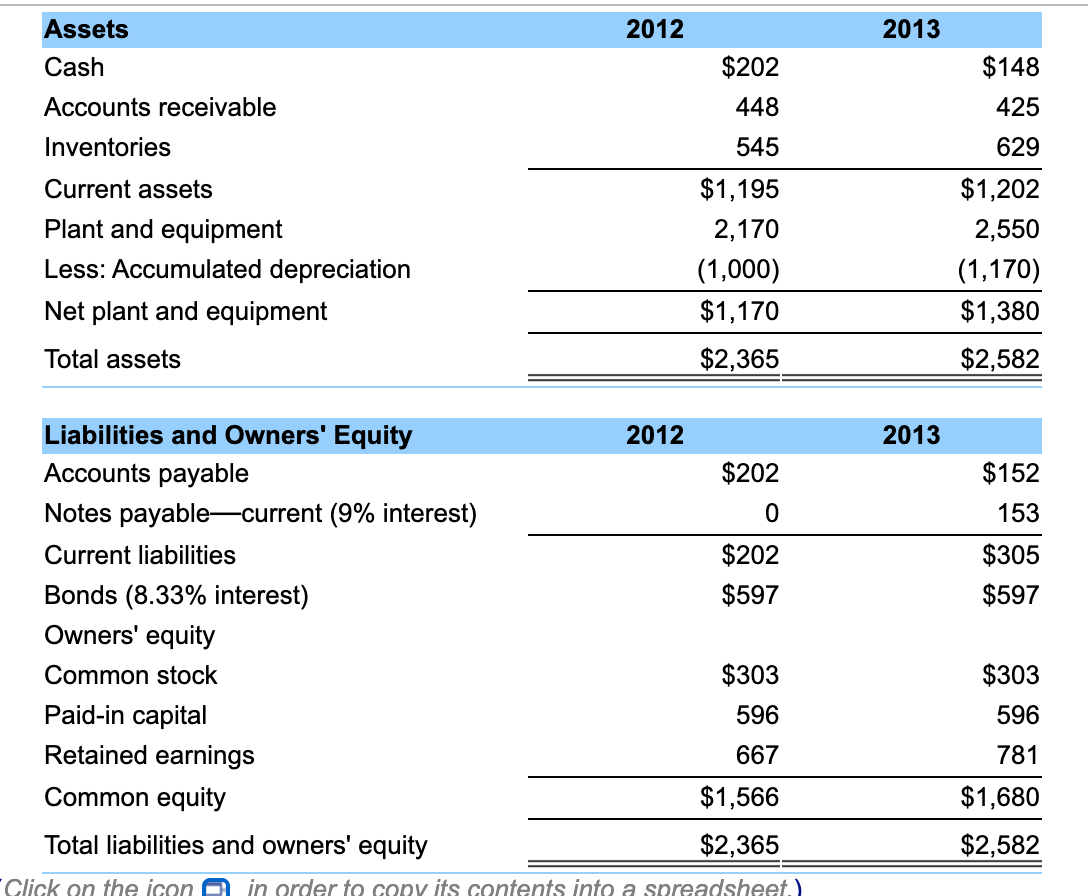

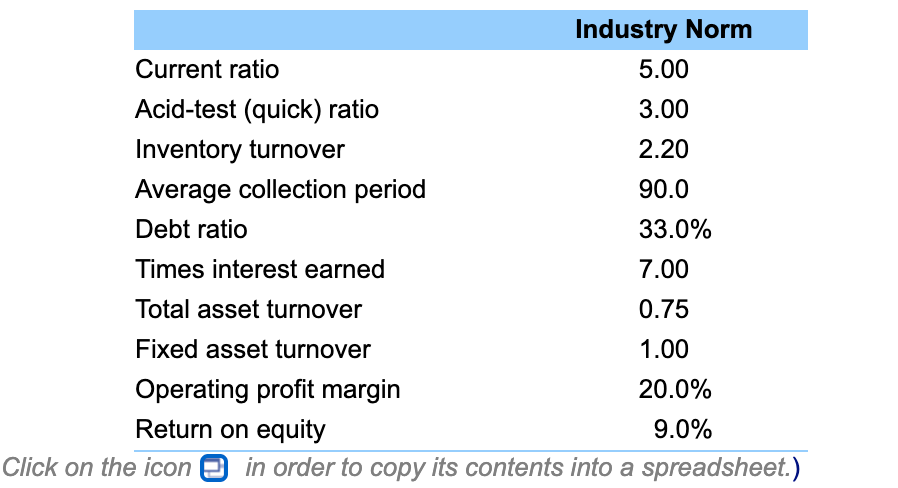

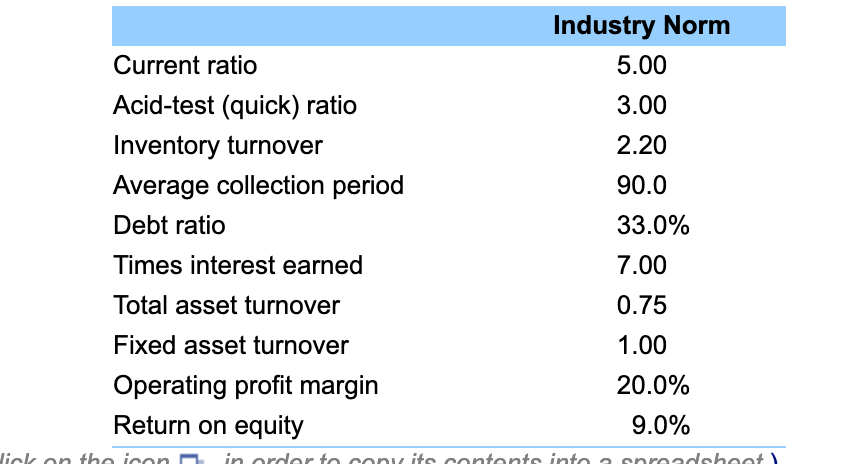

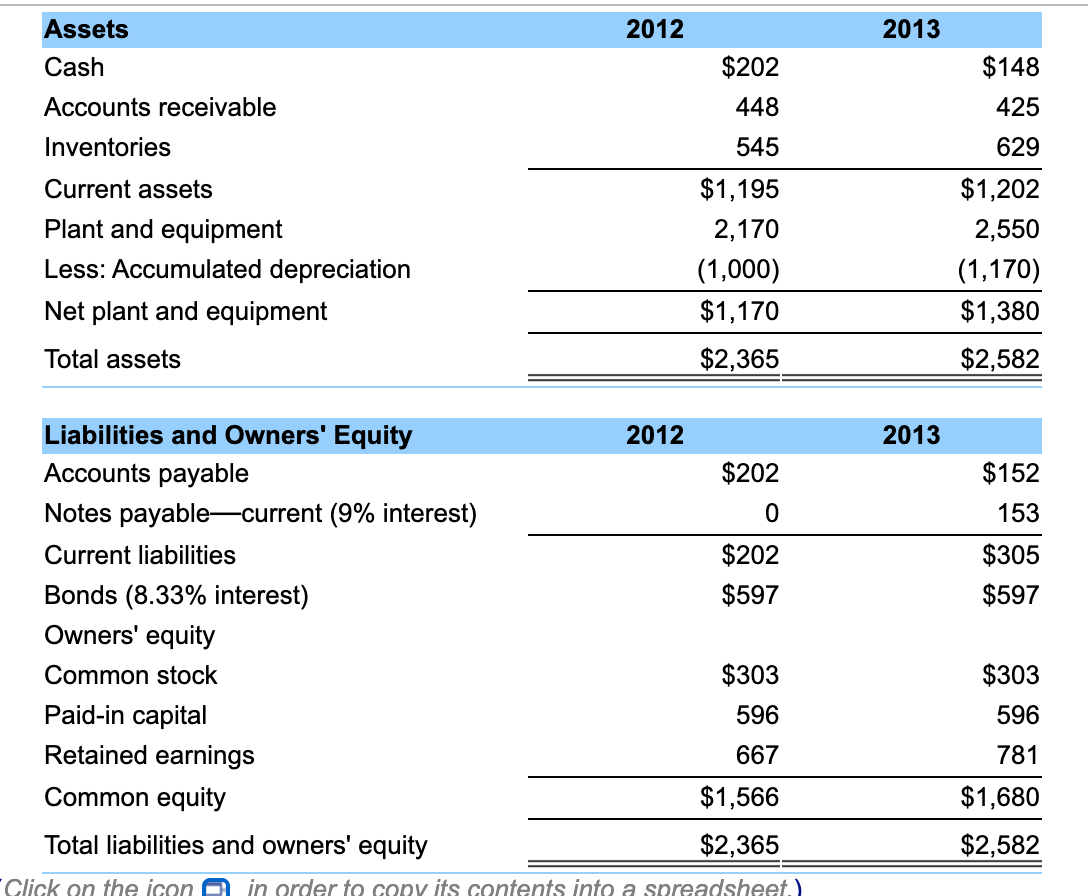

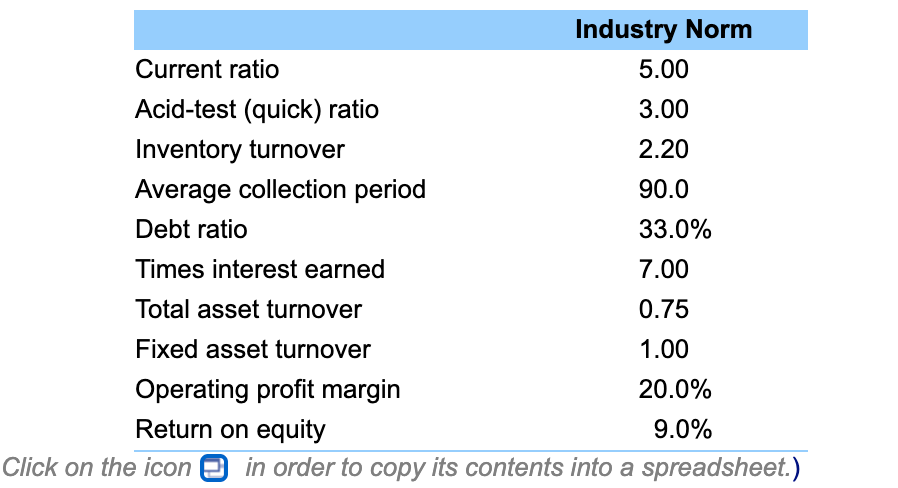

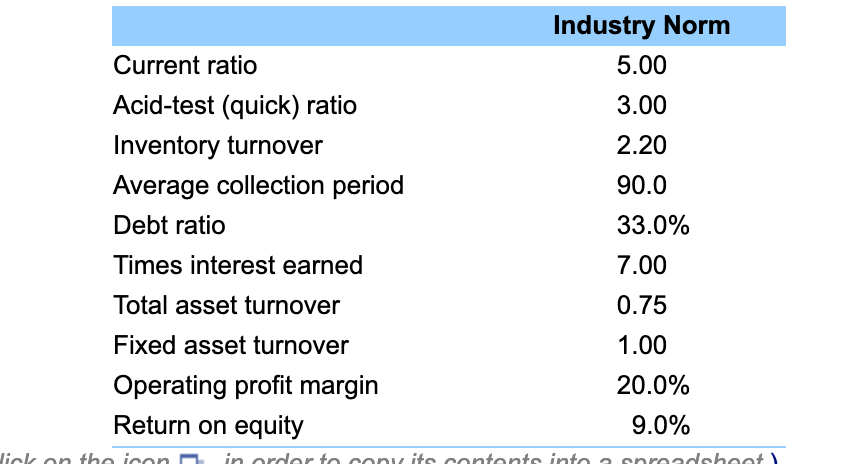

(Financial statement analysis) Using the following financial statements for Pamplin, Inc: a. Compute the following ratios for both 2012 and 2013 using the financial statements above: B b. Compare Pamplin's financial ratios to the industry norms listed above and assess each of the following attributes of the firm's financial condition: liquidity, capital structure, asset management efficiency, and profitability. a. Compute the following ratios for both 2012 and 2013 using the financial statements above: Pamplin's 2012 current ratio is (Round to two decimal places.) Assets 2012 2013 Cash $202 448 $148 425 Accounts receivable Inventories 545 629 Current assets Plant and equipment Less: Accumulated depreciation Net plant and equipment $1,195 2,170 (1,000) $1,170 $1,202 2,550 (1,170) $1,380 $2,582 Total assets $2,365 2012 2013 $202 $152 0 153 $202 $597 $305 $597 Liabilities and Owners' Equity Accounts payable Notes payablecurrent (9% interest) Current liabilities Bonds (8.33% interest) Owners' equity Common stock Paid-in capital Retained earnings Common equity Total liabilities and owners' equity $303 $303 596 596 667 781 $1,566 $1,680 $2,365 $2,582 Click on the icon in order to copy its contents into a spreadsheet.) Industry Norm Current ratio 5.00 Acid-test (quick) ratio 3.00 Inventory turnover 2.20 Average collection period 90.0 Debt ratio 33.0% Times interest earned 7.00 Total asset turnover 0.75 Fixed asset turnover 1.00 Operating profit margin 20.0% Return on equity 9.0% Click on the icon in order to copy its contents into a spreadsheet.) ) Current ratio Acid-test (quick) ratio Inventory turnover Average collection period Debt ratio Times interest earned Total asset turnover Fixed asset turnover Operating profit margin Return on equity Industry Norm 5.00 3.00 2.20 90.0 33.0% 7.00 0.75 1.00 20.0% 9.0% fickon the icon in order to convite contente into a nroadshoot) (Financial statement analysis) Using the following financial statements for Pamplin, Inc: a. Compute the following ratios for both 2012 and 2013 using the financial statements above: B b. Compare Pamplin's financial ratios to the industry norms listed above and assess each of the following attributes of the firm's financial condition: liquidity, capital structure, asset management efficiency, and profitability. a. Compute the following ratios for both 2012 and 2013 using the financial statements above: Pamplin's 2012 current ratio is (Round to two decimal places.) Assets 2012 2013 Cash $202 448 $148 425 Accounts receivable Inventories 545 629 Current assets Plant and equipment Less: Accumulated depreciation Net plant and equipment $1,195 2,170 (1,000) $1,170 $1,202 2,550 (1,170) $1,380 $2,582 Total assets $2,365 2012 2013 $202 $152 0 153 $202 $597 $305 $597 Liabilities and Owners' Equity Accounts payable Notes payablecurrent (9% interest) Current liabilities Bonds (8.33% interest) Owners' equity Common stock Paid-in capital Retained earnings Common equity Total liabilities and owners' equity $303 $303 596 596 667 781 $1,566 $1,680 $2,365 $2,582 Click on the icon in order to copy its contents into a spreadsheet.) Industry Norm Current ratio 5.00 Acid-test (quick) ratio 3.00 Inventory turnover 2.20 Average collection period 90.0 Debt ratio 33.0% Times interest earned 7.00 Total asset turnover 0.75 Fixed asset turnover 1.00 Operating profit margin 20.0% Return on equity 9.0% Click on the icon in order to copy its contents into a spreadsheet.) ) Current ratio Acid-test (quick) ratio Inventory turnover Average collection period Debt ratio Times interest earned Total asset turnover Fixed asset turnover Operating profit margin Return on equity Industry Norm 5.00 3.00 2.20 90.0 33.0% 7.00 0.75 1.00 20.0% 9.0% fickon the icon in order to convite contente into a nroadshoot)