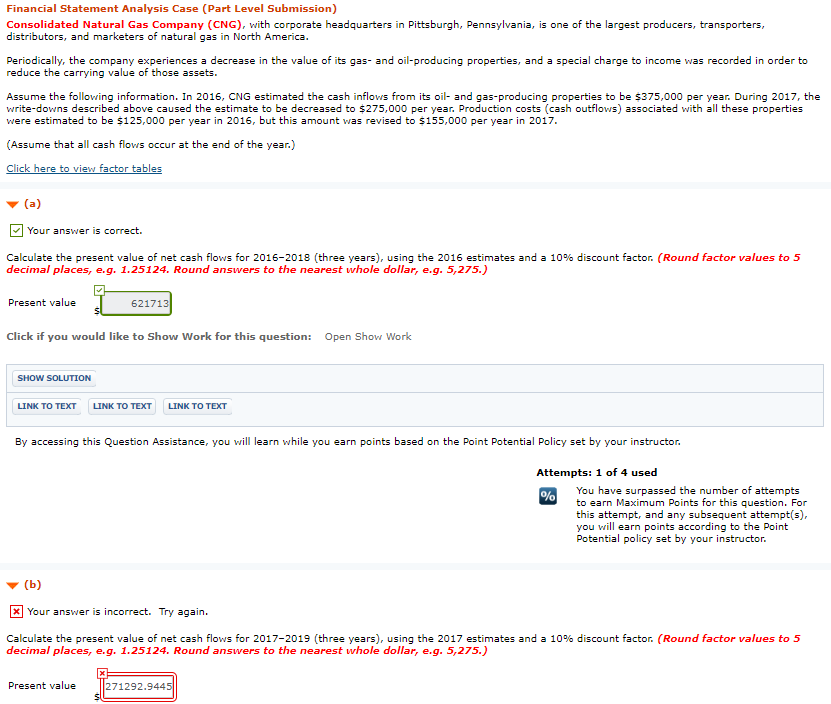

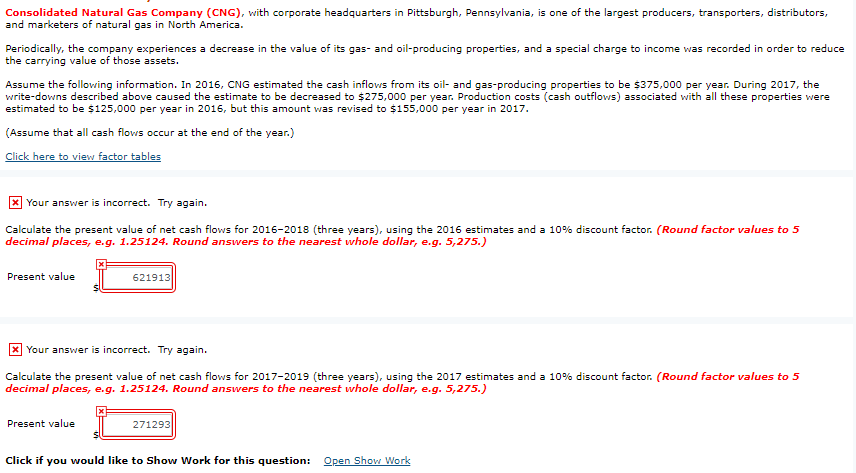

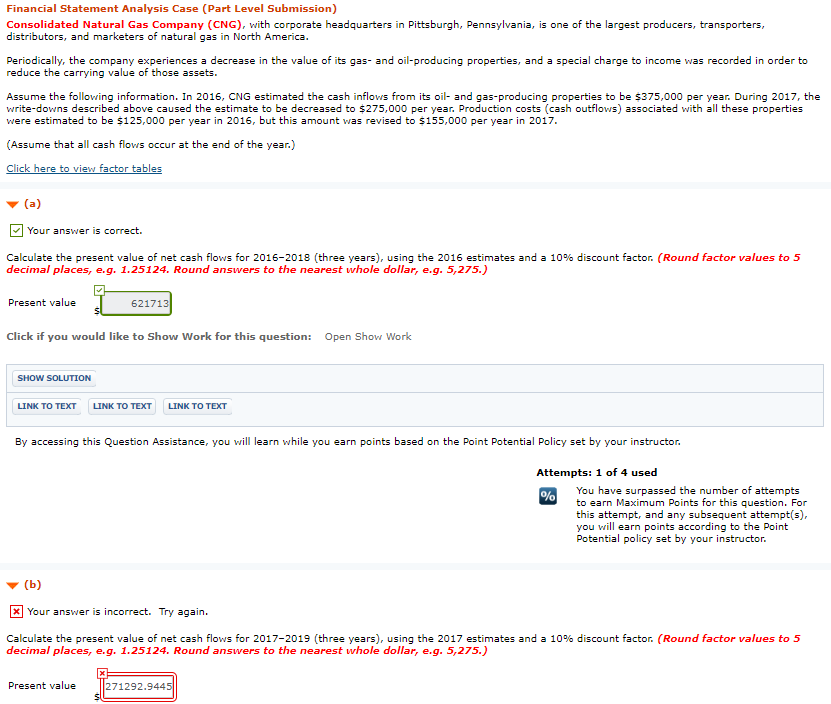

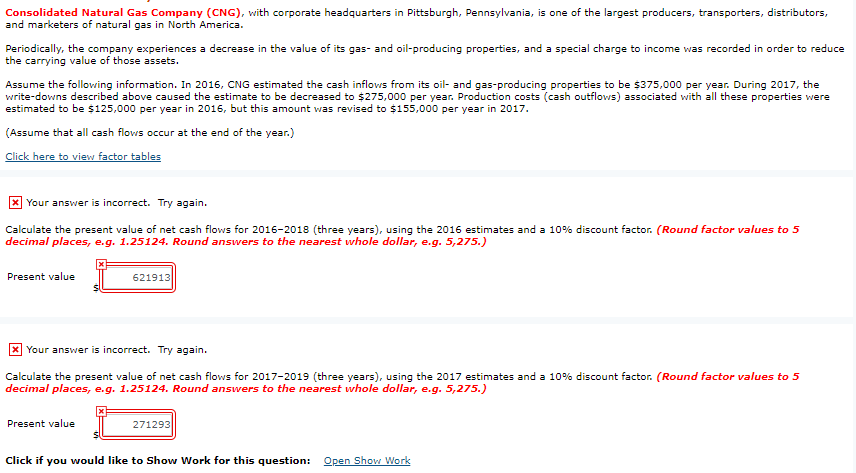

Financial Statement Analysis Case (Part Level Submission) Consolidated Natural Gas Company (CNG), with corporate headquarters in Pittsburgh, Pennsylvania, is one of the largest producers, transporters distributors, and marketers of natural gas in North America Periodically, the company experiences a decrease in the value of its gas- and oil-producing properties, and a special charge to income was recorded in order to reduce the carrying value of those as Assume the follovwing information. In 2016, CNG estimated the cash inflows from its oil- and gas-producing properties to be $375,000 per year. During 2017, the write-downs described above caused the estimate to be decreased to $275,000 per year. Production costs (cash outflows) associated with all these properties were estimated to be $125,000 per year in 2016, but this amount was revised to $155,000 per year in 2017 (Assume that all cash flowws occur at the end of the year.) Your answer is correct. Calculate the present value of net cash flows for 2016-2018 (three years), using the 2016 estimates and a 10% discount factor. (Round factor values to 5 decimal places, e.g. 1.25124. Round answers to the nearest whole dollar, e.g. 5,275.) Present value 621713 Click if you would like to Show Work for this question: Open Show Work SHOW SOLUTION LINK TO TEXT LINK TO TEXT LINK TO TEXT By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor Attempts: 1 of 4 used You have surpassed the number of attempts to earn Maximum Points for this question. For this attempt, and any subsequent attempt(s), you ill earn points according to the Point Potential policy set by your instructor. Your answer is incorrect. Try