Question

Financial statements and additional information for Noble Equipment Corp. are available for download from McGraw-Hills Connect or your course instructor (see the Preface for more

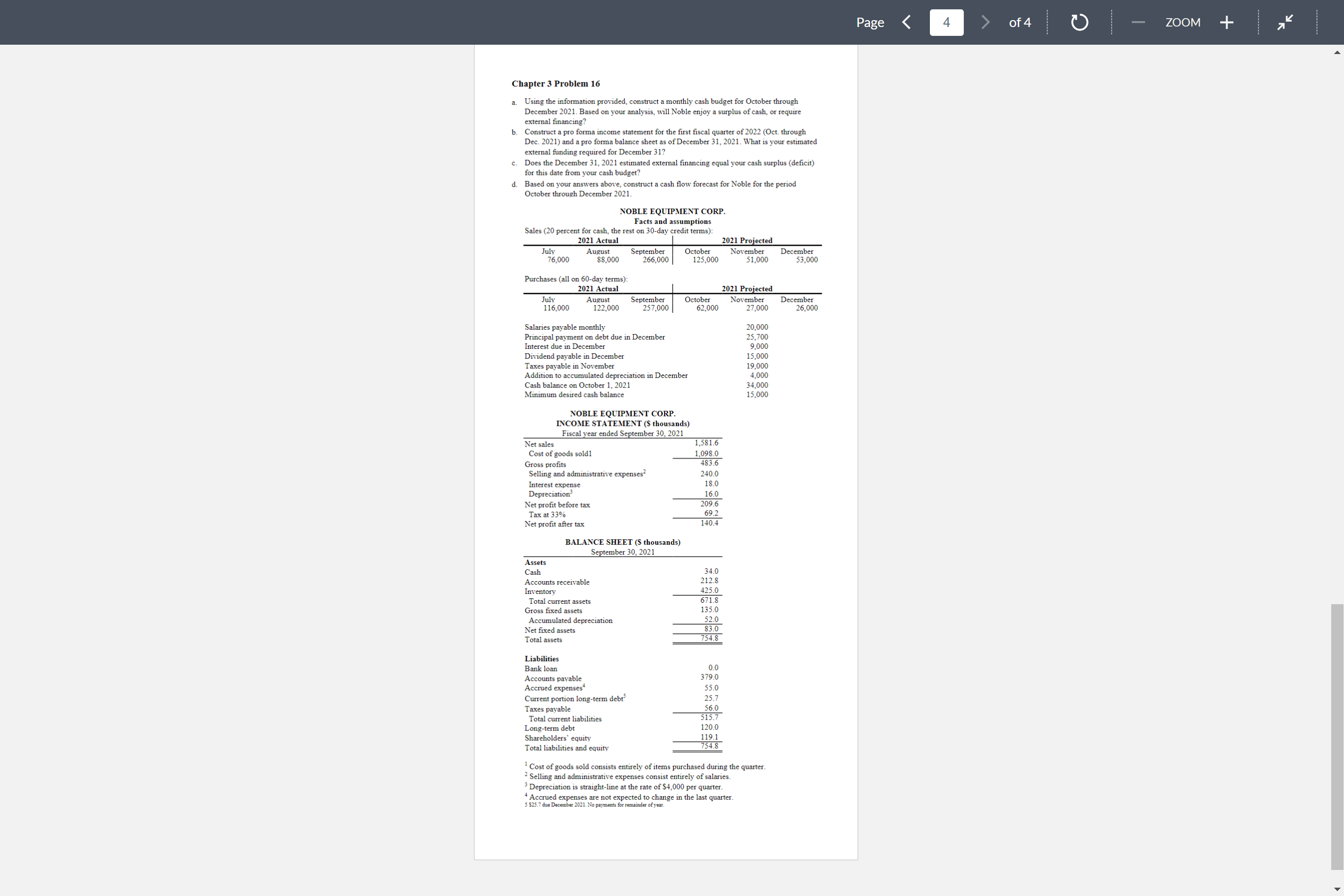

Financial statements and additional information for Noble Equipment Corp. are available for download from McGraw-Hills Connect or your course instructor (see the Preface for more information). The companys fiscal year-end is September 30. Nobles management wants to estimate the companys cash balances for the last three months of calendar year 2021, which are the first three months of fiscal year 2022. The questions accompanying the spreadsheet ask you to prepare a monthly cash budget, pro forma financial statements, and a cash flow forecast for the period.

