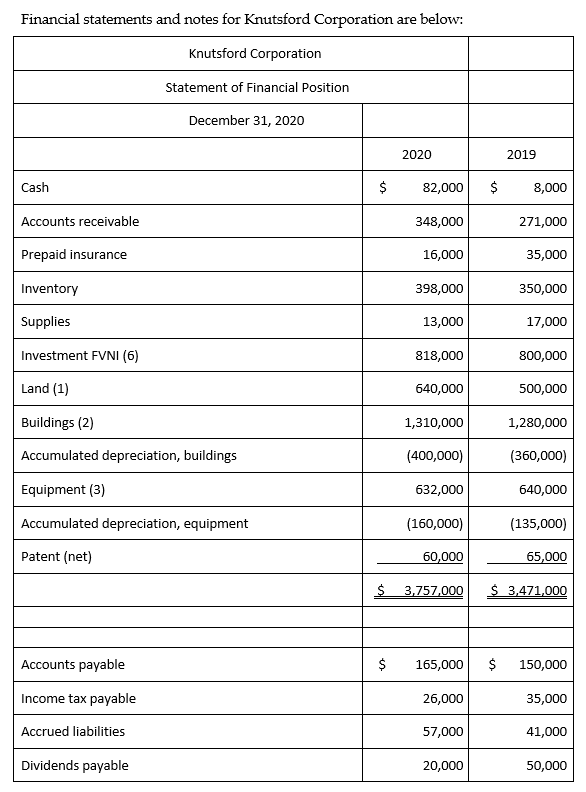

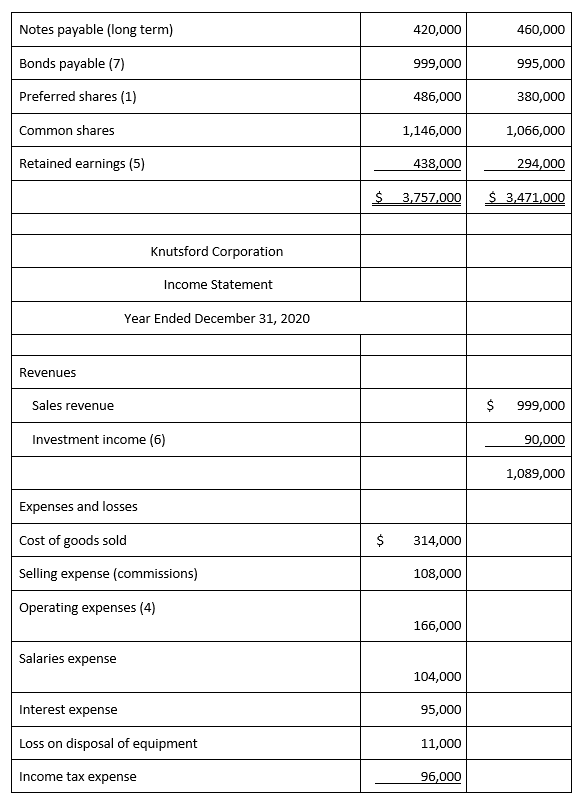

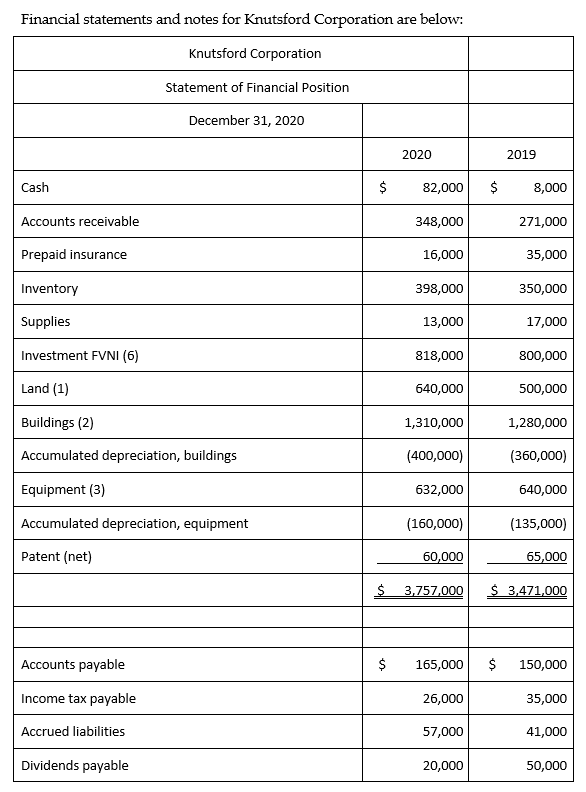

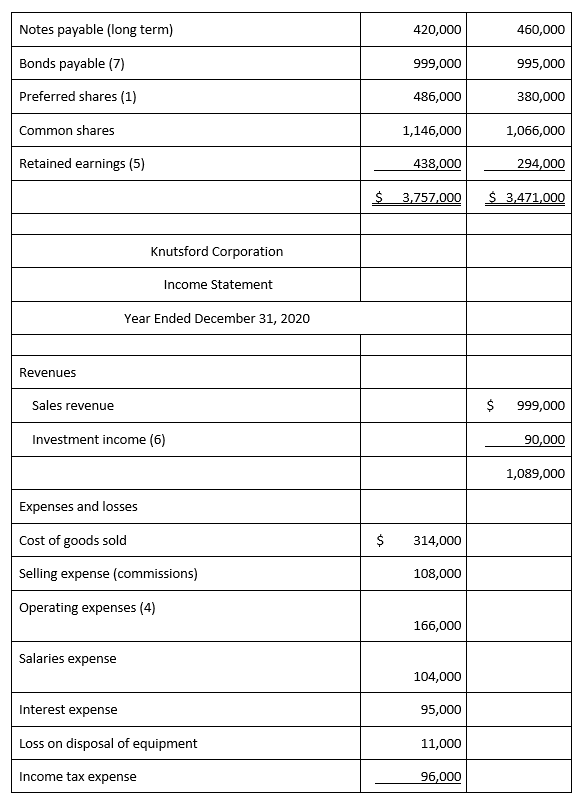

Financial statements and notes for Knutsford Corporation are below:

-

During 2020, Knutsford Corporation exchanged preferred shares for land valued at $100,000. It also purchased a second tract of land for cash. During the year, convertible preferred shares with a book value of $18,000 were exchanged for common shares.

-

One building was purchased during the year.

-

Equipment with a cost of $46,000 and accumulated depreciation of $32,000 was sold. Knutsford also purchased equipment.

-

Depreciation and amortization are included in operating expenses.

-

Dividends were paid.

-

Investment income includes dividend, interest, and gains. This includes an $18,000 unrealized gain.

-

The increase in bonds payable represents bond discount amortization for the year.

Financial statements and notes for Knutsford Corporation are below: Knutsford Corporation Statement of Financial Position December 31, 2020 2020 2019 Cash $ 82,000 $ 8,000 Accounts receivable 348,000 271,000 Prepaid insurance 16,000 35,000 Inventory 398,000 350,000 Supplies 13,000 17,000 Investment FVNI (6) 818,000 800,000 Land (1) 640,000 500,000 Buildings (2) 1,310,000 1,280,000 Accumulated depreciation, buildings (400,000) (360,000) Equipment (3) 632,000 640,000 Accumulated depreciation, equipment (160,000) (135,000) Patent (net) 60,000 65,000 $ 3,757,000 $ 3,471,000 Accounts payable $ 165,000 $ 150,000 Income tax payable 26,000 35,000 Accrued liabilities 57,000 41,000 Dividends payable 20,000 50,000 Notes payable (long term) 420,000 460,000 Bonds payable (7) 999,000 995,000 Preferred shares (1) 486,000 