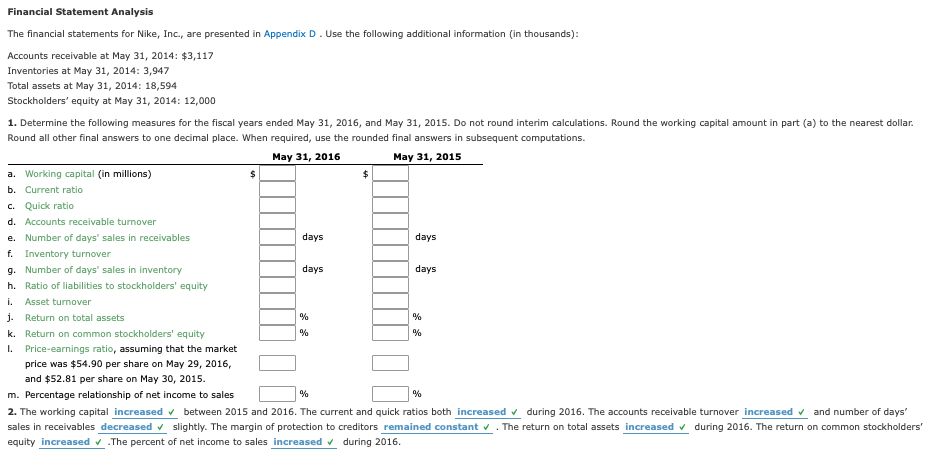

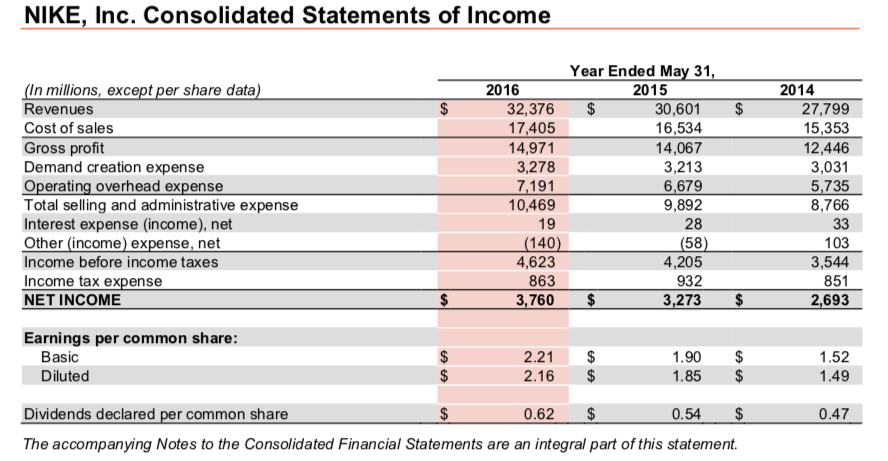

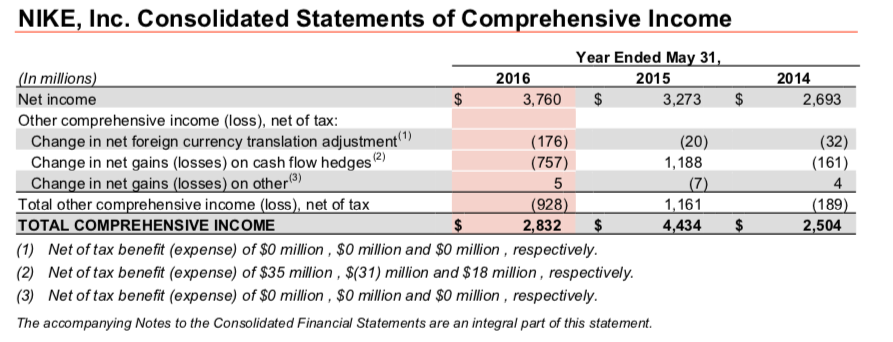

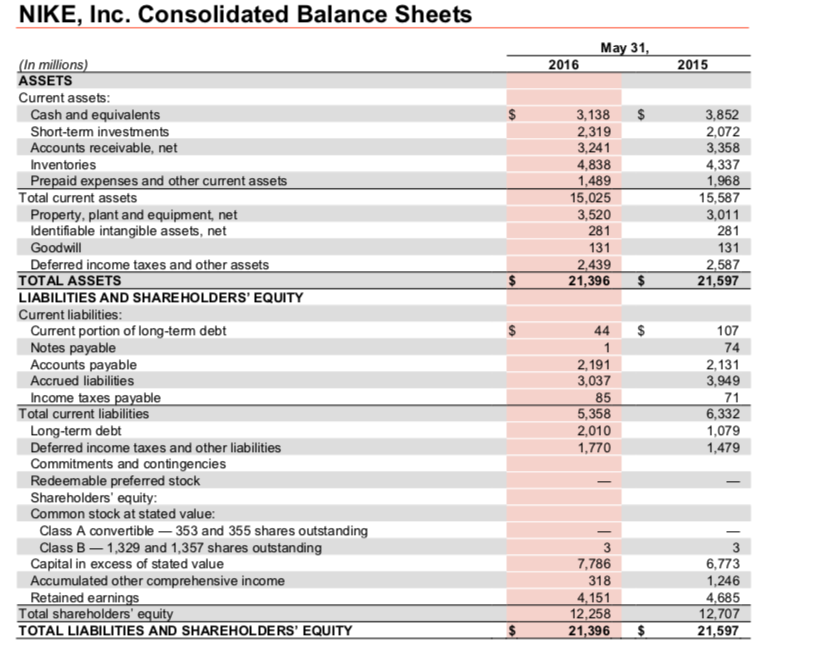

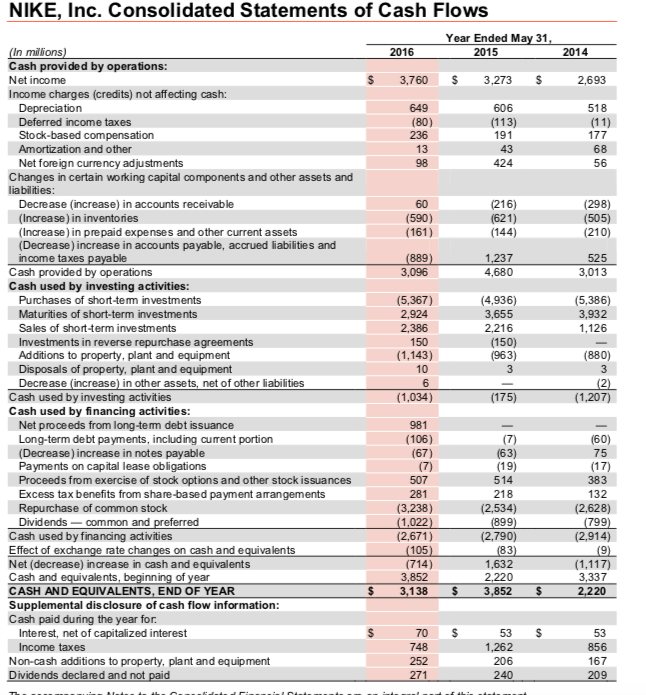

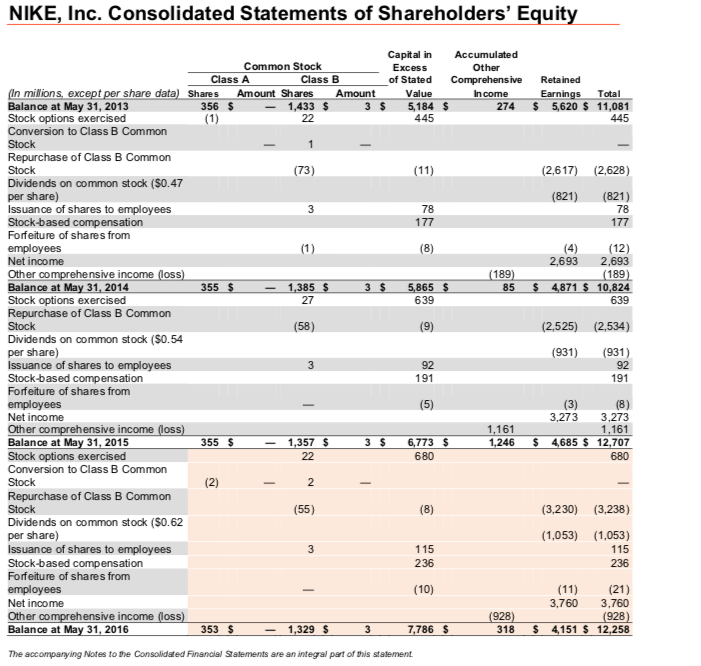

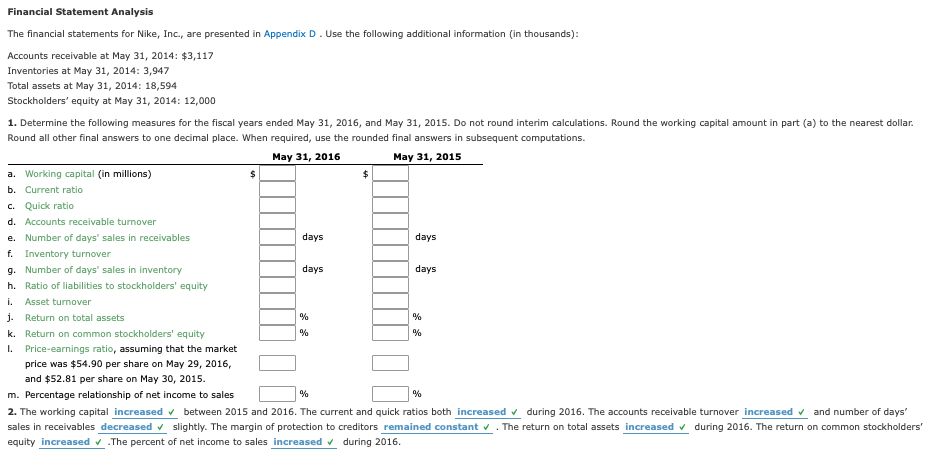

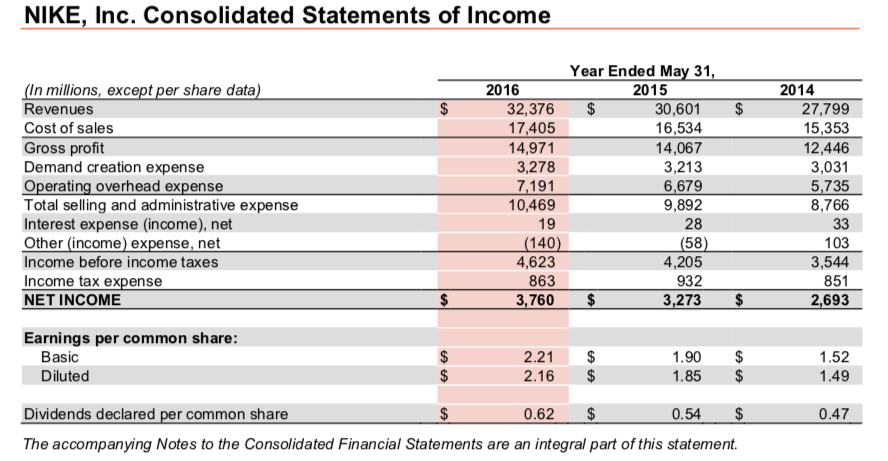

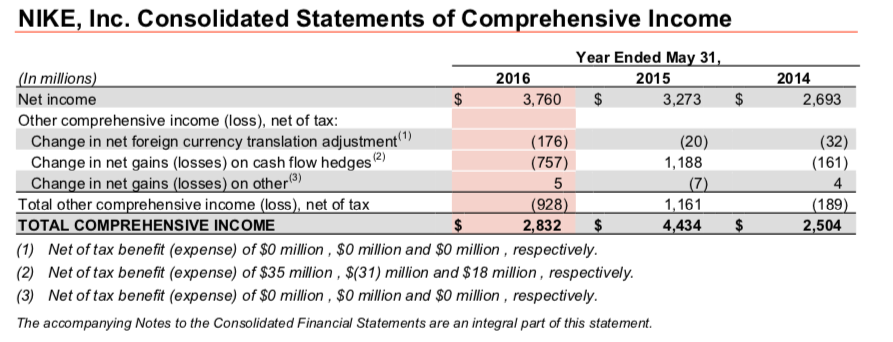

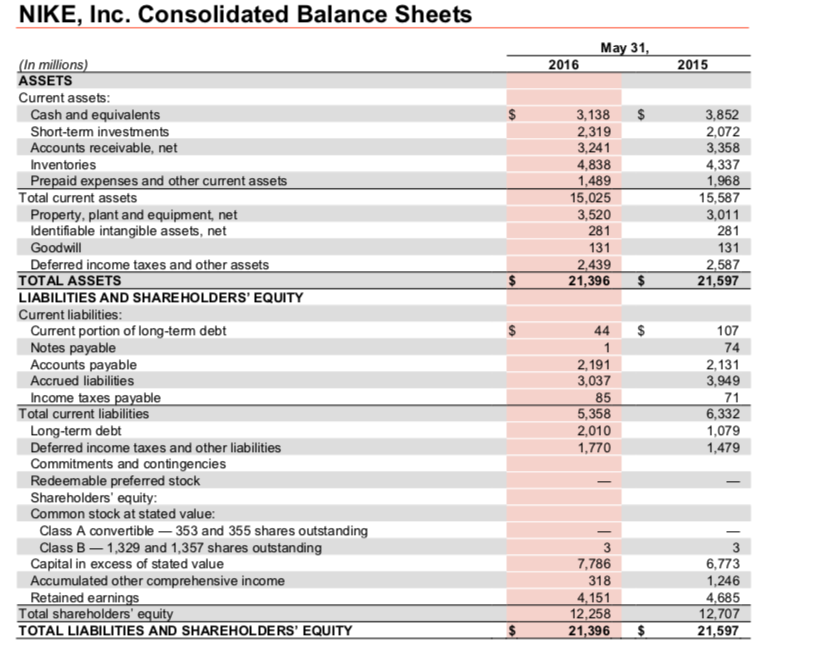

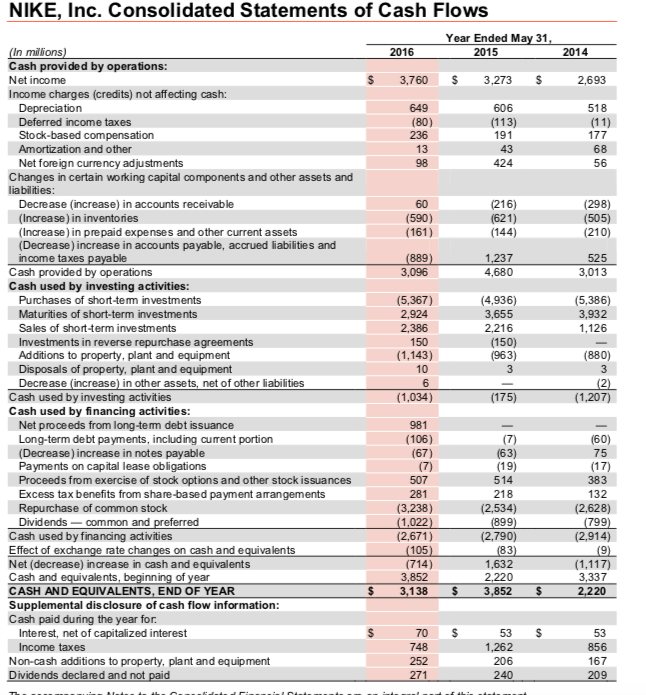

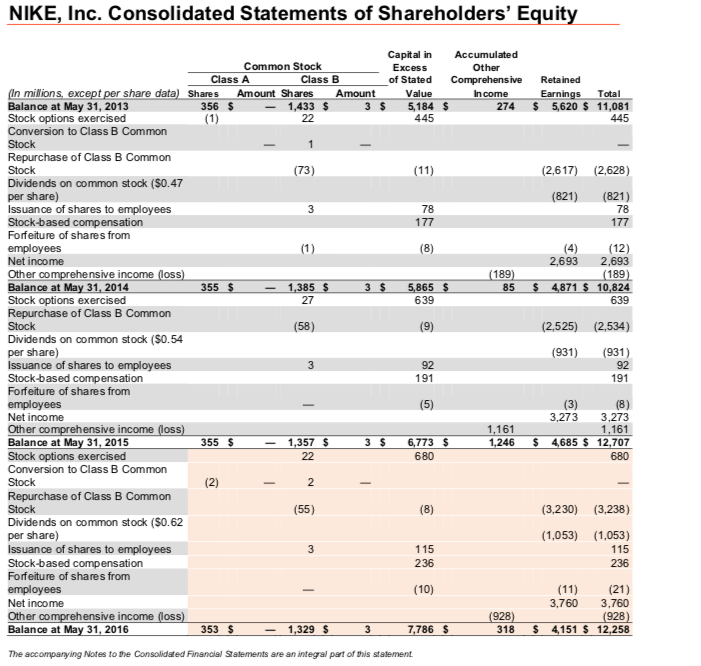

Financial Statement Analysis The financial statements for Nike, Inc., are presented in Appendix D . Use the following additional information (in thousands) Accounts receivable at May 31, 2014: $3,117 Inventories at May 31, 2014: 3,947 Total assets at May 31, 2014: 18,594 Stockholders' equity at May 31, 2014: 12,000 1. Determine the following measures for the fiscal years ended May 31, 2016, and May 31, 2015. Do not round interim calculations. Round the working capital amount in part (a) to the nearest dollan Round all other final answers to one decimal place. When required, use the rounded final answers in subsequent computations. May 31, 2016 May 31, 2015 a. Working capital (in millions) b. Current ratio c. Quick ratio d. Accounts receivable turnover e. Number of days sales in receivables f. Inventory turnover g. Number of days sales in inventory h. Ratio of liabilities to stockholders' equity i. Asset turnover days days days days Return on total assets Return on common stockholders' equity Price-earnings ratio, assuming that the market price was $54.90 per share on May 29, 2016 and $52.81 per share on May 30, 2015 k. I. m. Percentage relationship of net income to sales 2. The working capital increased between 2015 and 2016. The current and quick ratios both increased during 2016. The accounts receivable turnover increased and number of days' sales in receivables decreased slightly. The margin of protection to creditors remained constant .The return on total assets increased during 2016. The