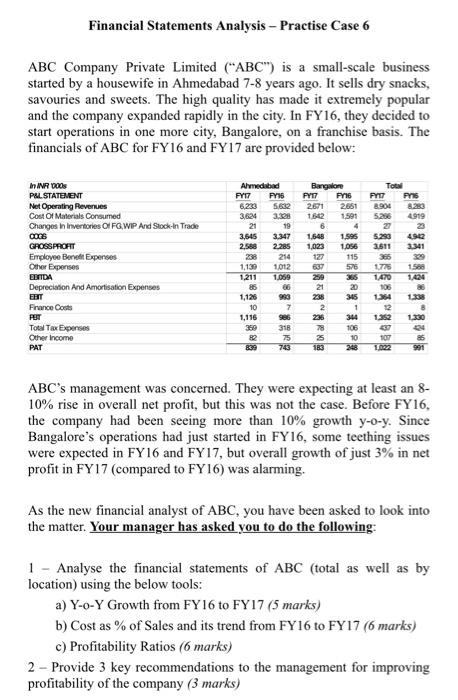

Financial Statements Analysis - Practise Case 6 ABC Company Private Limited ("ABC") is a small-scale business started by a housewife in Ahmedabad 7-8 years ago. It sells dry snacks, savouries and sweets. The high quality has made it extremely popular and the company expanded rapidly in the city. In FY16, they decided to start operations in one more city, Bangalore, on a franchise basis. The financials of ABC for FY16 and FY17 are provided below: PAS 1591 In INR DOO PALSTATEMENT Net Operating Revenues Cost Of Materials Consumed Changes in Inventories OI FGWP And Stock In Trade 2006 GROSSPORT Employee Benefit Expenses Other Expenses EBITDA Depreciation And Amortisation Expenses 1056 Almedabad FYI 6.233 5.632 3,624 3,328 21 19 3,645 3.347 2.558 2.25 214 1,130 1012 1.211 1.059 36 06 1,125 10 7 1,116 986 360 316 82 75 839 743 Bangalore PYTT FYI 201 2651 1662 6 4 1.648 1.595 1.623 127 115 637 576 250 21 20 345 2 1 236 344 78 106 25 10 183 Total FYTT Pris 8.900 8.253 5206 1919 23 5283 4912 3.511 3341 200 1775 1470 1424 106 134 1.338 12 8 1.352 1.330 France Costs PUT Total Tax Expenses Other Income PAT ABC's management was concerned. They were expecting at least an 8- 10% rise in overall net profit, but this was not the case. Before FY16, the company had been seeing more than 10% growth y-o-y. Since Bangalore's operations had just started in FY16, some teething issues were expected in FY16 and FY17, but overall growth of just 3% in net profit in FY 17 (compared to FY16) was alarming. As the new financial analyst of ABC, you have been asked to look into the matter. Your manager has asked you to do the following: 1 - Analyse the financial statements of ABC (total as well as by location) using the below tools: a) Y-o-Y Growth from FY16 to FY17 (5 marks) b) Cost as % of Sales and its trend from FY16 to FY 17 (6 marks) c) Profitability Ratios (6 marks) 2 - Provide 3 key recommendations to the management for improving profitability of the company (3 marks) Further Information about ABC provided to you by your manager: 1. The Business Head of Bangalore has informed the management that the only issue they are facing is slow demand in a new city. He claims that once the brand is established and sales increase, the problem will be solved. Your manager is sceptical of this. 2. The Ahmedabad manufacturing unit has fine-tuned its supply chain strategy over the years. Raw materials are procured from vendors who are located very close to the manufacturing unit, within the same area. These vendors have been carefully picked and provide high quality materials. There has been a steady raw material price increase over the years, but the Ahmedabad unit has been purchasing materials in bulk to get competitive rates. The Bangalore unit has also been able to identify suitable high quality vendors, but only in another town, so incoming freight cost remains high. Given the scale of the operations, the purchase quantities are relatively lower. 3. The manufacturing process is highly automated, and the workforce in both locations consists mainly of salespeople. In Ahmedabad, these salespeople have a strict incentive system tied to the sales made by them. 4. In both locations, the company has been making regular investments in operational assets to keep the production efficiency high. These assets have been funded by internal reserves. ABC borrows money only for working capital purposes. 5. The central finance team deploys excess funds of each location on a monthly basis into a diversified portfolio of investments, with a relatively low risk profile. Financial Statements Analysis - Practise Case 6 ABC Company Private Limited ("ABC") is a small-scale business started by a housewife in Ahmedabad 7-8 years ago. It sells dry snacks, savouries and sweets. The high quality has made it extremely popular and the company expanded rapidly in the city. In FY16, they decided to start operations in one more city, Bangalore, on a franchise basis. The financials of ABC for FY16 and FY17 are provided below: PAS 1591 In INR DOO PALSTATEMENT Net Operating Revenues Cost Of Materials Consumed Changes in Inventories OI FGWP And Stock In Trade 2006 GROSSPORT Employee Benefit Expenses Other Expenses EBITDA Depreciation And Amortisation Expenses 1056 Almedabad FYI 6.233 5.632 3,624 3,328 21 19 3,645 3.347 2.558 2.25 214 1,130 1012 1.211 1.059 36 06 1,125 10 7 1,116 986 360 316 82 75 839 743 Bangalore PYTT FYI 201 2651 1662 6 4 1.648 1.595 1.623 127 115 637 576 250 21 20 345 2 1 236 344 78 106 25 10 183 Total FYTT Pris 8.900 8.253 5206 1919 23 5283 4912 3.511 3341 200 1775 1470 1424 106 134 1.338 12 8 1.352 1.330 France Costs PUT Total Tax Expenses Other Income PAT ABC's management was concerned. They were expecting at least an 8- 10% rise in overall net profit, but this was not the case. Before FY16, the company had been seeing more than 10% growth y-o-y. Since Bangalore's operations had just started in FY16, some teething issues were expected in FY16 and FY17, but overall growth of just 3% in net profit in FY 17 (compared to FY16) was alarming. As the new financial analyst of ABC, you have been asked to look into the matter. Your manager has asked you to do the following: 1 - Analyse the financial statements of ABC (total as well as by location) using the below tools: a) Y-o-Y Growth from FY16 to FY17 (5 marks) b) Cost as % of Sales and its trend from FY16 to FY 17 (6 marks) c) Profitability Ratios (6 marks) 2 - Provide 3 key recommendations to the management for improving profitability of the company (3 marks) Further Information about ABC provided to you by your manager: 1. The Business Head of Bangalore has informed the management that the only issue they are facing is slow demand in a new city. He claims that once the brand is established and sales increase, the problem will be solved. Your manager is sceptical of this. 2. The Ahmedabad manufacturing unit has fine-tuned its supply chain strategy over the years. Raw materials are procured from vendors who are located very close to the manufacturing unit, within the same area. These vendors have been carefully picked and provide high quality materials. There has been a steady raw material price increase over the years, but the Ahmedabad unit has been purchasing materials in bulk to get competitive rates. The Bangalore unit has also been able to identify suitable high quality vendors, but only in another town, so incoming freight cost remains high. Given the scale of the operations, the purchase quantities are relatively lower. 3. The manufacturing process is highly automated, and the workforce in both locations consists mainly of salespeople. In Ahmedabad, these salespeople have a strict incentive system tied to the sales made by them. 4. In both locations, the company has been making regular investments in operational assets to keep the production efficiency high. These assets have been funded by internal reserves. ABC borrows money only for working capital purposes. 5. The central finance team deploys excess funds of each location on a monthly basis into a diversified portfolio of investments, with a relatively low risk profile