Answered step by step

Verified Expert Solution

Question

1 Approved Answer

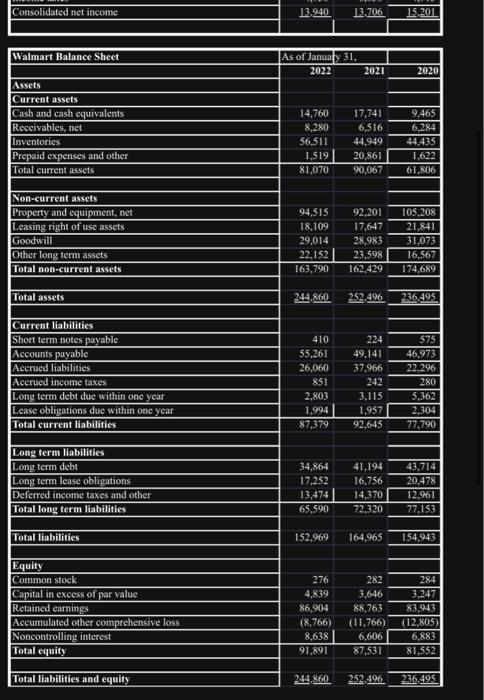

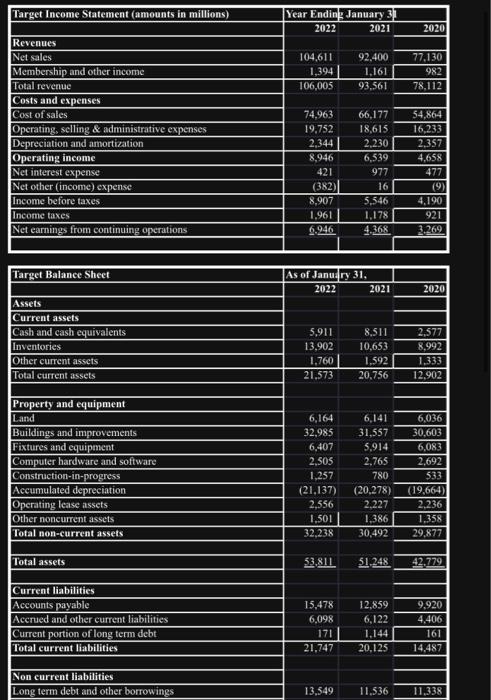

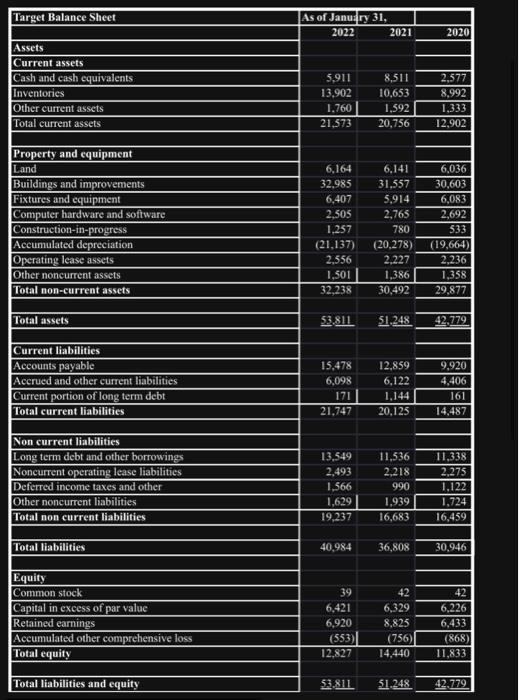

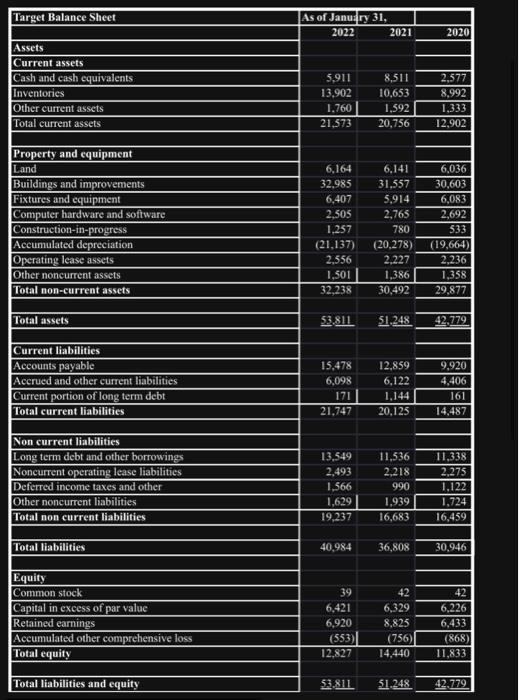

financial statement target walmart a. Calculate the following ratios for both Target and Walmart for 2022 and 2021: The financial statements are provided on the