return on common stockholders equity increased .The percent of net income to sales increased during 2016 NIKE, Inc. Consolidated Statements of Income Year Ended May 31 In millions, except per share data Revenues Cost of sales Gross profit Demand creation expense Operating overhead expense Total selling and administrative expense Interest expense (income), net Other (income) expense, net Income before income taxes Income tax expense NET INCOME 2016 2015 2014 27,799 15,353 12,446 3,031 5.735 8,766 32,376 $ 30,601 $ 17,405 14,971 3,278 7191 10,469 19 140 4,623 863 3,760 16,534 14,067 3,213 6,679 9,892 28 58 4,205 932 3,273 103 3,544 851 2,693 Earnings per common share 2.21 $ 2.16 $ 1.90 $ Basic Diluted 1.52 1.49 1.85 $ 0.54 $ The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement. Dividends declared per common share 0.62 $ 0.47 NIKE, Inc. Consolidated Statements of Comprehensive Income Year Ended May 31 2016 2014 In millions Net income Other comprehensive income (loss), net of tax 2015 3,760 $ 3,273 $ 2,693 Change in net foreign currency translation adjustment (176) (757) 5 928 2,832 (32) (20) 1,188 (161) 4 189 2,504 Change in net gains (losses) on cash flow hedges Change in net gains (losses) on other3) Total other comprehensive income (loss), net of tax TOTAL COMPREHENSIVE INCOME (1) Net of tax benefit (expense) of $0 million, $0 million and $O million, respectively (2) Net of tax benefit (expense) of $35 million, $(31) million and $18 million, respectively (3) Net of tax benefit (expense) of $0 million, $0 million and $O million, respectively The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement 1,161 4,434 NIKE, Inc. Consolidated Balance Sheets May 31 2016 In millions ASSETS Current assets 2015 3,138 S Cash and equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets 2,319 3,241 4,838 1,489 15,025 3,520 281 131 2439 21,396 3,852 2,072 3,358 4,337 1,968 15,587 3,011 281 131 2,587 21,597 Total current assets Property, plant and equipment, net ldentifiable intangible