380,000 Common shares 1,146,000 1,066,000 Retained earnings (5) 438,000 294,000 $ 3,757,000 $ 3,471,000 Knutsford Corporation Income Statement Year Ended December 31, 2020 Revenues Sales revenue $ 999,000 Investment income (6) 90,000 1,089,000 Expenses and losses Cost of goods sold $ 314,000 Selling expense (commissions) 108,000 Operating expenses (4) 166,000 Salaries expense 104,000 Interest expense 95,000 Loss on disposal of equipment 11,000 Income tax expense 96,000 Financial statements and notes for Knutsford Corporation are below: Knutsford Corporation Statement of Financial Position December 31, 2020 2020 2019 Cash $ 82,000 $ 8,000 Accounts receivable 348,000 271,000 Prepaid insurance 16,000 35,000 Inventory 398,000 350,000 Supplies 13,000 17,000 Investment FVNI (6) 818,000 800,000 Land (1) 640,000 500,000 Buildings (2) 1,310,000 1,280,000 Accumulated depreciation, buildings (400,000) (360,000) Equipment (3) 632,000 640,000 Accumulated depreciation, equipment (160,000) (135,000) Patent (net) 60,000 65,000 $ 3,757,000 $ 3,471,000 Accounts payable $ 165,000 $ 150,000 Income tax payable 26,000 35,000 Accrued liabilities 57,000 41,000 Dividends payable 20,000 50,000 Notes payable (long term) 420,000 460,000 Bonds payable (7) 999,000 995,000 Preferred shares (1) 486,000 380,000 Common shares 1,146,000 1,066,000 Retained earnings (5) 438,000 294,000 $ 3,757,000 $ 3,471,000 Knutsford Corporation Income Statement Year Ended December 31, 2020 Revenues Sales revenue $ 999,000 Investment income (6) 90,000 1,089,000 Expenses and losses Cost of goods sold $ 314,000 Selling expense (commissions) 108,000 Operating expenses (4) 166,000 Salaries expense 104,000 Interest expense 95,000 Loss on disposal of equipment 11,000 Income tax expense 96,000