Question

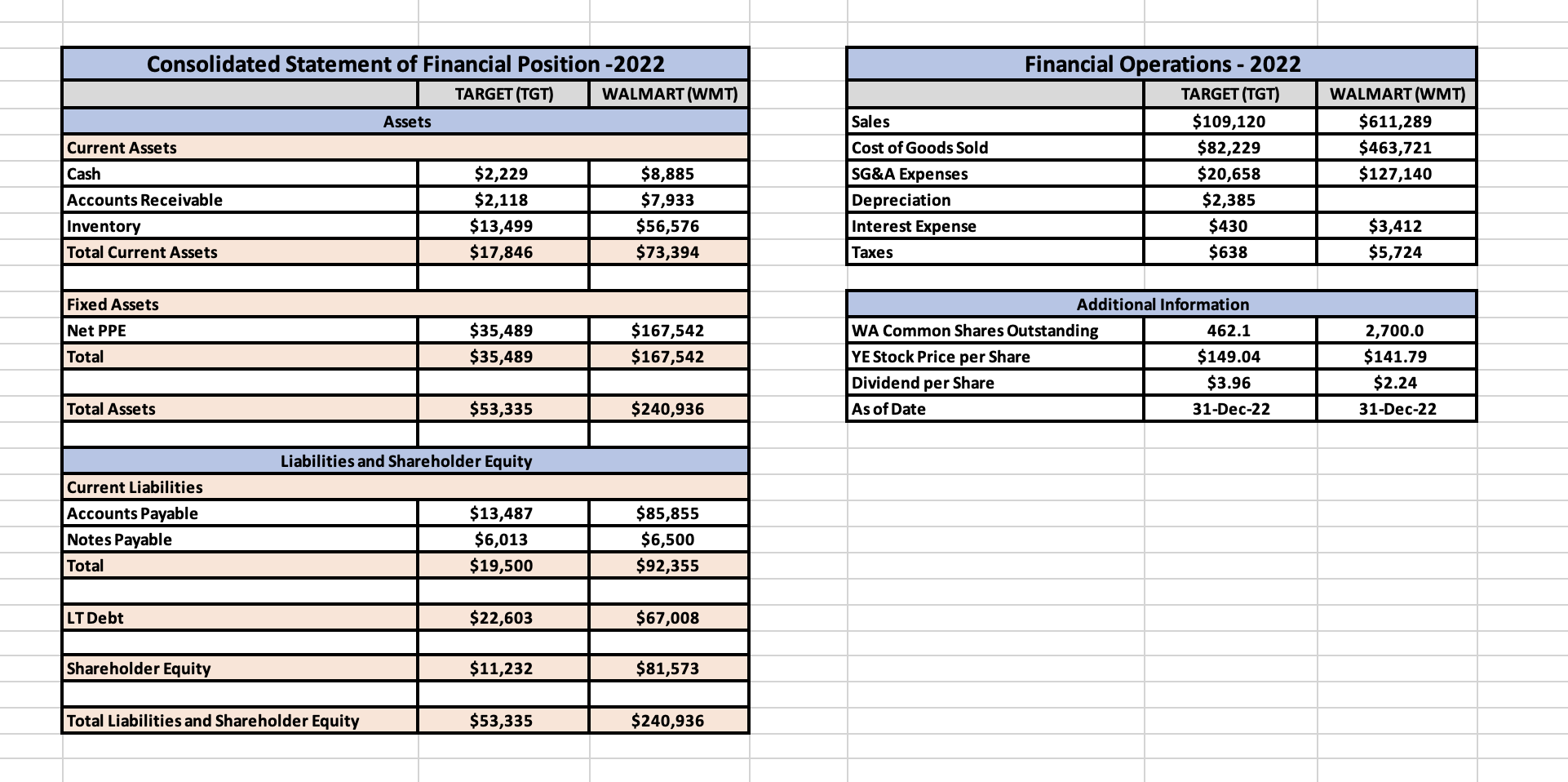

Financial Statements Analysis and Comparison Please use the data in the tables below to answer the following set of questions. Please use only the information

Financial Statements Analysis and Comparison

Please use the data in the tables below to answer the following set of questions. Please use only the information provided and

show any and all relevant calculations and work to support your answers.

1. Of the two companies and based only on the information provided, which company is likely to have the highest cost of debt? Please show all calculations and work necessary to justify your answer. Limit your answer to just one page.

1. Of the two companies and based only on the information provided, which company is likely to have the highest cost of debt? Please show all calculations and work necessary to justify your answer. Limit your answer to just one page.

2. Of the two companies and based only on the information provided, which company appears to be the most profitable? Please show all calculations and work necessary to justify your answer. Limit your answer to just one page.

3. Of the two companies and based only on the information provided, which company appears to be more inexpensive from an equity valuation standpoint? Please show all calculations and work necessary to justify your answer. Limit your answer to just one page.

4. Of the two companies and based only on the information provided, which company appears to manage its inventory more efficiently? Please show all calculations and work necessary to justify your answer. Limit your answer to just one page.

5. Of the two companies and based only on the information provided, which company has the higher dividend yield? Please show all calculations and work necessary to justify your answer. Limit your answer to just one page.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started