Answered step by step

Verified Expert Solution

Question

1 Approved Answer

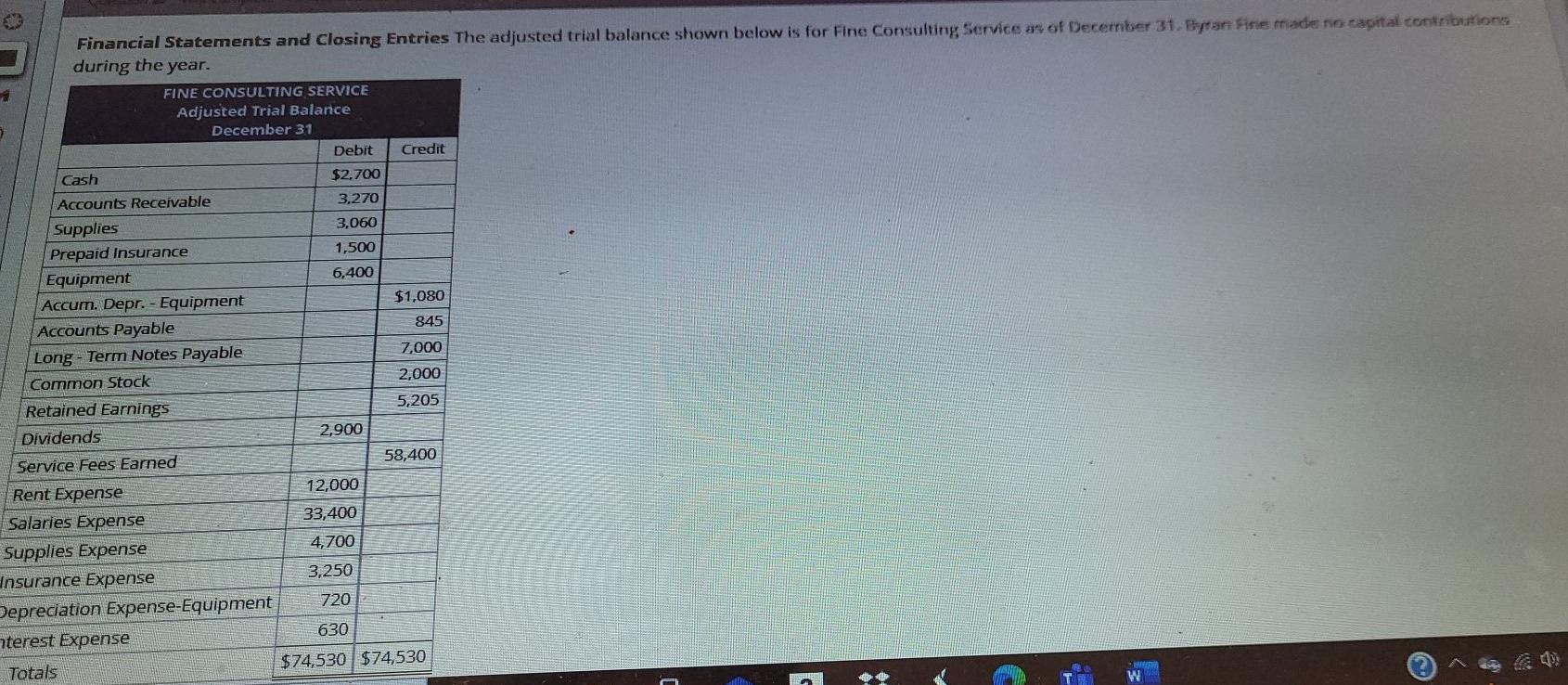

Financial Statements and Closing Entries The adjusted trial balance shown below is for Fine Consulting Service as of December 31. Byran Fine made no capital

