Answered step by step

Verified Expert Solution

Question

1 Approved Answer

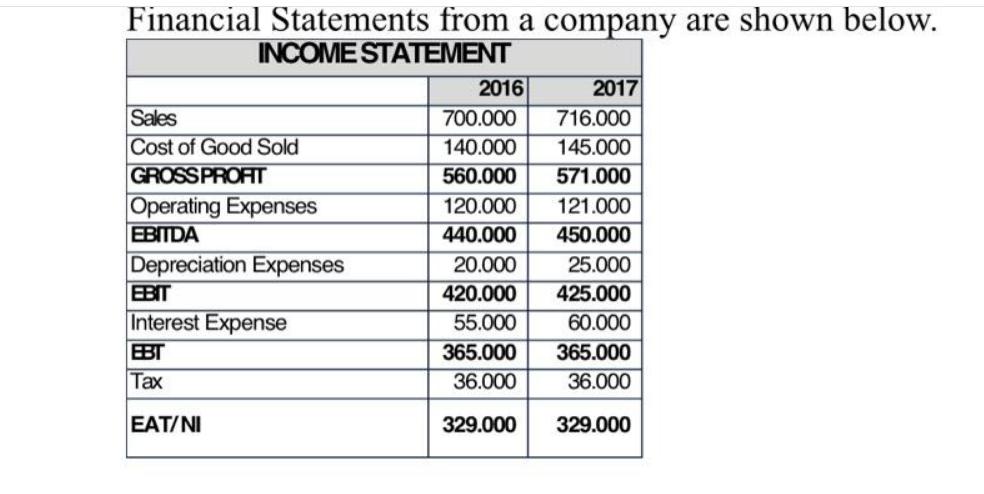

Financial Statements from a company are shown below. INCOME STATEMENT Sales Cost of Good Sold GROSS PROFIT Operating Expenses EBITDA Depreciation Expenses EBIT Interest

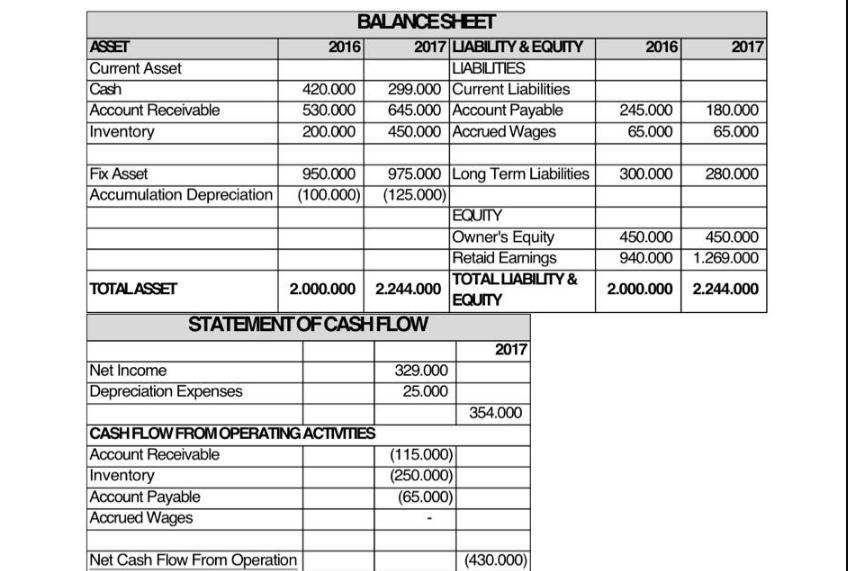

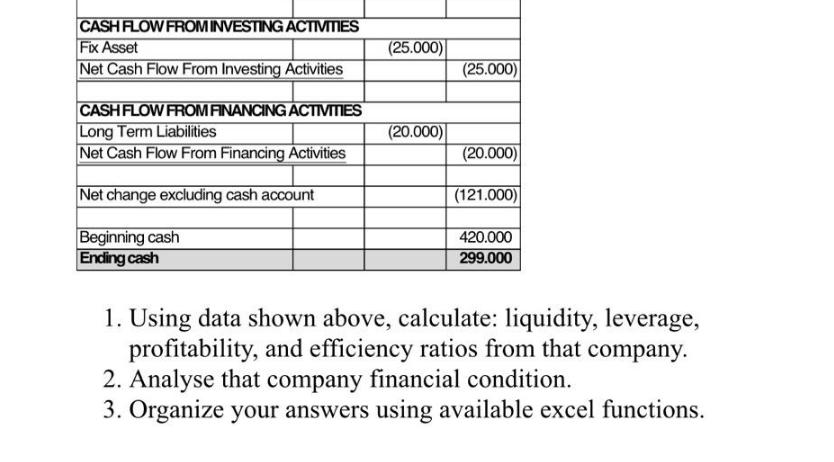

Financial Statements from a company are shown below. INCOME STATEMENT Sales Cost of Good Sold GROSS PROFIT Operating Expenses EBITDA Depreciation Expenses EBIT Interest Expense EBT Tax EAT/NI 2016 2017 716.000 145.000 571.000 121.000 450.000 20.000 25.000 420.000 425.000 55.000 60.000 365.000 365.000 36.000 36.000 329.000 329.000 700.000 140.000 560.000 120.000 440.000 ASSET Current Asset Cash Account Receivable Inventory TOTALASSET Net Income Depreciation Expenses BALANCE SHEET 2016 420.000 530.000 200.000 Fix Asset 950.000 Accumulation Depreciation (100.000) (125.000) Inventory Account Payable Accrued Wages Net Cash Flow From Operation 2017 LIABILITY & EQUITY LIABILITIES CASH FLOW FROM OPERATING ACTIVITIES Account Receivable 299.000 Current Liabilities 645.000 Account Payable 450.000 Accrued Wages 2.000.000 2.244.000 STATEMENT OF CASH FLOW 975.000 Long Term Liabilities 329.000 25.000 EQUITY Owner's Equity Retaid Earnings TOTAL LIABILITY & EQUITY (115.000) (250.000) (65.000) 2017 354.000 (430.000) 2016 245.000 65.000 300.000 2017 180.000 65.000 280.000 450.000 450.000 940.000 1.269.000 2.000.000 2.244.000 CASH FLOW FROM INVESTING ACTIVITIES Fix Asset Net Cash Flow From Investing Activities CASH FLOW FROM FINANCING ACTIVITIES Long Term Liabilities Net Cash Flow From Financing Activities Net change excluding cash account Beginning cash Ending cash (25.000) (20.000) (25.000) (20.000) (121.000) 420.000 299.000 1. Using data shown above, calculate: liquidity, leverage, profitability, and efficiency ratios from that company. 2. Analyse that company financial condition. 3. Organize your answers using available excel functions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay here are the calculations with workings shown Income Statement for 2020 in USD Sales 100000 Cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started