Question

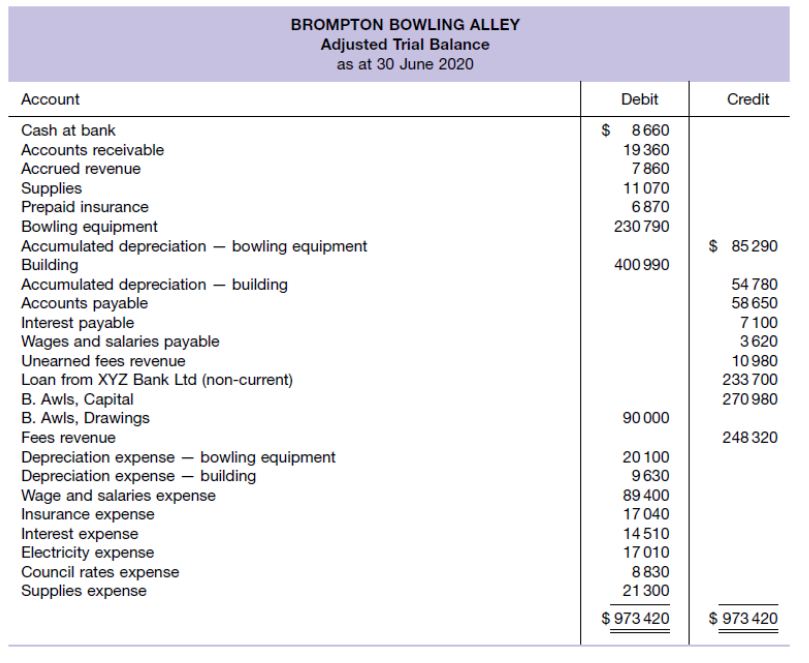

Financial statements from an adjusted trial balance; adjusting and closing entries (No GST) The adjusted trial balance of Brompton Bowling Alley at 30 June 2020,

Financial statements from an adjusted trial balance; adjusting and closing entries (No GST) The adjusted trial balance of Brompton Bowling Alley at 30 June 2020, the end of the entitys accounting year, follows.

Additional data taken into account in the preparation of the above adjusted trial balance at 30 June 2020.

1. Unearned fees revenue earned during the year, $5540.

2. Prepaid insurance expired during the year, $16 800.

3. Accrued interest expense, $6100.

4. Supplies used during the year, $8300.

5. Fees revenue earned but not recorded, $7860.

6. Depreciation for the year: bowling equipment, $20 100; building, $9630.

7. Accrued wages and salaries expense, $3620.

Required

(a) Prepare the income statement and statement of changes in equity for the year ended 30 June 2020 and a classified balance sheet as at 30 June 2020.

(b) Record adjusting and closing entries in the general journal.

(c) Prepare any suitable reversing entries on 1 July 2020.

BROMPTON BOWLING ALLEY Adjusted Trial Balance as at 30 June 2020 Account Debit Credit $ 8660 Cash at bank Accounts receivable Accrued revenue Supplies Prepaid insurance Bowling equipment Accumulated depreciation- bowling equipment Building Accumulated depreciation building Accounts payable Interest payable Wages and salaries payable Unearned fees revenue Loan from XYZ Bank Ltd (non-current) B. Awls, Capital B. Awls, Drawings Fees revenue Depreciation expense-bowling equipment Depreciation expense building Wage and salaries expense Insurance expense Interest expense Electricity expense Council rates expense Supplies expense 19 360 7 860 11 070 6870 230 790 $ 85290 400 990 54 780 58 650 7 100 3620 10980 233 700 270980 90000 248 320 20 100 9630 89 400 17 040 14510 17010 8830 21 300 $973 420 973 420Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started