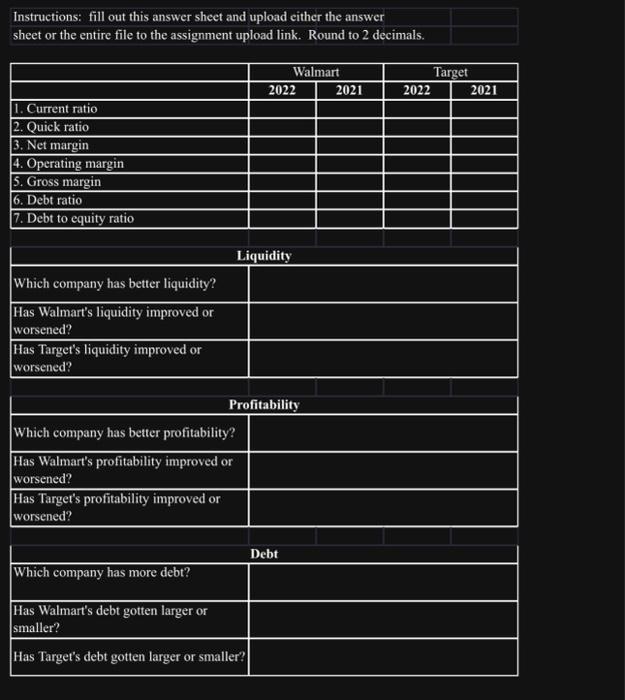

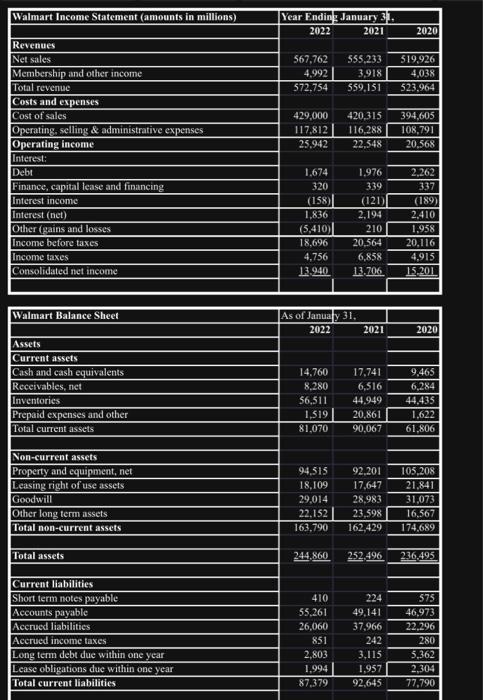

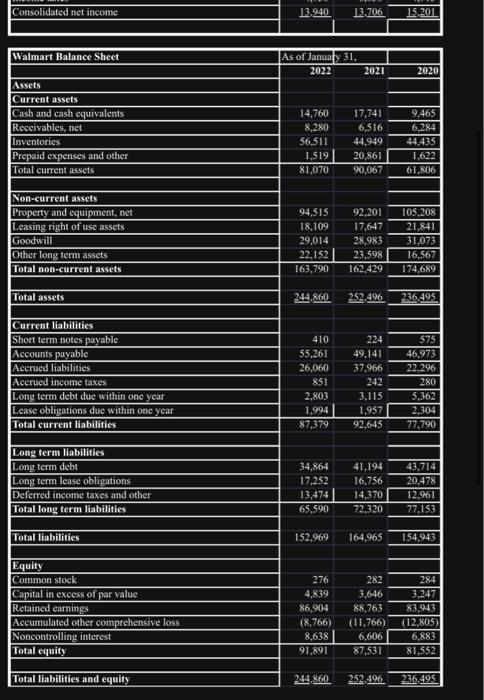

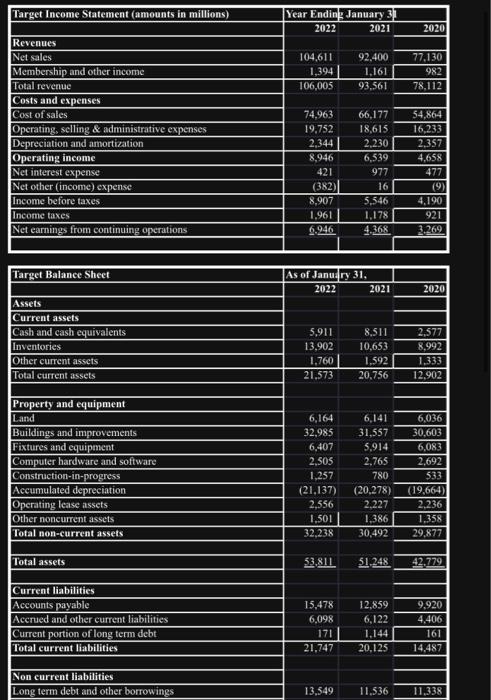

financial statement target walmart

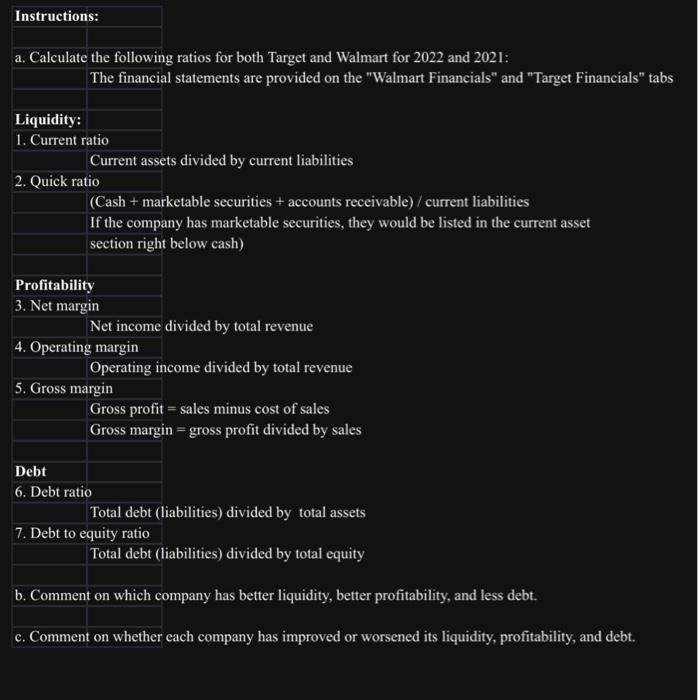

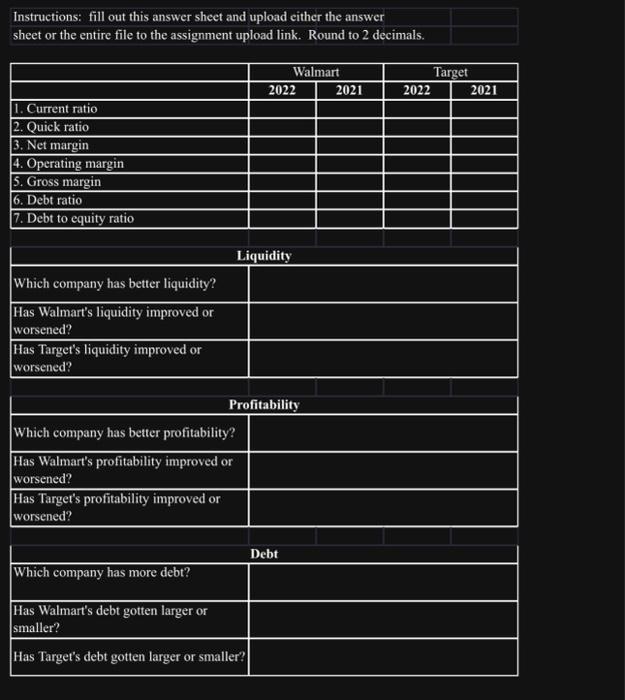

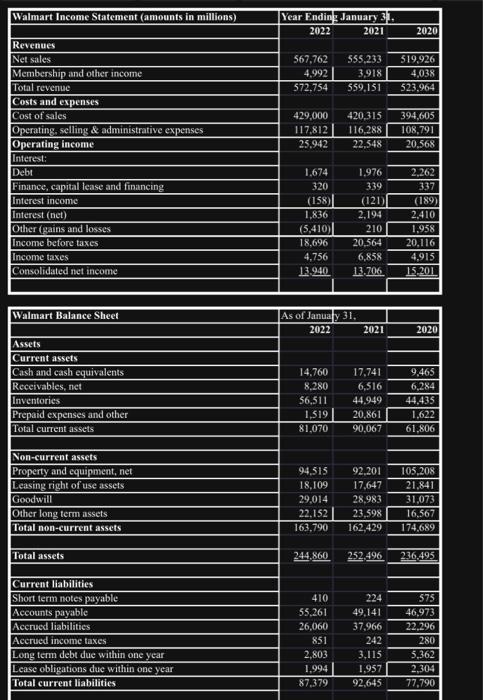

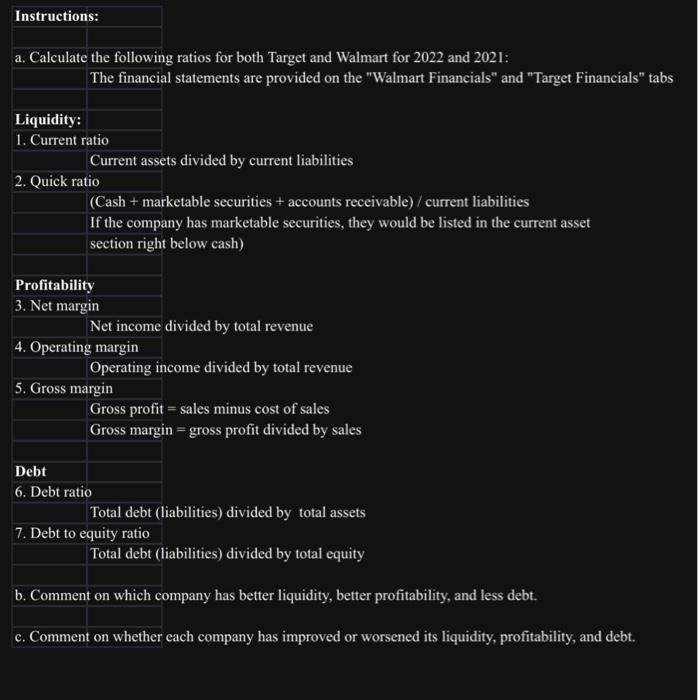

a. Calculate the following ratios for both Target and Walmart for 2022 and 2021: The financial statements are provided on the "Walmart Financials" and "Target Financials" tabs Liquidity: 1. Current ratio Current assets divided by current liabilities 2. Quick ratio (Cash + marketable securities + accounts receivable) / current liabilities If the company has marketable securities, they would be listed in the current asset section right below cash) Profitability 3. Net margin Net