Question

FINANCIAL STATEMENT ANALYSIS INDIVIDUAL ASSIGNMENT ACCT111 Fall 2020 CURRENT SITUATION In 2008, Mary Pendergast-Singh and her brother George Pendergast had recently inherited 51% and 49%

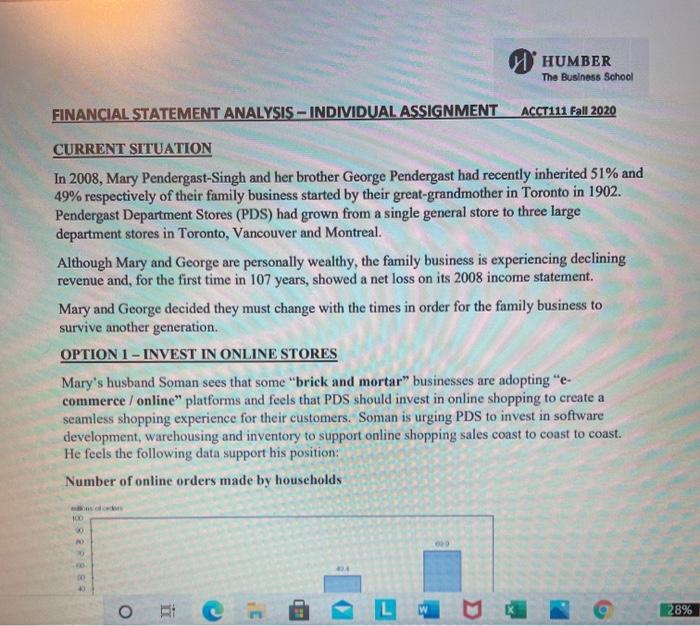

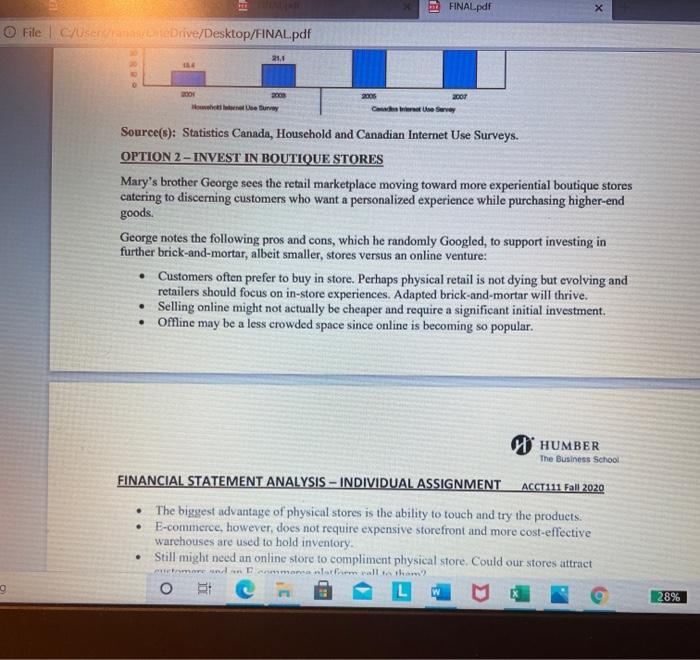

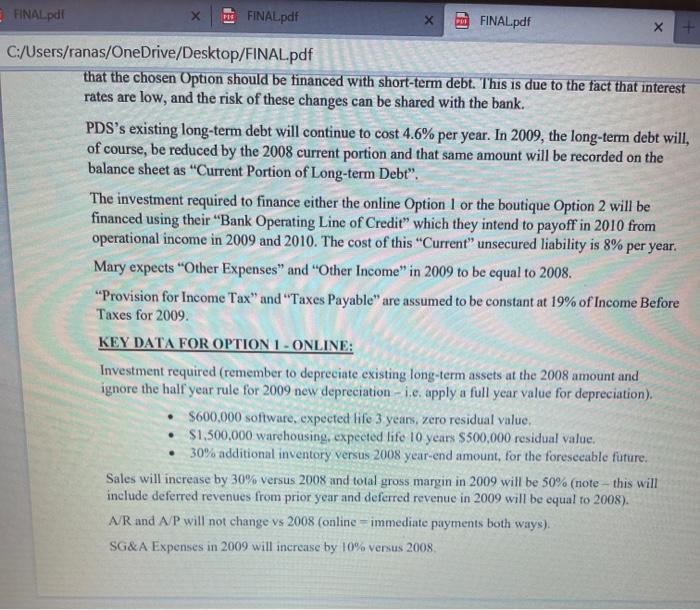

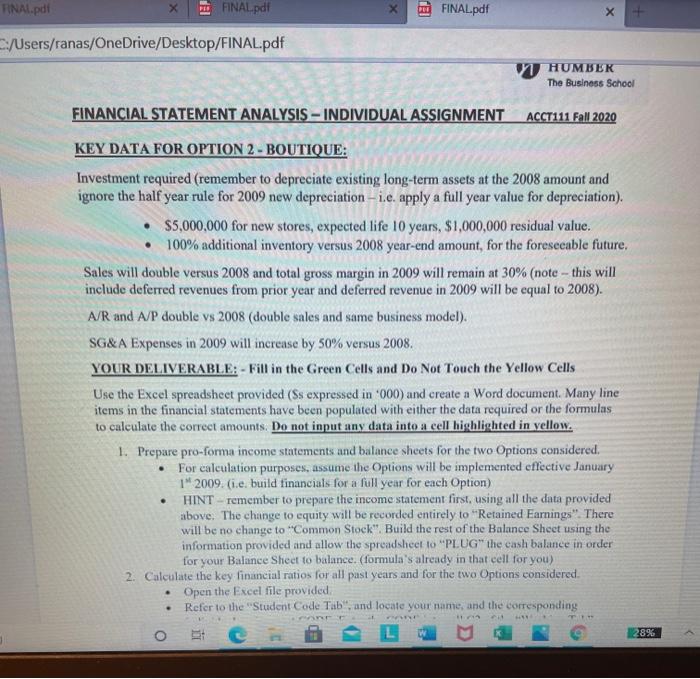

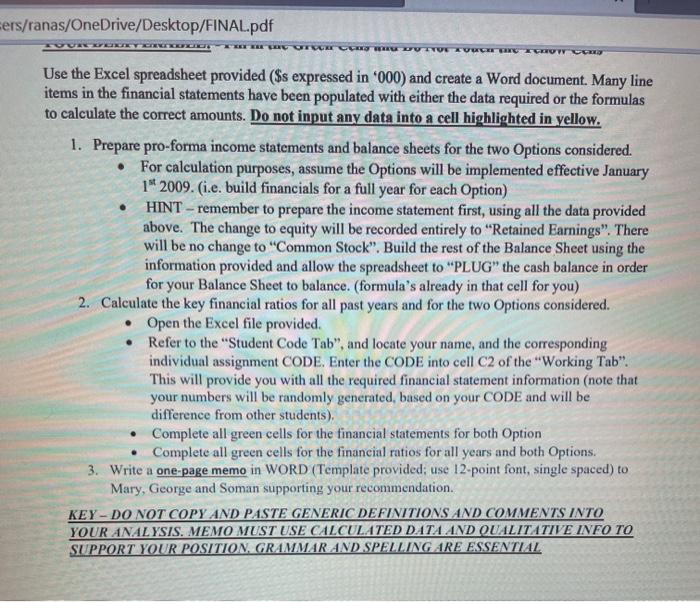

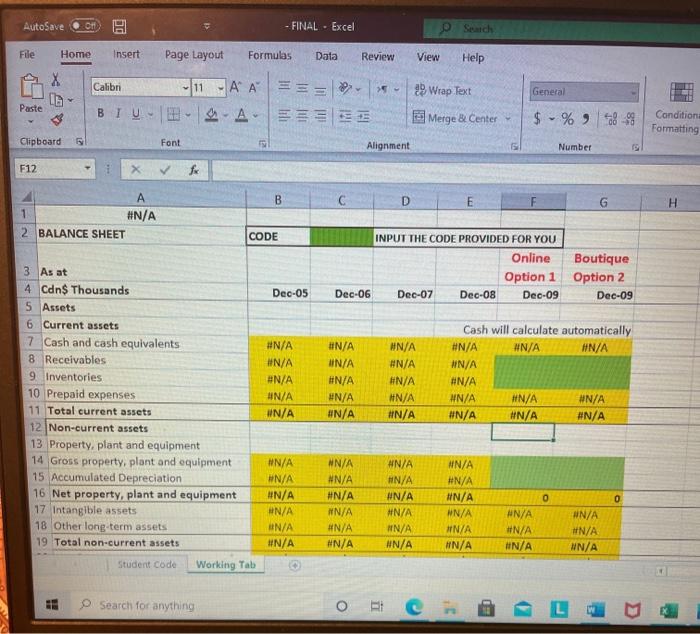

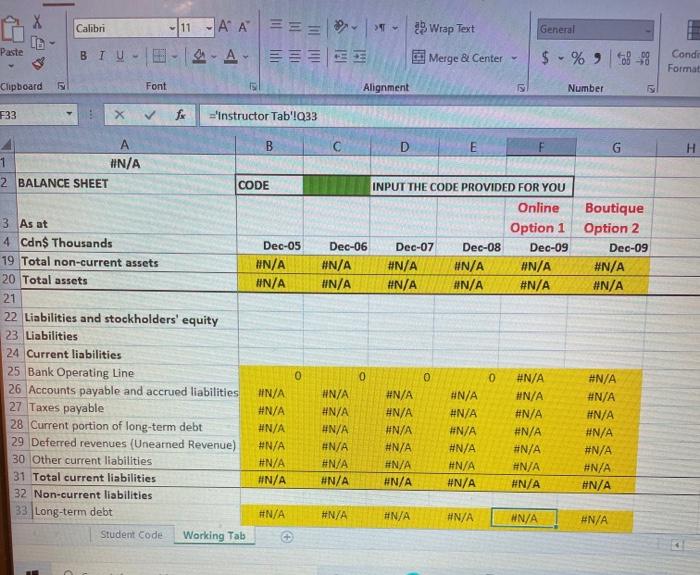

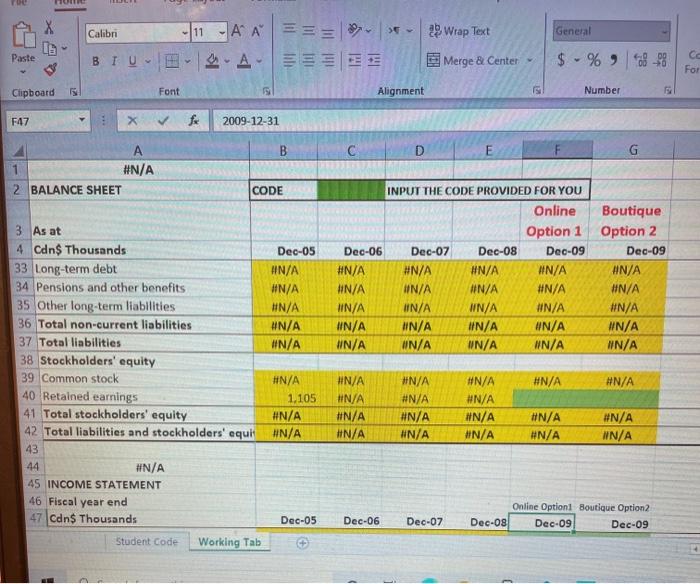

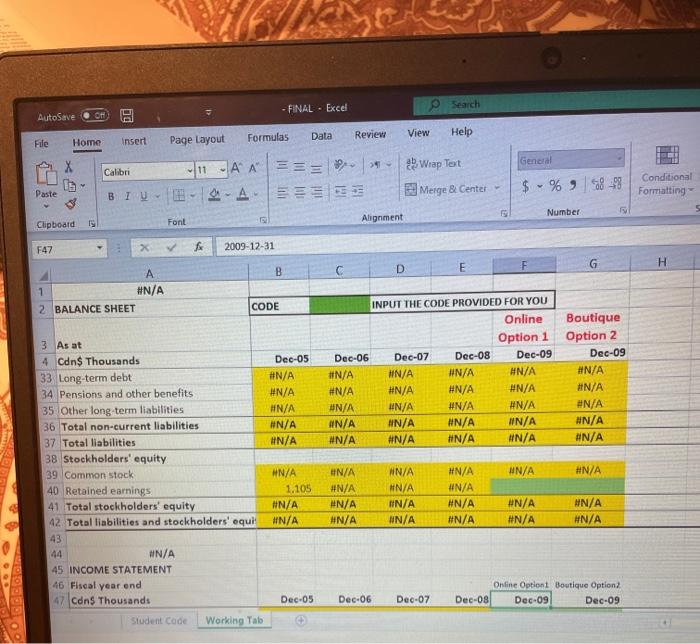

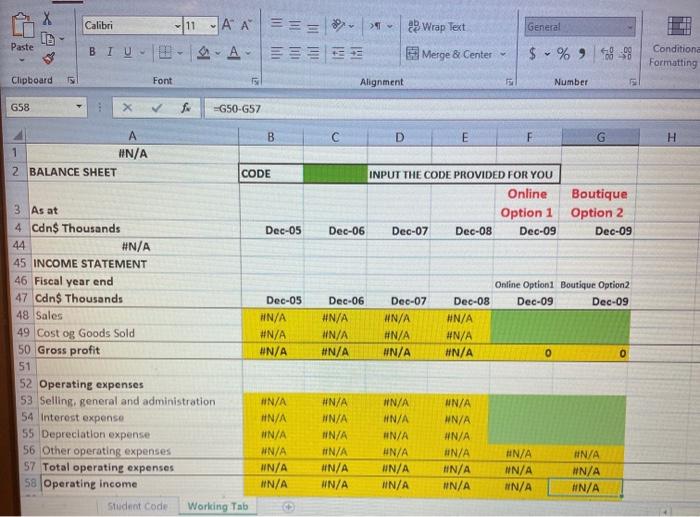

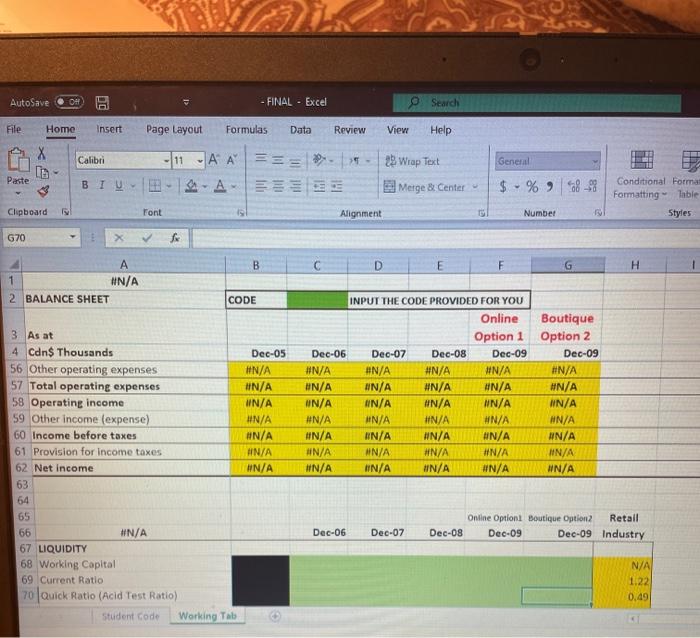

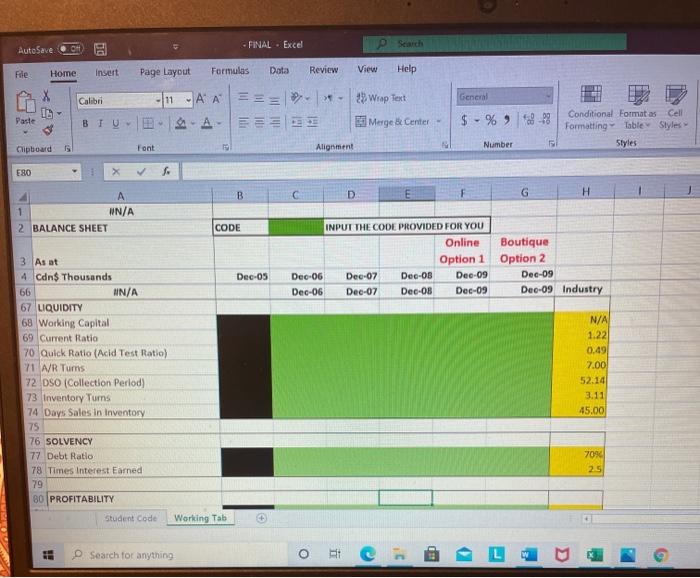

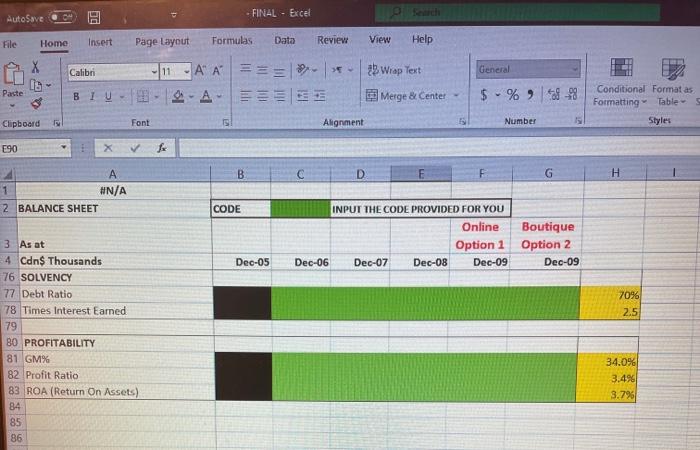

FINANCIAL STATEMENT ANALYSIS INDIVIDUAL ASSIGNMENT ACCT111 Fall 2020 CURRENT SITUATION In 2008, Mary Pendergast-Singh and her brother George Pendergast had recently inherited 51% and 49% respectively of their family business started by their great-grandmother in Toronto in 1902. Pendergast Department Stores (PDS) had grown from a single general store to three large department stores in Toronto, Vancouver and Montreal. Although Mary and George are personally wealthy, the family business is experiencing declining revenue and, for the first time in 107 years, showed a net loss on its 2008 income