FInancial Statement mention in image Just provide the answer in values. Q1:- As a result of MEXIT, Telford Engineering had lost 30% of its pre-MEXIT

FInancial Statement mention in image

Just provide the answer in values.

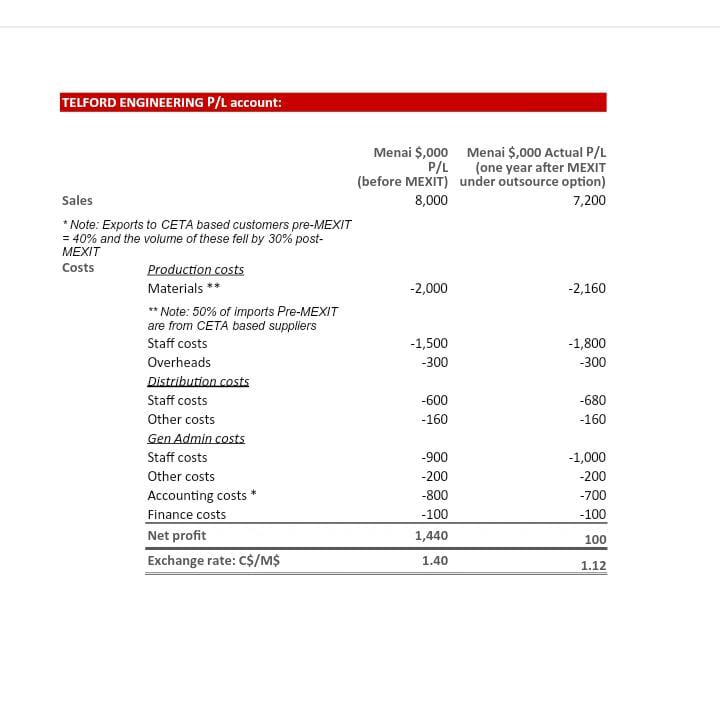

Q1:- As a result of MEXIT, Telford Engineering had lost 30% of its pre-MEXIT export sales to CETA customers, due to increased trade and tariff barriers with CETA. (See P/L account before MEXIT in the spreadsheet). A new opportunity has now been negotiated to sell the original 30% post-MEXIT loss in CETA exports to a range of customers in alternative export markets on another continent. These can be sold at the same price, bringing the factory back to full capacity. The materials cost of these additional sales, as a percentage of sales to the nearest whole percentage, will be the same as it is currently (See P/L account one year after MEXIT under the outsource option in the spreadsheet).

Q2:-After MEXIT the exchange rate value of $M fell from $C1.40 to the current rate of $C1.12. This has meant that the material imports from CETA have become significantly more expensive. The translated cost of these imported materials from CETA in the current P/L account is $M1,100,000. The purchasing team have identified an alternative domestic supplier source for all of the imported materials from CETA, who will charge Telford Engineering the same amount as it originally cost the company to import these materials at the pre-MEXIT exchange rate.

Q3:-Non-core functions in the General Administration department can be outsourced, saving 20% of the staff costs and other costs, included immediately below under the general admin heading, as stated in the current P/L account.

Q4:-Following an innovative business process improvement proposal in manufacturing at no extra development cost, it is possible to reduce the current staff costs in production, by 40%.

Q5:-An option to repurpose the main product of Telford Engineering can now be explored. This option is to construct steel reinforcement frames for factory construction in countries vulnerable to earthquakes. This would mean that all current spare capacity could be committed to this additional product. This will increase the current sales value by 10% and the materials costs will remain at 30% of sales for this additional output.

Q6 :-One of the Strategy and Development sub-committee members suggested that as Telford Engineering has core capability in constructing steel frames for bridge building, all the spare capacity could be used to fabricate a completely new, but similarly constructed product using the same process of manufacture. The proposal is to start producing booms or jibs for large crane manufacturers. This would cost $240,000 in additional development costs to convert and create spare capacity, but will open a completely new higher value market for Telford Engineering, increasing the current sales value by 20%. The higher sales margin would mean that the total cost of materials for this product will only be 25% of sales.

TELFORD ENGINEERING P/L account: P/L Menai $,000 Menai $,000 Actual P/L (one year after MEXIT (before MEXIT) under outsource option) Sales 8,000 7,200 * Note: Exports to CETA based customers pre-MEXIT = 40% and the volume of these fell by 30% post- MEXIT Costs Production costs Materials ** -2,000 -2,160 ** Note: 50% of imports Pre-MEXIT are from CETA based suppliers Staff costs -1,500 -1,800 Overheads -300 -300 Distribution costs Staff costs -600 -680 Other costs - 160 -160 Gen Admin costs Staff costs -900 -1,000 Other costs -200 -200 Accounting costs * -800 -700 Finance costs -100 -100 Net profit 1,440 100 Exchange rate: C$/M$ 1.40 1.12 TELFORD ENGINEERING P/L account: P/L Menai $,000 Menai $,000 Actual P/L (one year after MEXIT (before MEXIT) under outsource option) Sales 8,000 7,200 * Note: Exports to CETA based customers pre-MEXIT = 40% and the volume of these fell by 30% post- MEXIT Costs Production costs Materials ** -2,000 -2,160 ** Note: 50% of imports Pre-MEXIT are from CETA based suppliers Staff costs -1,500 -1,800 Overheads -300 -300 Distribution costs Staff costs -600 -680 Other costs - 160 -160 Gen Admin costs Staff costs -900 -1,000 Other costs -200 -200 Accounting costs * -800 -700 Finance costs -100 -100 Net profit 1,440 100 Exchange rate: C$/M$ 1.40 1.12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Please note The following answers are based on interpreting the given financial data and applying th...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started