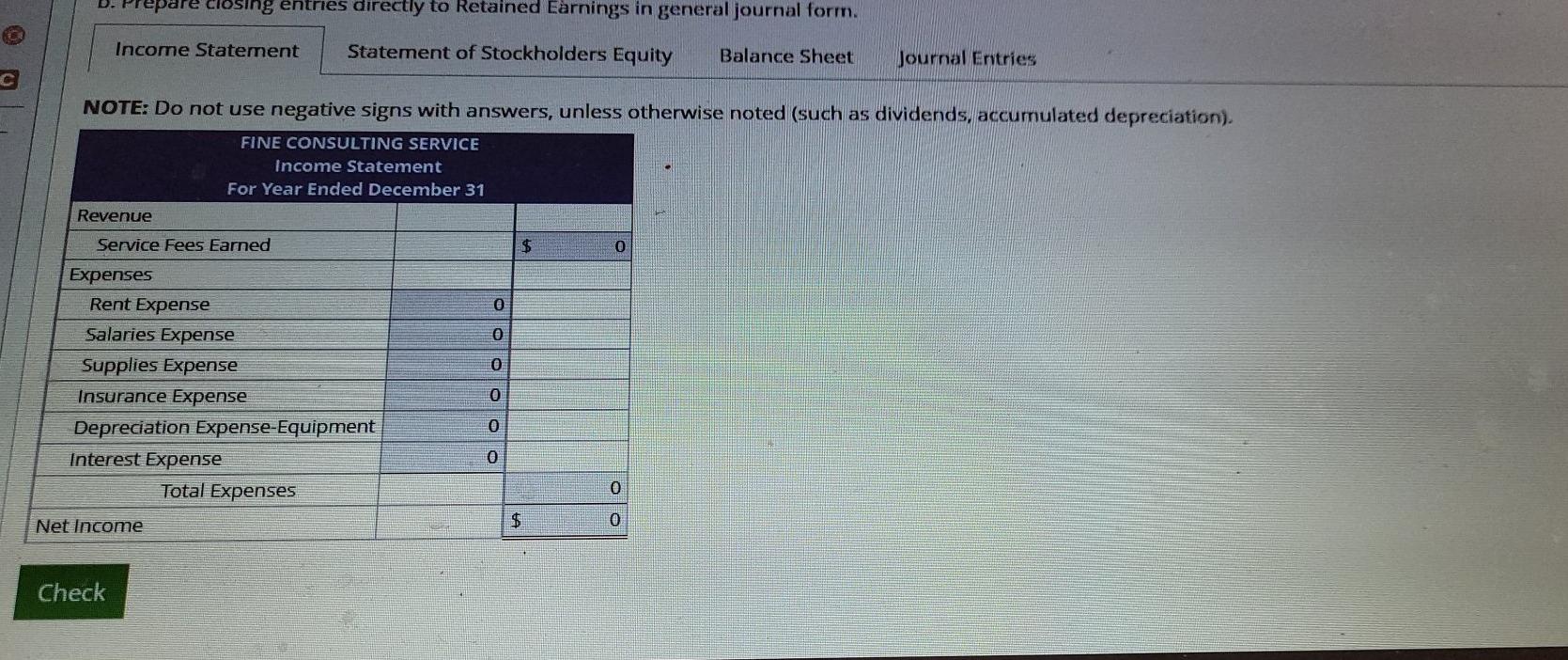

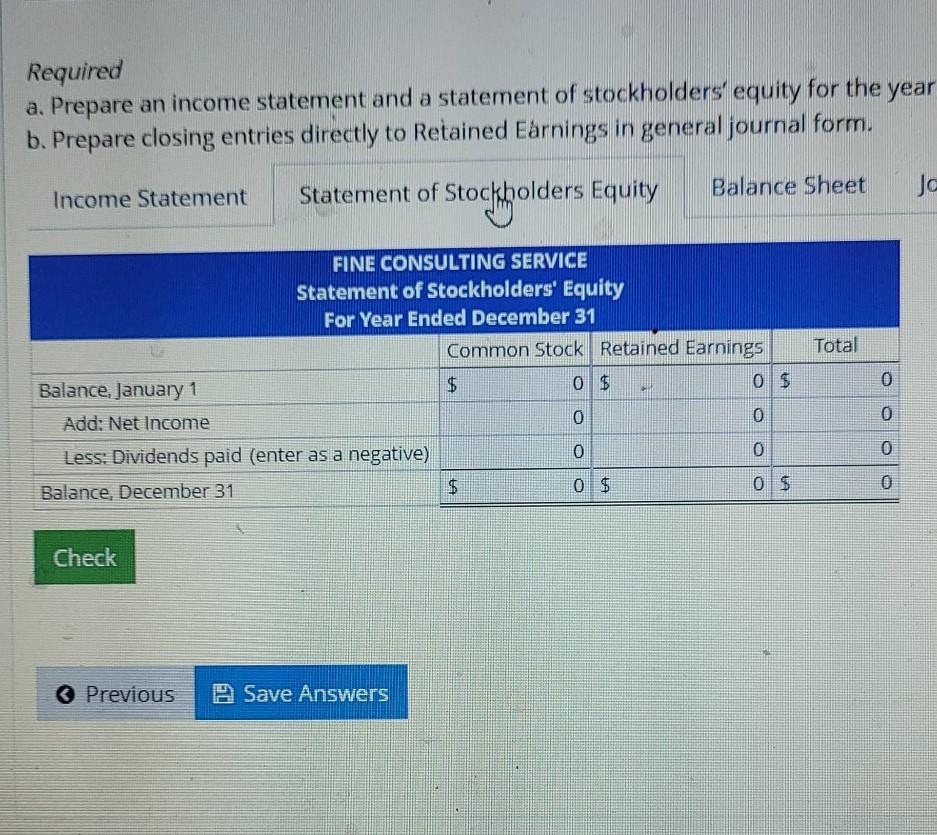

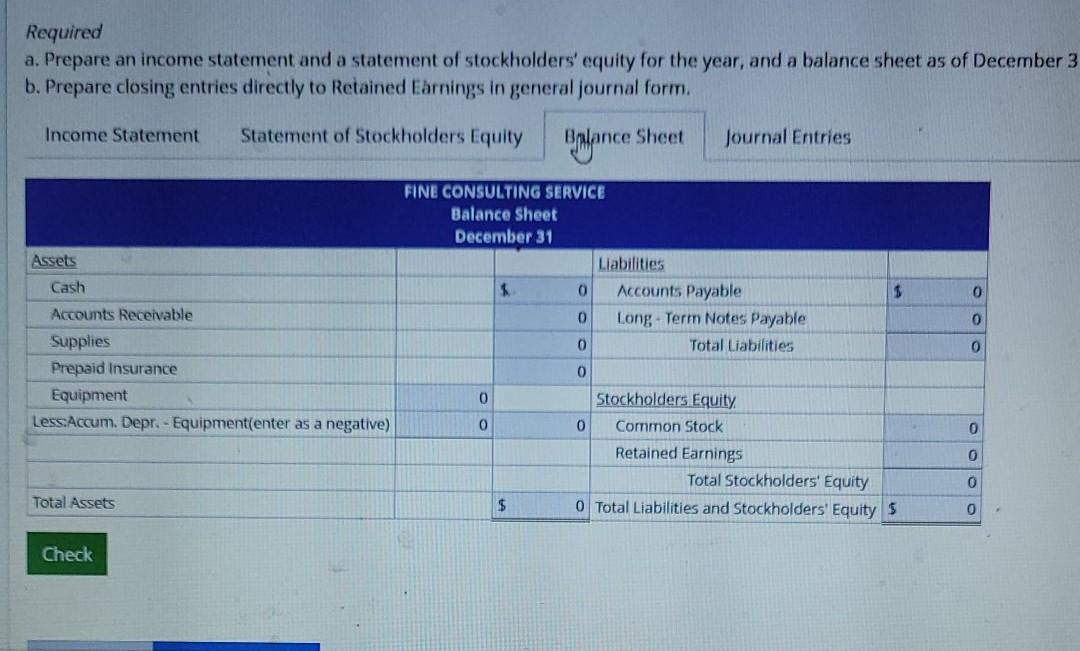

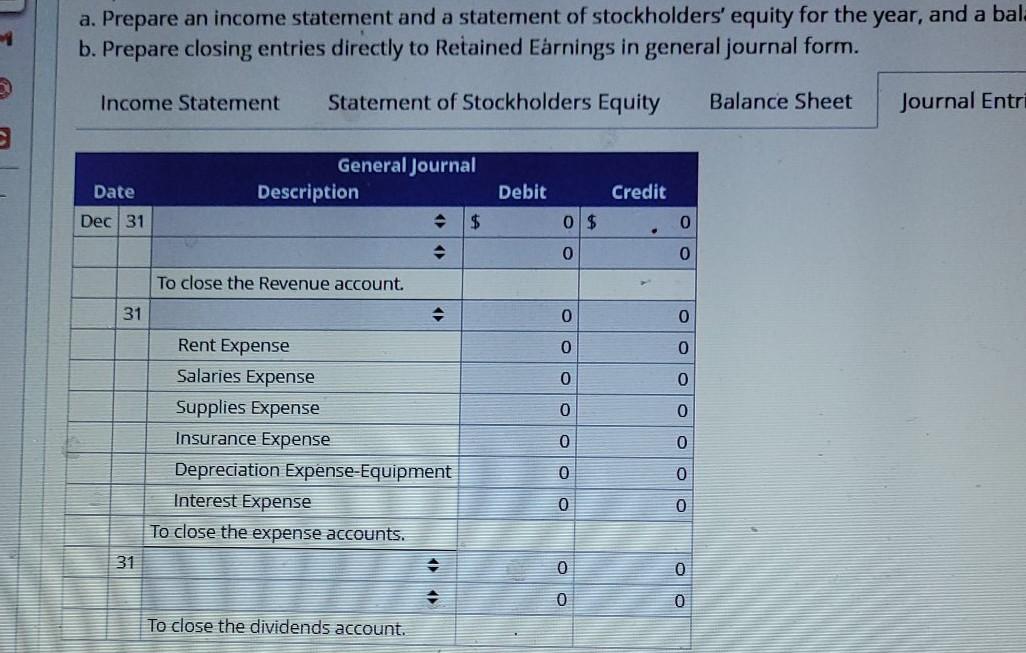

Financial Statements and Closing Entries The adjusted trial balance shown below is for Fine Consulting Service as of December 31. Byran Fine made no capital contributions during the year. FINE CONSULTING SERVICE Adjusted Trial Balance December 31 Debit Credit Cash $2.700 Accounts Receivable 3,270 Supplies 3,060 Prepaid Insurance 1,500 Equipment 6,400 Accum. Depr.- Equipment $1,080 Accounts Payable 845 7,000 Long - Term Notes Payable Common Stock 2,000 Retained Earnings 5,205 Dividends 2,900 Service Fees Earned 58,400 Rent Expense 12,000 Salaries Expense 33,400 Supplies Expense 4,700 Insurance Expense 3,250 Depreciation Expense-Equipment 720 terest Expense 630 Totals $74,530 $74,530 W Ing entries directly to Retained Earnings in general journal form. Income Statement Statement of Stockholders Equity Balance Sheet Journal Entries c NOTE: Do not use negative signs with answers, unless otherwise noted (such