Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial statement information affects the asset pricing of various securities. Two theories are important in explaining the equilibrium of equity securities expected return namely Capital

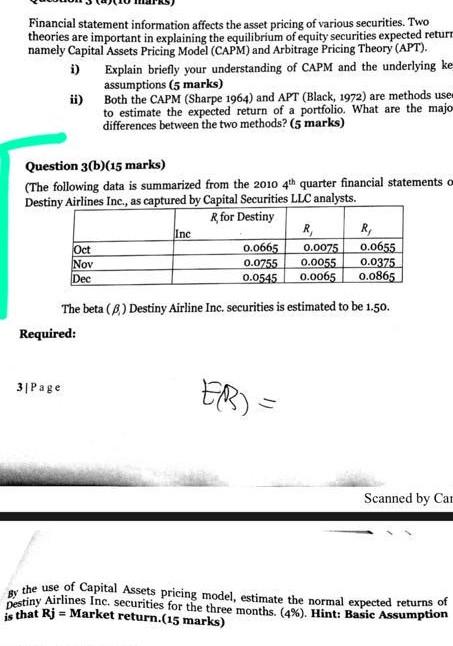

Financial statement information affects the asset pricing of various securities. Two theories are important in explaining the equilibrium of equity securities expected return namely Capital Assets Pricing Model (CAPM) and Arbitrage Pricing Theory (APT). i) Explain briefly your understanding of CAPM and the underlying ke assumptions (5 marks) ii) Both the CAPM (Sharpe 1964) and APT (Black, 1972) are methods use to estimate the expected return of a portfolio. What are the majo differences between the two methods? (5 marks) Inc Question 3(b)(15 marks) (The following data is summarized from the 2010 4th quarter financial statements Destiny Airlines Inc., as captured by Capital Securities LLC analysts. R for Destiny R R Oct 0.0665 0.0075 0.0655 0.0755 0.0055 0.0375 Dec 0.0545 0.0065 0.0865 The beta (2) Destiny Airline Inc. securities is estimated to be 1.50. Required: Nov 3|Page EB) Scanned by Car py the use of Capital Assets pricing model, estimate the normal expected returns of Destiny Airlines Inc. securities for the three months. (4%). Hint: Basic Assumption is that Rj - Market return (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started