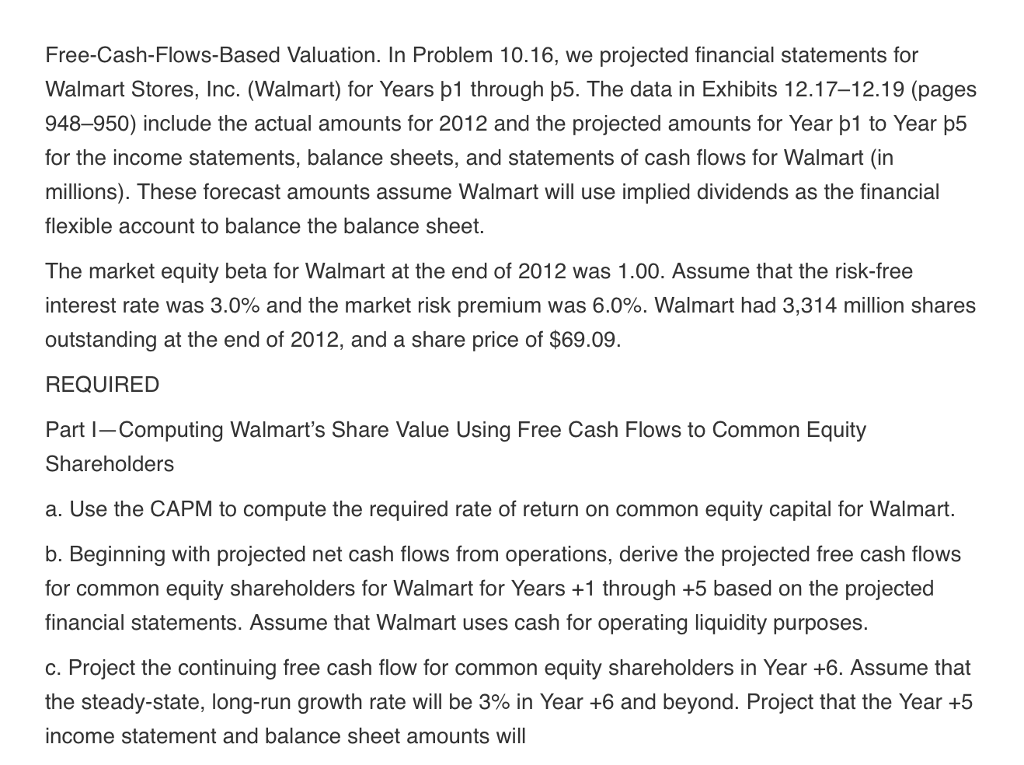

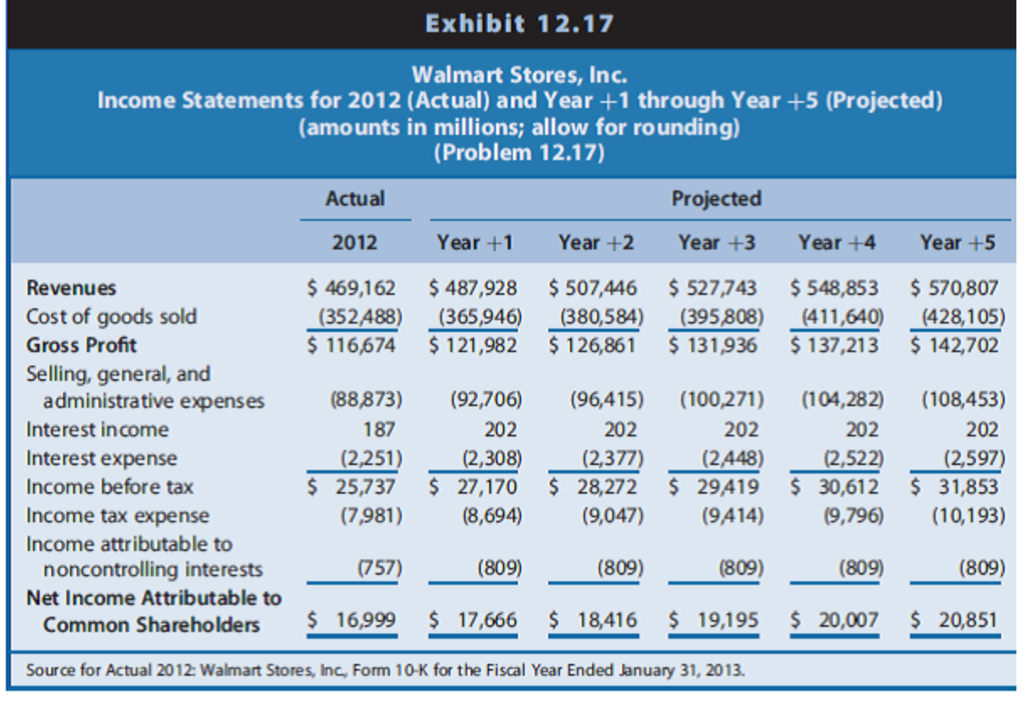

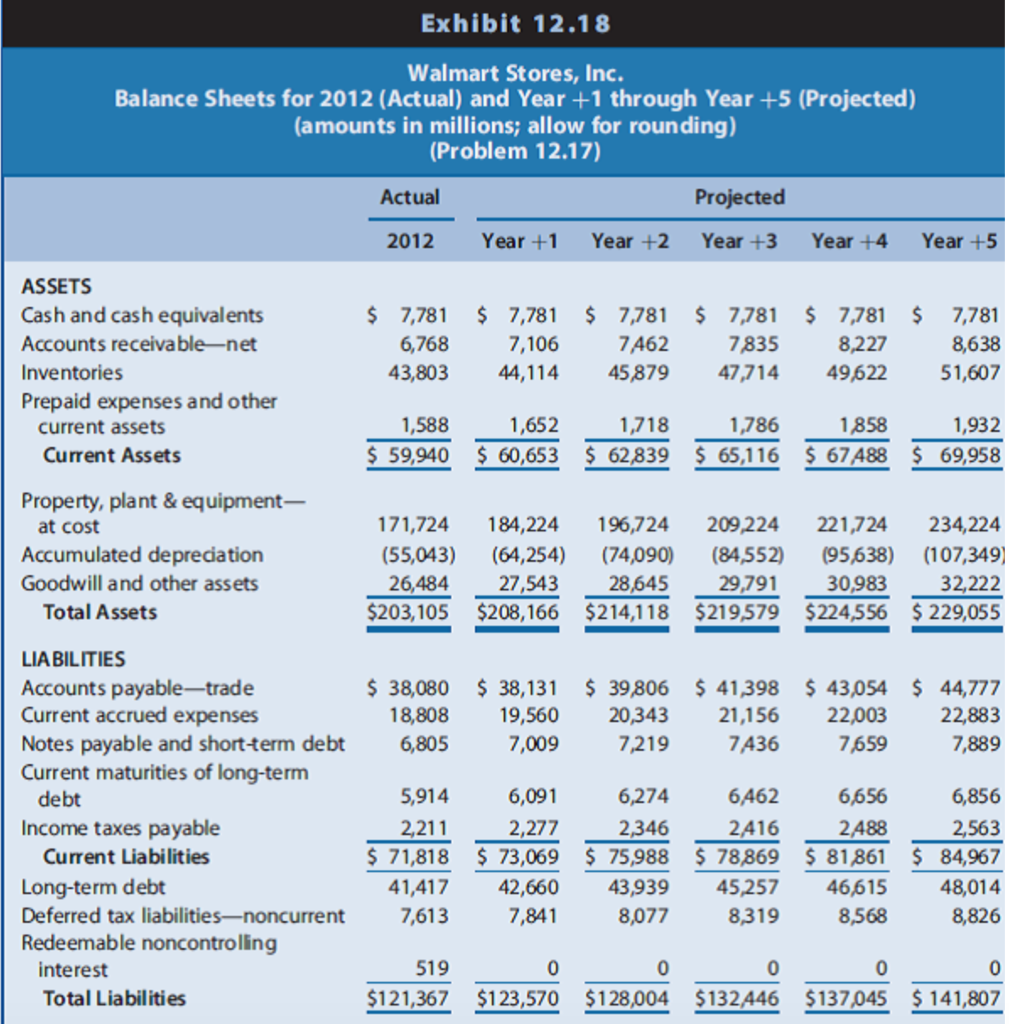

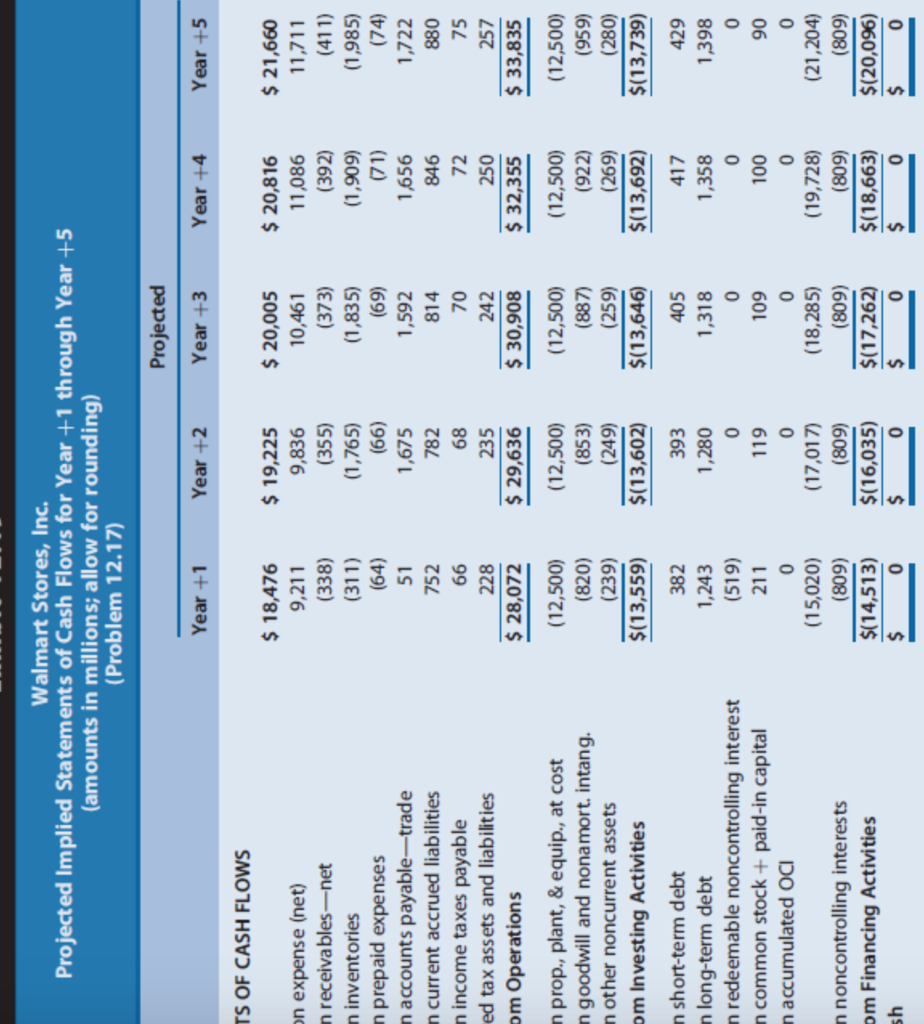

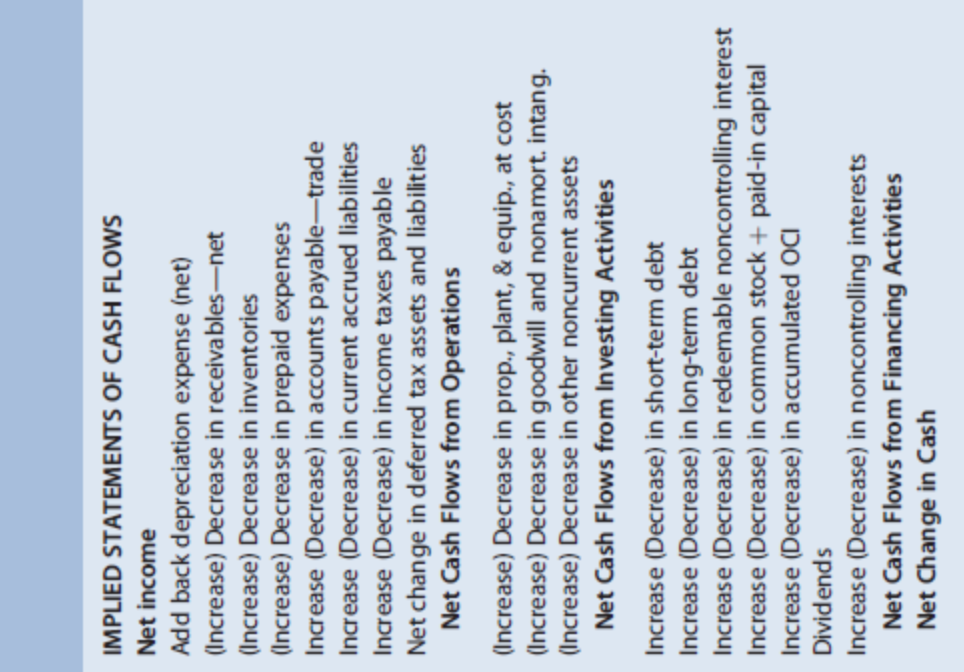

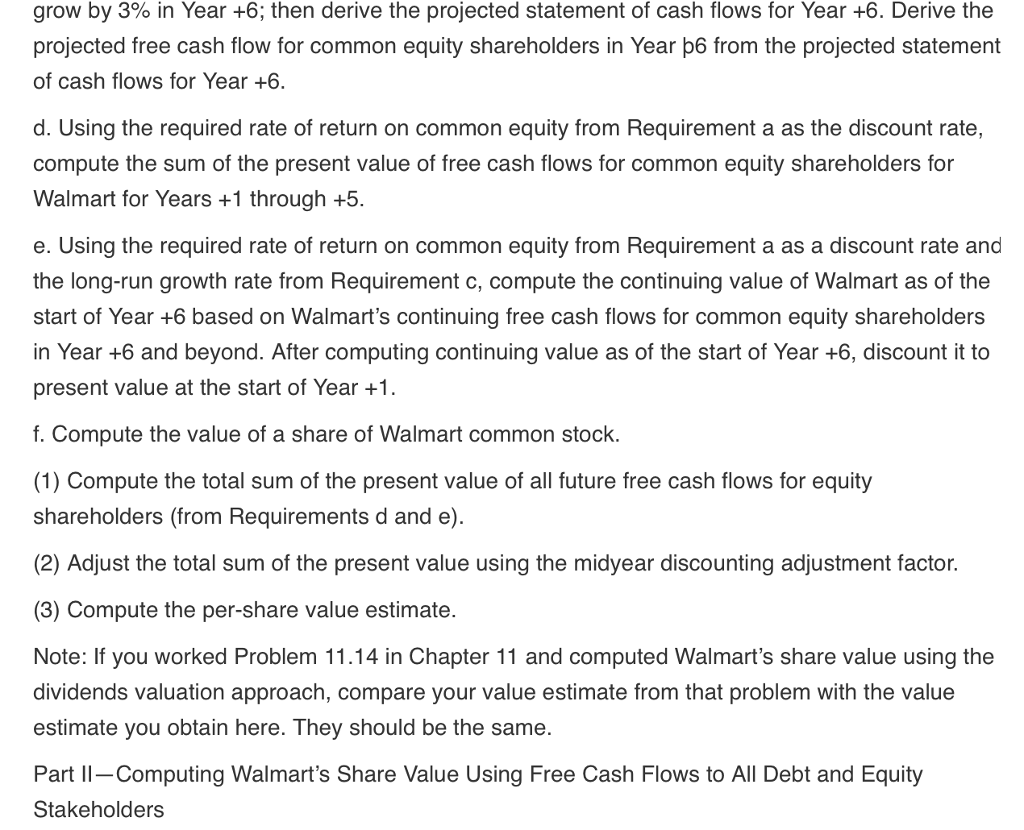

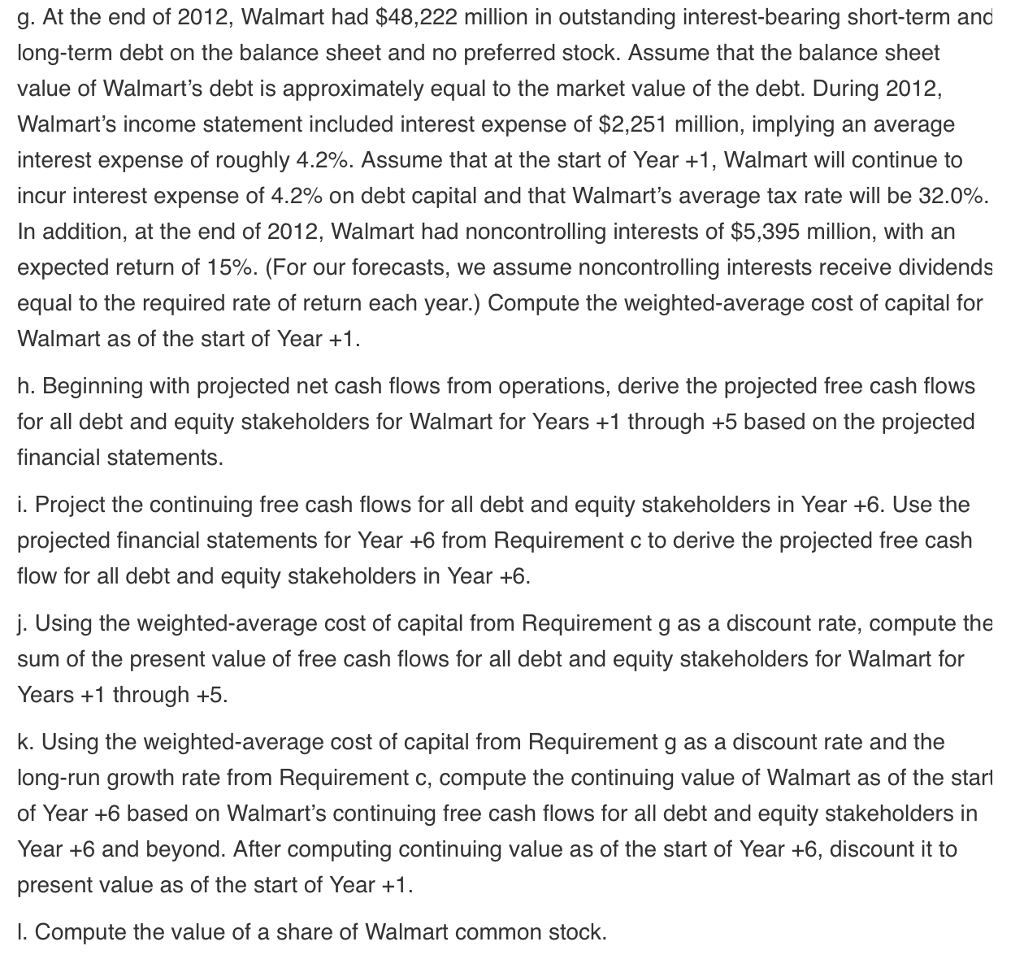

Free-Cash-Flows-Based Valuation. In Problem 10.16, we projected financial statements for Walmart Stores, Inc. (Walmart) for Years p1 through p5. The data in Exhibits 12.17-12.19 (pages 948-950) include the actual amounts for 2012 and the projected amounts for Year p1 to Year p5 for the income statements, balance sheets, and statements of cash flows for Walmart (in millions). These forecast amounts assume Walmart will use implied dividends as the financial flexible account to balance the balance sheet The market equity beta for Walmart at the end of 2012 was 1.00. Assume that the risk-free interest rate was 3.0% and the market risk premium was 6.0%. Walmart had 3,314 million shares outstanding at the end of 2012, and a share price of $69.09 REQUIRED Part I-Computing Walmart's Share Value Using Free Cash Flows to Common Equity Shareholders a. Use the CAPM to compute the required rate of return on common equity capital for Walmart b. Beginning with projected net cash flows from operations, derive the projected free cash flows for common equity shareholders for Walmart for Years +1 through +5 based on the projected financial statements. Assume that Walmart uses cash for operating liquidity purposes. c. Project the continuing free cash flow for common equity shareholders in Year +6. Assume that the steady-state, longrun growth rate will be 3% in Year +6 and beyond. Project that the Year +5 income statement and balance sheet amounts will Free-Cash-Flows-Based Valuation. In Problem 10.16, we projected financial statements for Walmart Stores, Inc. (Walmart) for Years p1 through p5. The data in Exhibits 12.17-12.19 (pages 948-950) include the actual amounts for 2012 and the projected amounts for Year p1 to Year p5 for the income statements, balance sheets, and statements of cash flows for Walmart (in millions). These forecast amounts assume Walmart will use implied dividends as the financial flexible account to balance the balance sheet The market equity beta for Walmart at the end of 2012 was 1.00. Assume that the risk-free interest rate was 3.0% and the market risk premium was 6.0%. Walmart had 3,314 million shares outstanding at the end of 2012, and a share price of $69.09 REQUIRED Part I-Computing Walmart's Share Value Using Free Cash Flows to Common Equity Shareholders a. Use the CAPM to compute the required rate of return on common equity capital for Walmart b. Beginning with projected net cash flows from operations, derive the projected free cash flows for common equity shareholders for Walmart for Years +1 through +5 based on the projected financial statements. Assume that Walmart uses cash for operating liquidity purposes. c. Project the continuing free cash flow for common equity shareholders in Year +6. Assume that the steady-state, longrun growth rate will be 3% in Year +6 and beyond. Project that the Year +5 income statement and balance sheet amounts willStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started