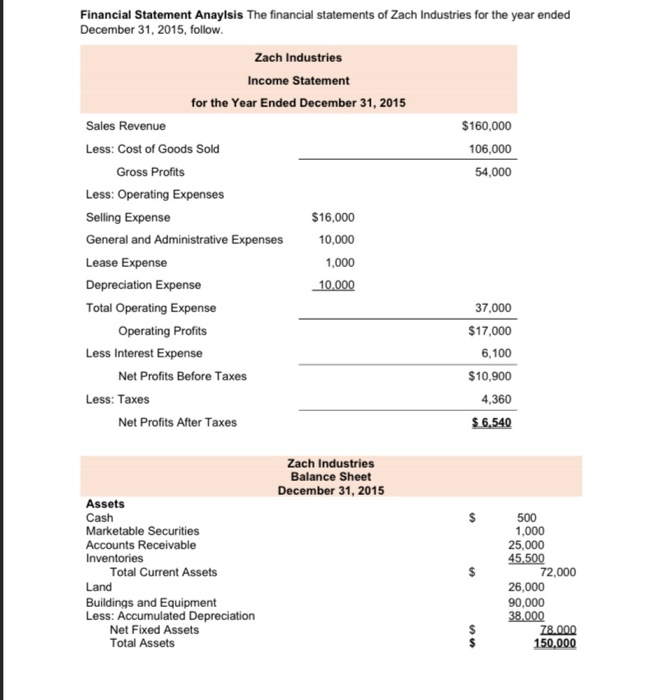

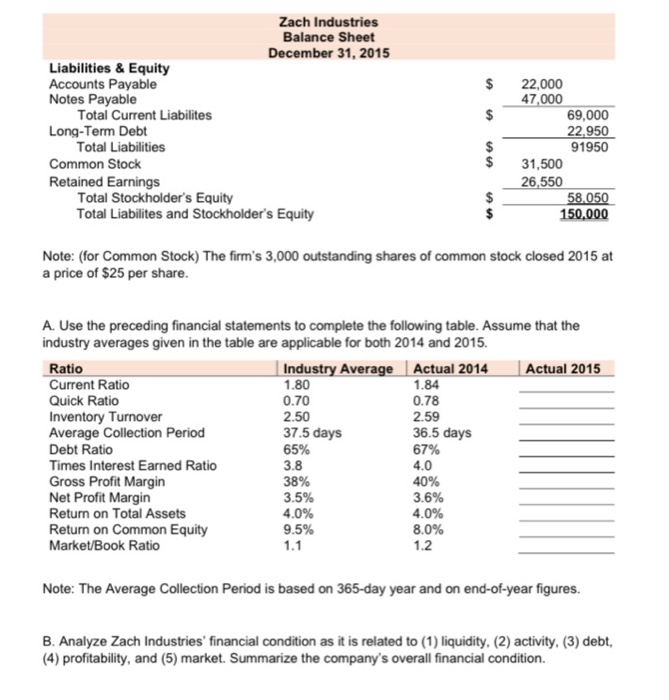

Financial Statement Anaylsis The financial statements of Zach Industries for the year ended December 31, 2015, follow. Zach Industries Income Statement for the Year Ended December 31, 2015 Sales Revenue $160,000 Less: Cost of Goods Sold 106,000 Gross Profits 54,000 Less: Operating Expenses Selling Expense $16,000 General and Administrative Expenses 10,000 Lease Expense 1,000 Depreciation Expense 10.000 Total Operating Expense 37,000 Operating profits $17,000 Less Interest Expense 6,100 Net Profits Before Taxes $10,900 Less: Taxes 4,360 Net Profits After Taxes $ 6,540 Zach Industries Balance Sheet December 31, 2015 Assets Cash Marketable Securities Accounts Receivable Inventories Total Current Assets Land 500 1,000 25,000 45,500 72,000 26,000 90,000 38.000 78.000 150,000 Buildings and Equipment Less: Accumulated Depreciation Net Fixed Assets Total Assets $ Zach Industries Balance Sheet December 31, 2015 Liabilities & Equity Accounts Payable Notes Payable Total Current Liabilites Long-Term Debt Total Liabilities Common Stock Retained Earnings Total Stockholder's Equity Total Liabilites and Stockholder's Equity $ $ $ $ 22,000 47,000 69,000 22,950 91950 31,500 26,550 58.050 150,000 $ Note: (for Common Stock) The firm's 3,000 outstanding shares of common stock closed 2015 at a price of $25 per share. A. Use the preceding financial statements to complete the following table. Assume that the industry averages given in the table are applicable for both 2014 and 2015. Ratio Industry Average Actual 2014 Actual 2015 Current Ratio 1.80 1.84 Quick Ratio 0.70 0.78 Inventory Turnover 2.50 2.59 Average Collection Period 37.5 days 36.5 days Debt Ratio 65% 67% Times Interest Earned Ratio 3.8 4.0 Gross Profit Margin 38% 40% Net Profit Margin 3.5% 3.6% Return on Total Assets 4.0% 4.0% Return on Common Equity 9.5% 8.0% Market/Book Ratio 1.1 1.2 Note: The Average Collection Period is based on 365-day year and on end-of-year figures. B. Analyze Zach Industries' financial condition as it is related to (1) liquidity, (2) activity, (3) debt, (4) profitability, and (5) market. Summarize the company's overall financial condition