Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Statement Analysis Compute the following financial ratios for Pepsico. Read these instructions! Show your calculations on a separate sheet of paper and turn in

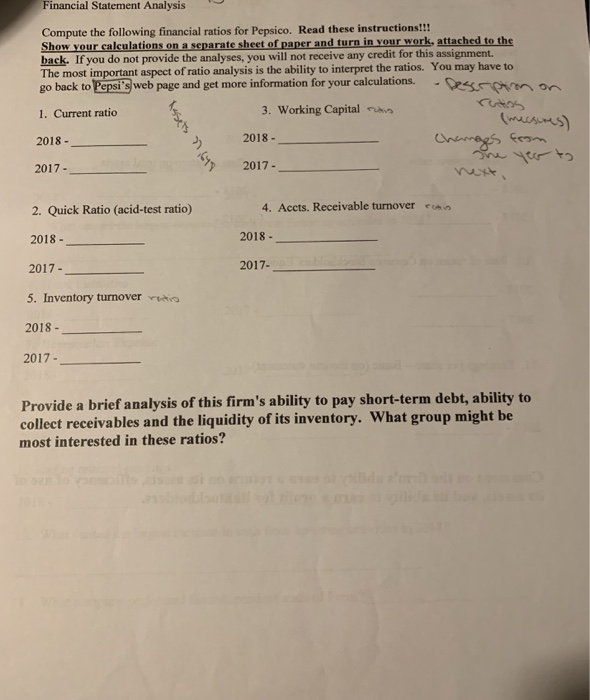

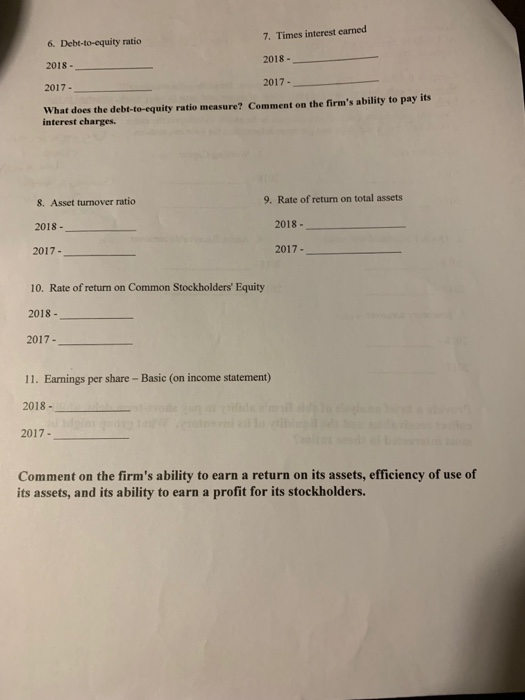

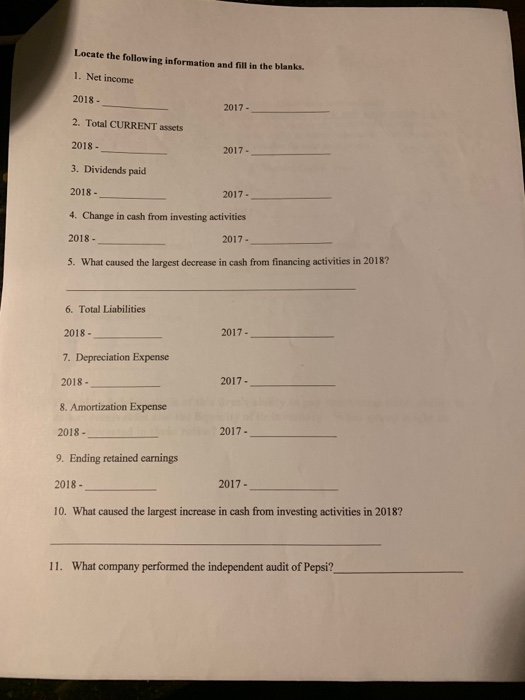

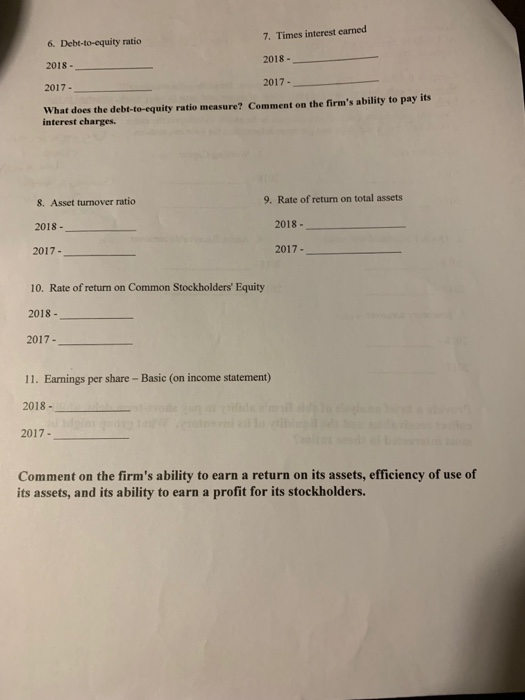

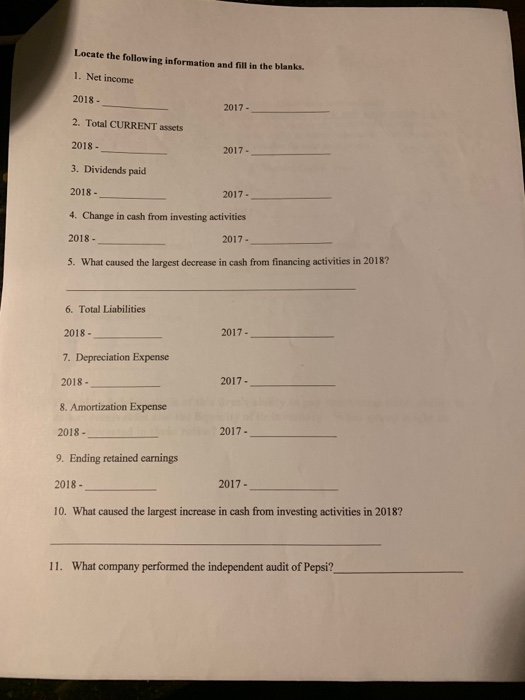

Financial Statement Analysis Compute the following financial ratios for Pepsico. Read these instructions! Show your calculations on a separate sheet of paper and turn in your work, attached to the back. If you do not provide the analyses, you will not receive any credit for this assignment. The most important aspect of ratio analysis is the ability to interpret the ratios. You may have to go back to Pepsi's web page and get more information for your calculations.on 3. Working Capital 2018 - 2017- 1. Current ratio 2018- 2017- 4. Accts. Receivable turnover 2018 2017 2. Quick Ratio (acid-test ratio) 2018 2017- 5. Inventory turnover 2018- 2017- Provide a brief analysis of this firm's ability to pay short-term debt, ability to collect receivables and the liquidity of its inventory. What group might be most interested in these ratios? 7. Times interest earned 2018- 2017 6. Debt-to-equity ratio 2018 2017- What does the debt-to-equity ratio measure? Comment on the firm's ability to pay its interest charges. 8. Asset turnover ratio 2018- 2017- 9. Rate of return on total assets 2018 2017- 10. Rate of return on Common Stockholders' Equity 2018 2017 11. Earnings per share -Basic (on income statement) 2018 2017- Comment on the firm's ability to earn a return on its assets, efficiency of use of its assets, and its ability to earn a profit for its stockholders. Locate the following information and fill n the blanks. 1. Net income 2018- 2. Total CURRENT assets 2018- 3. Dividends paid 2018- 4. Change in cash from investing activities 2018- 5. What caused the largest decrease in cash from financing activities in 2018? 2017- 2017- 2017 2017- 6. Total Liabilities 2018- 7. Depreciation Expense 2018 8. Amortization Expense 2017- 2017- 2017- 2018- 9. Ending retained earnings 2018- 2017 10. What caused the largest increase in cash from investing activities in 2018? What company performed the independent audit of Pepsi? 11

