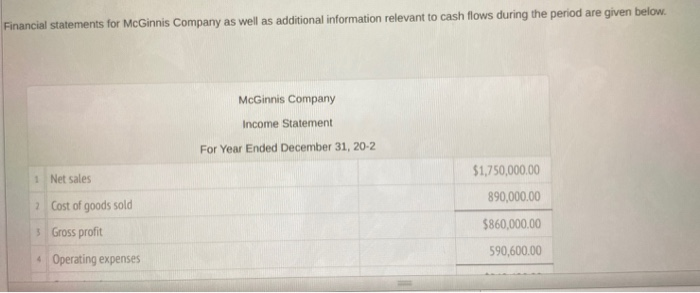

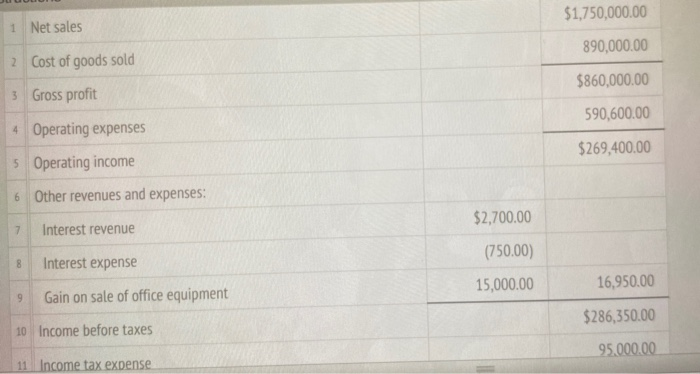

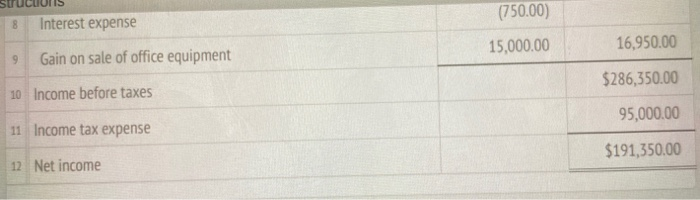

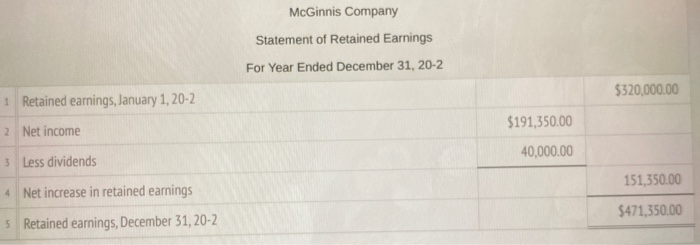

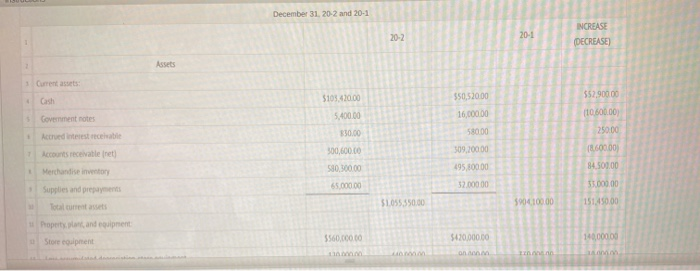

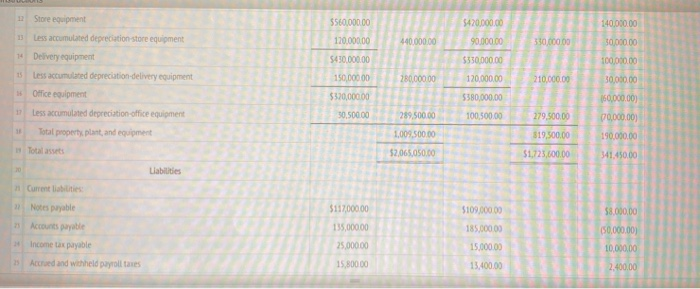

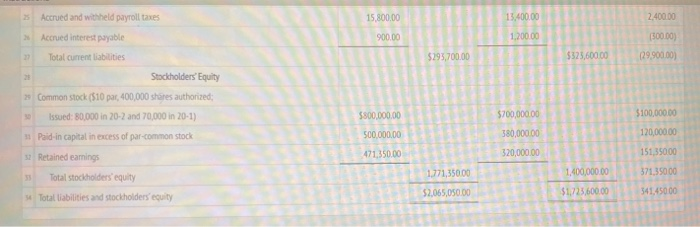

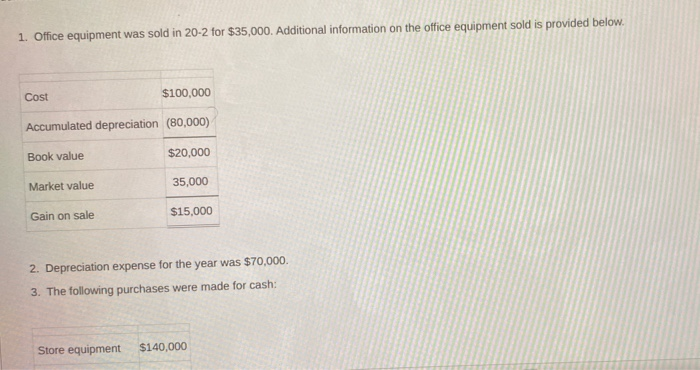

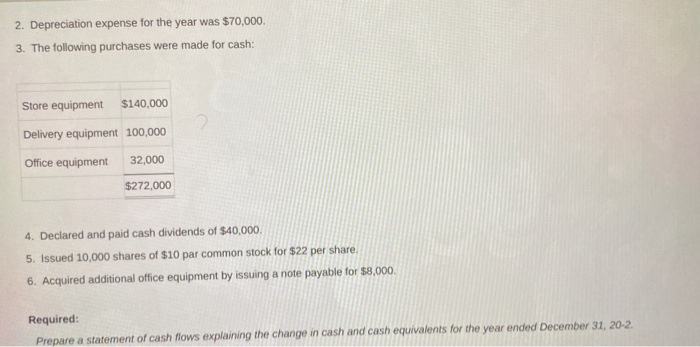

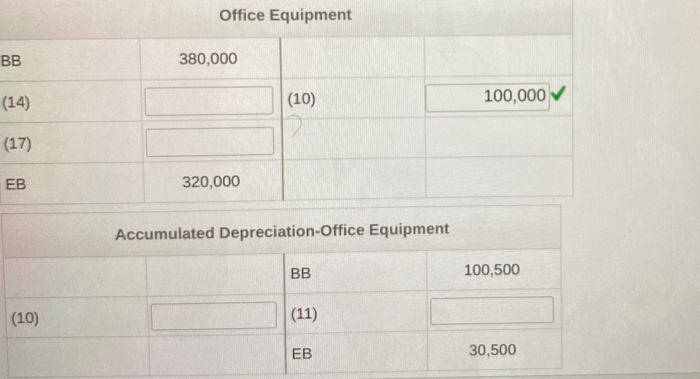

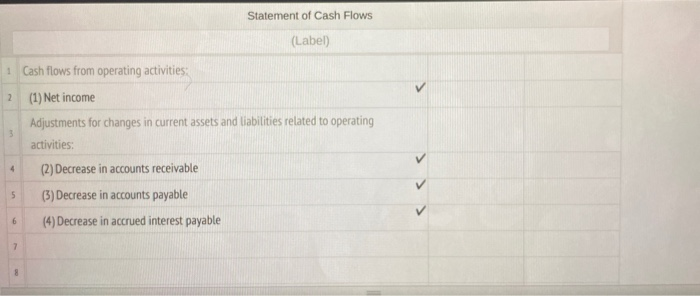

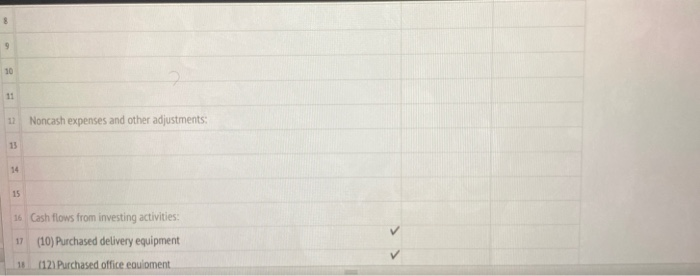

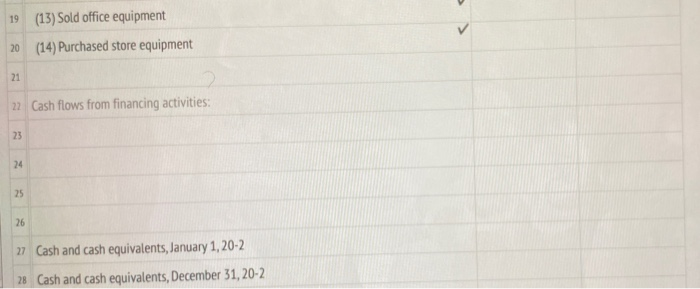

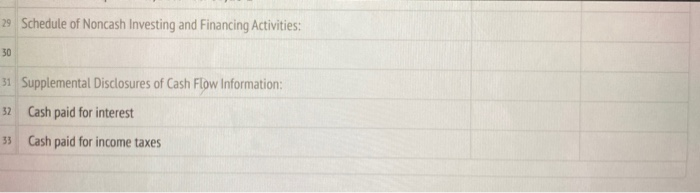

Financial statements for McGinnis Company as well as additional information relevant to cash flows during the period are given below. McGinnis Company Income Statement For Year Ended December 31, 20-2 $1,750,000.00 1 Net sales 890,000.00 ? Cost of goods sold $860,000.00 5 Gross profit 590,600.00 Operating expenses $1,750,000.00 1 Net sales 890,000.00 2 Cost of goods sold 3 Gross profit $860,000.00 590,600.00 4 Operating expenses $269,400.00 5 Operating income 6 Other revenues and expenses: $2,700.00 7 Interest revenue (750.00) 8 Interest expense 15,000.00 16,950.00 9 Gain on sale of office equipment $286,350.00 10 Income before taxes 95,000.00 11 Income tax expense (750.00) 8 Interest expense 15,000.00 16,950.00 9 Gain on sale of office equipment $286,350.00 10 Income before taxes 95,000.00 11 Income tax expense $191,350.00 12 Net income McGinnis Company Statement of Retained Earnings For Year Ended December 31, 20-2 $320,000.00 1 Retained earnings, January 1, 20-2 $191,350.00 2 Net income 40,000.00 3 Less dividends 151,350.00 4 Net increase in retained earnings $471,350.00 5 Retained earnings, December 31, 20-2 December 31. 