Answered step by step

Verified Expert Solution

Question

1 Approved Answer

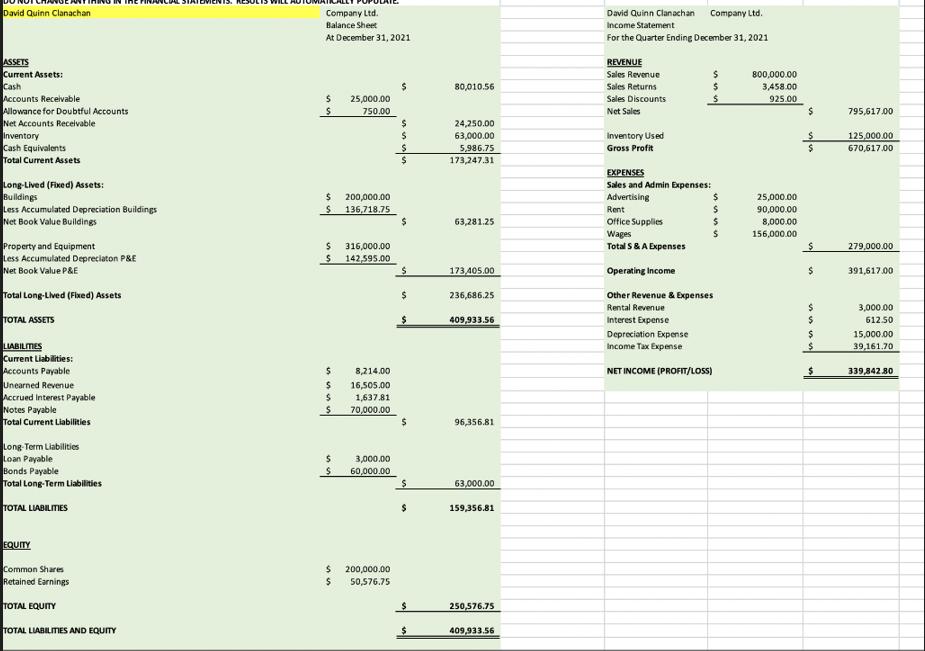

Financial statements are given below David Quinn Clanachan ASSETS Current Assets: Cash Accounts Receivable Allowance for Doubtful Accounts Net Accounts Receivable Inventory Cash Equivalents Total

Financial statements are given below

David Quinn Clanachan ASSETS Current Assets: Cash Accounts Receivable Allowance for Doubtful Accounts Net Accounts Receivable Inventory Cash Equivalents Total Current Assets Long-Lived (Fixed) Assets: Buildings Less Accumulated Depreciation Buildings Net Book Value Buildings Property and Equipment Less Accumulated Depreciaton P&E Net Book Value P&E Total Long-Lived (Fixed) Assets TOTAL ASSETS LIABILITES Current Liabilities: Accounts Payable Unearned Revenue Accrued Interest Payable Notes Payable Total Current Liabilities Long-Term Liabilities Loan Payable Bonds Payable Total Long-Term Liabilities TOTAL LIABILITIES IN INC EQUITY Common Shares Retained Earnings TOTAL EQUITY TOTAL LIABILITIES AND EQUITY Company Ltd. Balance Sheet At December 31, 2021 $ 25,000.00 $ 750.00 $ 200,000.00 $ 136,718.75 S 316,000.00 $ 142,595.00 $ 8,214.00 $ $ S 16,505.00 1,637.81 70,000.00 $ 3,000.00 $ 60,000.00 $ 200,000.00 $ 50,576.75 $ $ $ $ $ $ $ $ $ 80,010.56 24,250.00 63,000.00 5,986.75 173,247.31 63,281.25 173,405.00 236,686.25 409,933.56 96,356.81 63,000.00 159,356.81 250,576.75 409,933.56 David Quinn Clanachan Company Ltd. Income Statement For the Quarter Ending December 31, 2021 REVENUE Sales Revenue Sales Returns Sales Discounts Net Sales Inventory Used Gross Profit EXPENSES Sales and Admin Expenses: Advertising Rent Office Supplies Wages Total S & A Expenses Operating Income $ $ $ Depreciation Expense Income Tax Expense $ $ $ Other Revenue & Expenses Rental Revenue Interest Expense NET INCOME (PROFIT/LOSS) 800,000.00 3,458.00 925.00 25,000.00 90,000.00 8,000.00 156,000.00 $ $ $ $ $ $ $ $ $ 795,617.00 125,000.00 670,617.00 279,000.00 391,617.00 3,000.00 612.50 15,000.00 39,161.70 339,842.80

Step by Step Solution

There are 3 Steps involved in it

Step: 1

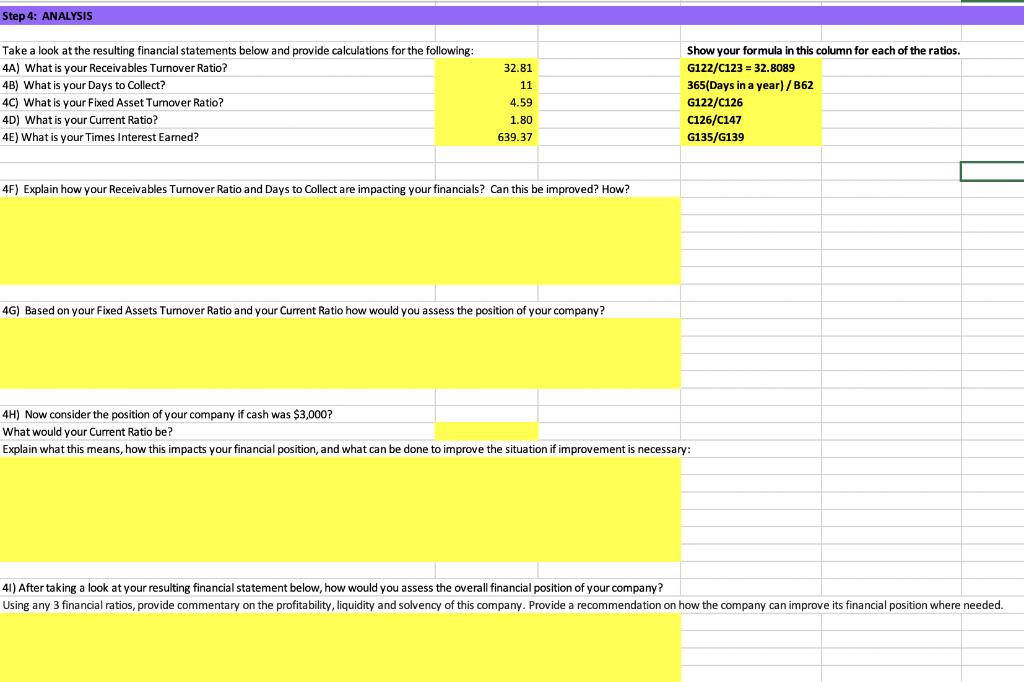

4A Receivables Turnover Ratio Net Sales Average Accounts Receivable 795617 25000 02 3281 4B Days to Collect 365 Receivables Turnover Ratio 365 3281 11 4C Fixed Asset Turnover Ratio Net Sales Net Prope...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started