Financial statements below

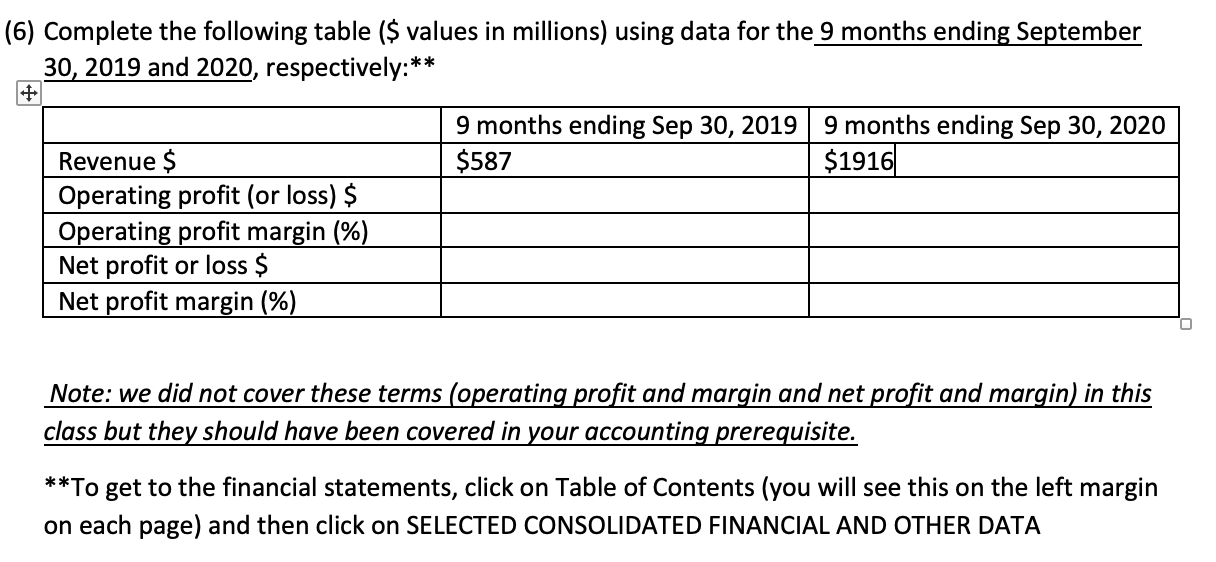

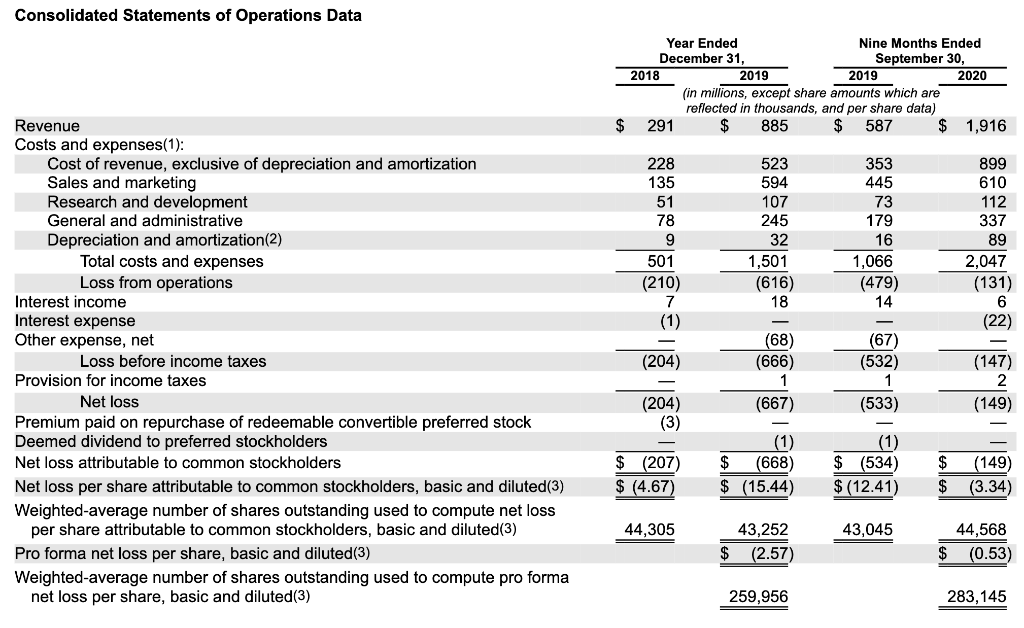

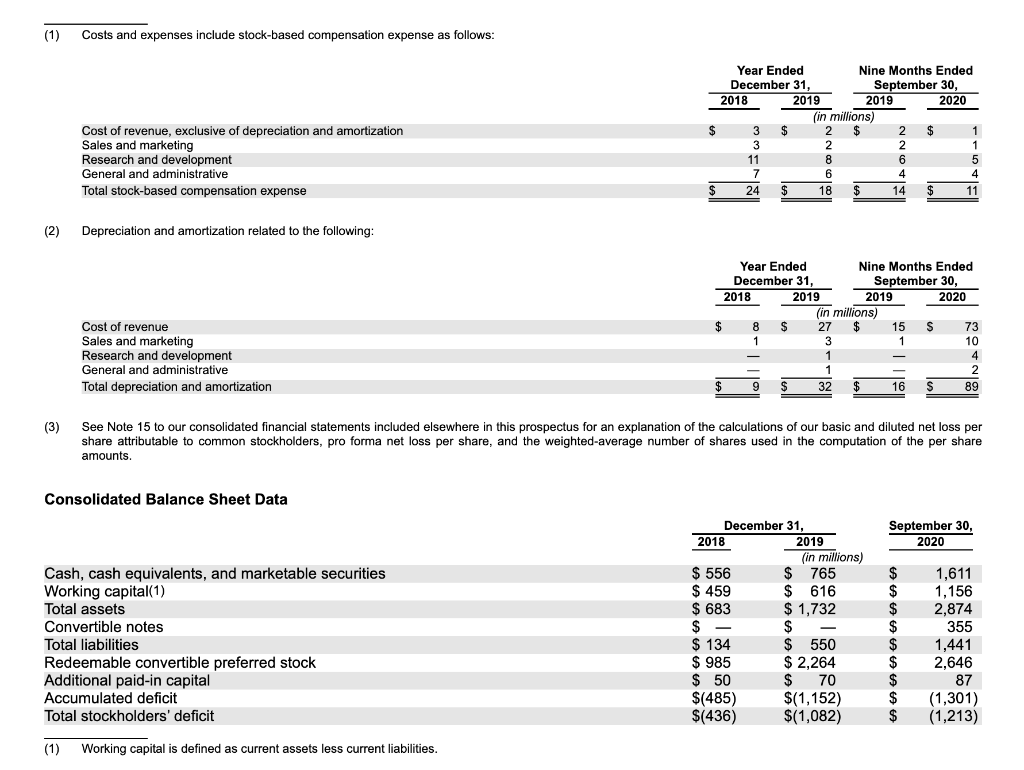

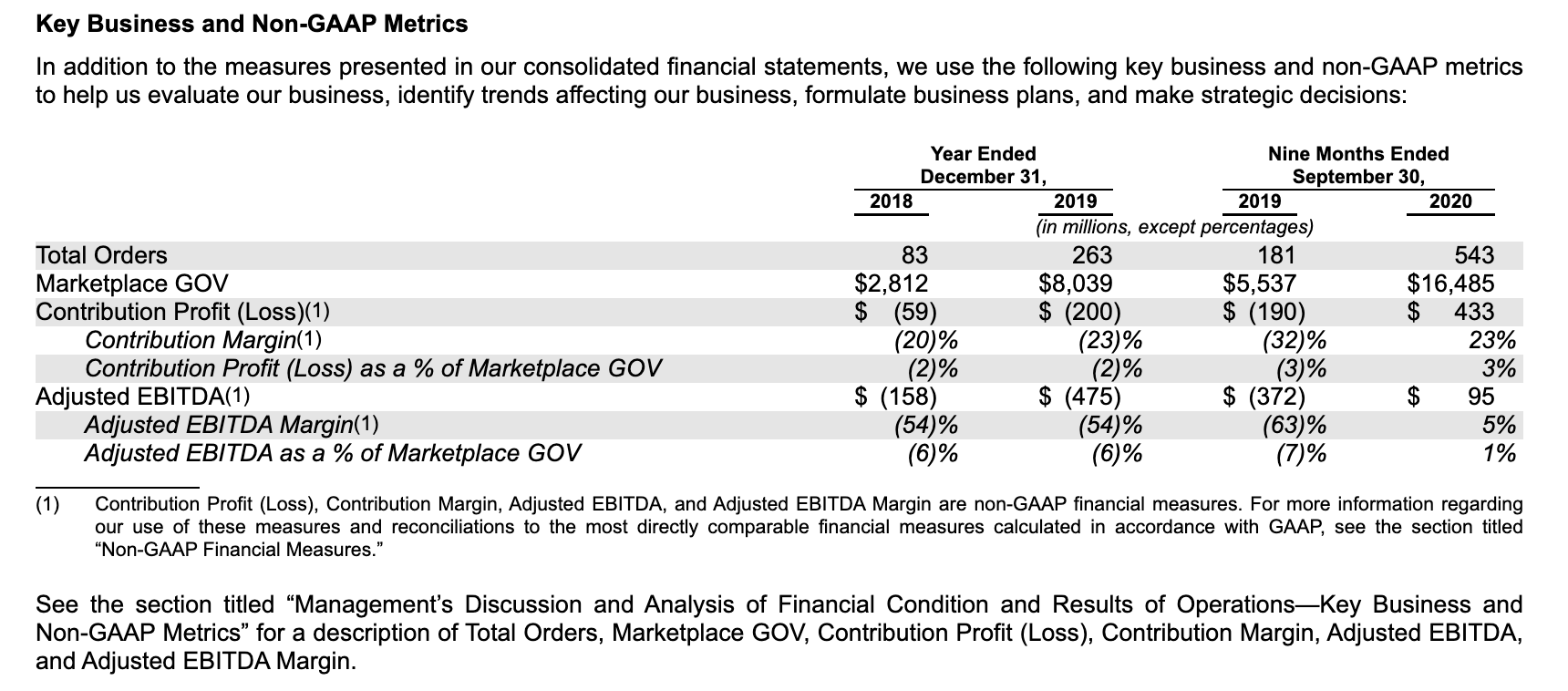

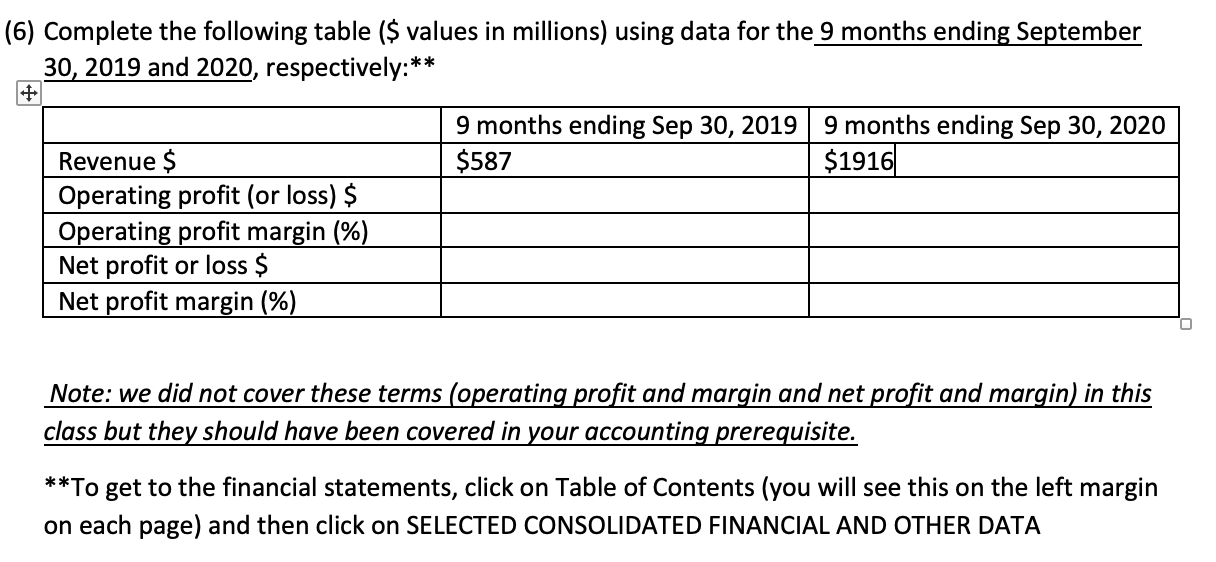

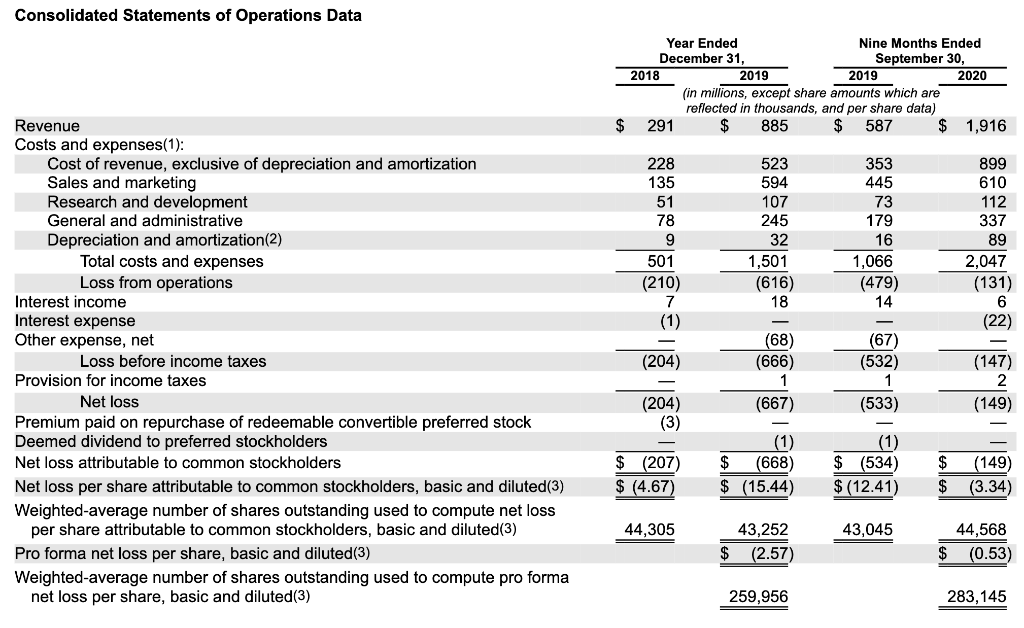

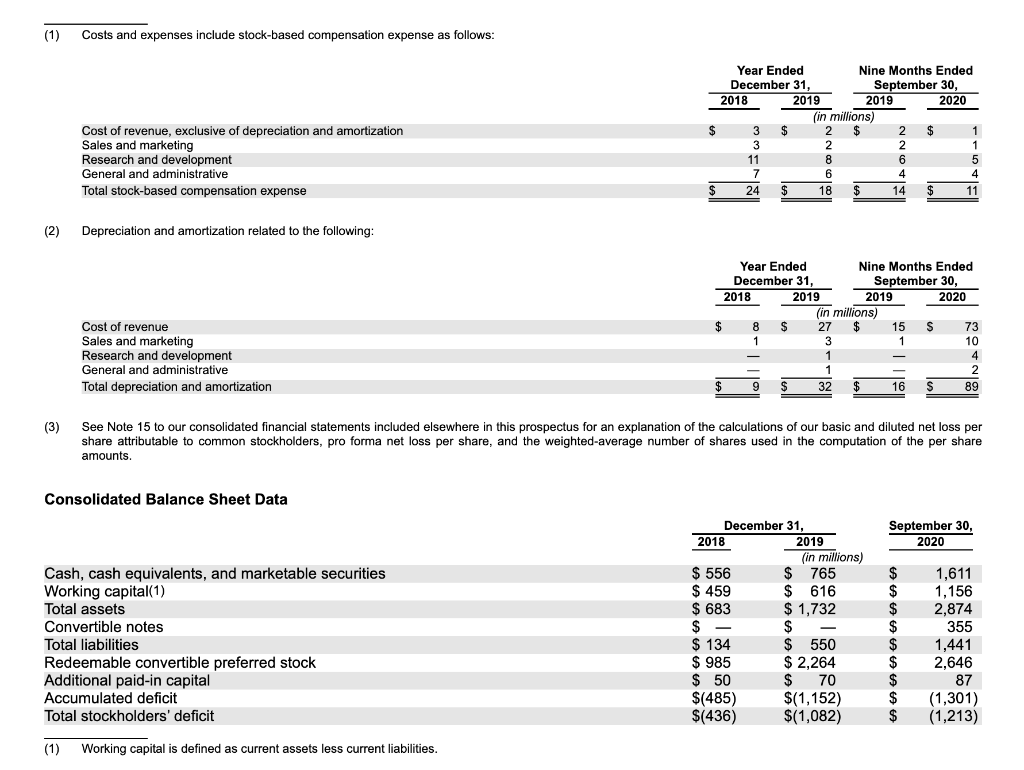

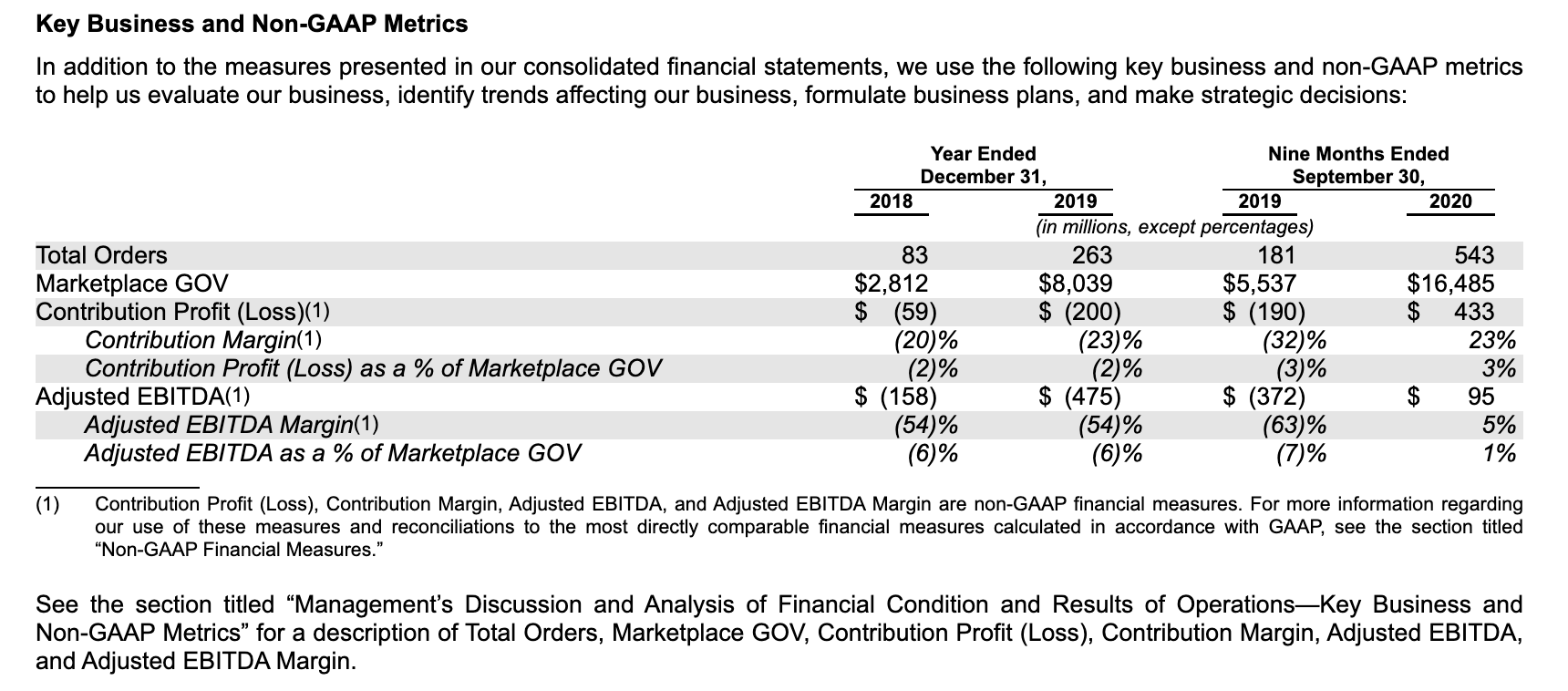

Complete the following table ( $ values in millions) using data for the 9 months ending September 30,2019 and 2020 , respectively:** Note: we did not cover these terms (operating profit and margin and net profit and margin) in this class but they should have been covered in your accounting prerequisite. **To get to the financial statements, click on Table of Contents (you will see this on the left margin on each page) and then click on SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA Consolidated Statements of Operations Data (1) Costs and expenses