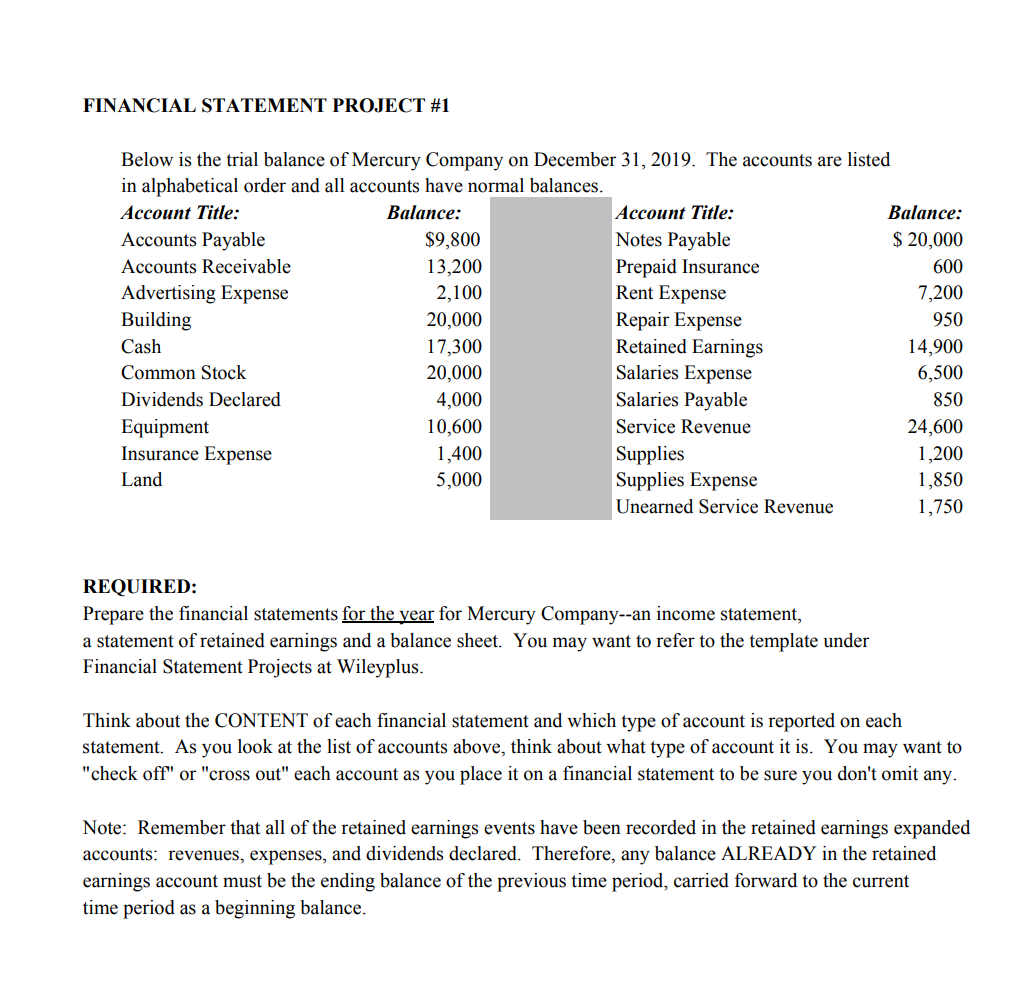

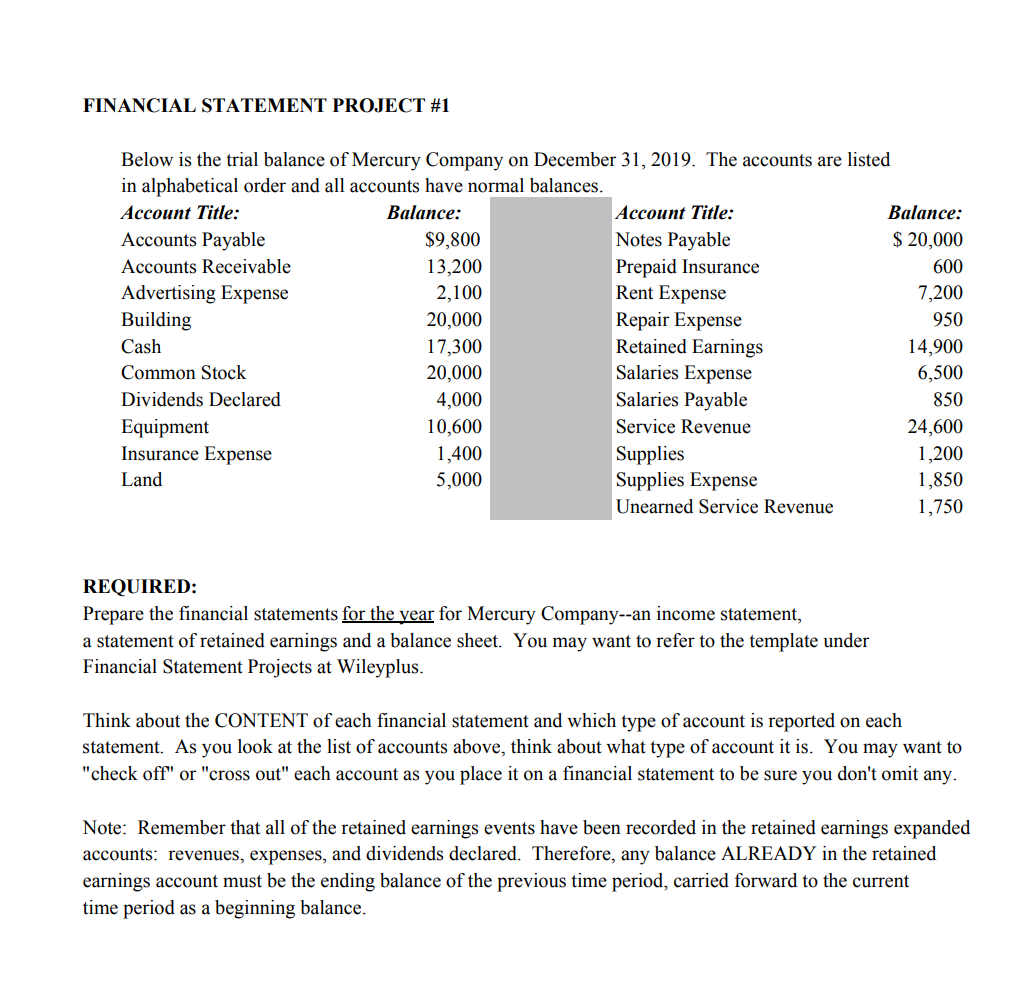

FINANCIAL STATEMENT PROJECT #1 Below is the trial balance of Mercury Company on December 31, 2019. The accounts are listed in alphabetical order and all accounts have normal balances. Account Title: Balance: Account Title: Balance: Accounts Payable $9,800 Notes Payable $ 20,000 Accounts Receivable 13,200 Prepaid Insurance 600 Advertising Expense 2,100 Rent Expense 7,200 Building 20,000 Repair Expense 950 Cash 17,300 Retained Earnings 14,900 Common Stock 20,000 Salaries Expense Dividends Declared 4,000 Salaries Payable 850 Equipment 10,600 Service Revenue 24,600 Insurance Expense 1,400 Supplies 1,200 Land 5,000 Supplies Expense 1,850 Unearned Service Revenue 1,750 6,500 REQUIRED: Prepare the financial statements for the year for Mercury Company--an income statement, a statement of retained earnings and a balance sheet. You may want to refer to the template under Financial Statement Projects at Wileyplus. Think about the CONTENT of each financial statement and which type of account is reported on each statement. As you look at the list of accounts above, think about what type of account it is. You may want to "check off" or "cross out" each account as you place it on a financial statement to be sure you don't omit any. Note: Remember that all of the retained earnings events have been recorded in the retained earnings expanded accounts: revenues, expenses, and dividends declared. Therefore, any balance ALREADY in the retained earnings account must be the ending balance of the previous time period, carried forward to the