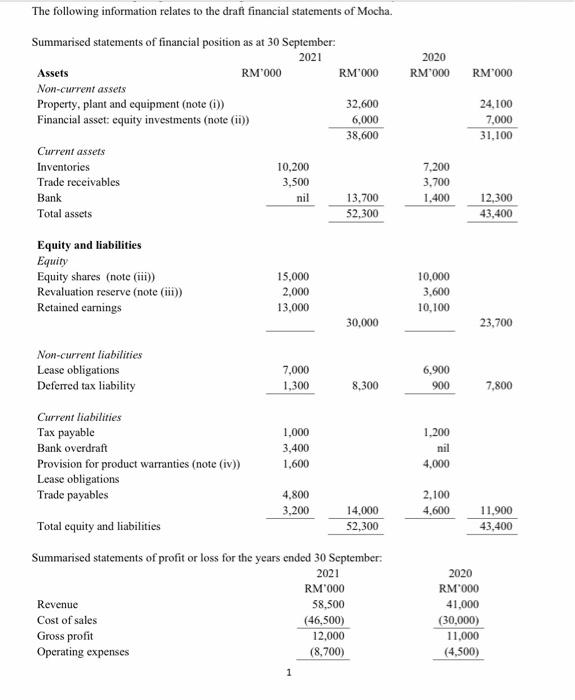

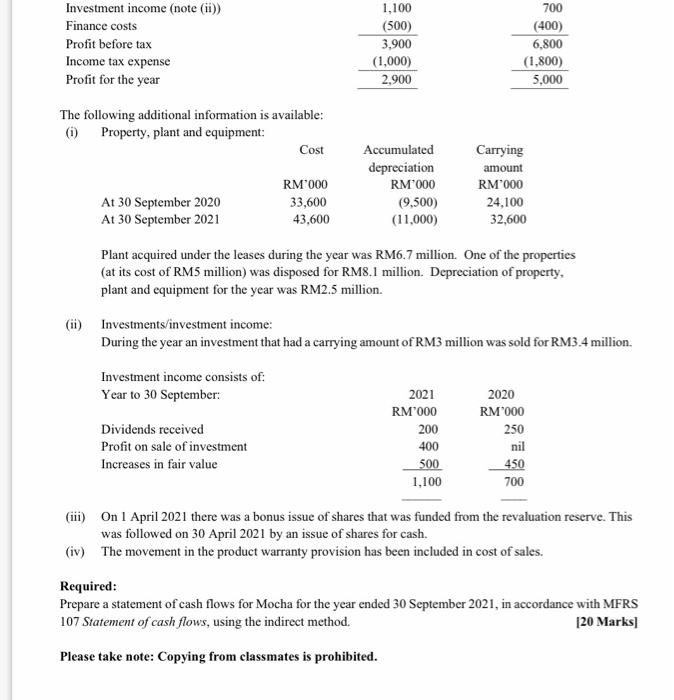

The following information relates to the draft financial statements of Mocha. 2020 RM 000 RM"000 Summarised statements of financial position as at 30 September: 2021 Assets RM 000 RM 000 Non-current assets Property, plant and equipment (note (1)) 32,600 Financial asset: equity investments (note (ii)) 6,000 38,600 Current assets Inventories 10,200 Trade receivables 3,500 Bank nil 13,700 Total assets 52,300 24,100 7,000 31,100 7,200 3.700 1,400 12,300 43,400 Equity and liabilities Equity Equity shares (note (11) Revaluation reserve (note (iii)) Retained earnings 15,000 2,000 13,000 10,000 3,600 10,100 30,000 23,700 Non-current liabilities Lease obligations Deferred tax liability 6,900 7,000 1,300 8,300 900 7,800 Current liabilities Tax payable Bank overdraft Provision for product warranties (note (iv)) Lease obligations Trade payables 1,000 3,400 1,600 1,200 nil 4.000 4.800 3,200 2.100 4,600 14,000 52,300 Total equity and liabilities 11,900 43,400 Summarised statements of profit or loss for the years ended 30 September 2021 RM1000 Revenue 58,500 Cost of sales (46,500) Gross profit 12,000 Operating expenses (8,700) 2020 RM000 41,000 (30,000) 11,000 (4,500) 1 Investment income (note (ii)) Finance costs Profit before tax Income tax expense Profit for the year 1,100 (500) 3,900 (1,000) 2,900 700 (400) 6,800 (1,800) 5,000 The following additional information is available: (1) Property, plant and equipment: Cost Accumulated depreciation RM 000 (9,500) (11,000) RM 000 33,600 43,600 Carrying amount RM 000 24,100 32,600 At 30 September 2020 At 30 September 2021 Plant acquired under the leases during the year was RM6.7 million. One of the properties (at its cost of RM5 million) was disposed for RM8.1 million. Depreciation of property, plant and equipment for the year was RM2.5 million. (ii) Investments/investment income: During the year an investment that had a carrying amount of RM3 million was sold for RM3.4 million. Investment income consists of: Year to 30 September: Dividends received Profit on sale of investment Increases in fair value 2021 RM000 200 400 500 1,100 2020 RM"000 250 nil 450 700 (iii) On 1 April 2021 there was a bonus issue of shares that was funded from the revaluation reserve. This was followed on 30 April 2021 by an issue of shares for cash. (iv) The movement in the product warranty provision has been included in cost of sales. Required: Prepare a statement of cash flows for Mocha for the year ended 30 September 2021, in accordance with MFRS 107 Statement of cash flows, using the indirect method. [20 Marks Please take note: Copying from classmates is prohibited