include stock-based compensation expense as follows: Cost of revenue, exclusive of depreciation and amortization Sales and marketing Research and development General and administrative Total stock-based compensation expense (2) Depreciation and amortization related to the following: Cost of revenue Sales and marketing Research and development General and administrative Total depreciation and amortization share attributable to common stockholders, pro forma net loss per share, and the weighted-average number of shares used in the computation of the per share amounts. Consolidated Balance Sheet Data Cash, cash equivalents, and marketable securities Working capital(1) Total assets Convertible notes Total liabilities Redeemable convertible preferred stock Additional paid-in capital Accumulated deficit Total stockholders' deficit (1) Working capital is defined as current assets less current liabilities. Key Business and Non-GAAP Metrics In addition to the measures presented in our consolidated financial statements, we use the following key business and non-GAAP metrics to help us evaluate our business, identify trends affecting our business, formulate business plans, and make strategic decisions: Total Orders Marketplace GOV Contribution Profit (Loss)(1) Contribution Margin(1) Contribution Profit (Loss) as a \% of Marketplace GOV Adjusted EBITDA(1) Adjusted EBITDA Margin(1) Adjusted EBITDA as a \% of Marketplace GOV (1) Contribution Profit (Loss), Contribution Margin, Adjusted EBITDA, and Adjusted EBITDA Margin are non-GAAP financial measures. For more information regarding our use of these measures and reconciliations to the most directly comparable financial measures calculated in accordance with GAAP, see the section titled "Non-GAAP Financial Measures." See the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operations-Key