20-2 and 20-1 20-2 20-1 INCREASE (DECREASE) 1 Current assets: $52.900.00 5105.420.00 5,400.00 550,520.00 16.000 DO 5 Government notes 58000 (10.600.00 250.00 (8.600.00 330.00 300,000.00 580.500.00 Accruederstelle Accounts receivable (net) 309.0000 84.500.00 Merchandise in 195.800.00 52.00000 65.000.00 55.000.00 $1.055.350.00 590010000 151.450.00 Supplies and prepayments Total current assets Property and equipment Store courent 0000955 5420.000 DO 143,000.00 UTUL OR ONAM 5560,000.00 $420,000.00 90,000.00 140,000.00 30,000.00 120.000.00 440,000.00 350,000.00 $430,000.00 $330.000.00 12 Store equipment 1 ss accumulated depreciation store equipment 14 Delivery equipment 15 Less accumulated depreciation-delivery equipment Office equipment 1 less accumulated depreciation office equipment 100,000.00 30,000.00 150 DOOD 280.000.00 120,000.00 210.000.00 $320,000.00 $380,000.00 30.500.00 289 500.00 100,500.00 279,500.00 160,000.00) 70,000.00) 190.000.00 Total propertyplant, and equipment 319,500.00 1,009.500.00 52,065.650.00 $1,725,000.00 341.450.00 Liabilities Current liabiti $117,000.00 Notes phable Accounts payable Income tax payable Accrued and withheld payrolles 58.000,00 (50,000.00) 5109,000.00 185.000.00 15,000.00 135,000.00 25,000.00 15,800.00 10.000,00 13.400.00 2.400.00 Accrued and withheld payroll taxes 15,800.00 13.400.00 2.400.00 900.00 1.200.00 > Accrued interest payable Total current liabilities (500.00 (29.900.00) $295,700.00 $325,600.00 Stockholders Equity 23 Common stock (510 par, 400,000 shares authorized: Issued: 80,000 in 20-2 and 70,000 in 20-1) 31 Paid-in capital in excess of par-common stock $100,000.00 $500,000.00 500,000.00 471,350.00 $700,000.00 380,000.00 120,000.00 320,000.00 15135000 52 Retained earings 1,771,350.00 371.350.00 Total stockholders' equity 1,400,000.00 $1,725,600.00 52,065,050.00 341.450.00 34 Total liabilities and stockholders' equity 1. Office equipment was sold in 20-2 for $35,000. Additional information on the office equipment sold is provided below. Cost $100,000 Accumulated depreciation (80,000) Book value $20,000 Market value 35,000 Gain on sale $15,000 2. Depreciation expense for the year was $70,000. 