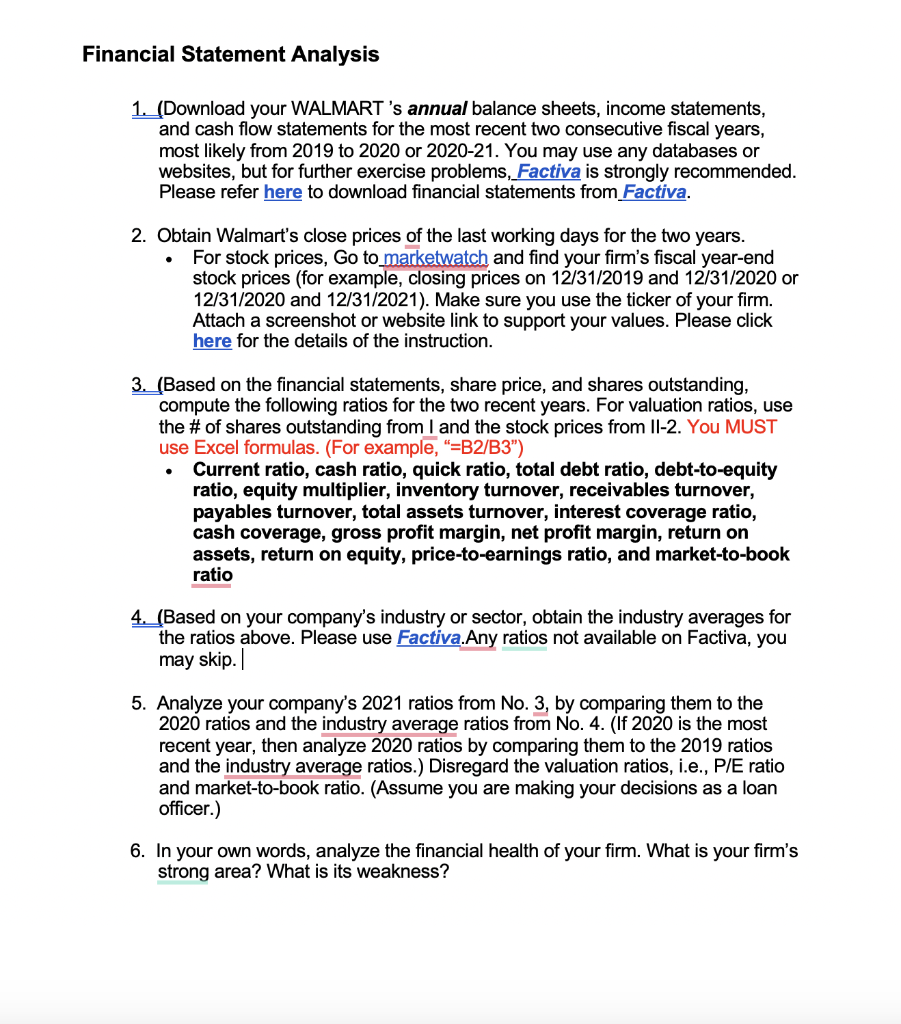

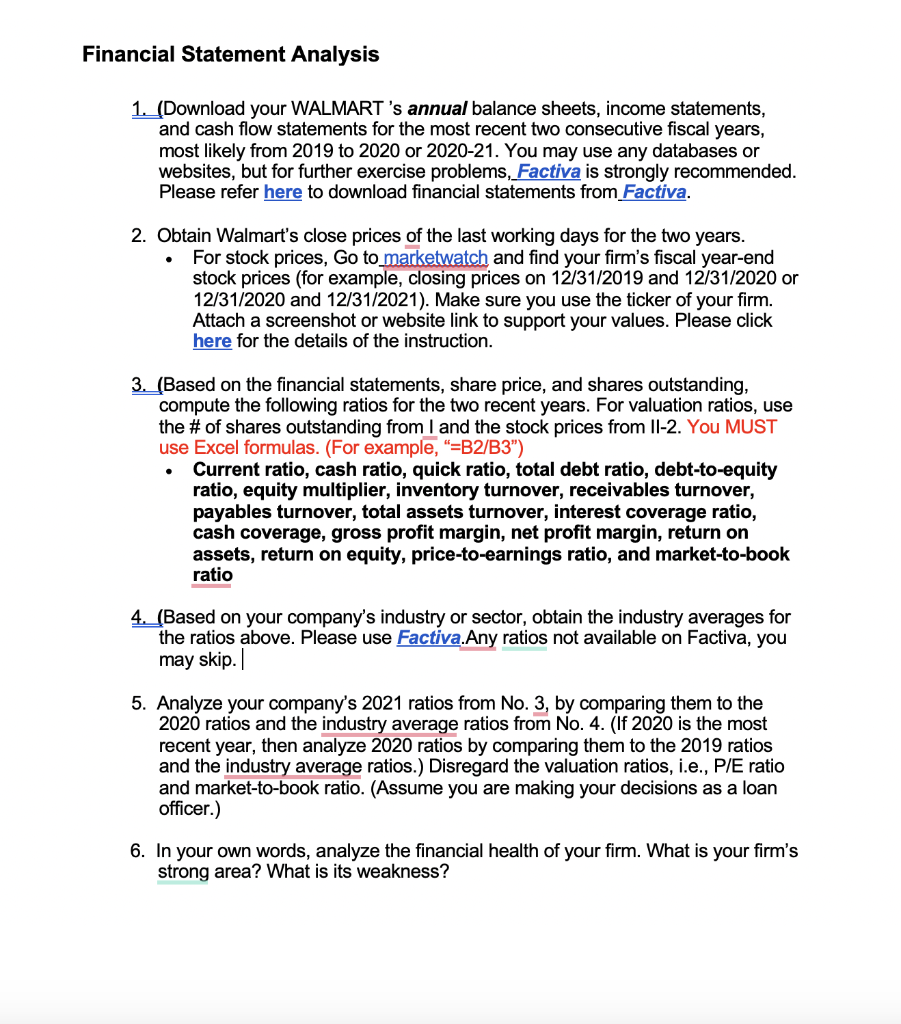

Financial Statement Analysis 1. (Download your WALMART's annual balance sheets, income statements, and cash flow statements for the most recent two consecutive fiscal years, most likely from 2019 to 2020 or 2020-21. You may use any databases or websites, but for further exercise problems, Factiva is strongly recommended. Please refer here to download financial statements from Factiva. 2. Obtain Walmart's close prices of the last working days for the two years. For stock prices, Go to marketwatch and find your firm's fiscal year-end stock prices (for example, closing prices on 12/31/2019 and 12/31/2020 or 12/31/2020 and 12/31/2021). Make sure you use the ticker of your firm. Attach a screenshot or website link to support your values. Please click here for the details of the instruction. 3. (Based on the financial statements, share price, and shares outstanding, compute the following ratios for the two recent years. For valuation ratios, use the # of shares outstanding from I and the stock prices from II-2. You MUST use Excel formulas. (For example, "=B2/B3") Current ratio, cash ratio, quick ratio, total debt ratio, debt-to-equity ratio, equity multiplier, inventory turnover, receivables turnover, payables turnover, total assets turnover, interest coverage ratio, cash coverage, gross profit margin, net profit margin, return on assets, return on equity, price-to-earnings ratio, and market-to-book ratio 4. (Based on your company's industry or sector, obtain the industry averages for the ratios above. Please use Factiva.Any ratios not available on Factiva, you may skip. 5. Analyze your company's 2021 ratios from No. 3, by comparing them to the 2020 ratios and the industry average ratios from No. 4. (If 2020 is the most recent year, then analyze 2020 ratios by comparing them to the 2019 ratios and the industry average ratios.) Disregard the valuation ratios, i.e., P/E ratio and market-to-book ratio. (Assume you are making your decisions as a loan officer.) 