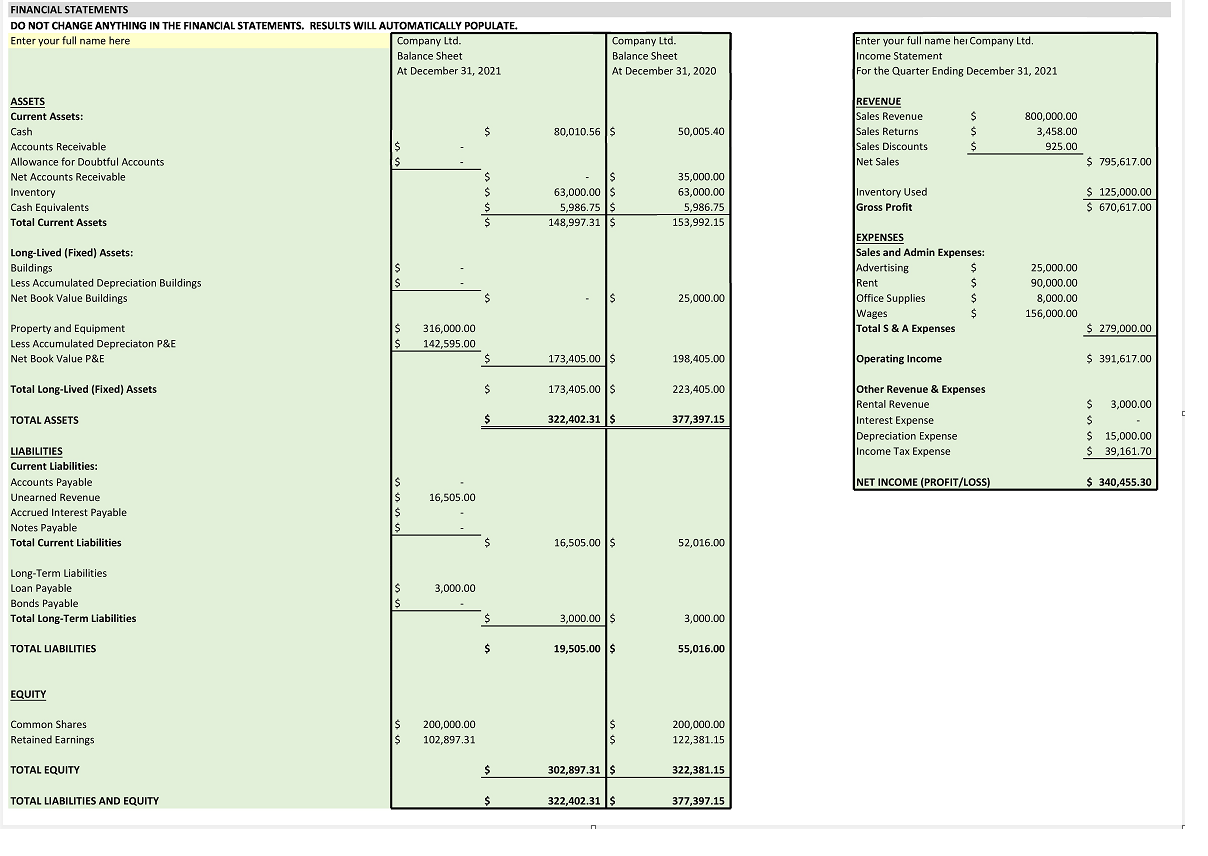

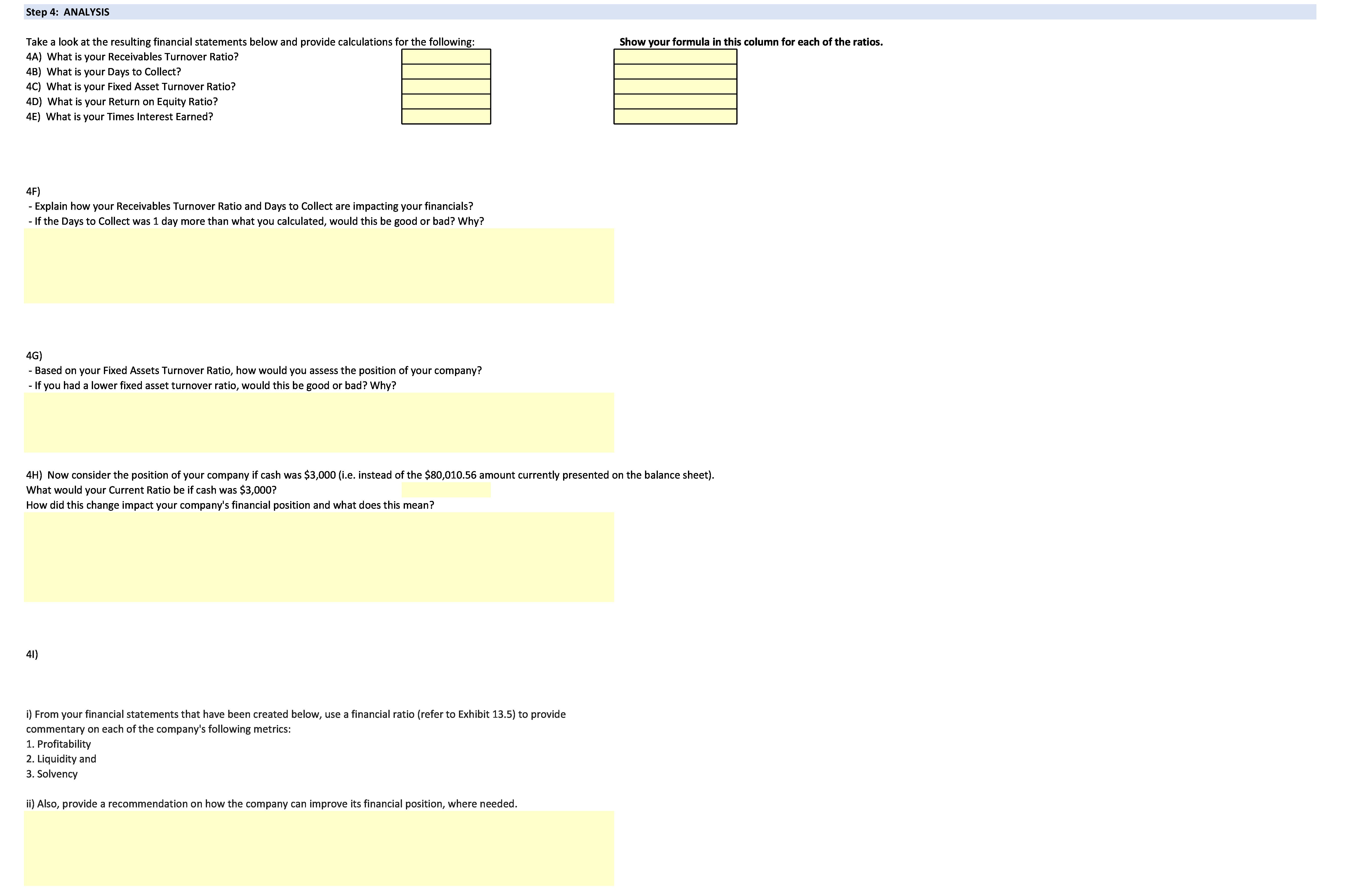

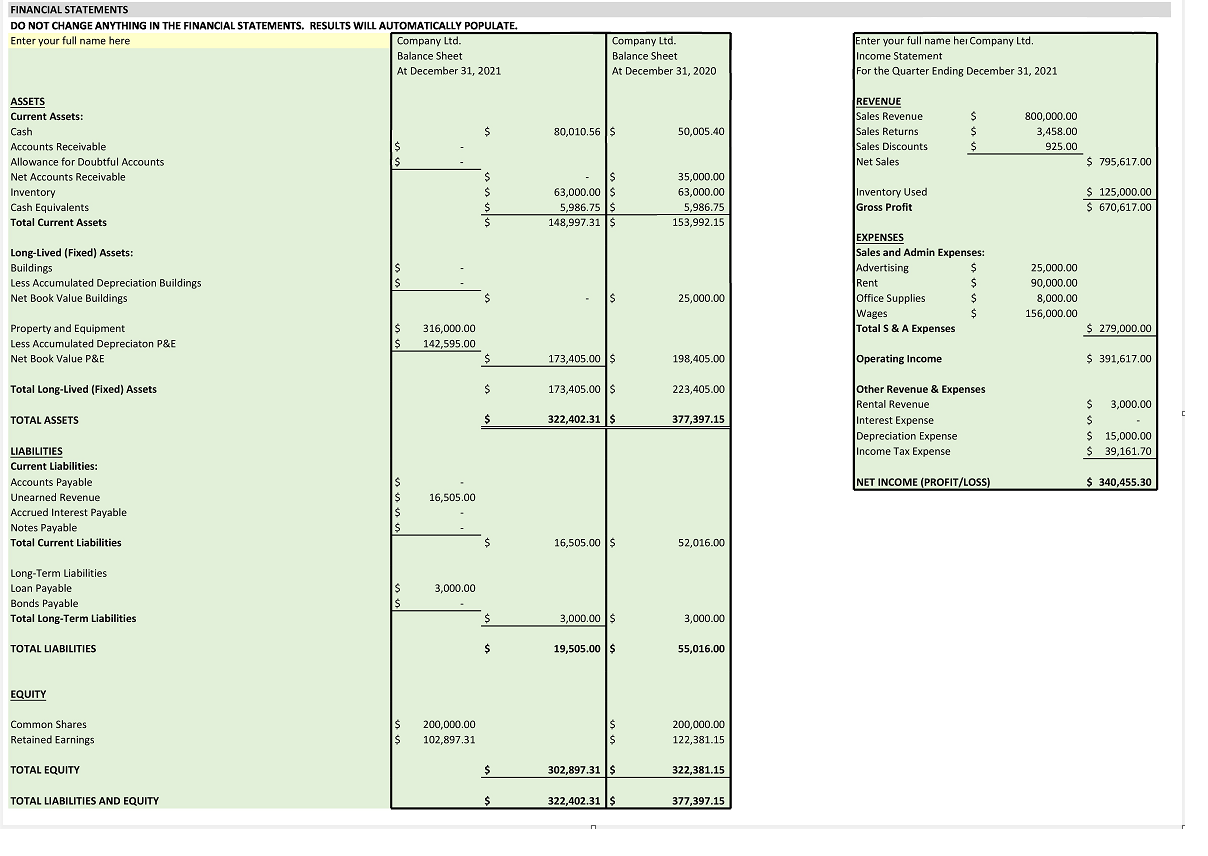

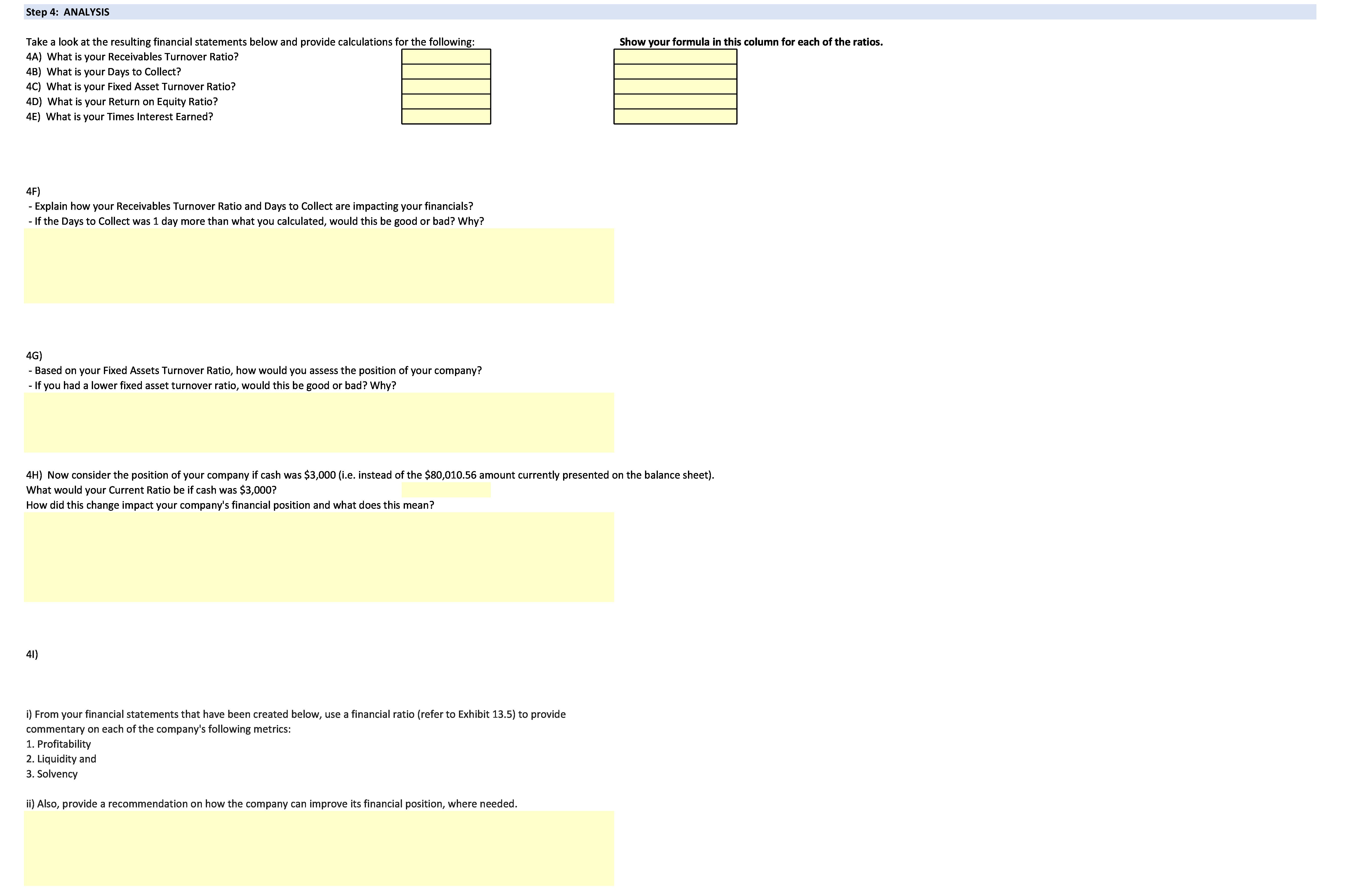

FINANCIAL STATEMENTS DO NOT CHANGE ANYTHING IN THE FINANCIAL STATEMENTS. RESULTS WILL AUTOMATICALLY POPULATE, Take a look at the resulting financial statements below and provide calculations for the following: Show your formula in this column for each of the ratios. 4A) What is your Receivables Turnover Ratio? 4B) What is your Days to Collect? 4C) What is your Fixed Asset Turnover Ratio? 4D) What is your Return on Equity Ratio? 4E) What is your Times Interest Earned? \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} 4F) - Explain how your Receivables Turnover Ratio and