assets, net Goodwill Deferred income taxes and other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities 44 S Current portion of long-term debt Notes payable Accounts payable Accrued liabilities Income taxes 107 74 2,131 3,949 71 6,332 ,079 1,479 2,191 3,037 85 5,358 ble Total current liabilities Long-term debt Deferred income taxes and other liabilities Commitments and contingencies Redeemable preferred stock Shareholders' equity Common stock at stated value: 1,770 Class A convertible-353 and 355 shares outstanding Class B 1,329 and 1,357 shares outstanding Capital in excess of stated value Accumulated other comprehensive income Retained earnin 7,786 6,773 Total shareholders TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 4,151 12,258 21,396 4,685 12,707 21,597 NIKE, Inc. Consolidated Statements of Cash Flows Year Ended May 31 2016 2015 2014 Cash provided by operations: Net income $ 3,760 S3,273 S 2,693 Income charges (credits) not affecting cash: 606 (80) 236 Deferred income taxes Stock-based compensation Amortization and other Net foreign currency adjustments 43 424 98 Changes in certain working capital components and other assets and lia bilities: Decrease (increase) in accounts receivable (Increase) in inventories (Increase) in prepaid expenses and other current assets (Decrease)increase in accounts payable, accrued liabilities and income taxes payable 60 (590) (298) (144) 889 3,096 Cash provided by operations Cash used by investing activities: 4,680 3,013 (5,367) 2,924 (5,386) 3,932 Purchases of short-term investments Maturities of short-term investments Sales of short-term inve stments Investments in reverse repurchase agreements Additions to property, plant and equipment Disposals of property, plant and equipment Decrease (increase) in other assets, net of other liabilities (4,936) 3,655 2,216 1,126 150 (963) (880) 6 (1,034) Cash used by investing activities Cash used by financing activities: (175) (1,207) Net proceeds from long-tem debt issuance Long-term debt payments, including