current time period as a beginning balance. FINANCIAL STATEMENT PROJECT #1 Below is the trial balance of Mercury Company on December 31, 2019. The accounts are listed in alphabetical order and all accounts have normal balances. Account Title: Balance: Account Title: Balance: Accounts Payable $9,800 Notes Payable $ 20,000 Accounts Receivable 13,200 Prepaid Insurance 600 Advertising Expense 2,100 Rent Expense 7,200 Building 20,000 Repair Expense 950 Cash 17,300 Retained Earnings 14,900 Common Stock 20,000 Salaries Expense Dividends Declared 4,000 Salaries Payable 850 Equipment 10,600 Service Revenue 24,600 Insurance Expense 1,400 Supplies 1,200 Land 5,000 Supplies Expense 1,850 Unearned Service Revenue 1,750 6,500 REQUIRED: Prepare the financial statements for the year for Mercury Company--an income statement, a statement of retained earnings and a balance sheet. You may want to refer to the template under Financial Statement Projects at Wileyplus. Think about the CONTENT of each financial statement and which type of account is reported on each statement. As you look at the list of accounts above, think about what type of account it is. You may want to "check off" or "cross out" each account as you place it on a financial statement to be sure you don't omit any. Note: Remember that all of the retained earnings events have been recorded in the retained earnings expanded accounts: revenues, expenses, and dividends declared. Therefore, any balance ALREADY in the retained earnings account must be the ending balance of the previous time period, carried forward to the current time period as a beginning balance