6. In your own words, analyze the financial health of your firm. What is your firm's strong area? What is its weakness? Financial Statement Analysis 1. (Download your WALMART's annual balance sheets, income statements, and cash flow statements for the most recent two consecutive fiscal years, most likely from 2019 to 2020 or 2020-21. You may use any databases or websites, but for further exercise problems, Factiva is strongly recommended. Please refer here to download financial statements from Factiva. 2. Obtain Walmart's close prices of the last working days for the two years. For stock prices, Go to marketwatch and find your firm's fiscal year-end stock prices (for example, closing prices on 12/31/2019 and 12/31/2020 or 12/31/2020 and 12/31/2021). Make sure you use the ticker of your firm. Attach a screenshot or website link to support your values. Please click here for the details of the instruction. 3. (Based on the financial statements, share price, and shares outstanding, compute the following ratios for the two recent years. For valuation ratios, use the # of shares outstanding from I and the stock prices from II-2. You MUST use Excel formulas. (For example, "=B2/B3") Current ratio, cash ratio, quick ratio, total debt ratio, debt-to-equity ratio, equity multiplier, inventory turnover, receivables turnover, payables turnover, total assets turnover, interest coverage ratio, cash coverage, gross profit margin, net profit margin, return on assets, return on equity, price-to-earnings ratio, and market-to-book ratio 4. (Based on your company's industry or sector, obtain the industry averages for the ratios above. Please use Factiva.Any ratios not available on Factiva, you may skip. 5. Analyze your company's 2021 ratios from No. 3, by comparing them to the 2020 ratios and the industry average ratios from No. 4. (If 2020 is the most recent year, then analyze 2020 ratios by comparing them to the 2019 ratios and the industry average ratios.) Disregard the valuation ratios, i.e., P/E ratio and market-to-book ratio. (Assume you are making your decisions as a loan officer.) 6. In your own words, analyze the financial health of your firm. What is your firm's strong area? What is its weakness