Chapter 3 Problem 16 a. Using the information provided, construct a monthly cash budget for October through December 2021. Based on your analysis, will Noble enjoy a surplus of cash, or require external financing? b. Construct a pro forma income statement for the first fiscal quarter of 2022 (Oct. through Dec. 2021) and a pro forma balance sheet as of December 31, 2021. What is your estimated external funding required for December 31 ? c. Does the December 31, 2021 estimated external financing equal your cash surplus (deficit) for this date from your cash budget? d. Based on your answers above, construct a cash flow forecast for Noble for the period October through December 2021. NOBLE EQUIPMENT CORP. INCOME STATEMENT (\$ thousands) 1 Cost of goods sold consists entirely of items purchased during the quarter. 2 Selling and administrative expenses consist entirely of salaries. 3 Depreciation is straight-line at the rate of $4,000 per quarter. 4 Accrued expenses are not expected to change in the last quarter. 5$25.7 due December 2021. No payments for remainder of year. Chapter 3 Problem 16 a. Using the information provided, construct a monthly cash budget for October through December 2021. Based on your analysis, will Noble enjoy a surplus of cash, or require external financing? b. Construct a pro forma income statement for the first fiscal quarter of 2022 (Oct. through Dec. 2021) and a pro forma balance sheet as of December 31, 2021. What is your estimated external funding required for December 31 ? c. Does the December 31, 2021 estimated external financing equal your cash surplus (deficit) for this date from your cash budget? d. Based on your answers above, construct a cash flow forecast for Noble for the period October through December 2021. NOBLE EQUIPMENT CORP. INCOME STATEMENT (\$ thousands) 1 Cost of goods sold consists entirely of items purchased during the quarter. 2 Selling and administrative expenses consist entirely of salaries. 3 Depreciation is straight-line at the rate of $4,000 per quarter. 4 Accrued expenses are not expected to change in the last quarter. 5$25.7 due December 2021. No payments for remainder of year

Chapter 3 Problem 16 a. Using the information provided, construct a monthly cash budget for October through December 2021. Based on your analysis, will Noble enjoy a surplus of cash, or require external financing? b. Construct a pro forma income statement for the first fiscal quarter of 2022 (Oct. through Dec. 2021) and a pro forma balance sheet as of December 31, 2021. What is your estimated external funding required for December 31 ? c. Does the December 31, 2021 estimated external financing equal your cash surplus (deficit) for this date from your cash budget? d. Based on your answers above, construct a cash flow forecast for Noble for the period October through December 2021. NOBLE EQUIPMENT CORP. INCOME STATEMENT (\$ thousands) 1 Cost of goods sold consists entirely of items purchased during the quarter. 2 Selling and administrative expenses consist entirely of salaries. 3 Depreciation is straight-line at the rate of $4,000 per quarter. 4 Accrued expenses are not expected to change in the last quarter. 5$25.7 due December 2021. No payments for remainder of year. Chapter 3 Problem 16 a. Using the information provided, construct a monthly cash budget for October through December 2021. Based on your analysis, will Noble enjoy a surplus of cash, or require external financing? b. Construct a pro forma income statement for the first fiscal quarter of 2022 (Oct. through Dec. 2021) and a pro forma balance sheet as of December 31, 2021. What is your estimated external funding required for December 31 ? c. Does the December 31, 2021 estimated external financing equal your cash surplus (deficit) for this date from your cash budget? d. Based on your answers above, construct a cash flow forecast for Noble for the period October through December 2021. NOBLE EQUIPMENT CORP. INCOME STATEMENT (\$ thousands) 1 Cost of goods sold consists entirely of items purchased during the quarter. 2 Selling and administrative expenses consist entirely of salaries. 3 Depreciation is straight-line at the rate of $4,000 per quarter. 4 Accrued expenses are not expected to change in the last quarter. 5$25.7 due December 2021. No payments for remainder of year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started