current portion (Decrease) increase in notes payable Payments on capital lease obligations Proceeds from exercise of stock options and other stock issuances Excess tax benefits from share-based payment arangements Repurchase of common stock (106) (60) (63) 383 132 (2,628) 281 (3,238) 1,022 (2,671) (2,534) (2,790) 1,632 799 Cash used by financing activities (2,914) Net (decrease) increase in cash and equivalents Cash and equivalents, beginning of year CASH AND EQUIVALENTS, END OF YEAR Supplemental disclosure of cash flow information: Cash paid during the year for. 714) 3,852 2,220 3,337 $ 3,138 S 3,852 S Interest, net of capitalized interest Income taxes 53 Non-cash additions to property, plant and equipment Dividends declared and not paid 1,262 206 240 NIKE, Inc. Consolidated Statements of Shareholders' Equit Capital in of Stated Amount SharesAmountValue 445 Accumulated Other Comprehens ive Common Stock Excess Class A Class B In milions, except per share data) Shares Balance at May 31, 2013 Stock options exercised Conversion to Class B Common In come Earnings Total 356 S -1,433 $ 3 $ 5,184 $ 274 S 5,620 S 11,081 Repurchase of Class B Common (73) (2,617) (2,628) nds on common stock (S0.47 per share) Issuance of shares to employees Stock-based compensation Forfeiture of shares from employees Net income (821) (821) 78 (12) 2,693 2,693 (189) 824 ther comprehensive income (loss Stock options exercised Repurchase of Class B Common 27 639 (2,525) (2,534) Dividends on common stock ($0.54 per share) Issuance of shares to employees Stock-based compensation Forfeiture of shares from employees Net income Other co mprehensive income (loss Balance at May 31, 2015 Stock options exercised Conversion to Class B Common 92 191 (931) (931) 92 191 3,273 3,273 1,161 1,246 4,685 S 12,707 1,161 355 $ 1,357 $ 773 S 680 Repurchase of Class B Common (55) (3,230) (3,238) Dividends on common stock ($0.62 per share) Issuance of shares to employees Stock-based compensation Forfeiture of shares from employees