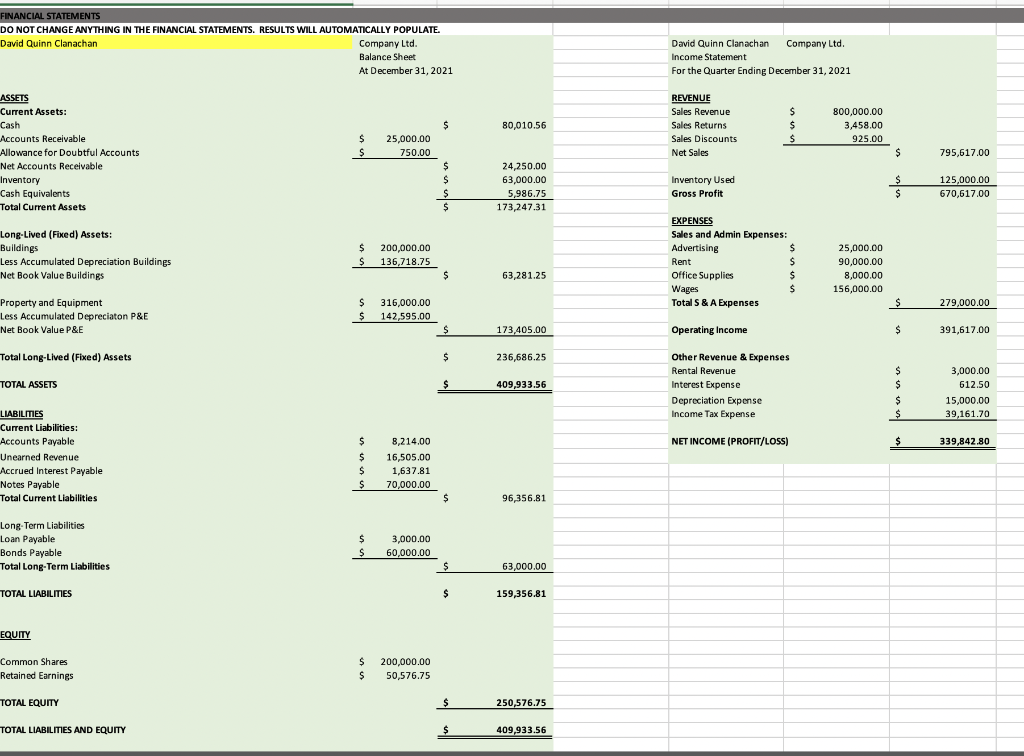

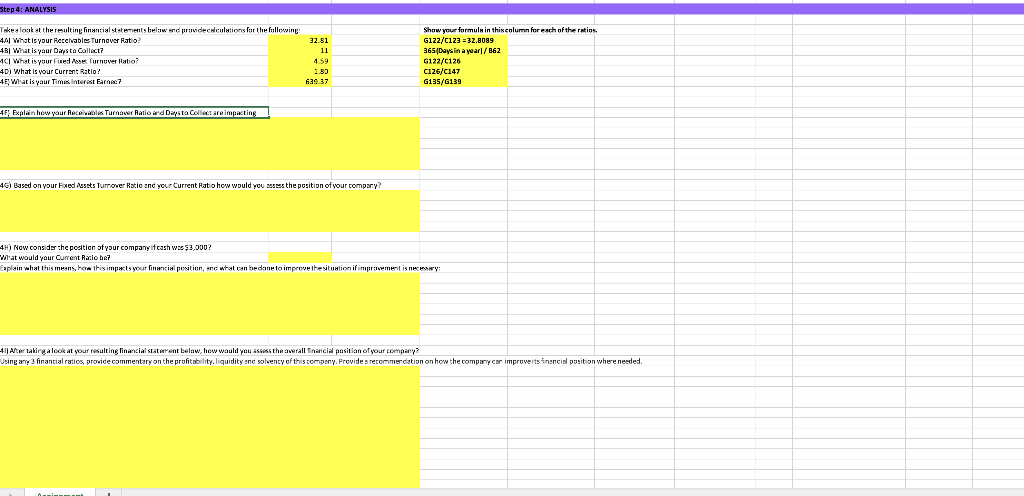

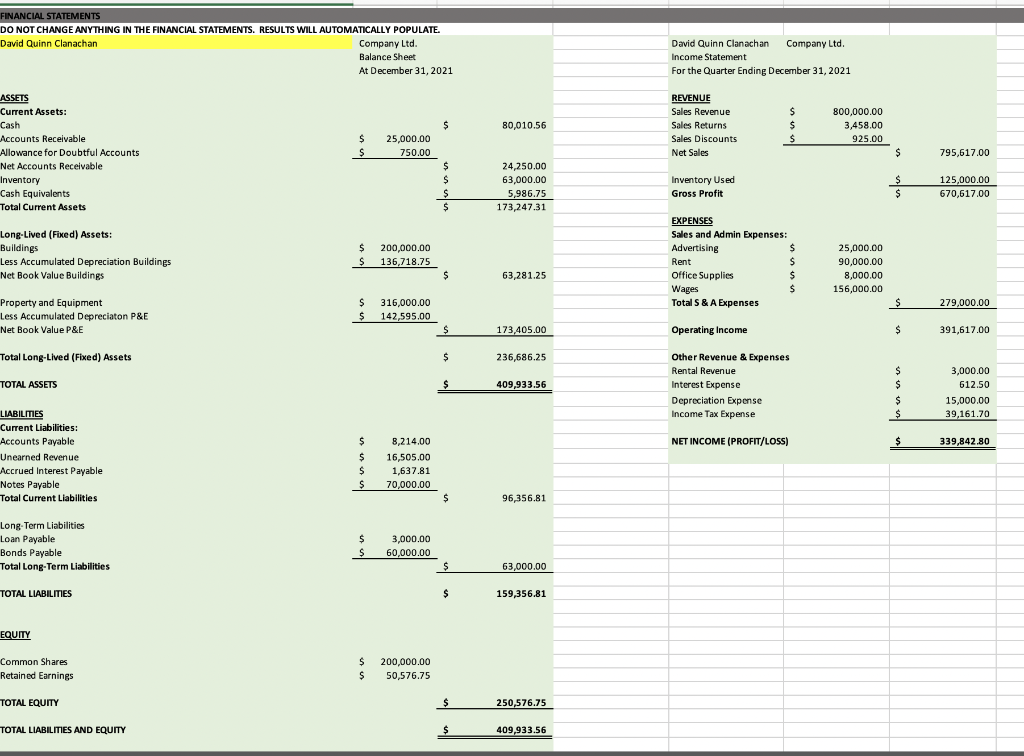

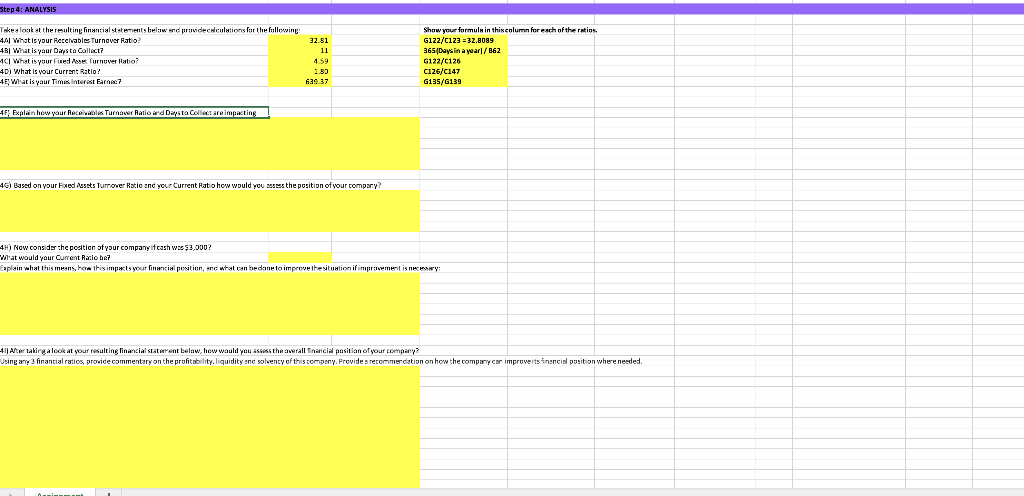

FINANCIAL STATEMENTS DO NOT CHANGE ANYTHING IN THE FINANCIAL STATEMENTS. RESULTS WILL AUTOMATICALLY POPULATE. David Quinn Clanachan Company Ltd. David Quinn Clanachan Company Ltd. Balance Sheet Income Statement At December 31, 2021 For the Quarter Ending December 31, 2021 REVENUE Current Assets: Cash Accounts Receivable Allowance for Doubtful Accounts Net Accounts Receivable Inventory Cash Equivalents Total Current Assets Long-Lived (Fixed) Assets: Bulldings Less Accumulated Depreciation Buildings Net Book Value Buildings Property and Equipment Less Accumulated Depreciaton P\&E Net Book Value P\&E Total Long-Lived (Fixed) Assets TOTAL ASSETS LIABILITES Current Liabilities: Accounts Payable Unearned Revenue Accrued Interest Payable Notes Payable Total Current Liabilities \begin{tabular}{ll} $ & 200,000.00 \\ $ & 136,718.75 \\ \hline \end{tabular} EXPENSES Sales and Admin Expenses: Long-Term Liabilities Loan Payable Bonds Payable Total Long-Term Liabilities TOTAL LIABILITES EQUITY Common