Days to Collect are impacting your financials? - If the Days to Collect was 1 day more than what you calculated, would this be good or bad? Why? 4G) - Based on your Fixed Assets Turnover Ratio, how would you assess the position of your company? - If you had a lower fixed asset turnover ratio, would this be good or bad? Why? 4H) Now consider the position of your company if cash was $3,000 (i.e. instead of the $80,010.56 amount currently presented on the balance sheet). What would your Current Ratio be if cash was $3,000 ? How did this change impact your company's financial position and what does this mean? 4I) i) From your financial statements that have been created below, use a financial ratio (refer to Exhibit 13.5) to provide commentary on each of the company's following metrics: 1. Profitability 2. Liquidity and 3. Solvency FINANCIAL STATEMENTS DO NOT CHANGE ANYTHING IN THE FINANCIAL STATEMENTS. RESULTS WILL AUTOMATICALLY POPULATE, Take a look at the resulting financial statements below and provide calculations for the following: Show your formula in this column for each of the ratios. 4A) What is your Receivables Turnover Ratio? 4B) What is your Days to Collect? 4C) What is your Fixed Asset Turnover Ratio? 4D) What is your Return on Equity Ratio? 4E) What is your Times Interest Earned? \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} 4F) - Explain how your Receivables Turnover Ratio and Days to Collect are impacting your financials? - If the Days to Collect was 1 day more than what you calculated, would this be good or bad? Why? 4G) - Based on your Fixed Assets Turnover Ratio, how would you assess the position of your company? - If you had a lower fixed asset turnover ratio, would this be good or bad? Why? 4H) Now consider the position of your company if cash was $3,000 (i.e. instead of the $80,010.56 amount currently presented on the balance sheet). What would your Current Ratio be if cash was $3,000 ? How did this change impact your company's financial position and what does this mean? 4I) i) From your financial statements that have been created below, use a financial ratio (refer to Exhibit 13.5) to provide commentary on each of the company's following metrics: 1. Profitability 2. Liquidity and 3. Solvency