Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial reporting Question 1: On March 1, 2007 Kapas Textiles ltd imported an automatic plant for Rs. 27 million. The relevant information is as follows:

Financial reporting

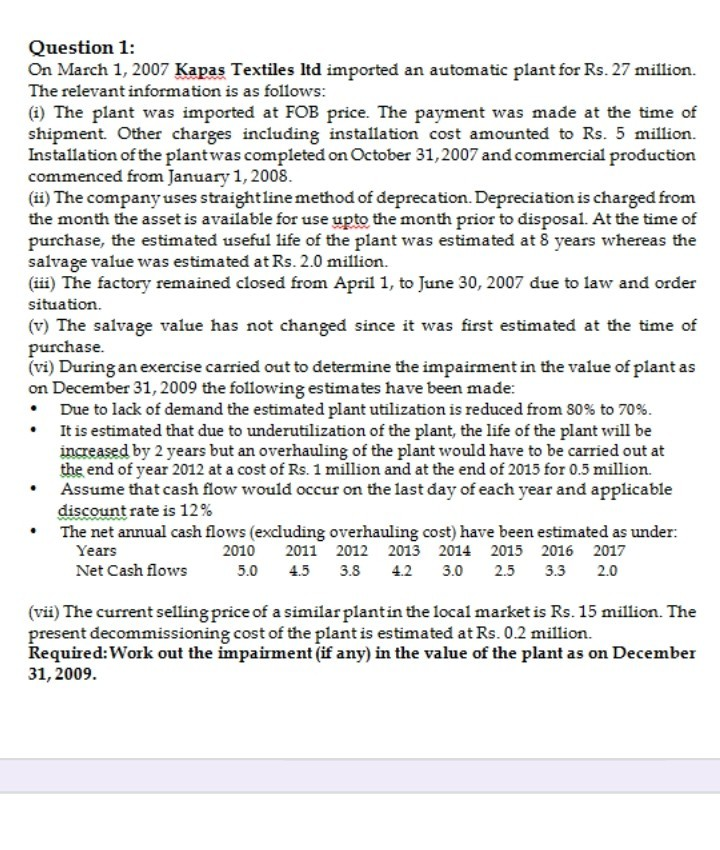

Question 1: On March 1, 2007 Kapas Textiles ltd imported an automatic plant for Rs. 27 million. The relevant information is as follows: (1) The plant was imported at FOB price. The payment was made at the time of shipment. Other charges including installation cost amounted to Rs. 5 million. Installation of the plant was completed on October 31, 2007 and commercial production commenced from January 1, 2008. (ii) The company uses straight line method of deprecation. Depreciation is charged from the month the asset is available for use upto the month prior to disposal. At the time of purchase, the estimated useful life of the plant was estimated at 8 years whereas the salvage value was estimated at Rs.2.0 million. (iii) The factory remained closed from April 1, to June 30, 2007 due to law and order situation. (v) The salvage value has not changed since it was first estimated at the time of purchase. (vi) During an exercise carried out to determine the impairment in the value of plantas on December 31, 2009 the following estimates have been made: Due to lack of demand the estimated plant utilization is reduced from 80% to 70%. It is estimated that due to underutilization of the plant, the life of the plant will be increased by 2 years but an overhauling of the plant would have to be carried out at the end of year 2012 at a cost of Rs. 1 million and at the end of 2015 for 0.5 million. Assume that cash flow would occur on the last day of each year and applicable discount rate is 12% The net annual cash flows (excluding overhauling cost) have been estimated as under: Years 2010 2011 2012 2013 2014 2015 2016 2017 Net Cash flows 5.0 4.5 3.8 4.2 3.0 2.5 3.3 2.0 (vii) The current selling price of a similar plant in the local market is Rs. 15 million. The present decommissioning cost of the plant is estimated at Rs.0.2 million. Required: Work out the impairment (if any) in the value of the plant as on December 31, 2009Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started