Financial Statement Analysis Compute the following financial ratios for Pepsico. Read these instructions! Show your calculations on a separate sheet of paper and turn in your work, attached to the back. If you do not provide the analyses, you will not receive any credit for this assignment. The most important aspect of ratio analysis is the ability to interpret the ratios. You may have to go back to Pepsi's web page and get more information for your calculations.on 3. Working Capital 2018 - 2017- 1. Current ratio 2018- 2017- 4. Accts. Receivable turnover 2018 2017 2. Quick Ratio (acid-test ratio) 2018 2017- 5. Inventory turnover 2018- 2017- Provide a brief analysis of this firm's ability to pay short-term debt, ability to collect receivables and the liquidity of its inventory. What group might be most interested in these ratios? 7. Times interest earned 2018- 2017 6. Debt-to-equity ratio 2018 2017- What does the debt-to-equity ratio measure? Comment on the firm's ability to pay its interest charges. 8. Asset turnover ratio 2018- 2017- 9. Rate of return on total assets 2018 2017- 10. Rate of return on Common Stockholders' Equity 2018 2017 11. Earnings per share -Basic (on income statement) 2018 2017- Comment on the firm's ability to earn a return on its assets, efficiency of use of its assets, and its ability to earn a profit for its stockholders. Locate the following information and fill n the blanks. 1. Net income 2018- 2. Total CURRENT assets 2018- 3. Dividends paid 2018- 4. Change in cash from investing activities 2018- 5. What caused the largest decrease in cash from financing activities in 2018? 2017- 2017- 2017 2017- 6. Total Liabilities 2018- 7. Depreciation Expense 2018 8. Amortization Expense 2017- 2017- 2017- 2018- 9. Ending retained earnings 2018- 2017 10. What caused the largest increase in cash from investing activities in 2018? What company performed the independent audit of Pepsi? 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started