Net income Other co Balance at May 31, 2016 (1,053) (1,053) 115 115 236 (10) 3,760 3,760 928 4,151 $ 12,258 ensive income loss 928 353 1,329 7,786 318 The accompanying Notes to the Consolidsted Financial Ststements are an integral part of this statement Financial Statement Analysis The financial statements for Nike, Inc., are presented in Appendix D . Use the following additional information (in thousands) Accounts receivable at May 31, 2014: $3,117 Inventories at May 31, 2014: 3,947 Total assets at May 31, 2014: 18,594 Stockholders' equity at May 31, 2014: 12,000 1. Determine the following measures for the fiscal years ended May 31, 2016, and May 31, 2015. Do not round interim calculations. Round the working capital amount in part (a) to the nearest dollan Round all other final answers to one decimal place. When required, use the rounded final answers in subsequent computations. May 31, 2016 May 31, 2015 a. Working capital (in millions) b. Current ratio c. Quick ratio d. Accounts receivable turnover e. Number of days sales in receivables f. Inventory turnover g. Number of days sales in inventory h. Ratio of liabilities to stockholders' equity i. Asset turnover days days days days Return on total assets Return on common stockholders' equity Price-earnings ratio, assuming that the market price was $54.90 per share on May 29, 2016 and $52.81 per share on May 30, 2015 k. I. m. Percentage relationship of net income to sales 2. The working capital increased between 2015 and 2016. The current and quick ratios both increased during 2016. The accounts receivable turnover increased and number of days' sales in receivables decreased slightly. The margin of protection to creditors remained constant .The return on total assets increased during 2016. The return on common stockholders equity increased .The percent of net income to sales increased during 2016 NIKE, Inc. Consolidated Statements of Income Year Ended May 31 In millions, except per share data Revenues Cost of sales Gross profit Demand creation