statement. Mary and George decided they must change with the times in order for the family business to survive another generation. OPTION 1 INVEST IN ONLINE STORES Marys husband Soman sees that some brick and mortar businesses are adopting ecommerce / online platforms and feels that PDS should invest in online shopping to create a seamless shopping experience for their customers. Soman is urging PDS to invest in software development, warehousing and inventory to support online shopping sales coast to coast to coast. He feels the following data support his position: Number of online orders made by households Source(s): Statistics Canada, Household and Canadian Internet Use Surveys. OPTION 2 INVEST IN BOUTIQUE STORES Marys brother George sees the retail marketplace moving toward more experiential boutique stores catering to discerning customers who want a personalized experience while purchasing higher-end goods. George notes the following pros and cons, which he randomly Googled, to support investing in further brick-and-mortar, albeit smaller, stores versus an online venture: Customers often prefer to buy in store. Perhaps physical retail is not dying but evolving and retailers should focus on in-store experiences. Adapted brick-and-mortar will thrive. Selling online might not actually be cheaper and require a significant initial investment. Offline may be a less crowded space since online is becoming so popular. FINANCIAL STATEMENT ANALYSIS INDIVIDUAL ASSIGNMENT ACCT111 Fall 2020 The biggest advantage of physical stores is the ability to touch and try the products. E-commerce, however, does not require expensive storefront and more cost-effective warehouses are used to hold inventory. Still might need an online store to compliment physical store. Could our stores attract customers and an E-commerce platform sell to them? George is urging Mary to create specialty stores within their three large urban stores and build smaller stores in mid-tier smaller towns across Canada. THE DECISION As discussed earlier, Mary and George had decided that they must change with the times in order for the family business to survive in the short-term and thrive into the future. Doing nothing is not an Option. Mary, the majority shareholder, must decide if Option 1 or Option 2 is the best path forward, considering both quantitative and qualitative criteria. KEY DATA FOR BOTH OPTIONS Although they can personally afford to invest the needed cash, Mary, Soman and George all agree that the chosen Option should be financed with short-term debt. This is due to the fact that interest rates are low, and the risk of these changes can be shared with the bank. PDSs existing long-term debt