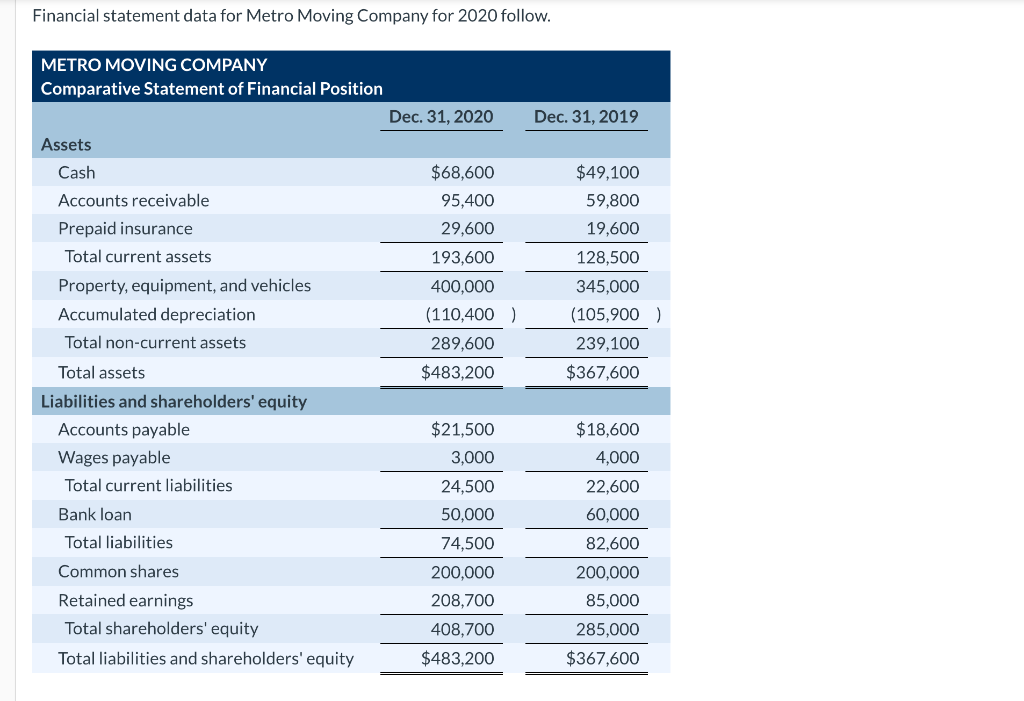

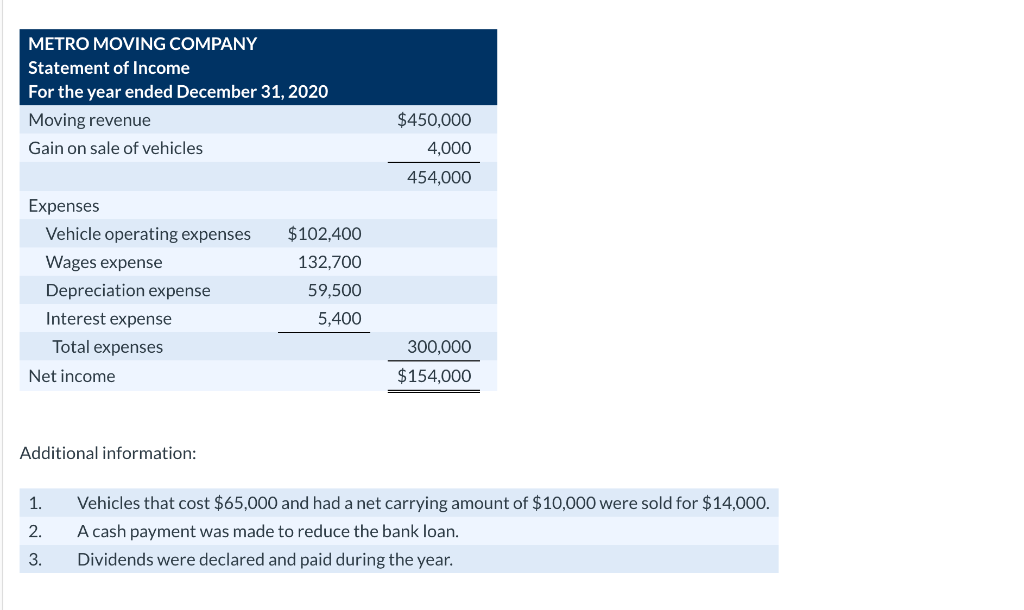

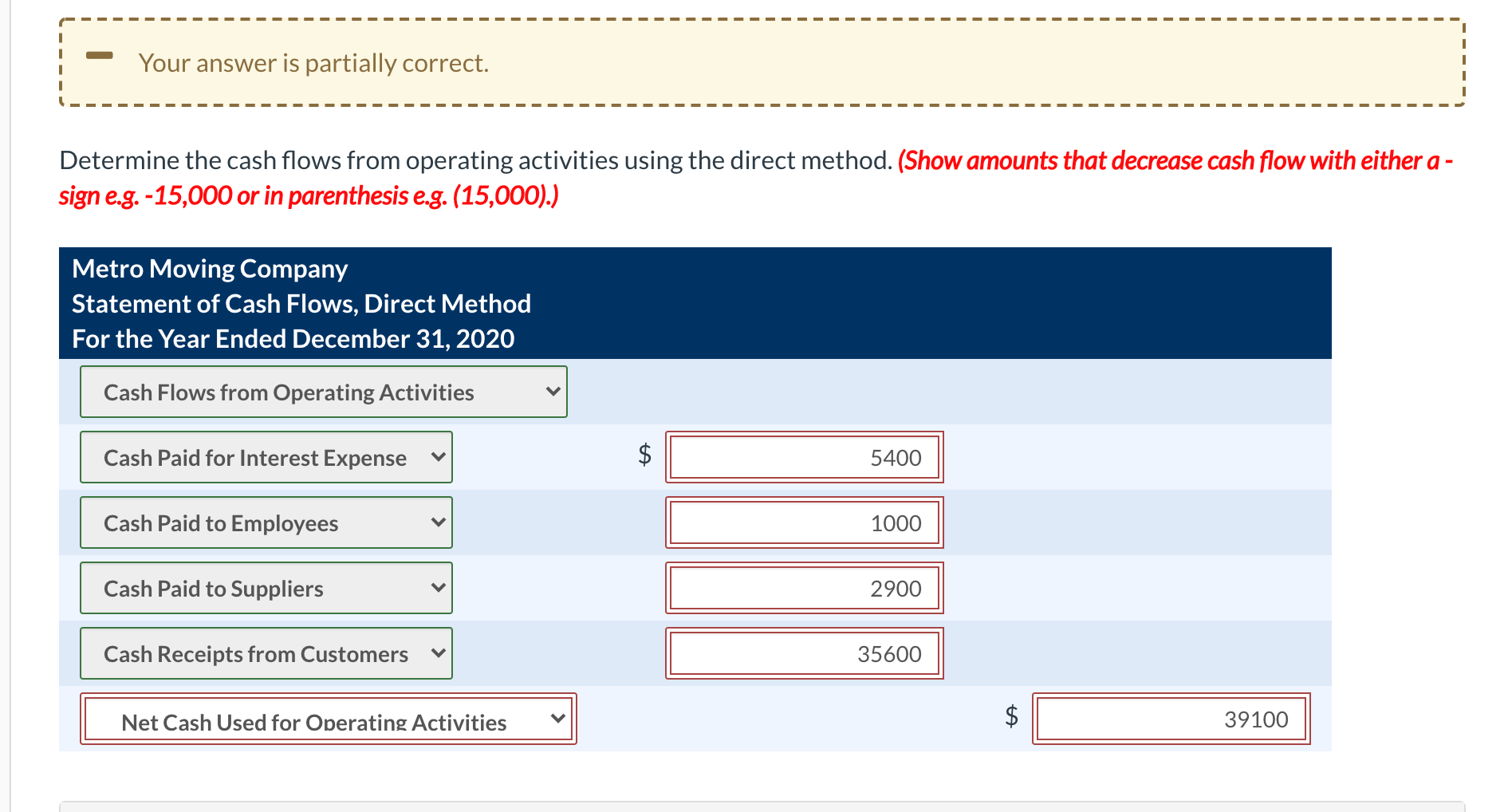

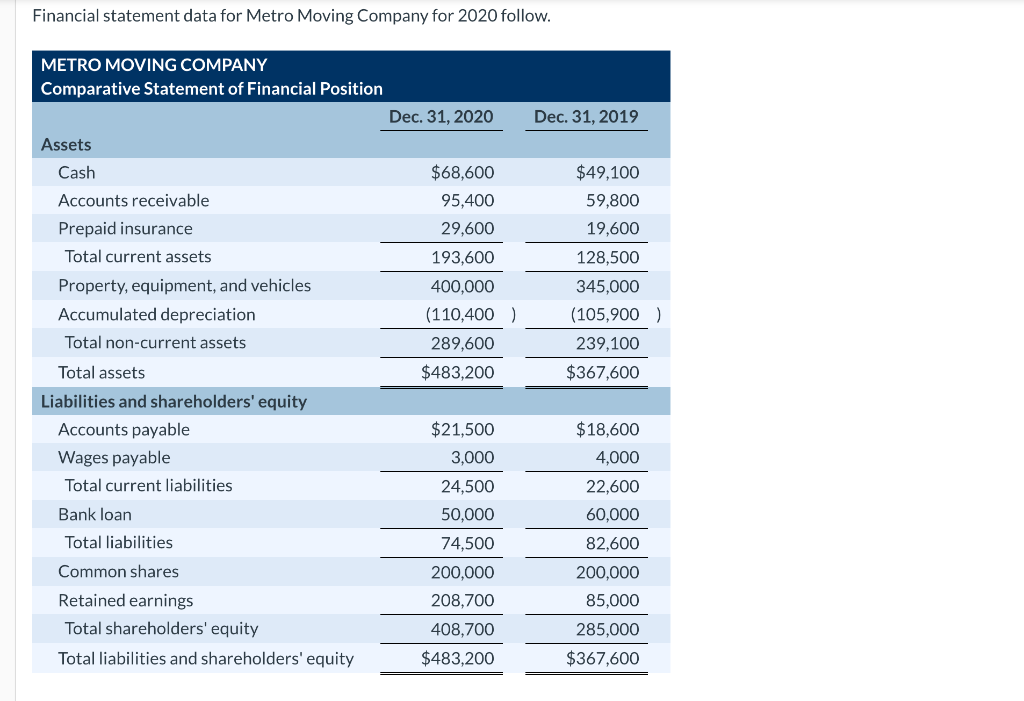

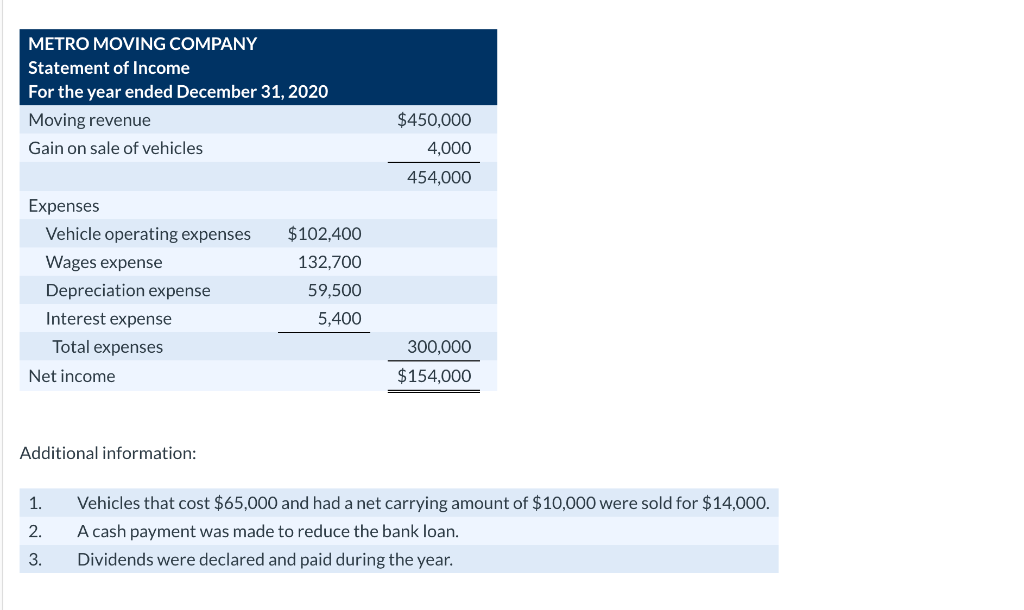

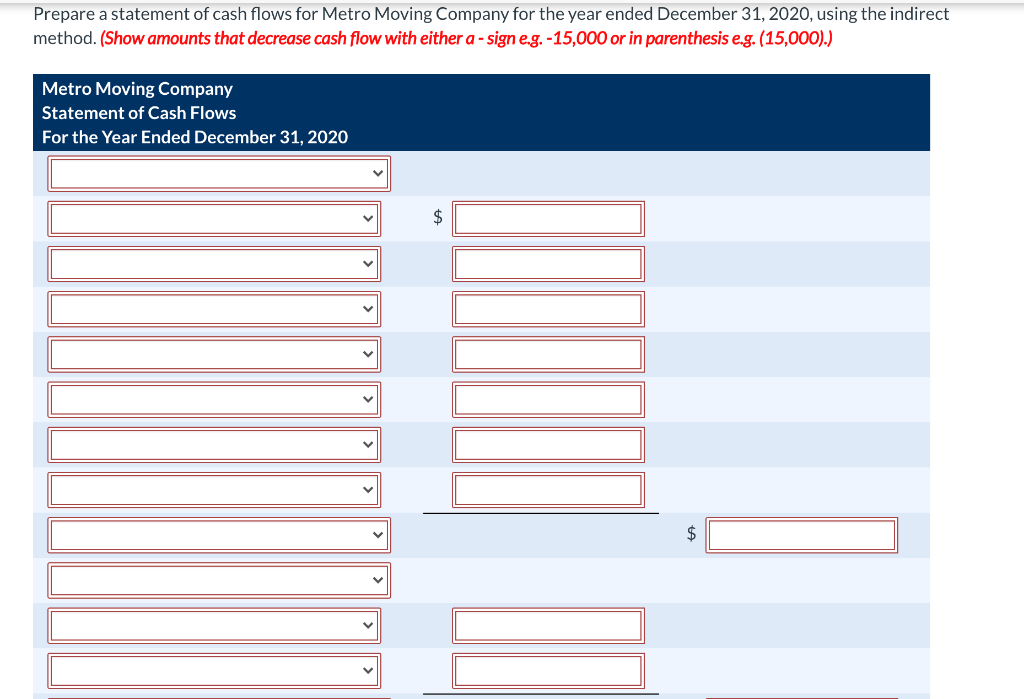

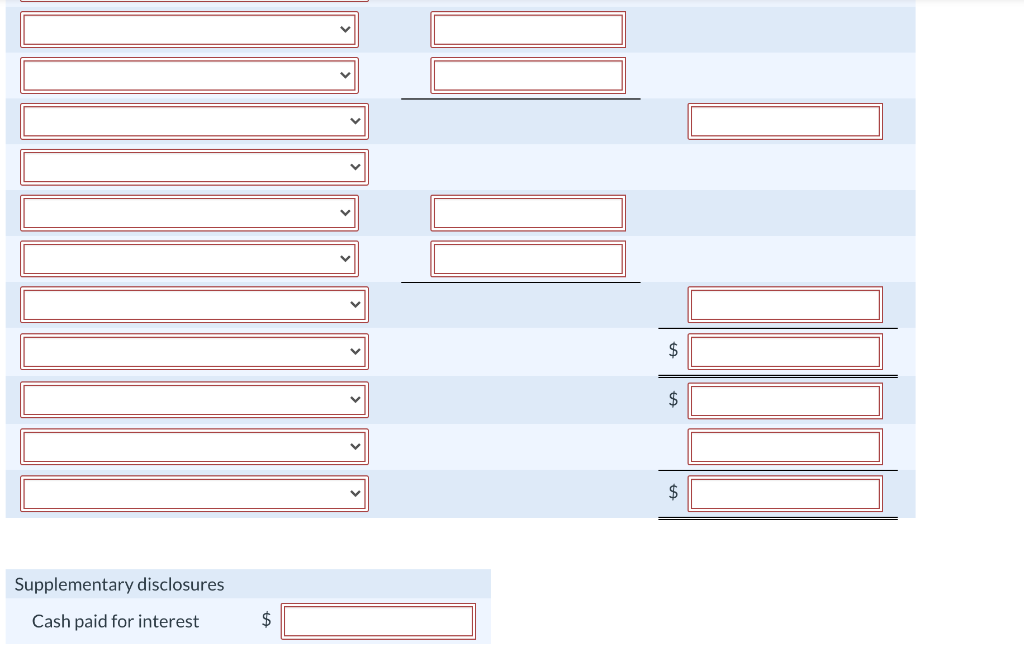

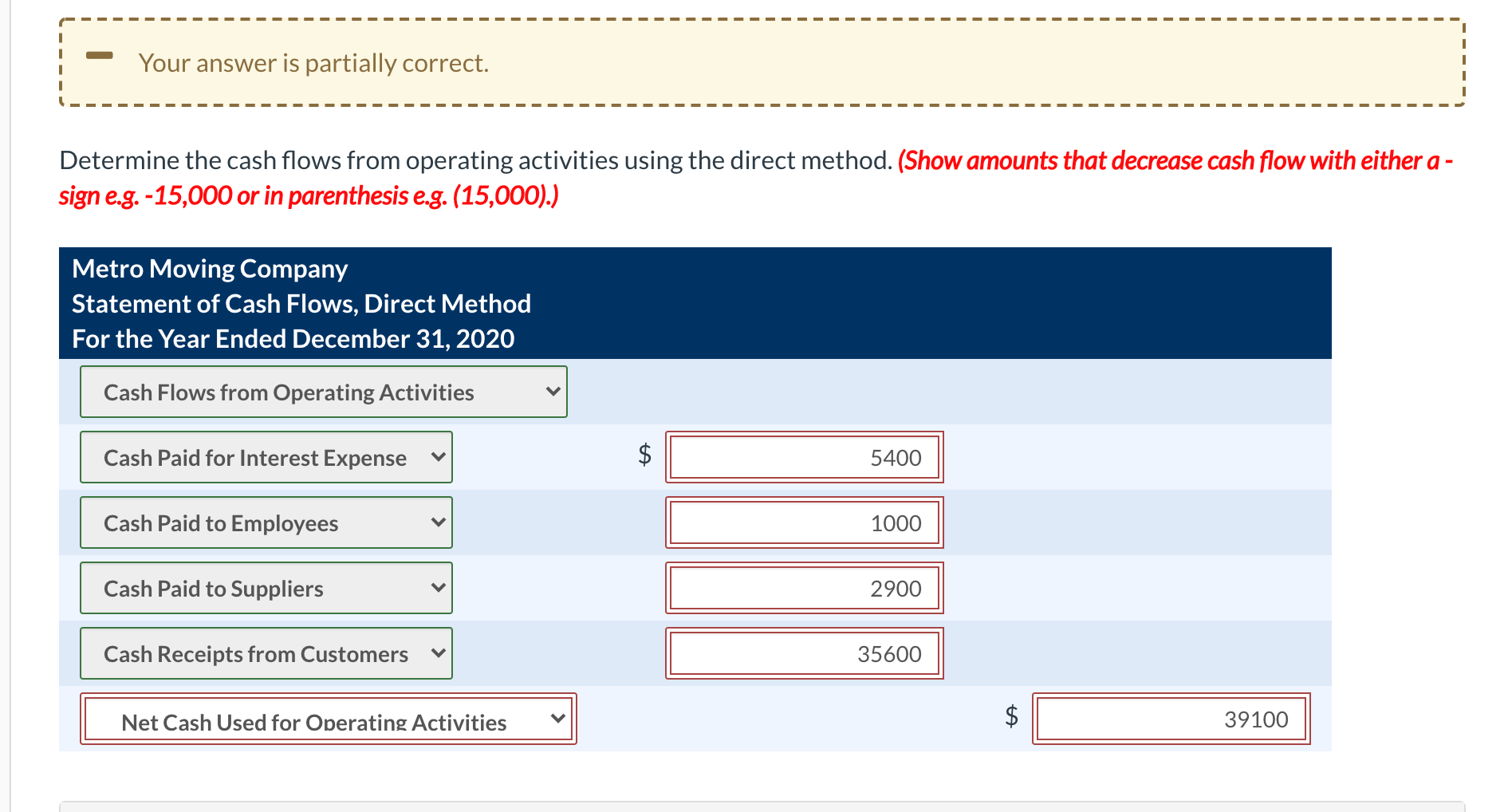

Financial statement data for Metro Moving Company for 2020 follow. Dec. 31, 2019 $49,100 METRO MOVING COMPANY Comparative Statement of Financial Position Dec. 31, 2020 Assets Cash $68,600 Accounts receivable 95,400 Prepaid insurance 29,600 Total current assets 193,600 Property, equipment, and vehicles 400,000 Accumulated depreciation (110,400) Total non-current assets 289,600 Total assets $483,200 Liabilities and shareholders' equity Accounts payable $21,500 Wages payable 3,000 Total current liabilities 24,500 Bank loan 50.000 Total liabilities 74,500 Common shares 200,000 Retained earnings 208,700 Total shareholders' equity 408,700 Total liabilities and shareholders' equity $483,200 59,800 19,600 128,500 345,000 (105,900) 239,100 $367,600 $18,600 4,000 22,600 60,000 82,600 200,000 85,000 285,000 $367,600 METRO MOVING COMPANY Statement of Income For the year ended December 31, 2020 Moving revenue Gain on sale of vehicles $450,000 4,000 454,000 Expenses Vehicle operating expenses Wages expense Depreciation expense Interest expense Total expenses $102,400 132,700 59,500 5,400 300,000 Net income $154,000 Additional information: 1. 2. Vehicles that cost $65,000 and had a net carrying amount of $10,000 were sold for $14,000. A cash payment was made to reduce the bank loan. Dividends were declared and paid during the year. 3. Prepare a statement of cash flows for Metro Moving Company for the year ended December 31, 2020, using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g.-15,000 or in parenthesis e.g. (15,000).) Metro Moving Company Statement of Cash Flows For the Year Ended December 31, 2020 $ V $ $ $ Supplementary disclosures Cash paid for interest $ Your answer is partially correct. 1 Determine the cash flows from operating activities using the direct method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Metro Moving Company Statement of Cash Flows, Direct Method For the Year Ended December 31, 2020 Cash Flows from Operating Activities Cash Paid for Interest Expense $ 5400 Cash Paid to Employees 1000 Cash Paid to Suppliers 2900 Cash Receipts from Customers 35600 Net Cash Used for Operating Activities $ 39100