expense Operating overhead expense Total selling and administrative expense Interest expense (income), net Other (income) expense, net Income before income taxes Income tax expense NET INCOME 2016 2015 2014 27,799 15,353 12,446 3,031 5.735 8,766 32,376 $ 30,601 $ 17,405 14,971 3,278 7191 10,469 19 140 4,623 863 3,760 16,534 14,067 3,213 6,679 9,892 28 58 4,205 932 3,273 103 3,544 851 2,693 Earnings per common share 2.21 $ 2.16 $ 1.90 $ Basic Diluted 1.52 1.49 1.85 $ 0.54 $ The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement. Dividends declared per common share 0.62 $ 0.47 NIKE, Inc. Consolidated Statements of Comprehensive Income Year Ended May 31 2016 2014 In millions Net income Other comprehensive income (loss), net of tax 2015 3,760 $ 3,273 $ 2,693 Change in net foreign currency translation adjustment (176) (757) 5 928 2,832 (32) (20) 1,188 (161) 4 189 2,504 Change in net gains (losses) on cash flow hedges Change in net gains (losses) on other3) Total other comprehensive income (loss), net of tax TOTAL COMPREHENSIVE INCOME (1) Net of tax benefit (expense) of $0 million, $0 million and $O million, respectively (2) Net of tax benefit (expense) of $35 million, $(31) million and $18 million, respectively (3) Net of tax benefit (expense) of $0 million, $0 million and $O million, respectively The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement 1,161 4,434 NIKE, Inc. Consolidated Balance Sheets May 31 2016 In millions ASSETS Current assets 2015 3,138 S Cash and equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets 2,319 3,241 4,838 1,489 15,025 3,520 281 131 2439 21,396 3,852 2,072 3,358 4,337 1,968 15,587 3,011 281 131 2,587 21,597 Total current assets Property, plant and equipment, net ldentifiable intangible assets, net Goodwill Deferred income taxes and other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities 44 S Current portion of long-term debt Notes payable Accounts payable Accrued liabilities Income taxes 107 74 2,131 3,949 71 6,332 ,079 1,479 2,191 