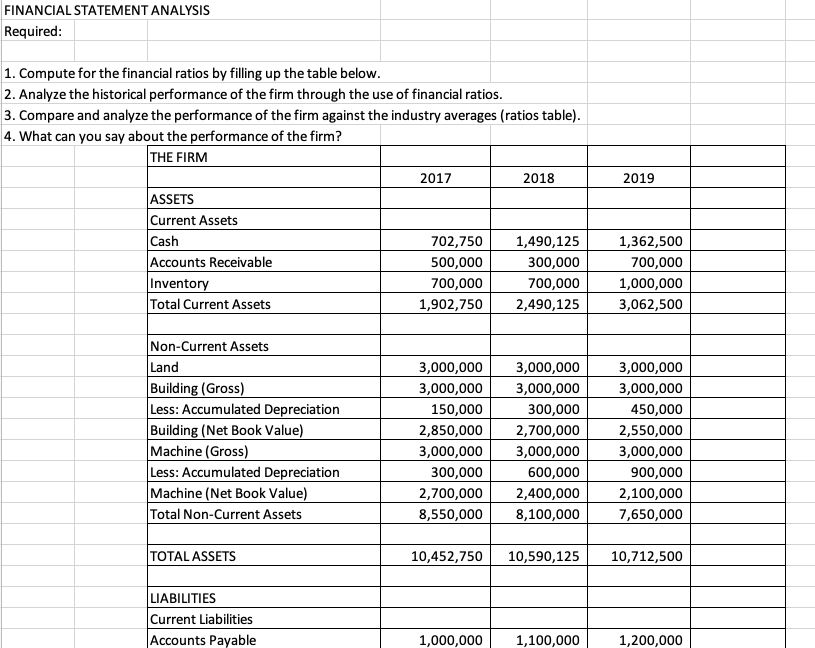

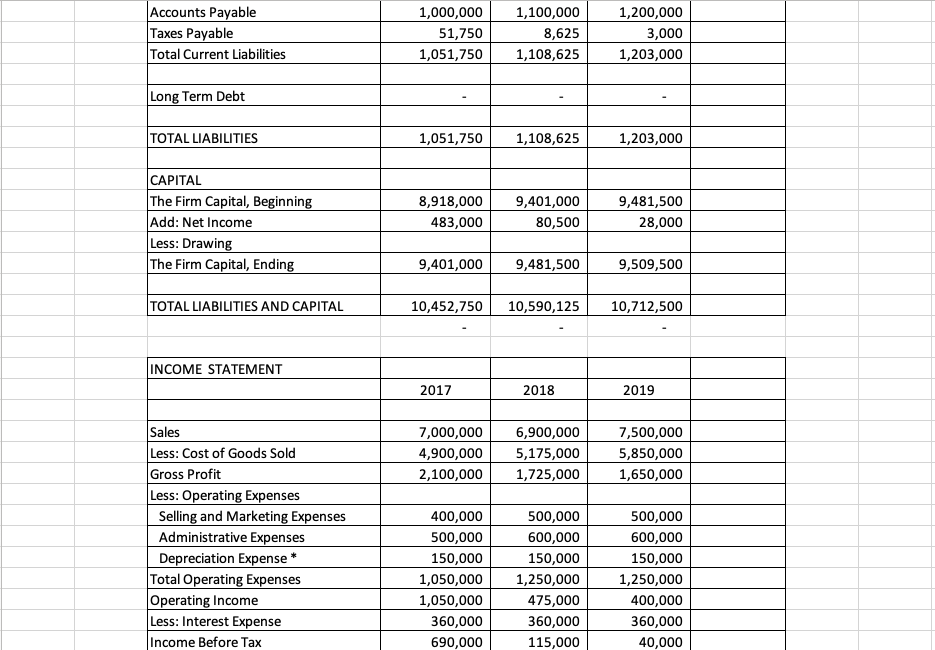

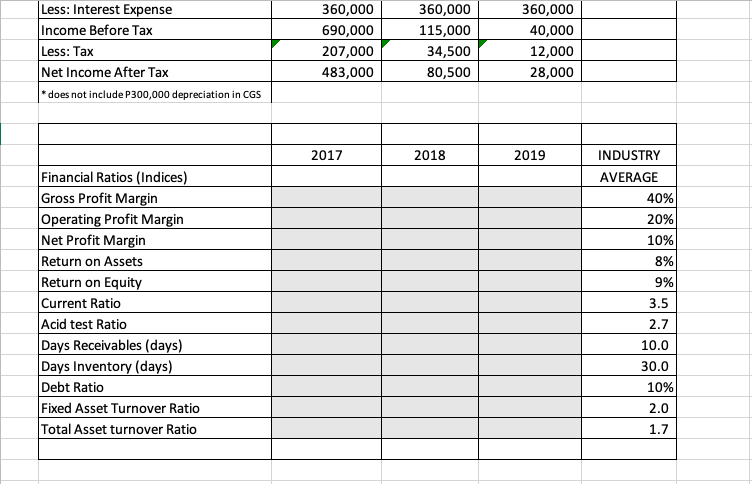

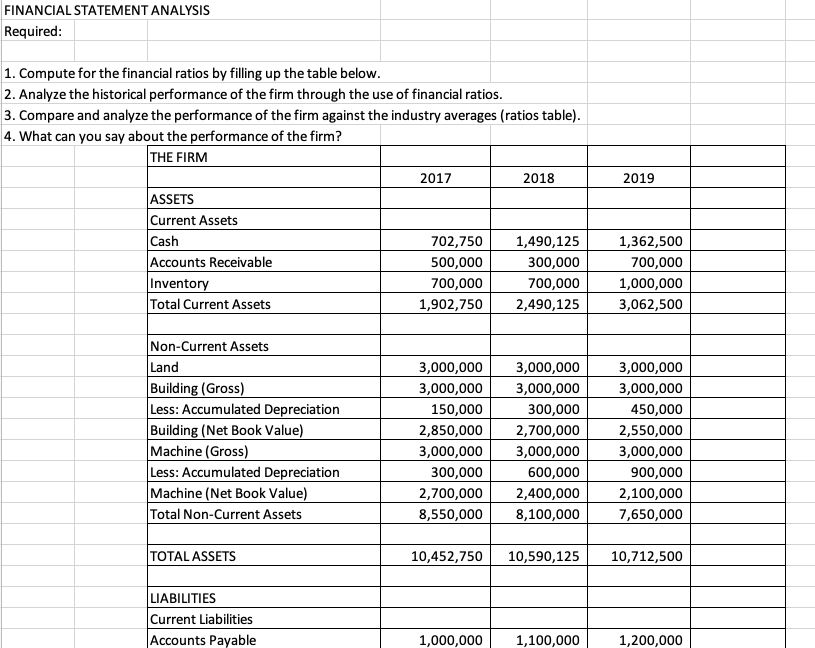

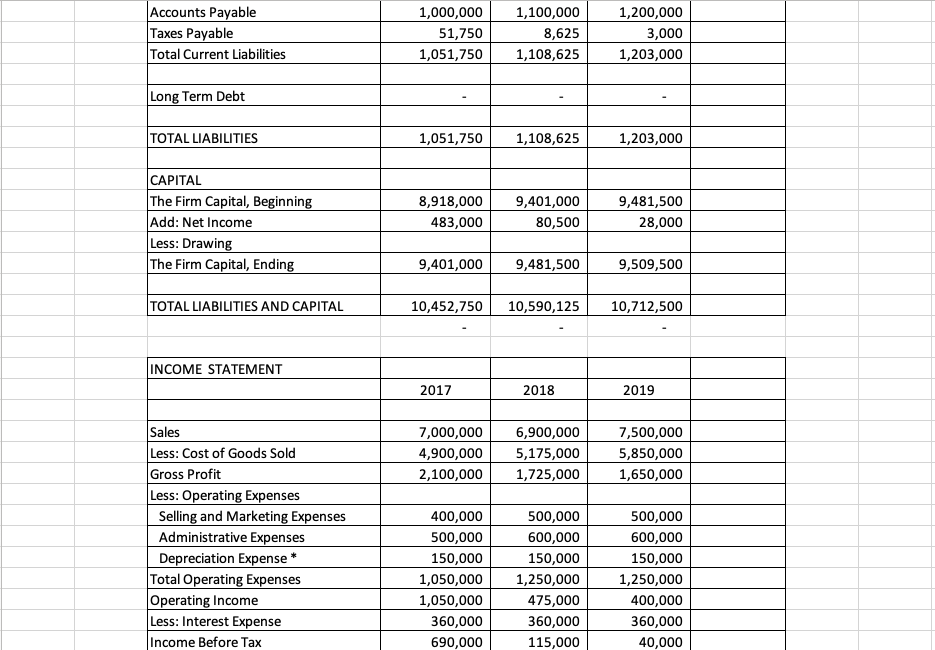

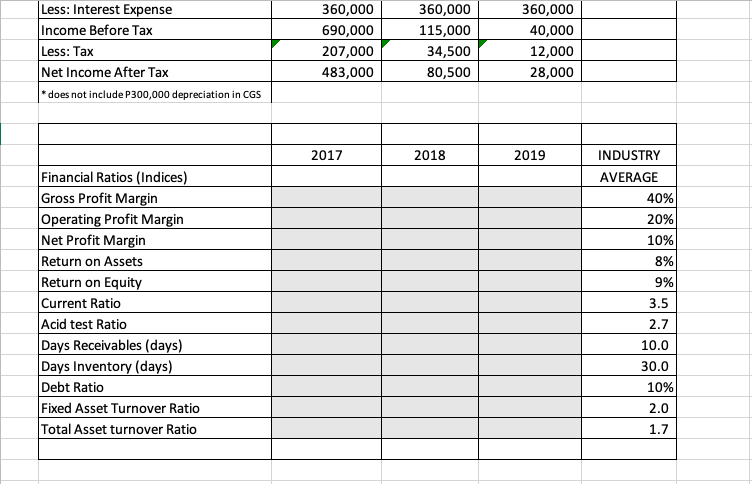

FINANCIAL STATEMENT ANALYSIS Required: 2019 1. Compute for the financial ratios by filling up the table below. 2. Analyze the historical performance of the firm through the use of financial ratios. 3. Compare and analyze the performance of the firm against the industry averages (ratios table). 4. What can you say about the performance of the firm? THE FIRM 2017 2018 ASSETS Current Assets Cash 702,750 1,490,125 Accounts Receivable 500,000 300,000 Inventory 700,000 700,000 Total Current Assets 1,902,750 2,490,125 1,362,500 700,000 1,000,000 3,062,500 Non-Current Assets Land Building (Gross) Less: Accumulated Depreciation Building (Net Book Value) Machine (Gross) Less: Accumulated Depreciation Machine (Net Book Value) Total Non-Current Assets 3,000,000 3,000,000 150,000 2,850,000 3,000,000 300,000 2,700,000 8,550,000 3,000,000 3,000,000 300,000 2,700,000 3,000,000 600,000 2,400,000 8,100,000 3,000,000 3,000,000 450,000 2,550,000 3,000,000 900,000 2,100,000 7,650,000 TOTAL ASSETS 10,452,750 10,590,125 10,712,500 LIABILITIES Current Liabilities Accounts Payable 1,000,000 1,100,000 1,200,000 Accounts Payable Taxes Payable Total Current Liabilities 1,000,000 51,750 1,051,750 1,100,000 8,625 1,108,625 1,200,000 3,000 1,203,000 Long Term Debt TOTAL LIABILITIES 1,051,750 1,108,625 1,203,000 CAPITAL The Firm Capital, Beginning Add: Net Income Less: Drawing The Firm Capital, Ending 8,918,000 483,000 9,401,000 80,500 9,481,500 28,000 9,401,000 9,481,500 9,509,500 TOTAL LIABILITIES AND CAPITAL 10,452,750 10,590,125 10,712,500 INCOME STATEMENT 2017 2018 2019 7,000,000 4,900,000 2,100,000 6,900,000 5,175,000 1,725,000 7,500,000 5,850,000 1,650,000 Sales Less: Cost of Goods Sold Gross Profit Less: Operating Expenses Selling and Marketing Expenses Administrative Expenses Depreciation Expense * Total Operating Expenses Operating Income Less: Interest Expense Income Before Tax 400,000 500,000 150,000 1,050,000 1,050,000 360,000 690,000 500,000 600,000 150,000 1,250,000 475,000 360,000 115,000 500,000 600,000 150,000 1,250,000 400,000 360,000 40,000 Less: Interest Expense Income Before Tax Less: Tax Net Income After Tax * does not include P300,000 depreciation in CGS 360,000 690,000 207,000 483,000 360,000 115,000 34,500 80,500 360,000 40,000 12,000 28,000 2017 2018 2019 Financial Ratios (Indices) Gross Profit Margin Operating Profit Margin Net Profit Margin Return on Assets Return on Equity Current Ratio Acid test Ratio Days Receivables (days) Days Inventory (days) Debt Ratio Fixed Asset Turnover Ratio Total Asset turnover Ratio INDUSTRY AVERAGE 40% 20% 10% 8% 9% 3.5 2.7 10.0 30.0 10% 2.0 1.7