Shares Retained Earnings $$200,000.0050,576.75 TOTAL EQUITY TOTAL LIABILITES AND EQUITY \begin{tabular}{ll} $ & 250,576.75 \\ \hline$ & 409,933.56 \\ \hline \end{tabular} 46) Basad on your Fased Aesets Turnower Ratio and your Current Hato how would you assess the position of your compary? 4H) Now consider :he peeition of your company if cash wse $3,000 ? Wlat would yaur Cument Ratio he? Eaplain what this means, how this impacts your financial positien, ane what tan be dane to improue the situation if impravement is necesery: 4ll After takirga loek at your fesulting finarncial statarent belaw, hew wauld pau assess th averall financial passitian of your zompany? FINANCIAL STATEMENTS DO NOT CHANGE ANYTHING IN THE FINANCIAL STATEMENTS. RESULTS WILL AUTOMATICALLY POPULATE. David Quinn Clanachan Company Ltd. David Quinn Clanachan Company Ltd. Balance Sheet Income Statement At December 31, 2021 For the Quarter Ending December 31, 2021 REVENUE Current Assets: Cash Accounts Receivable Allowance for Doubtful Accounts Net Accounts Receivable Inventory Cash Equivalents Total Current Assets Long-Lived (Fixed) Assets: Bulldings Less Accumulated Depreciation Buildings