3,037 85 5,358 ble Total current liabilities Long-term debt Deferred income taxes and other liabilities Commitments and contingencies Redeemable preferred stock Shareholders' equity Common stock at stated value: 1,770 Class A convertible-353 and 355 shares outstanding Class B 1,329 and 1,357 shares outstanding Capital in excess of stated value Accumulated other comprehensive income Retained earnin 7,786 6,773 Total shareholders TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 4,151 12,258 21,396 4,685 12,707 21,597 NIKE, Inc. Consolidated Statements of Cash Flows Year Ended May 31 2016 2015 2014 Cash provided by operations: Net income $ 3,760 S3,273 S 2,693 Income charges (credits) not affecting cash: 606 (80) 236 Deferred income taxes Stock-based compensation Amortization and other Net foreign currency adjustments 43 424 98 Changes in certain working capital components and other assets and lia bilities: Decrease (increase) in accounts receivable (Increase) in inventories (Increase) in prepaid expenses and other current assets (Decrease)increase in accounts payable, accrued liabilities and income taxes payable 60 (590) (298) (144) 889 3,096 Cash provided by operations Cash used by investing activities: 4,680 3,013 (5,367) 2,924 (5,386) 3,932 Purchases of short-term investments Maturities of short-term investments Sales of short-term inve stments Investments in reverse repurchase agreements Additions to property, plant and equipment Disposals of property, plant and equipment Decrease (increase) in other assets, net of other liabilities (4,936) 3,655 2,216 1,126 150 (963) (880) 6 (1,034) Cash used by investing activities Cash used by financing activities: (175) (1,207) Net proceeds from long-tem debt issuance Long-term debt payments, including current portion (Decrease) increase in notes payable Payments on capital lease obligations Proceeds from exercise of stock options and other stock issuances Excess tax benefits from share-based payment arangements Repurchase of common stock (106) (60) (63) 383 132 (2,628) 281 (3,238) 1,022 (2,671) (2,534) (2,790) 1,632 799 Cash used by financing activities (2,914) Net (decrease) increase in cash and equivalents Cash and equivalents, beginning of year CASH AND EQUIVALENTS, END OF YEAR Supplemental disclosure of cash flow information: Cash paid during the year for. 714) 3,852 2,220 3,337 $ 3,138 S 3,852 S Interest, net of capitalized interest Income taxes 53 Non-cash additions to property, plant and equipment Dividends declared and not paid 1,262 206 240 NIKE, Inc. Consolidated Statements of Shareholders' Equit Capital in of Stated Amount SharesAmountValue 445 Accumulated Other Comprehens ive Common Stock Excess Class A Class B In milions, except per share data) Shares Balance at May 31, 2013 Stock options exercised Conversion to Class B Common In come Earnings Total 356 S -1,433 $ 3 $ 5,184 $ 274 S 5,620 S 11,081 Repurchase of Class B Common (73) (2,617) (2,628) nds on common stock (S0.47 per share) Issuance of shares to employees Stock-based compensation Forfeiture of shares from employees Net income (821) (821) 78 (12) 2,693 2,693 (189) 824 ther comprehensive income (loss Stock options exercised Repurchase of Class B Common 27 639 (2,525) (2,534) Dividends on common stock ($0.54 per share) Issuance of shares to employees Stock-based compensation Forfeiture of shares from employees Net income Other co mprehensive income (loss Balance at May 31, 2015 Stock options exercised Conversion to Class B Common 92 191 (931) (931) 92 191 3,273 3,273 1,161 1,246 4,685 S 12,707 1,161 355 $ 1,357 $ 773 S 680 Repurchase of Class B Common (55) (3,230) (3,238) Dividends on common stock ($0.62 per share) Issuance of shares to employees Stock-based compensation Forfeiture of shares from employees Net income Other co Balance at May 31, 2016 (1,053) (1,053) 115 115 236 (10) 3,760 3,760 928 4,151 $ 12,258 ensive income loss 928 353 1,329 7,786 318 The accompanying Notes to the Consolidsted Financial Ststements are an integral part of this statement