Business and Non-GAAP Metrics" for a description of Total Orders, Marketplace GOV, Contribution Profit (Loss), Contribution Margin, Adjusted EBITDA, and Adjusted EBITDA Margin. Complete the following table ( $ values in millions) using data for the 9 months ending September 30,2019 and 2020 , respectively:** Note: we did not cover these terms (operating profit and margin and net profit and margin) in this class but they should have been covered in your accounting prerequisite. **To get to the financial statements, click on Table of Contents (you will see this on the left margin on each page) and then click on SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA Consolidated Statements of Operations Data (1) Costs and expenses include stock-based compensation expense as follows: Cost of revenue, exclusive of depreciation and amortization Sales and marketing Research and development General and administrative Total stock-based compensation expense (2) Depreciation and amortization related to the following: Cost of revenue Sales and marketing Research and development General and administrative Total depreciation and amortization share attributable to common stockholders, pro forma net loss per share, and the weighted-average number of shares used in the computation of the per share amounts. Consolidated Balance Sheet Data Cash, cash equivalents, and marketable securities Working capital(1) Total assets Convertible notes Total liabilities Redeemable convertible preferred stock Additional paid-in capital Accumulated deficit Total stockholders' deficit (1) Working capital is defined as current assets less current liabilities. Key Business and Non-GAAP Metrics In addition to the measures presented in our consolidated financial statements, we use the following key business and non-GAAP metrics to help us evaluate our business, identify trends affecting our business, formulate business plans, and make strategic decisions: Total Orders Marketplace GOV Contribution Profit (Loss)(1) Contribution Margin(1) Contribution Profit (Loss) as a \% of Marketplace GOV Adjusted EBITDA(1) Adjusted EBITDA Margin(1) Adjusted EBITDA as a \% of Marketplace GOV (1) Contribution Profit (Loss), Contribution Margin, Adjusted EBITDA, and Adjusted EBITDA Margin are non-GAAP financial measures. For more information regarding our use of these measures and reconciliations to the most directly comparable financial measures calculated in accordance with GAAP, see the section titled "Non-GAAP Financial Measures." See the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operations-Key Business and Non-GAAP Metrics" for a description of Total Orders, Marketplace GOV, Contribution Profit (Loss), Contribution Margin, Adjusted EBITDA, and Adjusted EBITDA Margin