Net Book Value Buildings Property and Equipment Less Accumulated Depreciaton P\&E Net Book Value P\&E Total Long-Lived (Fixed) Assets TOTAL ASSETS LIABILITES Current Liabilities: Accounts Payable Unearned Revenue Accrued Interest Payable Notes Payable Total Current Liabilities \begin{tabular}{ll} $ & 200,000.00 \\ $ & 136,718.75 \\ \hline \end{tabular} EXPENSES Sales and Admin Expenses: Long-Term Liabilities Loan Payable Bonds Payable Total Long-Term Liabilities TOTAL LIABILITES EQUITY Common Shares Retained Earnings $$200,000.0050,576.75 TOTAL EQUITY TOTAL LIABILITES AND EQUITY \begin{tabular}{ll} $ & 250,576.75 \\ \hline$ & 409,933.56 \\ \hline \end{tabular} 46) Basad on your Fased Aesets Turnower Ratio and your Current Hato how would you assess the position of your compary? 4H) Now consider :he peeition of your company if cash wse $3,000 ? Wlat would yaur Cument Ratio he? Eaplain what this means, how this impacts your financial positien, ane what tan be dane to improue the situation if impravement is necesery: 4ll After takirga loek at your fesulting finarncial statarent belaw, hew wauld pau assess th averall financial passitian of your zompany