income divided by total revenue 4. Operating margin Operating income divided by total revenue 5. Gross margin Gross profit = sales minus cost of sales Gross margin = gross profit divided by sales Debt 6. Debt ratio Total debt (liabilities) divided by total assets 7. Debt to equity ratio Total debt (liabilities) divided by total equity b. Comment on which company has better liquidity, better profitability, and less debt. c. Comment on whether each company has improved or worsened its liquidity, profitability, and debt. Instructions: fill out this answer sheet and upload cither the answer sheet or the entire file to the assignment upload link. Round to 2 decimals. \begin{tabular}{|l|c|c|c|c|} \hline & \multicolumn{2}{|c|}{ Walmart } & \multicolumn{2}{c|}{ Target } \\ \hline & 2022 & 2021 & 2022 & 2021 \\ \hline 1. Current ratio & & & & \\ \hline 2. Quick ratio & & & & \\ \hline 3. Net margin & & & & \\ \hline 4. Operating margin & & & & \\ \hline 5. Gross margin & & & & \\ \hline 6. Debt ratio & & & & \\ \hline 7. Debt to equity ratio & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Liquidity } \\ \hline Which company has better liquidity? & \\ \hline HasWalmartsliquidityimprovedorworsened? & \\ \hline HasTargetsliquidityimprovedorworsened? & \\ \hline \end{tabular} Profitability Which company has better profitability? Has Walmart's profitability improved or worsened? Has Target's profitability improved or worsened? \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Debt } \\ \hline Which company has more debt? & \\ \hline HasWalmartsdebtgottenlargerorsmaller? & \\ \hline Has Target's debt gotten larger or smaller? & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started