Answered step by step

Verified Expert Solution

Question

1 Approved Answer

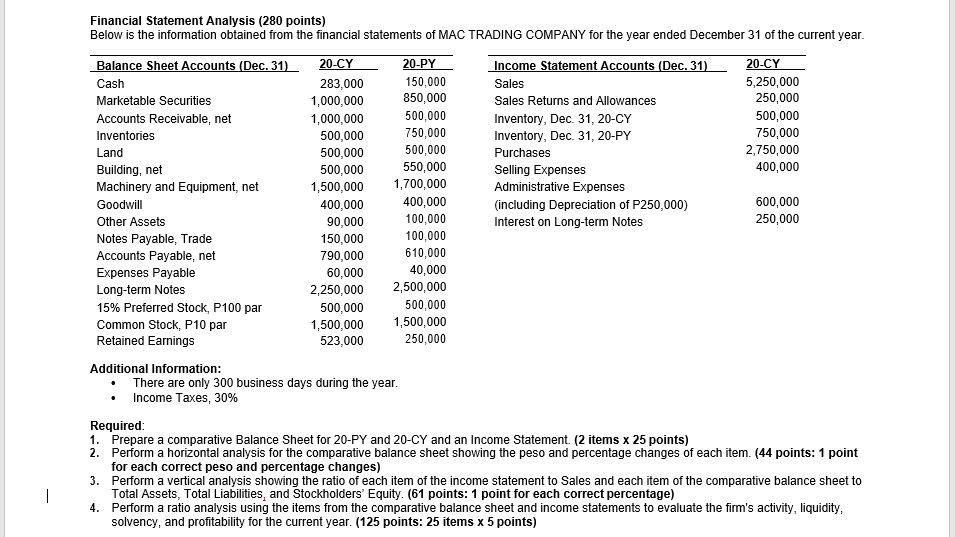

Financial Statement Analysis (280 points) Below is the information obtained from the financial statements of MAC TRADING COMPANY for the year ended December 31

Financial Statement Analysis (280 points) Below is the information obtained from the financial statements of MAC TRADING COMPANY for the year ended December 31 of the current year. Balance Sheet Accounts (Dec. 31) 20-CY 20-PY Cash 283,000 150,000 Income Statement Accounts (Dec. 31) Sales 20-CY 5,250,000 Marketable Securities 1,000,000 850,000 Sales Returns and Allowances 250,000 Accounts Receivable, net 1,000,000 500,000 Inventory, Dec. 31, 20-CY 500,000 Inventories 500,000 750,000 Inventory, Dec. 31, 20-PY 750,000 Land 500,000 500,000 Purchases 2,750,000 Building, net 500,000 550,000 Selling Expenses 400,000 Machinery and Equipment, net 1,500,000 1,700,000 Administrative Expenses Goodwill 400,000 400,000 (including Depreciation of P250,000) 600,000 Other Assets 90,000 100,000 Interest on Long-term Notes 250,000 Notes Payable, Trade 150,000 100,000 Accounts Payable, net 790,000 610,000 Expenses Payable 60,000 40,000 Long-term Notes 2,250,000 2,500,000 15% Preferred Stock, P100 par 500,000 500,000 Common Stock, P10 par 1,500,000 1,500,000 Retained Earnings 523,000 250,000 Additional Information: There are only 300 business days during the year. Income Taxes, 30% Required: 1. Prepare a comparative Balance Sheet for 20-PY and 20-CY and an Income Statement. (2 items x 25 points) 2. Perform a horizontal analysis for the comparative balance sheet showing the peso and percentage changes of each item. (44 points: 1 point for each correct peso and percentage changes) 3. Perform a vertical analysis showing the ratio of each item of the income statement to Sales and each item of the comparative balance sheet to Total Assets, Total Liabilities, and Stockholders' Equity. (61 points: 1 point for each correct percentage) 4. Perform a ratio analysis using the items from the comparative balance sheet and income statements to evaluate the firm's activity, liquidity, solvency, and profitability for the current year. (125 points: 25 items x 5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started