Financial Statement Analysis and Firm Value. Weis Markets, Inc., is a Pennsylvania business founded

by Harry and Sigmund Weis in 1912. The company is engaged principally in the retail sale of food and pet

supplies in Pennsylvania and surrounding states. The Weis family currently owns approximately 62 percent

of the outstanding shares. The companys retail food stores sell groceries, dairy products, frozen foods, meats,

seafood, fresh produce, floral, prescriptions, deli/bakery products, prepared foods, fuel and general merchan-

dise items, such as health and beauty care and household products.

Required

1. Was Year 3 a good year or a bad year for Weis? Why?

2. What was the companys interest coverage ratio in Year 3 and Year 2? On July 1, Year 3, Weis considered

borrowing $100 million of long-term debt at an interest rate of ten percent per year to finance a $100 mil-

lion investment in additional stores. The new properties would not generate earnings until Year 4. What

would the companys interest coverage ratio have been for Year 3 if it had completed the borrowing?

3. Evaluate Weiss profitability in Year 2 and Year 3 using the ROE Model discussed in Chapter 4.

4. On March 31, following Year 3, Weiss share price closed at $29.85 per share. Value Line forecasted sales

of $2,050 million and $2,125 million and EPS of $2.00 and $2.10 per share for fiscal Year 4 and Year 5,

respectively. The companys cost of equity is approximately nine percent. Using the Residual Income

valuation model, calculate the equity value of the company. [As a base case, a company whose expected

ROE is twelve percent (14 percent) per year, whose cost of equity is nine percent, and whose growth in

book value is expected to be four percent per year for the first ten years and three percent per year there-

after, would have an intrinsic value of 1.54 (1.90) times current book value.] Do you think Weis is worth

$29.85 per share? Why?