will continue to cost 4.6% per year. In 2009, the long-term debt will, of course, be reduced by the 2008 current portion and that same amount will be recorded on the balance sheet as Current Portion of Long-term Debt. The investment required to finance either the online Option 1 or the boutique Option 2 will be financed using their Bank Operating Line of Credit which they intend to payoff in 2010 from operational income in 2009 and 2010. The cost of this Current unsecured liability is 8% per year. Mary expects Other Expenses and Other Income in 2009 to be equal to 2008. Provision for Income Tax and Taxes Payable are assumed to be constant at 19% of Income Before Taxes for 2009. KEY DATA FOR OPTION 1 - ONLINE: Investment required (remember to depreciate existing long-term assets at the 2008 amount and ignore the half year rule for 2009 new depreciation i.e. apply a full year value for depreciation). $600,000 software, expected life 3 years, zero residual value. $1,500,000 warehousing, expected life 10 years $500,000 residual value. 30% additional inventory versus 2008 year-end amount, for the foreseeable future. Sales will increase by 30% versus 2008 and total gross margin in 2009 will be 50% (note this will include deferred revenues from prior year and deferred revenue in 2009 will be equal to 2008). A/R and A/P will not change vs 2008 (online = immediate payments both ways). SG&A Expenses in 2009 will increase by 10% versus 2008. FINANCIAL STATEMENT ANALYSIS INDIVIDUAL ASSIGNMENT ACCT111 Fall 2020 KEY DATA FOR OPTION 2 - BOUTIQUE: Investment required (remember to depreciate existing long-term assets at the 2008 amount and ignore the half year rule for 2009 new depreciation i.e. apply a full year value for depreciation). $5,000,000 for new stores, expected life 10 years, $1,000,000 residual value. 100% additional inventory versus 2008 year-end amount, for the foreseeable future. Sales will double versus 2008 and total gross margin in 2009 will remain at 30% (note this will include deferred revenues from prior year and deferred revenue in 2009 will be equal to 2008). A/R and A/P double vs 2008 (double sales and same business model). SG&A Expenses in 2009 will increase by 50% versus 2008. YOUR DELIVERABLE: - Fill in the Green Cells and Do Not Touch the Yellow Cells Use the Excel spreadsheet provided ($s expressed in 000) and create a Word document. Many line items in the financial statements have been populated with either the data required or the formulas to calculate the correct amounts. Do not input any data into a cell highlighted in yellow. 1. Prepare pro-forma income statements and balance sheets for the two Options considered. For calculation purposes, assume the Options will be implemented effective January 1 st 2009. (i.e. build financials for a full year for each Option) HINT remember to prepare the income statement first, using all the data provided above. The change to equity will be recorded entirely to Retained Earnings. There will be no change to Common Stock. Build the rest of the Balance Sheet using the information provided and allow the spreadsheet to PLUG the cash balance in order for your Balance Sheet to balance. (formulas already in that cell for you) 2. Calculate the key financial ratios for all past years and for the two Options considered. Open the Excel file provided. Refer to the Student Code Tab, and locate your name, and the corresponding individual assignment CODE. Enter the CODE into cell C2 of the Working Tab. This will provide you with all the required financial statement information (note that your numbers will be randomly generated, based on your CODE and will be difference from other students). Complete all green cells for the financial statements for both Option Complete all green cells for the financial ratios for all years and both Options. 3. Write a one-page memo in WORD (Template provided; use 12-point font, single spaced) to Mary, George and Soman supporting your recommendation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started