3. The following purchases were made for cash: Store equipment $140,000 2. Depreciation expense for the year was $70,000. 3. The following purchases were made for cash: Store equipment $140,000 Delivery equipment 100,000 Office equipment 32,000 $272,000 4. Declared and paid cash dividends of $40,000, 5. Issued 10,000 shares of $10 par common stock for $22 per share. 6. Acquired additional office equipment by issuing a note payable for $8,000. Required: Prepare a statement of cash flows explaining the change in cash and cash equivalents for the year ended December 31, 20-2. Office Equipment 380,000 (14) (10) 100,000 V (17) 320,000 Accumulated Depreciation Office Equipment 100,500 (10) (11) 30,500 Statement of Cash Flows 2 (Label) 1 Cash flows from operating activities: (1) Net income Adjustments for changes in current assets and liabilities related to operating activities: 4 (2) Decrease in accounts receivable 5 (3) Decrease in accounts payable (4) Decrease in accrued interest payable 3 6 9 10 11 Noncash expenses and other adjustments: 13 14 15 16 Cash flows from investing activities: (10) Purchased delivery equipment 1121 Purchased office equioment 17 18 19 (13) Sold office equipment 20 (14) Purchased store equipment 21 22 Cash flows from financing activities: 23 24 25 26 27 Cash and cash equivalents, January 1, 20-2 28 Cash and cash equivalents, December 31, 20-2 29 Schedule of Noncash Investing and Financing Activities: 30 31 Supplemental Disclosures of Cash Flow Information: Cash paid for interest 32 33 Cash paid for income taxes