ABC Company produces and sells I product. Once the products are produced, they are sold, and there is no work-in- process, no any inventory

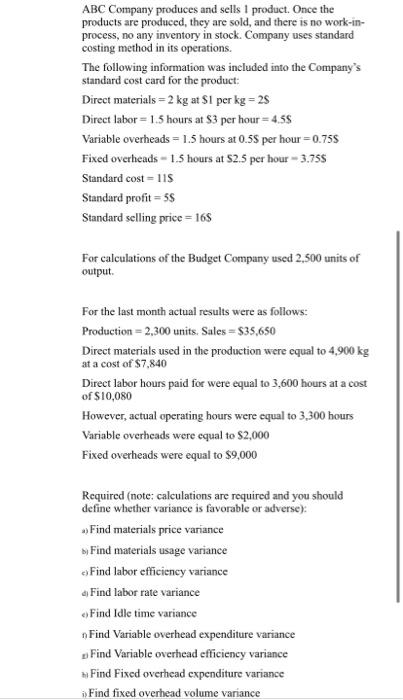

ABC Company produces and sells I product. Once the products are produced, they are sold, and there is no work-in- process, no any inventory in stock. Company uses standard costing method in its operations. The following information was included into the Company's standard cost card for the product: Direct materials = 2 kg at S1 per kg = 25 Direct labor = 1.5 hours at $3 per hour = 4.58 Variable overheads = 1.5 hours at 0.58 per hour =0.755 Fixed overheads - 1.5 hours at $2.5 per hour - 3.75S Standard cost = 115 Standard profit = 55 Standard selling price = 168 For calculations of the Budget Company used 2,500 units of output. For the last month actual results were as follows: Production = 2,300 units. Sales = $35,650 Direct materials used in the production were equal to 4,900 kg at a cost of $7,840 Direct labor hours paid for were equal to 3,600 hours at a cost of $10,080 However, actual operating hours were equal to 3,300 hours Variable overheads were equal to $2,000 Fixed overheads were equal to $9,000 Required (note: calculations are required and you should define whether variance is favorable or adverse): Find materials price variance b Find materials usage variance oFind labor efficiency variance a Find labor rate variance Find Idle time variance n Find Variable overhead expenditure variance Find Variable overhead efficiency variance Find Fixed overhead expenditure variance Find fixed overhead volume variance ) Find sales volume variance k) Find selling price variance ) Find the total Sales variance m) Prepare the Operating statement for the last month for ABC Company

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

As per given details please refer below answer a Material Price Variance Material Price Variance Actual unit cost Standard unit cost Actual Quantity Purchased Actual Quantity Purchased 4900 kg Actual ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started