as dividends, accumulated depreciation), FINE CONSULTING SERVICE Income Statement For Year Ended December 31 Revenue Service Fees Earned $ o 0 O Expenses Rent Expense Salaries Expense Supplies Expense Insurance Expense Depreciation Expense-Equipment Interest Expense Total Expenses O O 0 O 0 Net Income Check Required a. Prepare an income statement and a statement of stockholders' equity for the year b. Prepare closing entries directly to Retained Earnings in general journal form. Statement of Stockholders Equity Balance Sheet Income Statement Total FINE CONSULTING SERVICE Statement of stockholders' Equity For Year Ended December 31 Common Stock Retained Earnings Balance, January 1 $ 0 $ 0 $ Add: Net Income 0 0 Less: Dividends paid (enter as a negative) O 0 Balance December 31 0 $ 0 $ 0 0 0 $ 0 Check Previous B Save Answers Required a. Prepare an income statement and a statement of stockholders' equity for the year, and a balance sheet as of December 3 b. Prepare closing entries directly to Retained Earnings in general journal form. Income Statement Statement of Stockholders Equity bulance Sheet Journal Entries Assets Cash FINE CONSULTING SERVICE Balance Sheet December 31 Liabilities 0 Accounts Payable 0 Long-Term Notes Payable 0 Total Liabilities 0 0 0 Accounts Receivable Supplies Prepaid Insurance Equipment Less:Accum. Depr. - Equipment(enter as a negative) 0 0 0 0 Stockholders Equity 0 Common Stock Retained Earnings Total Stockholders' Equity 0 Total Liabilities and Stockholders' Equity 5 0 0 Total Assets $ 0 Check 1 a. Prepare an income statement and a statement of stockholders' equity for the year, and a bal- b. Prepare closing entries directly to Retained Earnings in general journal form. Income Statement Statement of Stockholders Equity Balance Sheet Journal Entri Date General Journal Description $ Debit Credit Dec 31 0 $ 0 . 0 0 To close the Revenue account. 31 - 0 0 0 0 0 0 0 Rent Expense Salaries Expense Supplies Expense Insurance Expense Depreciation Expense-Equipment Interest Expense To close the expense accounts. 0 0 0 0 0 0 31 0 o o O To close the dividends account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started