again. Calculate the present value of net cash flows for 2017-2019 (three years), using the 2017 estimates and a 10% discount factor. (Round factor values to 5 decimal places, e.g. 1.25124. Round answers to the nearest whole dollar, e.g. 5,275.) Present value 271292.944 Consolidated Natural Gas Company (CNG), with corporate headquarters in Pittsburgh, Pennsylvania, is one of the largest producers, transporters, distributors, and marketers of natural gas in North America Periodically, the company experiences a decrease in the value of its gas- and oil-producing properties, and a special charge to income was recorded in order to reduce th e carrying value of those assets. Assume the following information. In 2016, CNG estimated the cash inflows from its oil- and gas-producing properties to be $375,000 per year. During 2017, the write-downs described above caused the estimate to be decreased to $275,000 per year. Production costs (cash outflows) associated with all these properties were estimated to be $125,000 per year in 2016, but this amount was revised to $155,000 per year in 2017 (Assume that all cash flowws occur at the end of the year.) factor tables Your answer is incorret. Try again. Calculate the present value of net cash flows for 2016-2018 (three years), using the 2016 estimates and a 10% discount factor (Round factor values to 5 decimal places, e.g. 1.25124. Round answers to the nearest whole dollar, e.g. 5,275.) Present value 621913 Your answer is incorret. Try again. Calculate the present value of net cash flows for 2017-2019 (three years), using the 2017 estimates and a 10% discount factor. (Round factor values to 5 decimal places, e.g. 1.25124. Round answers to the nearest whole dollar, e.g. 5,275.) Present value 271293 Click if you would like to Show Work for this question: Open Show Work