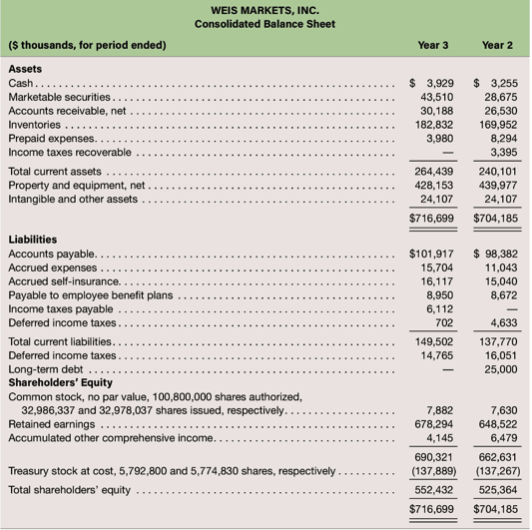

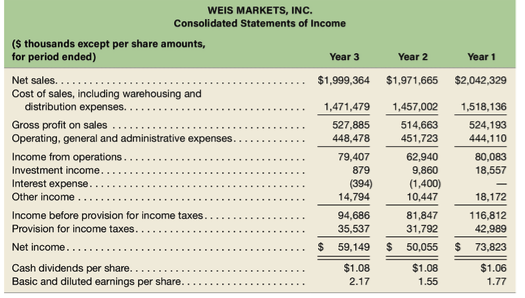

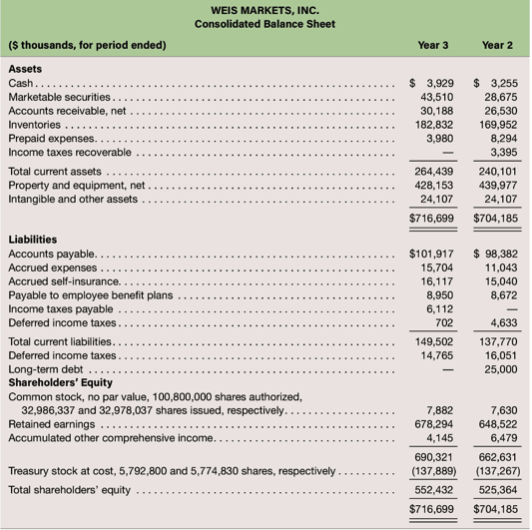

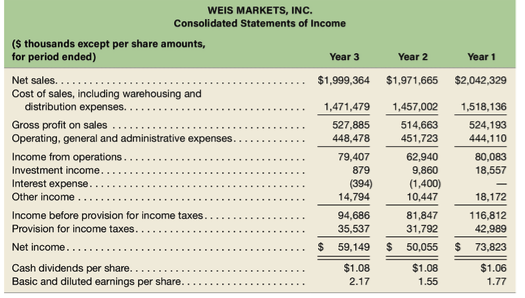

WEIS MARKETS, INC. Consolidated Balance Sheet Year 3 Year 2 (s thousands, for period ended) Assets Cash.. Marketable securities.. Accounts receivable, net Inventories ... Prepaid expenses. Income taxes recoverable Total current assets Property and equipment, net Intangible and other assets $ 3,929 43,510 30,188 182,832 3,980 1. $ 3,255 28,675 26,530 169,952 8,294 3,395 240,101 439,977 24,107 $704,185 264,439 428,153 24,107 $716,699 $ 98,382 11,043 15,040 8,672 Liabilities Accounts payable.. Accrued expenses Accrued self-insurance Payable to employee benefit plans Income taxes payable Deferred income taxes Total current liabilities Deferred income taxes. Long-term debt Shareholders' Equity Common stock, no par value, 100,800,000 shares authorized, 32,986,337 and 32,978,037 shares issued, respectively. Retained earnings .. Accumulated other comprehensive income. $101,917 15,704 16,117 8,950 6,112 702 149,502 14,765 4,633 137,770 16,051 25,000 7,882 678,294 4,145 690,321 (137.889) 552,432 7,630 648,522 6,479 662,631 (137,267) 525,364 Treasury stock at cost, 5,792,800 and 5,774,830 shares, respectively Total shareholders' equity $716,699 $704,185 WEIS MARKETS, INC. Consolidated Statements of Income (s thousands except per share amounts, for period ended) Year 3 Year 2 Year 1 Net sales. $1,999,364 $1,971,665 $2,042,329 Cost of sales, including warehousing and distribution expenses... 1,471,479 1,457,002 1,518,136 Gross profit on sales 527,885 514,663 524,193 Operating, general and administrative expenses. 448,478 451,723 444,110 Income from operations. 79,407 62,940 80,083 Investment income. 879 9,860 18,557 Interest expense. (394) (1,400) Other income 14,794 10,447 18,172 Income before provision for income taxes. 94,686 81,847 116,812 Provision for income taxes. 35,537 31,792 42.989 Net income... $ 59,149 $ 50,055 $ 73,823 Cash dividends per share. $1.08 $1.08 $1.06 Basic and diluted earnings per share.. 2.17 1.55 1.77 Year 2 Year 1 $ 50,055 $ 73,823 43,755 7.222 1,629 (570) 44.169 6,682 (5,913) (1.279) (1.411) (2.923) (251) 14,993 (1.395) 8.508 1,194 (2.696) 9.551 WEIS MARKETS, INC. Consolidated Statements of Cash Flow (s thousands, for period ended) Year 3 Cash flows from operating activities Net income..... $ 59,149 Adjustments to reconcile net income to net cash provided by operating activities Depreciation.... 41.885 Amortization.. 5,797 (Gain) loss on sale of fixed assets (3,620) Gain on sale of marketable securities Changes in operating assets and liabilities Inventories (12,880) Accounts receivable and prepaid expenses 656 Income taxes recoverable.. 3,395 Accounts payable and other liabilities Income taxes payable ..... 6,112 Deferred income taxes... (3.561) Net cash provided by operating activities 106,484 Cash flows from investing activities Purchase of property and equipment... (46,056) Proceeds from the sale of property and equipment. 14,520 Purchase of marketable securities.. (21,754) Proceeds from maturities of marketable securities 2.929 Proceeds from sale of marketable securities.. Increase in intangible and other assets.. (702) Net cash provided by used in) investing activities (51,063) Cash flows from financing activities Proceeds (payments) of long-term debt, net.. (25,000) Proceeds from issuance of common stock 252 Dividends paid.. (29,377) Purchase and cancellation of stock. Purchase of treasury stock... (622) Net cash used in financing activities (54,747) Net increase (decrease) in cash.. $ 674 1,381 113,880 2.472 125,565 (48,046) 86 (299,064) 556,141 123,660 (19) 332,758 (56,331) 11,714 (259,574) 108.154 127,043 (13,379) (82,373) 35 (44,191) 25,000 36 (37,202) (434,317) (289) (446,772) $ (134) (199) (44,355) $ (1,163)